Banner Printing Base Fabric Market Size 2024-2028

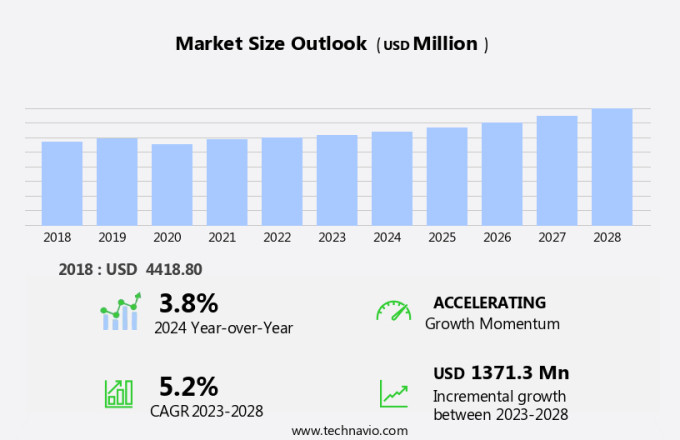

The banner printing base fabric market size is forecast to increase by USD 1.37 billion at a CAGR of 5.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One major trend driving market growth is the rise in disposable income, enabling businesses and individuals to invest in high-quality promotional materials, such as fabric banners. Another factor fueling market expansion is the increasing preference for fabric banners over vinyl, as fabric offers superior durability, flexibility, and aesthetics. The textile technology employed in banner printing has evolved significantly, enabling customization and flexibility in design.

- However, the market faces challenges from digital advertising, which has gained popularity in recent years. To stay competitive, banner printing base fabric providers must focus on offering innovative solutions that cater to the unique needs of their clients while maintaining cost-effectiveness. In summary, the market is poised for growth due to increasing disposable income, the growing popularity of fabric banners, and the need for innovative solutions to compete with digital advertising.

What will be the Size of the Banner Printing Base Fabric Market During the Forecast Period?

- The market encompasses a diverse range of signage fabrics utilized in the printing industry to cater to the advertising sector. These fabrics, including canvas, sustainable, weather-resistant, eco-friendly, and various durable options, are integral to banner production. Banner consumption is driven by various industries, with retail and event sectors leading the charge. Aesthetic considerations play a crucial role in banner design, with an increasing focus on sustainable and eco-friendly fabric options. Weather-resistant and durable fabrics are essential for outdoor applications, ensuring longevity and protection against the elements. Banner printing costs are influenced by several factors, including fabric type, size, and complexity of design.

- Additionally, online banner printing services and software have streamlined the production process, offering cost-effective solutions for businesses. The market continues to grow, driven by advancements in technology and the ever-evolving needs of the advertising industry. Banner fabric applications span across various sectors, including retail, promotional, and event marketing. From vinyl and polyester to canvas and textile-based options, the versatility of banner fabrics ensures they remain a staple in the advertising landscape. Banner design software and installation services further enhance the value proposition, making banners a go-to solution for businesses seeking effective and visually appealing marketing solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- PVC

- Polyester

- Vinyl

- Others

- End-user

- Retail and commercial

- Corporate events

- Entertainment events

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Material Insights

- The PVC segment is estimated to witness significant growth during the forecast period.

The market primarily utilizes polyvinyl chloride (PVC) as the preferred material due to its versatile properties and extensive applications. PVC's composition, consisting of PVC resin, fabric, and additives, enhances its performance characteristics, making it an optimal choice for outdoor advertising, signage, and displays. PVC banners offer exceptional durability, as they are inherently waterproof and UV-resistant, ensuring their longevity in various environmental conditions. Additionally, advancements in textile technologies enable the use of recycled materials and digitally printable fabrics, providing a more sustainable and aesthetically appealing alternative to traditional PVC banners. These innovations cater to evolving market trends and consumer preferences.

Get a glance at the market report of share of various segments Request Free Sample

The PVC segment was valued at USD 1.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region is a major contributor to The market due to the high volume of trade exhibitions, commercial events, and retail expansions. In 2023, China alone hosted over 7,852 trade exhibitions, signifying a significant increase from the previous year. This surge in trade events underscores the increasing demand for top-tier banner materials that provide excellent print quality and durability. Biodegradable fabrics, such as canvas and recycled polyester, are gaining popularity due to their eco-friendly attributes. Wind load is another crucial factor in the selection of banner materials, ensuring their stability in various weather conditions. Interactive banners made from biodegradable fabrics offer a sustainable solution for businesses seeking to reduce their carbon footprint while maintaining visual appeal. The market is expected to grow steadily, driven by these trends and the increasing demand for high-quality banners across various industries.

Market Dynamics

Our banner printing base fabric market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Banner Printing Base Fabric Market?

A rise in disposable income is the key driver of the market.

- The market is experiencing growth due to the increasing disposable income of consumers, leading to higher demand for advertising and promotional materials. This trend is evident in Brazil, where the average real monthly income for employed individuals rose by 7.2% in 2023 compared to the previous year, and by 1.8% compared to 2019. This income growth empowers consumers to spend more, prompting businesses to invest in effective advertising strategies. As a result, there is a growing need for high-quality banner printing base fabrics, which are essential for creating visually appealing and durable banners for various events and outdoor advertising.

- Additionally, environmental concerns are also influencing the market, with a shift towards eco-friendly and sustainable options. Lightweight, mesh fabrics made from recycled materials are gaining popularity due to their low environmental impact and high airflow, making them ideal for outdoor advertising. Additionally, the use of low-VOC inks and digitally printable fabrics contributes to more sustainable production processes. The market for banner fabrics is diverse, with various textile technologies and printing techniques used to cater to different applications. High-resolution digital printing enables the creation of personalized banners for corporate branding and interactive displays, while mesh fabrics offer flexibility and weather-resistance for outdoor signage.

- In conclusion, the prognosis period for the market is positive, with consumer behavior indicating continued demand for immersive and engaging advertising experiences. As businesses seek to differentiate themselves, they are investing in high-quality, sustainable materials for their banners, creating opportunities for growth in the market. Furthermore, the use of advanced technologies, such as NFC chips, can enhance the interactivity of banners, providing consumers with a more personalized and engaging experience. This trend is expected to continue, with digital signage becoming increasingly popular for events, exhibitions, and other marketing initiatives. In conclusion, the market is experiencing growth due to the increasing demand for effective advertising strategies and the shift towards sustainable and eco-friendly materials. The use of advanced technologies is also driving innovation and creating new opportunities for businesses to engage consumers in unique and memorable ways.

What are the market trends shaping the Banner Printing Base Fabric Market?

The growing popularity of fabric banners over vinyl is the upcoming trend in the market.

- The market is experiencing a significant trend towards fabric banners due to their aesthetic appeal, flexibility, and eco-friendly attributes. Brands are seeking innovative ways to connect with consumers, and fabric banners offer a soft, elegant touch that enhances brand imagery and promotes a professional appearance. Superior print quality is another advantage of fabric banners, thanks to advancements in digital printing technology that enable high-resolution graphics with vivid colors and intricate details. Fabric banners are also more sustainable, with options for recycled materials, low-VOC inks, and eco-friendly production processes. Mesh fabrics, in particular, provide excellent airflow and wind load resistance, making them ideal for outdoor advertising and events.

- Additionally, interactive banners with NFC chips offer a unique consumer experience, adding value to brands' marketing efforts. The market for banner fabrics is diverse, with various textile technologies and printing methods available to cater to different service categorizations, prognosis periods, and consumer behaviors. Weather-resistant and recyclable materials, such as polyester and recycled polyester, ensure durability and sustainability, making fabric banners a popular choice for both indoor and outdoor applications.

What challenges does Banner Printing Base Fabric Market face during the growth?

Competition from digital advertising is a key challenge affecting the market growth.

- The market is experiencing significant competition from the rise of digital advertising. Traditional fabric banners offer limitations in terms of instantaneous reach, targeted marketing, and flexible content delivery. This shift towards digital platforms poses a challenge for businesses specializing in print media. Digital advertising channels, such as social media, search engines, and display ads, offer extensive opportunities for brands to engage with consumers in real-time. These platforms enable marketers to analyze performance metrics and adjust campaigns dynamically, resulting in higher engagement rates compared to static fabric banners. Moreover, the environmental impact of banner printing using non-eco-friendly inks and non-recyclable materials is a growing concern.

- Additionally, consumers increasingly prefer sustainable options, including low-VOC inks and fabrics made from recycled materials. Mesh fabrics, which offer airflow and excellent durability, are gaining popularity for their aesthetic appeal and eco-friendly production processes. Textile technologies continue to advance, with digitally printable fabrics becoming increasingly common. These fabrics offer high-resolution digital printing capabilities, making them suitable for events and exhibitions. Biodegradable fabrics, such as canvas and recycled polyester, are also gaining traction due to their sustainability and wind load resistance. The flexibility of digital signage and interactive banners, including those with NFC chips, further differentiates them from fabric banners.

- In conclusion, weather-resistant display materials are essential for outdoor advertising, making sustainable and recyclable materials a priority for businesses seeking to minimize their environmental impact and align with consumer preferences. In the prognosis period, the market dynamics of the banner printing base fabric industry will continue to evolve, with a focus on sustainability, flexibility, and digital technologies. Financial statements and consumer behavior will play a significant role in shaping the market's future.

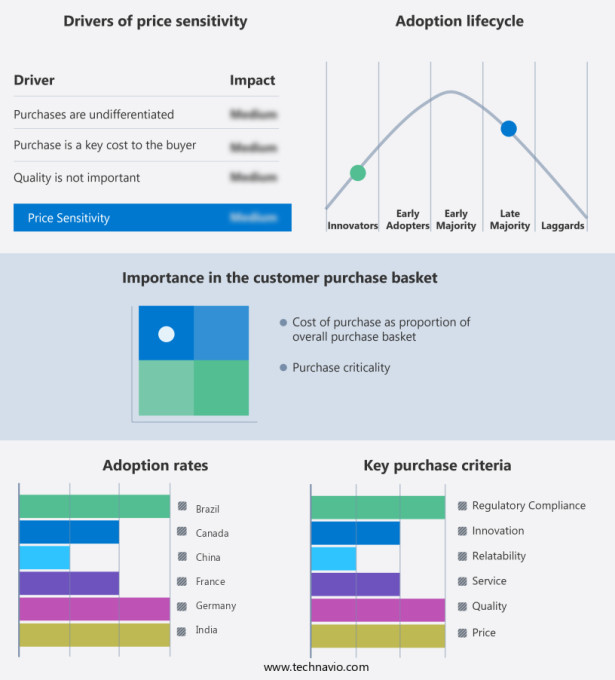

Exclusive Customer Landscape

The banner printing base fabric market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M India Ltd. - The company specializes in providing advanced banner printing base fabric solutions for various applications. These technologies encompass vinyl graphics, window films, building and wall graphics, floor graphics, and illuminated signs.

The banner printing base fabric market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M India Ltd.

- Apex Mills

- Aurora Specialty Textiles Group Inc.

- Avery Dennison Corp.

- Big Media Printing

- Cooley Group

- Duracote Corp.

- Fisher textiles

- Heytex Bramsche GmbH

- Mactac

- Mehler Texnologies Gmbh

- PONGS GROUP GmbH and Co. KG

- Sefar AG

- Serge Ferrari SAS

- Sioen Industries NV

- Snyder Manufacturing

- Symplico

- Ultraflex Systems Inc.

- Unisignflex

- Verseidag Indutex Gmbh

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Banner printing base fabrics play a crucial role in the creation of eye-catching and effective advertising materials. These fabrics serve as the foundation for various types of banners, including those used for outdoor advertising, corporate branding, and immersive experiences at events. In this article, we will explore the market dynamics and trends shaping the banner fabric industry. Lightweight and Durable: The demand for lightweight and durable banner fabrics is on the rise. These fabrics offer several advantages, such as easy transportation, installation, and removal. Additionally, they ensure the longevity of the banner, making them a popular choice for both short-term and long-term applications.

Environmental concerns have become increasingly important in various industries, including the banner fabric market. Low-VOC (Volatile Organic Compounds) inks and recycled materials are gaining popularity due to their reduced environmental impact. Mesh fabrics, which allow for airflow and are often used for outdoor advertising, are also eco-friendly as they offer excellent transparency and reduce the need for additional lighting. Corporate Branding and Aesthetic Appeal: Banner fabrics are not just functional; they also play a significant role in creating a strong visual identity for businesses. High-resolution digital printing technologies enable the production of personalized banners with vibrant colors and intricate designs, enhancing the aesthetic appeal and making them a valuable investment for companies.

Advancements in textile technologies have led to the development of new banner fabric options. For instance, biodegradable fabrics made from natural materials like canvas or recycled polyester are gaining traction due to their sustainability. These fabrics offer an eco-friendly alternative to traditional vinyl or polyester banners and can help businesses reduce their carbon footprint. Flexibility and Interactive Elements: The banner fabric market is also witnessing the integration of technology into banner designs. Interactive banners with NFC (Near Field Communication) chips allow consumers to engage with the content using their smartphones, creating a more immersive experience. Sustainable Materials and Production Processes: Consumer behavior is driving the demand for sustainable materials and eco-friendly production processes in the banner fabric industry.

Wind load-resistant fabrics made from recycled materials are becoming increasingly popular due to their durability and reduced environmental impact. Service Categorization and Prognosis Period: The banner fabric market can be categorized based on service offerings, including design, printing, and installation. The prognosis period for the market is positive, with continued growth expected due to the increasing demand for personalized, eco-friendly, and technologically advanced banner solutions. In conclusion, the banner fabric market is undergoing significant changes, with a focus on lightweight, durable, and eco-friendly options. The integration of technology and sustainability into banner designs is also shaping the industry's future. As businesses continue to seek innovative ways to engage consumers and reduce their environmental impact, the demand for high-quality banner fabrics is expected to remain strong.

The banner industry continues to evolve, offering various fabric options for custom banners that cater to diverse needs. Signage fabrics, such as canvas and sustainable fabrics, have gained popularity due to their aesthetic appeal and durability. Canvas fabric, a traditional choice, provides a classic look for retail banners, while sustainable fabrics offer eco-friendly alternatives. Weather-resistant fabrics are essential for outdoor banners, ensuring their longevity against harsh environmental conditions. Banner printing software for iOS and Mac is increasingly used for designing and creating custom banners, offering flexibility and convenience.

Banner printing costs vary depending on the fabric type, size, and printing method. Durable and flexible fabrics, like display fabric, are popular choices due to their affordability and weather resistance. Banner printing services near me and online are easily accessible, with many banner printing companies offering banner printing software free for customers. Banner installation is crucial for ensuring the longevity and effectiveness of banners. Whether you're looking for a retail banner or a large-scale banner for an event, there are banner printing services and software available to meet your needs. Investing in high-quality banner materials and printing methods will ensure a professional and long-lasting result.

|

Banner Printing Base Fabric Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2024-2028 |

USD 1.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

US, China, Germany, India, Japan, UK, Canada, France, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch