Automotive Steering Knuckle Market Size 2024-2028

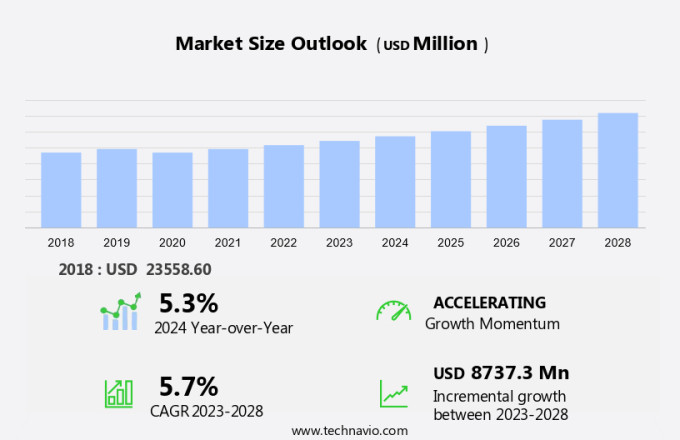

The automotive steering knuckle market size is forecast to increase by USD 8.74 billion, at a CAGR of 5.7% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One driving force is the increasing demand for improved steering precision in vehicles. This has led to advancements in the manufacture of steering knuckles, resulting in better performance and safety. Another trend influencing the market is the rising adoption of rear-axle steering systems, which require specialized steering knuckles. Additionally, the cost of steel, a primary material used in the production of steering knuckles, continues to rise, driving up the overall cost of these components. In the aftermarket sector, there is a growing demand for replacement steering knuckles as vehicles age and wear. Tie rods, a critical component of steering systems, are also experiencing increased demand due to their role in ensuring proper steering alignment. Overall, the market is poised for continued growth, driven by these and other market trends.

What will be the Size of the Market During the Forecast Period?

- The automotive steering knuckle is a critical component in vehicle suspension systems. It connects the steering arm to the wheel hub and facilitates the transfer of steering forces from the steering system to the wheels. The steering knuckle plays a significant role in ensuring vehicle stability and handling. The market is witnessing several trends that are shaping its growth. These trends include the focus on enhancing steering knuckle performance, improving durability, and reducing weight. Steering knuckle performance is a key consideration for automotive manufacturers. The use of advanced materials and manufacturing techniques is leading to the development of high-performance steering knuckles. These components offer improved steering accuracy, better response, and enhanced safety. Another trend in the market is the focus on increasing durability. Steering knuckles are subjected to high loads and harsh operating conditions.

- Therefore, manufacturers are investing in materials and manufacturing processes that can withstand these conditions and extend the life of the components. Weight reduction is another trend that is gaining popularity in the automotive industry. Lightweight steering knuckles can help reduce vehicle weight, leading to improved fuel efficiency and better performance. Aluminum knuckles are a popular choice due to their high strength-to-weight ratio. The optimization of steering knuckle design is also a significant trend in the market. Advanced simulation tools and testing techniques are being used to optimize the design of steering knuckles for specific vehicle applications. This leads to improved performance, durability, and cost savings. Steering knuckle technology is evolving rapidly, with innovations in materials, manufacturing processes, and design.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger car

- Commercial vehicle

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

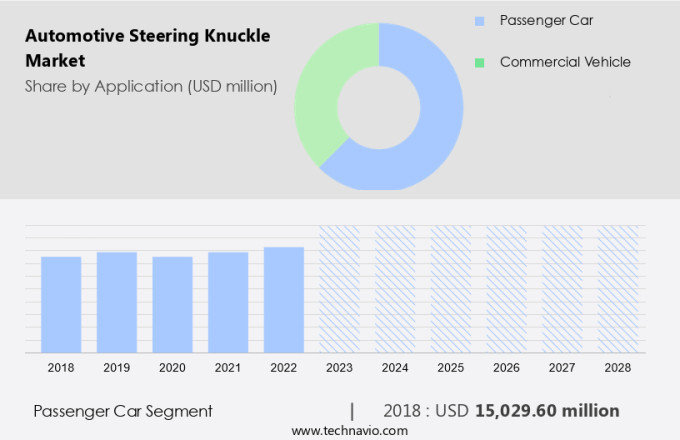

- The passenger car segment is estimated to witness significant growth during the forecast period.

The market experiences growth due to the expanding automotive industry and rising production of passenger vehicles. The demand for lightweight components, such as cast aluminum and forged steel steering knuckles, is increasing as a result. For instance, high-performance vehicles utilize forged steering knuckles in their double-ball-joint MacPherson strut suspension systems. Additionally, the need for lightweight components is more pronounced in off-road vehicles and sports utility vehicles (SUVs). The SUV market is currently witnessing significant growth, particularly in the sales volume of small and crossover SUVs, due to their affordability and lower cost of ownership.

Get a glance at the market report of share of various segments Request Free Sample

The passenger car segment was valued at USD 15.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 70% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Asia Pacific (APAC), the automotive market is experiencing significant growth, driven by the region's strong economy and increasing consumer purchasing power. Countries such as China, India, Japan, and South Korea are leading this growth, with China being the largest and fastest-growing market. The region's economic expansion has led to increased demand for both passenger and commercial vehicles. Additionally, APAC is an attractive destination for automotive manufacturing due to government incentives, low production costs, and abundant raw materials. Moreover, the automotive industry in APAC is undergoing technological advancements, with the integration of the Internet of Things (IoT) and autonomous vehicles becoming increasingly common.

In addition, composite materials are also gaining popularity in automotive manufacturing due to their lightweight and durable properties, contributing to improved fuel efficiency and reduced emissions. Governments in the region are implementing emission caps to reduce the carbon footprint of the automotive sector, further driving the demand for more eco-friendly technologies. In summary, the Asia Pacific automotive market is experiencing significant growth due to its fast-paced economy, increasing consumer purchasing power, and attractive manufacturing conditions. The integration of advanced technologies, such as IoT and autonomous vehicles, and the adoption of eco-friendly materials are key trends shaping the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

Increased precision in the manufacture of steering knuckle is the key driver of the market.

- The steering knuckle is a crucial component in the automotive suspension system, responsible for connecting the wheel assembly to the vehicle's chassis. This connection allows for the transfer of steering input from the steering gear to the tire, enabling directional control. The design of the steering knuckle incorporates a hub or spindle, which attaches to the suspension geometry components. The tire or wheel assembly is securely held in place by the steering knuckle, while the steering arm is connected to the steering mechanism. Proper functioning of these components is vital for ensuring vehicle stability and enhancing the overall driving experience.

- One method to improve the longevity and performance of the steering knuckle is through honing the bore. This process refines the surface of the steering knuckle bore, leading to better wheel bearing life and improved handling and comfort. The automotive steering knuckle plays a pivotal role in ensuring safe and comfortable vehicle operation by connecting the tire assembly to the chassis and facilitating steering input. The honing process enhances the lifespan of the wheel bearing and improves handling and comfort by refining the steering knuckle bore.

What are the market trends shaping the Market?

Increasing trend of rear-axle steering system is the upcoming trend in the market.

- The automotive industry continues to advance with innovative technologies, leading to the integration of new components, designs, and materials. One such development is the implementation of rear-axle steering in passenger vehicles. Originally used in multi-axle trucks to improve maneuverability, this steering system has become increasingly popular in passenger cars due to continuous innovation.

- As the adoption of rear-axle steering grows, so does the demand for automotive steering knuckles. These crucial components connect the wheel hub to the suspension system and facilitate the transfer of steering forces. Manufacturers are focusing on using materials like ductile cast iron to produce strong and durable steering knuckles. This trend is expected to continue, driving the growth of the market.

What challenges does the market face during the growth?

Increasing the cost of steel is a key challenge affecting the market growth.

- The cost fluctuations of steel, a key component in automotive manufacturing, significantly influence production expenses. As a primary material in vehicle production, steel price changes directly impact the automotive industry. The global steel market is projected to expand if manufacturers can effectively manage globalization and customization. Recent trends indicate that rising coking coal prices contribute to escalating steel production costs.

- However, the overall trend has been unpredictable, with prices experiencing considerable volatility due to factors such as inflation, the pandemic, and supply chain disruptions. Automotive steering knuckles, a crucial part of hydraulic steering systems, are manufactured using steel. The instability in steel prices can, therefore, affect the production and pricing of steering knuckles. Understanding the market dynamics and trends in the steel industry is essential for businesses operating in the automotive sector to make informed decisions and mitigate potential risks.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amtek Co. Inc.

- BEINBAUER GROUP

- Dorman Products Inc.

- FAGOR EDERLAN S. COOP.

- Farinia SA

- Fengcheng Danyang Machinery Co.Ltd.

- Georg Fischer Ltd.

- Happy Forgings Ltd.

- Kalyani Steels Ltd.

- Mobex Global

- Ningbo Saipu Auto Steering System Co. Ltd.

- RIVOLTECH AUTO ENGG. PVT. LTD.

- Sandvik Coromant

- Sarvagya Lifters Pvt. Ltd.

- Seco

- Teksid S.p.A.

- TeraFlex Inc.

- The Sakthi Group

- Tungaloy Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant component in the automotive industry, playing a crucial role in the suspension and steering systems of vehicles. These essential parts are responsible for connecting the wheel hub to the steering arm and the suspension system. The steering knuckle is designed to provide the necessary steering angle and suspension geometry for optimal vehicle performance. Manufacturers use various materials such as ductile cast iron, forging, and composite material to produce these components. Ductile cast iron is commonly used due to its durability and strength, while forged steel is preferred for high-performance applications. Composite materials are also gaining popularity due to their lightweight properties, contributing to fuel-efficient steering solutions.

Further, the steering knuckle market caters to both the OEM and aftermarket sectors. Commercial vehicles and passenger cars utilize these components to ensure safety features and proper steering functionality. The integration of IoT technology and the rise of autonomous vehicles are expected to create new opportunities for steering knuckle supply and production. Safety remains a top priority, with manufacturers focusing on designing and producing steering knuckles that meet emission caps and adhere to stringent safety regulations. The market is also witnessing advancements in steering knuckle design, including the use of gable and tie rod improvements, to enhance vehicle handling and performance.

The automotive steering knuckle market is rapidly evolving with advancements in steering knuckle design software and robotics for precise steering knuckle repair and steering knuckle replacement. Innovations in steering knuckle systems focus on lightweighting using aluminum steering knuckles, improving durability and sustainability. Steering knuckle testing and Steering knuckle testing inspection are crucial for ensuring quality and reliability, while automation and assembly processes drive cost efficiency. Steering knuckle optimization techniques enhance steering knuckle performance, while patents protect cutting-edge designs. The integration of 3D printing for steering knuckle components is transforming production, promoting recycling and safety. With ongoing innovations and advancements, the steering knuckle remains pivotal in automotive applications, contributing to improved steering knuckle performance, safety, and cost management.

The automotive steering knuckle market is witnessing significant growth, driven by steering knuckle robotics and advancements in automation for efficient assembly and inspection processes. Steering knuckle durability and reliability are critical, with innovations focusing on lightweighting through the use of aluminum knuckles and steering knuckle 3D printing. These technologies not only reduce cost but also enhance performance and safety. The rise in steering knuckle innovations has led to patents that protect cutting-edge designs, while sustainability efforts emphasize recycling and eco-friendly production methods. Manufacturers are focused on improving quality, lowering the price, and exploring different types of knuckles to meet evolving market needs. These steering knuckle benefits promise improved efficiency, safety, and long-term cost effectiveness for the automotive sector.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2024-2028 |

USD 8.74 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

China, US, Japan, India, Germany, UK, South Korea, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch