Automotive Steering Column Market Size 2024-2028

The automotive steering column market size is forecast to increase by USD 2.74 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing adoption of electric power steering (EPS) systems. EPS offers several advantages, including improved fuel efficiency, reduced emissions, and enhanced driving dynamics, making it a preferred choice for automakers and consumers alike. Another key trend shaping the market is the continuous advances in steering technology, with the increasing penetration of steer-by-wire technology. This technology eliminates the need for a physical connection between the steering wheel and the front wheels, offering benefits such as improved safety, enhanced vehicle dynamics, and the potential for advanced driver assistance systems (ADAS).

- However, the market also faces challenges, including the high cost of advanced steering systems and the need for significant regulatory compliance. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on cost reduction strategies, collaborations with technology partners, and investments in research and development to stay ahead of the competition.

What will be the Size of the Automotive Steering Column Market during the forecast period?

- The market encompasses the production and supply of steering columns and associated components for vehicles. This market is a significant business area within the automotive industry, driven by the increasing integration of electronics into automobiles. Steering columns now house various functions such as radio and music systems, cruise control, climate control, call answering, and steering-assisted safety features. These advancements have led to the development of EP sensors, torque sensors, and position sensors, which communicate with the engine control unit (ECU) to enhance vehicle performance and safety.

- The market's growth is influenced by factors like the proliferation of steering-mounted electronics and the adoption of autonomous driving technologies, including LiDAR smart sensors from companies like LeddarTech. Despite challenges like logistical complications and raw material shipments disruptions, the market remains strong and continues to evolve, responding to the ever-changing demands of the automotive industry.

How is the Automotive Steering Column Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger car

- Commercial vehicle

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

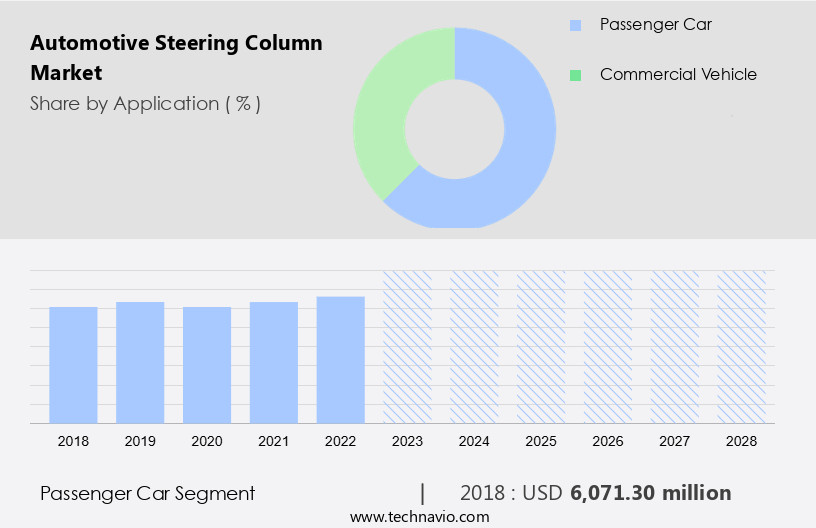

The passenger car segment is estimated to witness significant growth during the forecast period. The market is a significant segment within the automotive components industry, driven by the production of passenger vehicles. This market is influenced by various business areas, including travel bans, logistics, and supply chain disruptions, which impact raw material shipments and operational plants. Steering column manufacturers produce steering-mounted electronics, automobile dashboard-based components such as radio and music systems, cruise control, climate control, call answering, and steering-assisted safety features like ASR and DSR. The market caters to vehicle production in electric vehicles, luxury vehicles, and traditional hydraulic systems, adhering to emission norms and policies. Key players include EPS manufacturers like ZF, AKC, and EV suppliers.

The integration of self-driving technology, Generation 3 AUTOSAR software, and advanced sensors like LeddarTech LiDAR smart sensors is shaping the future of steering columns, steering wheels, steering boxes, and tractor applications. The market is subject to cost and profitability considerations, as well as vehicle dynamics and actuators in powertrain and suspension systems.

Get a glance at the market report of share of various segments Request Free Sample

The Passenger car segment was valued at USD 6.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

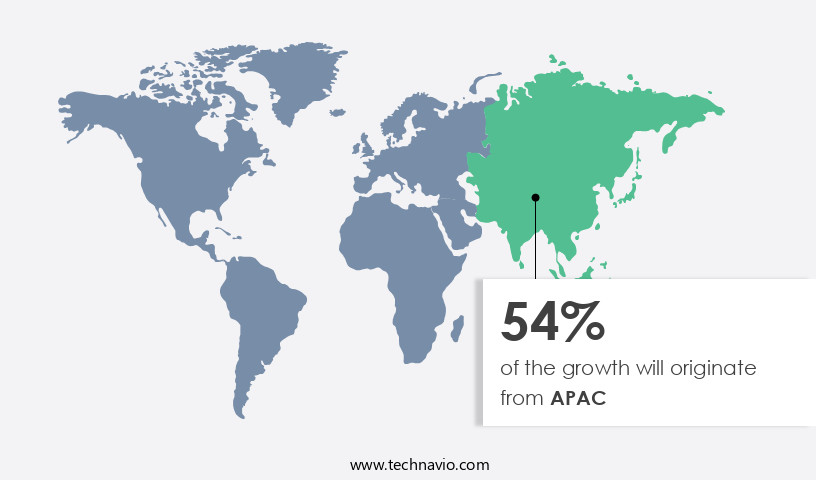

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific (APAC) region, driven primarily by China, India, Indonesia, and South Korea, is experiencing rapid economic growth. This economic expansion has significantly increased per-capita income between 2016 and 2018, enhancing consumer purchasing power and boosting automobile sales. Additionally, countries in the region have invested heavily in infrastructure and industrial development, fueling demand for commercial vehicles. APAC is now the world's fastest-growing and largest automotive market due to its fast-paced economies, attractive government incentives, and strategic location for automotive manufacturing. The region is home to numerous automotive components suppliers and manufacturers. The automotive industry in APAC covers various business areas, such as steering columns, steering boxes, electric power steering (EPS), and self-driving technology.

Key trends include the popularization of electric vehicles (EVs), the implementation of emission norms, and the development of autonomous driving technology. The region's growth is further supported by the production of electric vehicles, hybrids, pickups, and heavy-duty vehicles. Despite challenges like travel bans, logistics, and supply chain disruptions, raw material shipments and operational plants continue to thrive. Advanced technologies like steering-mounted electronics, automobile dashboard-based systems (radio and music, climate control, call answering, steering-assisted safety, and advanced driver-assistance systems like ASR and DSR), lateral and yaw motion sensors, torque sensors, position sensors, ECUs, and actuators are transforming the automotive industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Steering Column Industry?

- Growing demand for electric power steering is driving advanced steering columns adoption is the key driver of the market. The market has witnessed significant advancements, transitioning from traditional hydraulic steering to electronic steer-by-wire systems. These developments aim to enhance driving ease and bolster road safety. One of the key factors fueling this progress is the demand for improved fuel economy. Electronic Power Steering (EPS), a crucial component in modern vehicles, is a testament to these advancements. EPS not only contributes to better fuel efficiency but also serves as a foundation for various safety systems, such as lane keep assist and electronic stability control.

- The automotive industry's relentless pursuit of enhancing driver safety, comfort, and convenience continues to drive innovation. Automakers are collaborating with OEM suppliers to enhance safety features, including lane keep assist and electronic stability control, through the integration of EPS. Additionally, policies and incentives, as well as ongoing projects, are driving the adoption of advanced steering technologies in pickups, heavy-duty vehicles, and tractor applications.

What are the market trends shaping the Automotive Steering Column Industry?

- Continuous advances in automotive steering technology is the upcoming market trend. The automotive steering system market has witnessed significant advancements, driven by increasing environmental concerns and regulatory compliance. Governments worldwide are investing heavily in research and development (R&D) to improve engine efficiency and reduce vehicle emissions. In response, steering system manufacturers are innovating in design and technology to enhance performance and meet emission norms. The integration of electronics in vehicles has accelerated this trend, leading automobile manufacturers to invest in advanced safety systems and electronics for steering systems.

- This technological evolution is transforming the automotive industry, making vehicles safer and more efficient. The electric vehicle market is also expected to significantly impact the market's growth, with the rising cost and profitability of these advanced steering systems making them an attractive investment for automakers. Overall, the focus on vehicle dynamics and the integration of safety technologies with steering systems is set to shape the future of the market.

What challenges does the Automotive Steering Column Industry face during its growth?

- Increasing penetration of steer-by-wire technology is a key challenge affecting the industry's growth. Steer-by-wire technology represents a significant advancement in automotive engineering, eliminating the traditional mechanical link between the steering wheel and the steering system through electrically connected motors. This innovation enables vehicles to change wheel direction based on commands received from connected devices, with the vehicle computer translating these commands to the wheels. The implementation of steer-by-wire technology offers numerous benefits, including enhanced handling and safety.

- By removing the physical connection between the steering wheel and the steering system, manufacturers can more easily adapt this technology to various car models, resulting in cost savings and design flexibility. Furthermore, steer-by-wire systems provide improved performance, reliability, and safety, while reducing manufacturing and operating costs and contributing to better fuel economy.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BorgWarner Inc.

- Continental AG

- Coram Europe Srl

- Fuji Autotech AB

- HL Mando Co. Ltd.

- Huhei Henglong Auto System Group

- JTEKT Corp.

- Leopold Kostal GmbH & Co. KG

- Nexteer Automotive Group Ltd.

- NSK Ltd.

- Pailton Engineering Ltd.

- Robert Bosch GmbH

- thyssenkrupp AG

- Yamada Manufacturing Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital component of modern vehicles, facilitating the direction of the automobile. This business area experiences continuous evolution, driven by advancements in technology and shifting consumer preferences. The production of vehicles relies heavily on the steering column and its associated components. Steering-mounted electronics have become increasingly common in automobile dashboards, integrating features such as radio and music systems, cruise control, climate control, call answering, and steering-assisted safety systems. These innovations enhance the driving experience and contribute to the popularity of self-driving technology. The market is influenced by various factors, including raw material shipments, logistics, and supply chain dynamics.

Moreover, traditional hydraulic systems have given way to electric power steering (EPS) systems, which offer improved fuel efficiency and vehicle dynamics. EPS manufacturers and automotive suppliers have been investing in research and development to create more advanced systems, such as torque sensors and position sensors, to optimize driving performance. Electric vehicles (EVs) and hybrid systems have gained significant attention in recent years, leading to increased demand for lightweight steering components. Policies, incentives, and projects aimed at reducing emissions and promoting sustainable transportation have further fueled this trend. The European Union-wide emission measurement regulations, for instance, have led to the implementation of more stringent emission norms worldwide.

Furthermore, the automotive industry is also witnessing the emergence of autonomous driving technology, with Generation 3 autonomous vehicles expected to hit the market soon. This shift towards self-driving cars will significantly impact the steering column market, as these vehicles will require advanced sensors and actuators to navigate the road. Leading automakers are collaborating with technology companies to integrate advanced sensors into their vehicles to enhance safety and driving capabilities. These partnerships will likely drive innovation in the steering column market, as automakers seek to differentiate themselves in a competitive landscape. Moreover, the steering column market is not limited to passenger cars but also extends to heavy-duty vehicles, pickups, tractors, and motor vehicles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.74 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Steering Column Market Research and Growth Report?

- CAGR of the Automotive Steering Column industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive steering column market growth of industry companies

We can help! Our analysts can customize this automotive steering column market research report to meet your requirements.