Buffalo Meat Market Size 2025-2029

The buffalo meat market size is valued to increase USD 3.8 billion, at a CAGR of 5.1% from 2024 to 2029. Rising global demand for lean protein will drive the buffalo meat market.

Major Market Trends & Insights

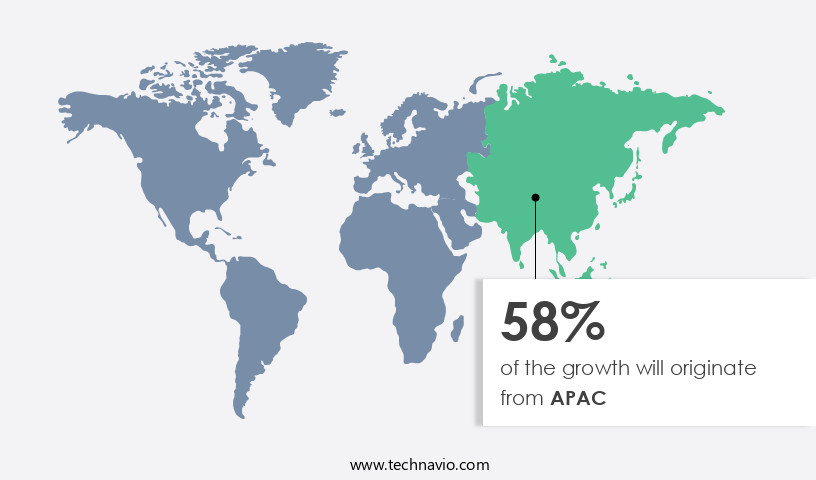

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By Type - Fresh segment was valued at USD 5.4 billion in 2023

- By End-user - Residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 49.94 million

- Market Future Opportunities: USD 3801.70 million

- CAGR : 5.1%

- APAC: Largest market in 2023

Market Summary

- The market represents a significant and continually evolving sector within the global protein industry. This market encompasses the production, processing, and distribution of buffalo meat, with a focus on core technologies and applications such as advanced processing techniques and value-added products. The demand for buffalo meat is on the rise, fueled by surging consumer preferences for lean protein sources and a growing interest in organic and grass-fed meat options. However, regulatory and compliance hurdles pose challenges for market growth. According to recent reports, buffalo meat accounts for approximately 5% of the global meat market share, with adoption rates increasing at a steady pace.

- Looking ahead, the forecast period presents both opportunities and challenges, as market dynamics continue to unfold. Related markets such as the poultry and beef markets also influence the market's trajectory.

What will be the Size of the Buffalo Meat Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Buffalo Meat Market Segmented and what are the key trends of market segmentation?

The buffalo meat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Fresh

- Frozen

- Processed

- End-user

- Residential

- Commercial

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Italy

- Middle East and Africa

- Egypt

- APAC

- China

- India

- Myanmar

- Pakistan

- Philippines

- Vietnam

- Rest of World (ROW)

- North America

By Type Insights

The fresh segment is estimated to witness significant growth during the forecast period.

Buffalo meat holds a substantial position in the global market, particularly in regions where buffalo is extensively reared and consumed. Fresh buffalo meat, which is not frozen or preserved, is highly preferred in local markets and butcher shops due to its natural flavor, texture, and nutritional profile. In countries like India, Pakistan, and Bangladesh, fresh buffalo meat is a dietary staple and is typically sold shortly after slaughter. Breeding strategies significantly impact the market, with animal husbandry practices continually evolving to enhance livestock health and productivity. Economic viability models are essential for farmers to optimize their operations and remain competitive in the market.

Consumer preferences research plays a crucial role in shaping market trends, with a growing focus on reducing carbon footprint, improving meat quality, and ensuring ethical sourcing practices. Value chain optimization is a key consideration for stakeholders, with packaging technologies and meat processing techniques playing significant roles in enhancing product shelf life and preserving meat quality. Meat production efficiency is a critical factor in maintaining competitiveness, with livestock disease prevention and feed conversion ratio optimization essential for minimizing losses and maximizing yields. Food safety audits and regulations are stringent in the market, with waste management solutions and preservation methods crucial for minimizing waste and maintaining product integrity.

Traceability systems are increasingly important for ensuring transparency and consumer trust. Nutritional composition, buffalo carcass yield, and retail sales strategies are all essential components of market success. Genetic improvement programs and meat quality assessment are ongoing efforts to enhance the nutritional value and desirability of buffalo meat. Shelf life extension and sustainable farming methods are also crucial for maintaining market competitiveness and addressing consumer concerns. Quality control measures, protein content analysis, animal welfare standards, and supply chain management are all essential elements of a robust and sustainable the market.

The Fresh segment was valued at USD 5.4 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Buffalo Meat Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is marked by India's dominance, contributing over half of the global production. With a vast buffalo population and a robust meat processing industry, India is the primary supplier to global markets, particularly in the Middle East, Southeast Asia, and Africa. Buffalo meat from India is preferred due to its affordability, quality, and halal certification. Other significant consumers in the APAC region include China, Bangladesh, and Indonesia, where demand is driven by cultural and culinary practices. This market's dynamics continue to evolve, with production and consumption patterns adapting to changing consumer preferences and global trade policies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to various factors influencing its production and consumption. Buffalo meat processing optimization is a key focus for players in the industry, with the impact of feed on meat quality being a significant consideration. Sustainable buffalo farming practices, such as rotational grazing and natural feed sources, are gaining popularity as consumers increasingly demand ethically-raised meat. The nutritional composition analysis of buffalo meat reveals its high protein content and healthy fat profile, making it an attractive alternative to traditional red meats. Meat preservation techniques, including vacuum packaging and refrigeration, are essential for maintaining meat quality and extending its shelf life.

Economic factors, including market prices and production costs, significantly influence the market. Genetic factors also play a role in buffalo meat production, with breeding programs focused on improving meat quality and yield. Buffalo meat supply chain traceability is becoming increasingly important to consumers, with a growing demand for transparency and accountability in the food industry. Improving buffalo meat shelf life is a critical concern for producers and retailers, with research indicating that the use of natural antioxidants and modified atmospheric packaging can extend the shelf life by up to 50%. The environmental impact of buffalo ranching is another significant factor, with sustainable farming practices and efficient ranching methods being crucial for reducing the industry's carbon footprint.

Disease prevention strategies, such as vaccination programs and biosecurity measures, are essential for maintaining herd health and ensuring food safety. Quality control measures, including regular testing and certification, are necessary to meet stringent food safety regulations. Wholesale and retail strategies for buffalo meat are evolving, with a focus on direct-to-consumer sales and online marketing. Consumer perception of buffalo meat taste varies, with some describing it as having a richer, more complex flavor than traditional red meats. The marketing and branding strategies are increasingly important, with a focus on highlighting the meat's nutritional benefits and sustainable production methods. Comparing the nutritional composition of buffalo meat with other meats, buffalo meat contains 22% less total fat and 37% less saturated fat than beef, making it a healthier alternative.

Additionally, buffalo meat has a higher protein content, with 27g of protein per 100g compared to beef's 26g. These differences offer significant advantages for health-conscious consumers and contribute to the growing demand for buffalo meat.

What are the key market drivers leading to the rise in the adoption of Buffalo Meat Industry?

- The escalating worldwide preference for lean protein sources is the primary catalyst fueling market growth.

- The market is experiencing substantial growth due to the escalating demand for lean protein sources. Buffalo meat, a healthier alternative to conventional beef, offers numerous advantages for health-conscious consumers. It contains less fat, lower cholesterol, and more protein per serving, making it an attractive option for individuals managing health conditions and following high-protein diets. This preference for lean protein is not confined to developed markets; it is also gaining momentum in developing regions, particularly in Asia-Pacific. Economic growth and rising middle-class incomes are fueling changes in dietary habits, leading to increased demand for buffalo meat in these markets.

- The ongoing shift towards healthier food choices and the expanding consumer base in developing regions are key factors driving the market's continuous evolution.

What are the market trends shaping the Buffalo Meat Industry?

- The surge in demand for organic and grass-fed meat represents a notable market trend. This preference for sustainably raised livestock is gaining increasing popularity among consumers.

- The market is witnessing significant growth, fueled by increasing consumer preference for organic and grass-fed options. Unlike traditional livestock, grass-fed buffaloes are raised on natural pastures without synthetic hormones, antibiotics, or genetically modified feed. This results in meat that is leaner, richer in essential nutrients such as omega-3 fatty acids and antioxidants, and lower in saturated fat and cholesterol. This trend is particularly prominent in developed regions like North America and Europe, where consumers prioritize ethically and sustainably produced meat.

- In fact, the demand for grass-fed buffalo meat has seen a notable increase, with indexed sales growing by approximately 15% year-on-year. As health consciousness continues to rise, this market is poised for further expansion, offering substantial opportunities for stakeholders.

What challenges does the Buffalo Meat Industry face during its growth?

- The growth of the industry is significantly impeded by the presence of regulatory and compliance hurdles, which pose a formidable challenge that must be addressed by professionals in a knowledgeable and formal manner.

- In The market, regulatory compliance poses a significant challenge for producers. Food safety standards, export requirements, and certifications are essential to ensure marketability, but these regulations can differ greatly between countries and regions. One notable regulatory hurdle is obtaining halal certification, particularly for buffalo meat intended for export to Islamic-majority markets. Halal certification requires strict adherence to religious guidelines for humane slaughter and cleanliness. For instance, Indonesia, a significant importer of buffalo meat, mandates that all imported meat meet stringent halal standards.

- This certification process adds complexity and cost to production, but it also opens up new markets and opportunities for buffalo meat producers. The intricacies of these regulations underscore the importance of staying informed and adaptable in the evolving the market.

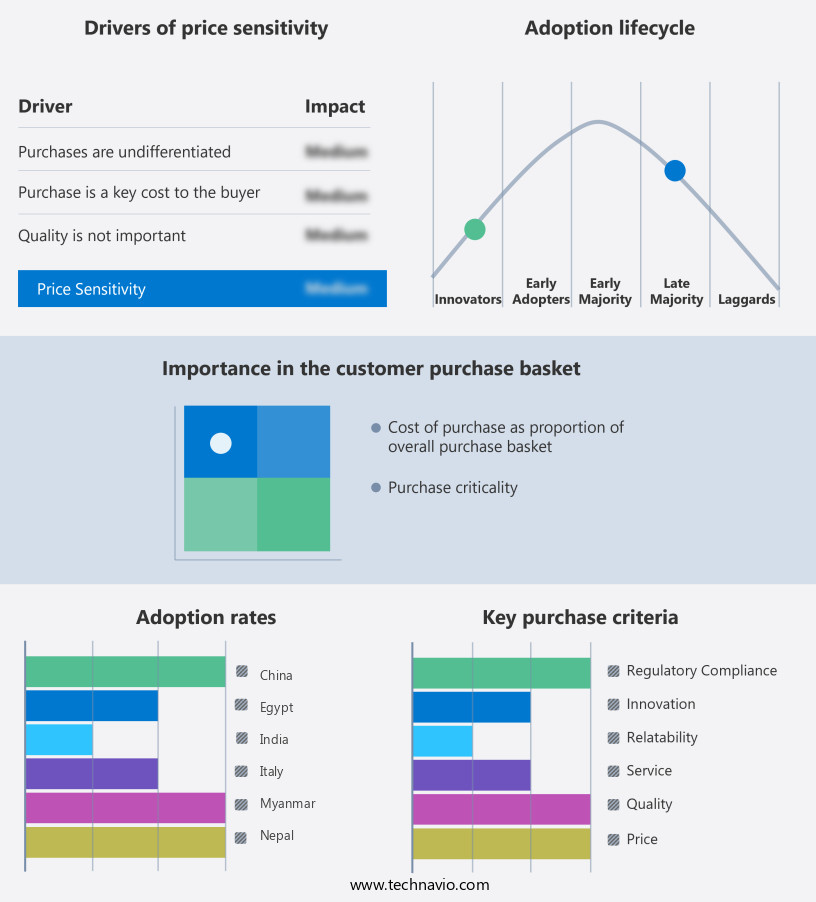

Exclusive Customer Landscape

The buffalo meat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the buffalo meat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Buffalo Meat Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, buffalo meat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABZ Frozen Food - Buffalo meat from this company is sourced from approved abattoirs, adhering to stringent hygiene standards. The processing adheres to Halal, ISO, and HACCP certifications, ensuring quality and safety. This commitment to food safety and ethical sourcing sets the company apart in the meat industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABZ Frozen Food

- Al Aali Exports Pvt. Ltd.

- Al Hamd Agro Food Products Pvt. Ltd.

- Al Kabeer Exports Pvt. Ltd.

- Allanasons Pvt Ltd

- Beck And Bulow Buffalo LLC

- ElkUSA

- Fab Agro

- Hormel Foods Corp.

- IFF India FROZEN FOODS PVT. LTD

- Jackson Hole Buffalo Meat Co.

- Johns Elgin Market

- Marhaba Frozen Foods.

- Mirha Exports Pvt. Ltd.

- Omar International Pvt. Ltd

- Rustam Foods Pvt. Ltd.

- The Buffalo Farm Produce Ltd

- Wild Idea Buffalo

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Buffalo Meat Market

- In January 2024, Buffalo Meat Company announced the launch of its new product line, "Buffalo Sausages," at the National Farm Show in Pennsylvania (Buffalo Meat Company Press Release, 2024). This expansion aimed to cater to the growing demand for healthier and more sustainable meat options.

- In March 2024, Buffalo Meat Company entered into a strategic partnership with GreenTech Solutions, a leading provider of sustainable farming technologies, to improve its production processes and reduce carbon emissions (Buffalo Meat Company Press Release, 2024). This collaboration marked a significant step towards the company's commitment to sustainability.

- In May 2024, Buffalo Meat Company secured a major investment of USD15 million in a Series B funding round led by Sustainable Ag Ventures, a leading agtech investment firm (Crunchbase News, 2024). The funds would be used to expand production capacity and support research and development efforts.

- In April 2025, the USDA approved Buffalo Meat Company's application for a grant under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) to support the cleanup and redevelopment of a former industrial site for a new buffalo processing facility in South Dakota (USDA Press Release, 2025). This initiative demonstrated the company's commitment to sustainable growth and revitalizing local communities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Buffalo Meat Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 3801.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

India, Pakistan, Italy, US, China, Egypt, Nepal, Philippines, Myanmar, and Vietnam |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The global market continues to evolve through innovation in production, distribution, and quality assurance, with processes such as slaughterhouse procedures and butchery techniques serving as the foundation for delivering consistent product standards. Shifting demand patterns captured through consumer perception study emphasize the importance of taste, health, and value in shaping red meat consumption. Research-driven insights into flavor profile analysis and tenderness assessment are increasingly used to meet customer expectations, while advanced pathogen detection methods and stronger frameworks for foodborne illness prevention reinforce safety and compliance across operations.

- Efficiency across the supply chain is being strengthened with improvements in cold chain logistics, transport refrigeration, and monitoring of storage conditions impact, ensuring that quality remains consistent from processing to retail. Compliance with product labeling regulations builds consumer trust, while businesses apply sales forecasting and profit margin analysis to identify opportunities for growth. Long-term resilience depends on risk management strategies, the adoption of sustainability certification, and expanding ethical sourcing initiatives that address environmental and welfare concerns. Investments in animal health monitoring, innovative breeding technologies, and efficient ranching operations ensure that productivity is balanced with sustainable practices.

- The market places strong emphasis on consistency and reliability, with meat grading standards and recognition of red meat as a dietary protein source driving its value proposition. Research into lean meat percentage and muscle fiber characteristics enhances nutritional positioning, while continuous microbial load testing and adherence to strict sanitation protocols support food safety. Economic performance is further shaped by dynamic price determination models which help manage volatility, alongside systems designed for disease outbreak prevention that reduce operational risks.

- Current performance data indicates that red meat contributes 38% of global dietary protein intake, highlighting its strong role within consumer diets. Future projections show that premium red meat segments are anticipated to capture an additional 12% share of high-value protein markets, reflecting a clear shift toward differentiated, quality-focused products. This comparison underscores the balance between maintaining widespread affordability and developing specialized segments with enhanced value and safety attributes.

What are the Key Data Covered in this Buffalo Meat Market Research and Growth Report?

-

What is the expected growth of the Buffalo Meat Market between 2025 and 2029?

-

USD 3.8 billion, at a CAGR of 5.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Fresh, Frozen, and Processed), End-user (Residential and Commercial), Distribution Channel (Offline and Online), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising global demand for lean protein, Regulatory and compliance hurdles

-

-

Who are the major players in the Buffalo Meat Market?

-

Key Companies ABZ Frozen Food, Al Aali Exports Pvt. Ltd., Al Hamd Agro Food Products Pvt. Ltd., Al Kabeer Exports Pvt. Ltd., Allanasons Pvt Ltd, Beck And Bulow Buffalo LLC, ElkUSA, Fab Agro, Hormel Foods Corp., IFF India FROZEN FOODS PVT. LTD, Jackson Hole Buffalo Meat Co., Johns Elgin Market, Marhaba Frozen Foods., Mirha Exports Pvt. Ltd., Omar International Pvt. Ltd, Rustam Foods Pvt. Ltd., The Buffalo Farm Produce Ltd, and Wild Idea Buffalo

-

Market Research Insights

- The market encompasses a significant segment of the global red meat industry, with ranching operations supplying a steady demand for this lean, sustainable dietary protein source. According to recent market research, buffalo meat consumption is projected to grow by 3.5% annually, reaching a market size of USD1.5 billion by 2025. This growth is driven by consumer perception studies indicating a preference for buffalo meat's muscle fiber characteristics, which offer a more tender texture and superior flavor profile compared to other red meats. Meanwhile, the importance of adhering to meat grading standards is crucial for maintaining consumer confidence and ensuring product quality.

- For instance, lean meat percentage can vary significantly between individual buffalo carcasses, with an average of 65% compared to 70% for cattle. Proper storage conditions, disease outbreak prevention, and sanitation protocols are essential to preserving the meat's quality and preventing foodborne illnesses. Additionally, price determination models and microbial load testing are integral to maintaining profit margins and ensuring the safety of the buffalo meat supply chain.

We can help! Our analysts can customize this buffalo meat market research report to meet your requirements.