Automotive Seat Control Module Market Size 2023-2027

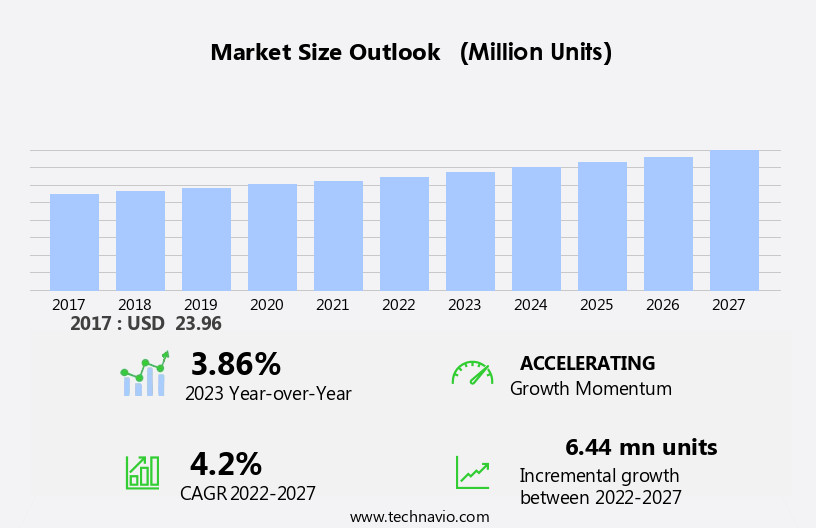

The automotive seat control module market size is forecast to increase by 6.44 million units at a CAGR of 4.2% between 2022 and 2027.

- The market is witnessing significant growth due to the increasing popularity of luxury vehicles. These vehicles often come equipped with advanced seat control systems, providing comfort and convenience to passengers. Another trend driving market growth is the development of plug-and-play seat control modules, which offer easy installation and integration with existing vehicle systems. However, there are limitations associated with seat control modules, such as high cost and complexity, which may hinder market growth. Despite these challenges, the market is expected to continue expanding due to the increasing demand for premium features in vehicles. The use of advanced technologies like Bluetooth connectivity and smartphone integration in seat control modules is also expected to boost market growth In the coming years. Overall, the market is a dynamic and innovative space, offering numerous opportunities for growth and development.

What will be the Size of the Automotive Seat Control Module Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for advanced driving comfort technology in cars. Seat control modules, which integrate automotive seat massage systems, ventilation systems, and adjustment systems, are becoming increasingly popular as consumers prioritize comfort and safety In their vehicle purchases. These features enhance the overall driving experience by providing ergonomic design, luxury car features, and vehicle comfort.

- Additionally, the market is witnessing the integration of advanced technology such as air conditioning, heating, and automation into seat control modules. Comfort trends include sustainable transportation, vehicle connectivity, and vehicle customization, all of which are driving the demand for these advanced systems. The market, which supplies the components for seat control modules, is also experiencing growth due to the increasing popularity of these features. The automotive industry is focusing on vehicle safety, reliable performance, and passenger experience, making seat control modules an essential component of modern vehicle design.

How is this Automotive Seat Control Module Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "mn units" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- End-user

- OEM

- Aftermarket

- Application

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By End-user Insights

- The OEM segment is estimated to witness significant growth during the forecast period.

Seat control modules have gained significant traction In the automotive industry, particularly in luxury passenger vehicles. These modules enable automatic seat adjustment and intelligent configuration based on user preferences, enhancing the overall driving experience. Comfort and safety are key selling points for luxury cars, and seat control modules deliver on both fronts. Advanced features such as massage functions, air conditioning, and customizable recline settings add to the appeal. The integration of IoT and artificial intelligence (AI) technology is driving demand for seat control modules, as they offer personalized comfort and convenience. OEMs are investing In the development of wellness features, positioning seats as the ultimate wearable device due to their data collection capabilities.

The increasing preference for a seamless travel experience and the rise of high-end vehicles are expected to boost the profitability of automotive control modules In the automobile sector. Safety requirements, such as adjustable lumbar support and airbag integration, are also being addressed through the use of these modules. The integration of smartphones and other electronic components, as well as the development of infrastructure and quality inspection processes, are essential for ensuring operational excellence and meeting industry standards. The increasing demand for comfort and customization, along with safety features and materials used in premium products, are key factors driving the growth of the seat control module market.

Get a glance at the Automotive Seat Control Module Industry report of share of various segments Request Free Sample

The OEM segment was valued at 18.50 million units in 2017 and showed a gradual increase during the forecast period.

Regional Analysis

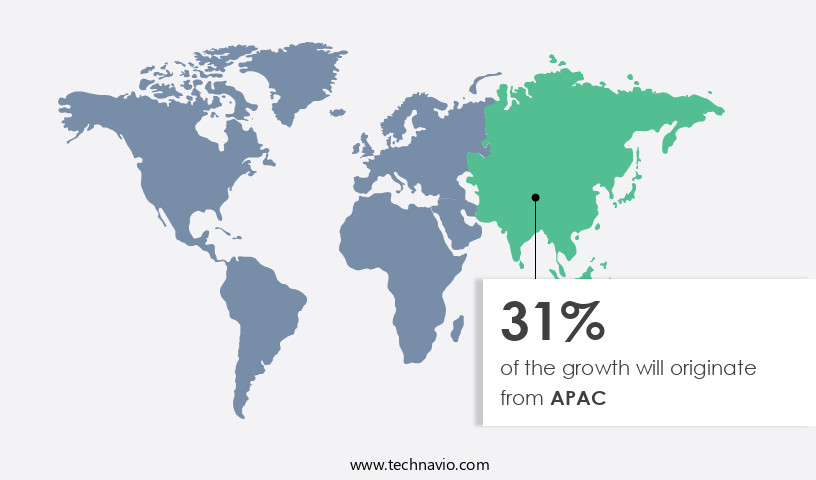

- APAC is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing sales of premium vehicles, urbanization, rising disposable income, and technological advancements. With urbanization rates reaching 82% In the US and 81% in Canada in 2019, the demand for premium vehicles has increased, as these vehicles often feature high-end technologies to enhance both interiors and performance. Automotive control modules, including power modules for heating, ventilation, and massage functions, as well as integrated systems for air conditioning and infotainment, are essential components of these premium vehicles. Customization, comfort, and safety features are key priorities for consumers, driving demand for automation, memory control modules, and advanced safety systems.

The integration of IoT and artificial intelligence (AI) into automotive interiors is also a significant trend, offering passengers a seamless travel experience. The automobile sector is focusing on operational excellence, quality inspection, and infrastructure development to meet consumer expectations and remain competitive. The market for automotive seat control modules is expected to remain profitable, with a focus on power efficiency, industry standards, and safety regulations.

Market Dynamics

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Seat Control Module Industry?

The increasing popularity of luxury vehicles is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for comfort and customization in passenger vehicles. Integrated systems, including heating, air conditioning, and massage functions, are becoming increasingly popular features in both mid-size and high-end vehicles. Automakers are focusing on automation and AI technology to enhance the driving experience, with memory control modules and adjustable lumbar support being key offerings. The integration of IoT and smartphone technology is also a trend, allowing for seamless control and personalization. Safety remains a priority, with features such as occupant recognition, belt reminders, and airbag integration becoming standard. The competition In the market is intense, with manufacturers striving for operational excellence and profitability.

- The industry is also seeing infrastructure development, quality inspection, and adherence to industry standards and safety laws. The integration of smart functions and electronic components, including sensors, is essential for connected cars and the future of vehicle production. Consumers' expectations for a comfortable and convenient travel experience continue to shape the market, with an emphasis on precision and materials in premium products.

What are the market trends shaping the Automotive Seat Control Module Industry?

The development of plug-and-play seat control modules is the upcoming market trend.

- The market encompasses power modules that enable features such as heating, position adjustment, and memory control for comfortable and customized ing in passenger vehicles. Integrated systems, including massage functions, air conditioning, and ventilation, enhance the travel experience and contribute to the demand for comfort in high-end vehicles and luxury cars. Automation and AI-generated software offer personalization and precision, while safety features and materials ensure premium products meet industry standards and safety requirements.

- However, the installation of replacement seat control modules in aging vehicles can be complex and costly. Skilled mechanics are often required for proper tuning and adjustment, which can increase installation charges. This direct replacement does not necessitate programming or skilled mechanics, streamlining the installation process and potentially reducing costs. Despite these advancements, the limited availability of skilled mechanics and the additional installation charges may hinder market growth during the forecast period.

What challenges does the Automotive Seat Control Module Industry face during its growth?

Limitations associated with seat control modules is a key challenge affecting the industry growth.

- The market is driven by the increasing demand for comfortable and customized interiors in both passenger and high-end vehicles. Advanced features, such as power modules for position adjustment, heating, ventilation, and massage functions, are integral to enhancing the driving experience. Integrated systems, including air conditioning and infotainment, further contribute to the market's growth. However, the market may face restraints due to technical difficulties and malfunctions In these advanced systems, which may impact vehicle performance and occupant comfort. Additionally, the integration of artificial intelligence and IoT in automotive control modules, along with safety features and luxury amenities, adds to the complexity of the seat control modules.

- The market's profitability is influenced by consumer expectations for operational excellence, personalization, and seamless integration with smartphones and other electronic components. The integration of sensors and safety systems, such as occupant recognition and belt reminders, further adds to the market's growth. Regulations and safety requirements, including airbag integration and adjustable lumbar support, are essential considerations for manufacturers. The development of infrastructure and quality inspection processes is crucial to ensuring the production of premium products that meet industry standards and safety laws. The market's growth is also influenced by the increasing popularity of electric vehicles and the demand for long-distance travel comfort.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive seat control module market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Electronics Co. Ltd.

- Continental AG

- De Amertek Corp.

- Diodes Inc.

- Dorman Products Inc.

- Embitel Technologies Pvt. Ltd.

- HELLA GmbH & Co. KGaA

- HiRain Technologies Co. Ltd.

- Infineon Technologies AG

- Lear Corp.

- Leopold Kostal GmbH & Co. KG

- Nidec Corp.

- Pektron Group Ltd.

- Robert Bosch GmbH

- STMicroelectronics NV

- Tata Elxsi Ltd

- Texas Instruments Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of advanced technologies designed to enhance the driving experience and passenger comfort in vehicles. These modules, which integrate heating, ventilation, massage functions, and position adjustment capabilities, have gained significant traction In the automotive industry due to the increasing demand for customization and premium features. The integration of automation and artificial intelligence (AI) in automotive control modules has been a key trend in recent years. These systems enable memory settings, personalized climate control, and even occupant recognition, providing a seamless experience for drivers and passengers. The use of AI-generated software also allows for real-time adjustments based on driving conditions and user preferences.

Furthermore, the automotive sector has seen a shift towards the development of integrated systems, with interiors becoming increasingly focused on comfort and convenience. The incorporation of IoT technology and the integration of smartphones have further enhanced the functionality of seat control modules, allowing for remote control and real-time monitoring of various vehicle systems. The demand for comfort and customization in automobiles is a significant driver for the growth of the seat control module market. High-end vehicles and luxury cars, in particular, have seen a rise in demand for these features, as they cater to the evolving preferences of consumers.

The Automotive Seat Control Module market is experiencing significant growth due to the increasing demand for comfortable and advanced car technology. This market includes seat adjustment systems, massage systems, and ventilation systems, which are essential components of automotive interior design in midsize cars and luxury vehicles. Power module manufacturers are at the forefront of this market, providing innovative solutions to enhance vehicle comfort. The heating market is a key segment of the automotive seat control module market, offering drivers and passengers the ability to maintain their preferred temperature. Comfortable car technology, such as adjustable seats and climate control systems, are becoming increasingly important for vehicle reliability and driver satisfaction. Car insurance companies are recognizing the importance of seat control modules in vehicle safety and are factoring them into their rating systems. Autonomous driving and connected car features are also driving demand for advanced seat control systems, as drivers and passengers expect the same level of comfort and convenience in self-driving cars.

Automotive design trends, such as fuel efficiency and car safety regulations, are also influencing the development of seat control modules. ADAS features, such as driver assistance technology and infotainment systems, are being integrated into seat control modules to provide a more comprehensive driving experience. The power module market for seat control systems is expected to grow significantly in the coming years, driven by the increasing demand for comfortable and advanced car technology. The automotive industry trends towards smart car technology and connected features are also expected to drive growth in this market. Vehicle maintenance and car buying guides are increasingly highlighting the importance of seat control modules in ensuring a comfortable and safe driving experience.

The increasing popularity of electric vehicles has also led to an uptick In the adoption of seat control modules, as they contribute to overall vehicle efficiency and the provision of a comfortable travel experience. The competition In the automotive control modules market is fierce, with various players vying for market share. Companies are investing heavily in research and development, focusing on the integration of advanced technologies and the development of more efficient and precise systems. The emphasis on operational excellence and quality inspection is crucial in this industry, as clients demand high-performing and reliable products. The infrastructure development In the automotive industry, including favorable government policies and regulations, has also played a role In the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2023-2027 |

6.44 million units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

3.86 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Seat Control Module Market Research and Growth Report?

- CAGR of the Automotive Seat Control Module industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive seat control module market growth of industry companies

We can help! Our analysts can customize this automotive seat control module market research report to meet your requirements.