C5 Resin Market Size 2024-2028

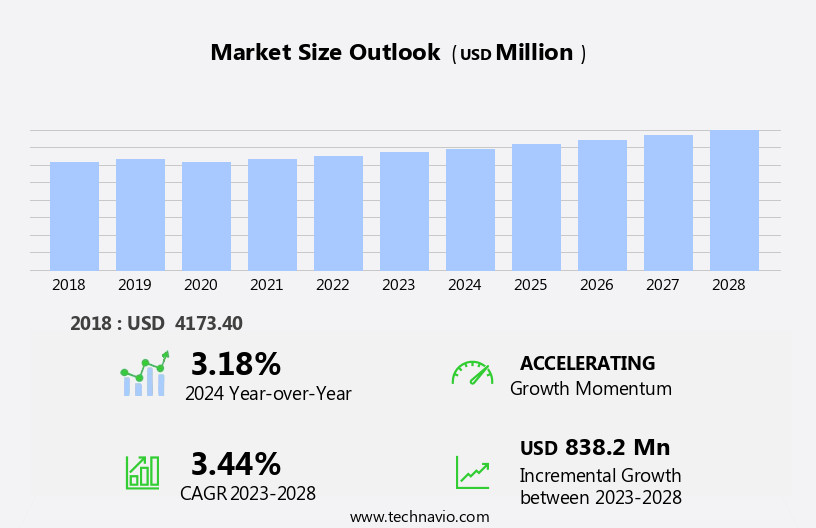

The c5 resin market size is forecast to increase by USD 838.2 million at a CAGR of 3.44% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand from the building and construction industry and the automotive sector. The building and construction industry's growth can be attributed to the rising demand for energy-efficient and durable materials, leading to a surge in the use of C5 Resins in insulation adhesives and roofing applications. Similarly, the automotive industry's demand is fueled by the increasing production of lightweight vehicles, which require C5 Resins for their manufacturing. However, the market's growth is not without challenges. Stringent and unproductive regulatory policies pose a significant obstacle, as they increase production costs and hinder market expansion.

- For instance, regulatory compliance with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations in Europe can add up to 10% to the cost of producing C5 Resins. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of regulatory developments and invest in research and development to create compliant and cost-effective solutions.

What will be the Size of the C5 Resin Market during the forecast period?

- The market continues to evolve, driven by the increasing demand for high-performance materials in various sectors. Green technology is a significant factor shaping the market's dynamics, with the focus on reducing carbon footprints and utilizing renewable resources. Structural components, such as those made from polyester resin, offer lightweight alternatives to traditional materials, enhancing mechanical properties like tensile strength and flexural strength. Automated production ,unsaturated polyster resin and advanced resin formulation techniques enable manufacturers to improve quality control and produce thermoset resins with enhanced chemical resistance, corrosion prevention, and heat resistance. Carbon fiber and glass fiber reinforcements further boost the performance of composite materials, making them suitable for applications in wind energy, industrial manufacturing, and consumer goods.

- The ongoing trend toward additive manufacturing, or 3D printing, is also impacting the market. This technology allows for the production of complex parts with superior mechanical properties, such as impact strength and UV resistance, using materials like unsaturated polyester resin, epoxy resin, and vinyl ester resin. The evolving market landscape continues to unfold, with innovation and sustainability at its core.

How is this C5 Resin Industry segmented?

The c5 resin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Paintings and coatings

- Adhesives and sealants

- Others

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Type

- Aliphatic C5 Resins

- Aromatic C5 Resins

- End-User

- Automotive

- Construction

- Packaging

- Textiles

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

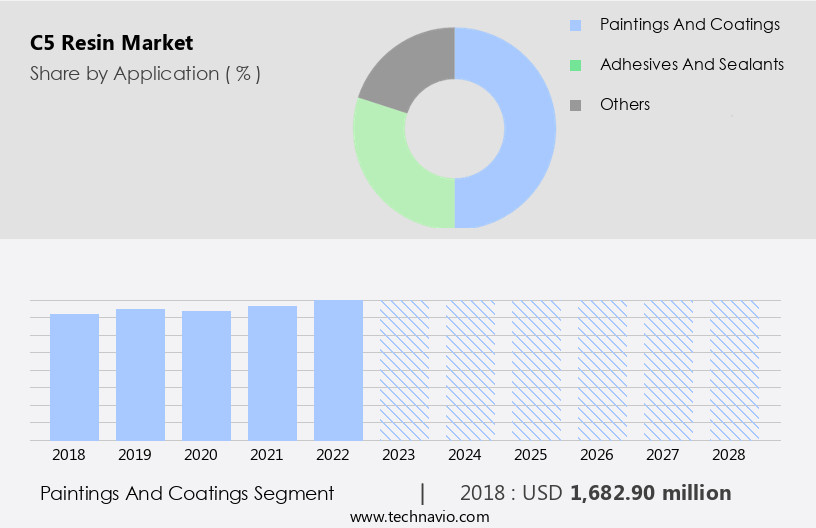

By Application Insights

The paintings and coatings segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to its application in various industries, particularly in the production of green technology, structural components, and composite materials. C5 resins, which include unsaturated polyester resin, polyamide resign, vinyl ester resin, and epoxy resin, offer superior mechanical properties such as tensile strength, flexural strength, and impact strength. These high-performance materials are increasingly being used in the manufacturing of lightweight and durable structural components for industries like automotive, aerospace, and wind energy. Moreover, the use of C5 resins in fiber-reinforced plastics (FRPs) has gained popularity due to their excellent chemical resistance, water resistance, and corrosion prevention properties.

The automation of production processes using 3D printing technology has further accelerated the demand for C5 resins in the manufacturing sector. Renewable resources are becoming increasingly important in the production of C5 resins, with bio-based resins gaining traction due to their eco-friendly nature. Consumer goods industries are also adopting C5 resins due to their ability to provide desirable properties such as heat resistance, UV resistance, and improved mechanical properties. The construction industry's global growth and the resulting increase in demand for paints and coatings are expected to drive the market's growth during the forecast period. The use of C5 resins in paints and coatings provides stability, glossiness, and resistance to environmental factors, making them an essential component in the production of high-quality paints and coatings.

The Paintings and coatings segment was valued at USD 1682.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth due to the increasing demand from the automotive and building and construction industries. In the automotive sector, the region's economy, particularly in countries like India, Indonesia, Thailand, and Vietnam, is driving the market forward. Although China's automotive market growth has slowed down recently, the demand for automotive coatings remains high due to ongoing production. Moreover, the building and construction industry in APAC is adopting C5 resin for its structural components due to its superior mechanical properties, including tensile strength and impact resistance. The region's focus on green technology and renewable resources is also contributing to the growing popularity of C5 resin, which is used in producing high-performance composite materials, lightweight structures, and fiber-reinforced plastics.

The market in APAC is also witnessing advancements in production methods, such as automated production and additive manufacturing, which allow for greater precision and consistency in resin formulation and quality control. Thermoset resins, including unsaturated polyester resin, epoxy resin, and vinyl ester resin, are widely used due to their chemical resistance, heat resistance, and corrosion prevention properties. In the wind energy sector, C5 resin's lightweight and high-strength properties make it an ideal choice for manufacturing wind turbine blades and other components. Furthermore, the increasing use of bio-based resins in consumer goods is also contributing to the market's growth.Overall, the market in APAC is poised for continued growth due to its versatility, durability, and ability to meet the evolving demands of various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The C5 Resin Market is witnessing consistent growth, driven by its wide application across adhesives, coatings, sealants, and rubber industries. C5 hydrocarbon resins are valued for their excellent tackifying properties and compatibility with various polymers. Aliphatic C5 resins offer light color and low odor, making them ideal for hot-melt adhesives and packaging. C5/C9 copolymers combine the advantages of both resins, enhancing performance in pressure-sensitive adhesives. Hydrogenated C5 resins provide superior stability, clarity, and weather resistance, suited for high-end applications. Modified C5 resins are tailored for specific industrial uses, improving performance and adhesion. The market also includes adhesive C5 resins, coating C5 resins, sealant C5 resins, rubber compounding resins, and ink C5 resins, each addressing specialized performance requirements in their respective sectors.

With the evolving with a focus on sustainability, performance, and advanced applications. Growing demand for low-VOC C5 resins and bio-based C5 resins reflects the industry's shift toward eco-friendly formulations and sustainable production. These innovations support regulatory compliance and reduce environmental impact. In adhesives, high-tack adhesives and smart adhesive systems enhance bonding strength and application efficiency. Durable coating resins and heat-resistant sealants are gaining traction in automotive, construction, and packaging sectors for their resilience and longevity. The rise of fast-curing resins supports high-speed manufacturing, while the use of C5 resins in high-performance tires improves grip and durability. These trends position C5 resins as key components in next-generation material solutions across global industries.

What are the key market drivers leading to the rise in the adoption of C5 Resin Industry?

- The building and construction industry's rising demand serves as the primary driver for market growth.

- C5 resins play a significant role in the construction industry, contributing to economic and social development by enhancing infrastructure facilities. These resins are primarily utilized in paints, adhesives, and sealants. In paints, C5 resins improve surface gloss and provide exceptional resistance to acid and alkali substances. Additionally, they are employed as asphalt modifiers for producing colored surfaces. C5 resins exhibit desirable properties such as short cure times, high impact strength, and excellent heat resistance, making them a preferred choice for various applications. In wind energy, C5 resins are used in the production of wind turbine blades due to their superior strength and durability.

- Furthermore, the increasing demand for eco-friendly and sustainable products has led to the development of bio-based C5 resins, which offer reduced carbon footprint and enhanced sustainability. In the realm of consumer goods, C5 resins are utilized in the production of various items, including automotive parts, electrical appliances, and construction materials. Epoxy resins, a type of C5 resin, offer excellent adhesion properties and are widely used in the manufacturing industry for bonding various materials. Overall, the versatility and performance advantages of C5 resins make them an indispensable component in numerous industries, driving their demand and market growth.

What are the market trends shaping the C5 Resin Industry?

- The automotive industry is experiencing significant demand, marking a notable trend in the upcoming market. This heightened interest represents a crucial development for businesses in this sector.

- C5 resins play a significant role in the manufacturing industry, particularly in the automotive sector. In tire rubber compounding, these resins enhance the resistance to chipping and boost the compound's modulus, making them highly compatible with both natural and synthetic rubber. The petrochemical resins' improved bonding and tackiness have led to their increased usage in the rubber tire industry. Furthermore, in the tire and tube industry, C5 resins facilitate the even distribution of fillers during tire vulcanization, contributing to the demand for these resins. The automotive segment is poised for substantial growth, especially in the Asia Pacific region, due to rising per capita income, infrastructure improvements, and increasing vehicle ownership.

- In the industrial manufacturing sector, C5 resins, such as vinyl ester resin, are valued for their high-performance properties. They offer excellent flexural strength, UV resistance, and corrosion prevention, making them ideal for various applications, including coatings, adhesives, and composite materials. The adoption of additive manufacturing technologies has further expanded the applications of C5 resins, enabling the production of complex and lightweight components with superior mechanical properties. C5 resins' versatility and performance benefits make them indispensable in various industries. Their demand is expected to grow as manufacturers continue to seek high-performance materials for their applications.

What challenges does the C5 Resin Industry face during its growth?

- The strict and ineffective regulatory policies pose a significant challenge to the expansion and productivity of the industry. C5 resins, a type of thermoset resin, play a crucial role in various industries due to their superior properties such as high tensile strength, chemical resistance, and immunity to moisture. In the current business landscape, there is a growing emphasis on green technology and the use of renewable resources. This trend is influencing the demand for C5 resins in the production of composite materials, particularly in structural components. Manufacturers are focusing on automated production processes to increase efficiency and reduce hazardous emissions. The need for compliance with stringent environmental regulations is driving this shift towards more sustainable manufacturing methods.

- C5 resins, derived from petroleum, are subject to various regulations due to their potential impact on the environment. To meet these requirements, producers are exploring alternatives to traditional manufacturing methods, such as the use of bio-based feedstocks. The chemical resistance and immunity to moisture of C5 resins make them ideal for use in various industries, including automotive, construction, and wind energy. The automotive industry, in particular, is experiencing significant growth in the use of composite materials due to their lightweight properties and improved fuel efficiency. In the construction industry, C5 resins are used in the production of fiberglass reinforced polyester (FRP) composites for various applications, including roofing and insulation.

- In conclusion, the market is dynamic and evolving, driven by factors such as regulatory compliance, the shift towards green technology, and the growing demand for composite materials. Manufacturers must stay abreast of these trends and adapt their processes accordingly to remain competitive in the market. The use of renewable resources and automated production processes are key areas of focus for companies looking to reduce their environmental impact and improve efficiency.

Exclusive Customer Landscape

The c5 resin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the c5 resin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, c5 resin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arakawa Chemical Industries Co. Ltd. - The company specializes in providing innovative solutions through its range of offerings, including Arkon. Our products are designed to enhance user experience and efficiency, incorporating advanced technologies and sleek designs. By prioritizing originality and quality, we aim to elevate search engine exposure and deliver valuable insights to our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arakawa Chemical Industries Co. Ltd.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Exxon Mobil Corp.

- Henan Anglxxon Chemical Products Co. Ltd.

- Kolon Industries Inc.

- Lesco Chemical Ltd.

- Neville Chemical Co.

- Puyang Changyu Petroleum Resins Co. Ltd.

- Puyang Tiancheng Chemical Co. Ltd.

- Qingdao Bater Chemical Co. Ltd.

- Qingdao Higree Chemical Co. Ltd.

- Qingdao Reehua Yuanhai Biotech Co. Ltd.

- Ruisen Petroleum Resin Co. Ltd.

- Seacon Corp.

- Shanghai Jinsen Hydrocarbon Resins Co. Ltd.

- Sojitz Corp.

- TotalEnergies SE

- Zeon Corp.

- Zibo Luhua Hongjin New Material Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in C5 Resin Market

- In February 2023, BASF SE, a leading global chemical producer, announced the expansion of its C5 chemistry value chain with the construction of a new propanol plant in Ludwigshafen, Germany. This â¬300 million investment aims to increase the company's global production capacity by 50% (BASF press release, 2023).

- In July 2024, SABIC and LyondellBasell, two major players in the market, formed a strategic collaboration to develop and commercialize advanced circular polymers. This joint venture leverages SABIC's expertise in renewable feedstocks and LyondellBasell's technology in polymer production (LyondellBasell press release, 2024).

- In October 2024, Covestro AG, a leading polymer manufacturer, received approval from the European Commission for its new butanediol production plant in China. This â¬1.2 billion project is expected to increase Covestro's global butanediol capacity by 50% and strengthen its presence in the Asian market (Covestro press release, 2024).

- In March 2025, INEOS Styrolution, the world's leading styrenics supplier, showcased its innovative new C5 resin, Styrolux. This high-performance material offers improved processability and enhanced properties, setting a new benchmark in the market (INEOS Styrolution press release, 2025).

Research Analyst Overview

The market encompasses the production, development, and distribution of resins, including high-performance polymers, engineering plastics, and advanced materials. Demand for these resins continues to grow due to their use in lightweight and high-strength applications, particularly in the composite industry. Resin innovation, such as resin modification and infusion technologies, drives market trends, enabling the production of superior performing materials. Resin manufacturing processes, including transfer molding, injection molding, and curing, are essential to the supply chain. Resin characterization and lifespan assessment are crucial to ensuring product performance and durability. High resin production levels and the availability of various resin types contribute to a competitive market.

Market is expanding rapidly, driven by diverse industrial applications and sustainability trends. C5 hydrocarbon resins for adhesives offer excellent tack and bonding, widely used in pressure-sensitive and hot-melt adhesives. Hydrogenated C5 resins for coatings provide superior clarity, weather resistance, and stability. In the printing industry, low-VOC C5 resins for printing inks help meet environmental standards. Emerging bio-based C5 resins for tires support green mobility, while high-tack C5 adhesives for food packaging enhance sealing and durability. C5/C9 copolymers for sealants improve elasticity and adhesion in construction and automotive use. Demand is rising for eco-friendly C5 resins for construction and heat-resistant C5 resins for automotive under green building and vehicle efficiency standards. Sustainable C5 resin production and fast-curing C5 resins for road markings highlight the industry's push toward performance and environmental responsibility.

Suppliers strive to maintain cost competitiveness while delivering consistent quality. Resin recycling efforts aim to minimize waste and reduce environmental impact. Resin applications span numerous industries, including automotive, construction, and electronics. As the need for high-performance materials continues to rise, resin technology and processing techniques will remain at the forefront of market trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled C5 Resin Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.44% |

|

Market growth 2024-2028 |

USD 838.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.18 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this C5 Resin Market Research and Growth Report?

- CAGR of the C5 Resin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the c5 resin market growth of industry companies

We can help! Our analysts can customize this c5 resin market research report to meet your requirements.