Calibration Management Software Market Size 2025-2029

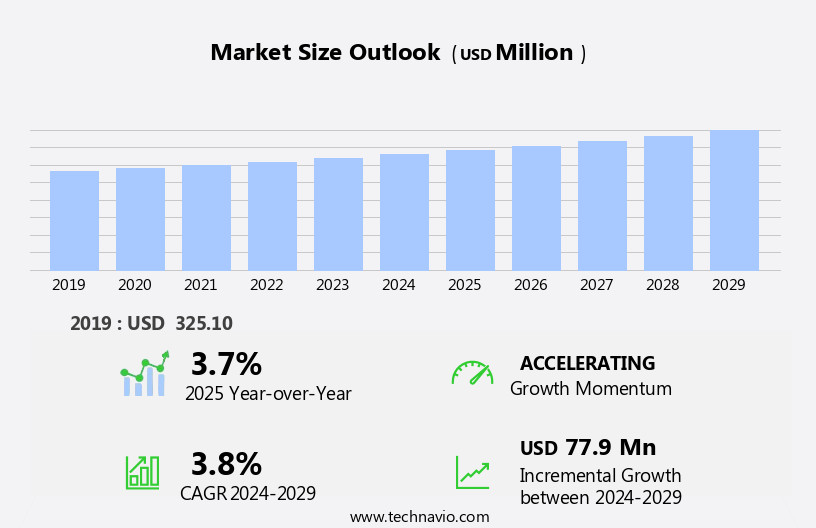

The calibration management software market size is forecast to increase by USD 77.9 million, at a CAGR of 3.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the automation of calibration service processes. Companies are increasingly adopting calibration software to streamline their operations and improve efficiency. This trend is particularly prominent in industries with stringent regulatory requirements, such as pharmaceuticals and manufacturing, where accurate and consistent calibration is essential. Another key driver is the increased focus on predictive maintenance and analytics. Calibration software enables organizations to collect and analyze data from their equipment, allowing them to identify potential issues before they become major problems. This proactive approach not only reduces downtime but also improves overall equipment effectiveness and product quality.

- However, the market is not without challenges. The threat of cyberattacks and security is a significant concern, as calibration software often contains sensitive data. Companies must invest in robust cybersecurity measures to protect their systems and data from unauthorized access. Additionally, the complexity of implementing and integrating calibration software can be a barrier to entry for smaller organizations or those with limited IT resources. Despite these challenges, the potential benefits of calibration management software make it an attractive investment for businesses seeking to optimize their operations and improve their competitive position.

What will be the Size of the Calibration Management Software Market during the forecast period?

The market continues to evolve, driven by the constant need for accurate and reliable measurements across various sectors. Calibration scheduling is a critical aspect, ensuring that instruments undergo regular calibration to maintain optimal performance. Laboratories specialize in calibration for sensors, electronic devices, and mechanical components, while on-site calibration allows for field technicians to calibrate equipment in real-time. Volume calibration and asset management are essential for industries dealing with liquids and gases, providing traceability and accountability. Audit trails and compliance management ensure regulatory requirements are met, reducing downtime and ensuring data acquisition is accurate and secure. Cloud-based calibration and data analysis enable remote access to calibration records and real-time monitoring, improving calibration efficiency and reducing costs.Over 60% of companies now utilize cloud-based calibration and data analysis solutions, enabling remote access to calibration records and real-time monitoring, improving efficiency and reducing operational costs by up to 25%.

NIST traceable calibration reports provide a standardized and verifiable means of documenting calibration results. Flow calibration, torque calibration, pressure calibration, and thermal calibration are just a few of the many calibration procedures available, each with unique applications. Calibration certificates and work order management and warehouse streamline the process, ensuring that equipment maintenance is efficient and effective. Calibration software and quality assurance systems provide a centralized platform for managing calibration procedures, inventory management, and preventative maintenance. Automated calibration can reduce manual error by up to 40%, while remote calibration capabilities have grown in adoption, especially in industries with geographically dispersed assets.Regulatory compliance and remote calibration capabilities are becoming increasingly important, allowing organizations to maintain compliance and reduce the need for on-site visits.

Calibration due dates, data logging, and preventative maintenance scheduling ensure that equipment is always calibrated on time and in compliance with industry standards. Calibration costs and equipment maintenance are significant considerations, making calibration software an essential investment for organizations seeking to optimize their operations and maintain regulatory compliance. The calibration management system market is a dynamic and evolving landscape, with new technologies and applications continually emerging to meet the changing needs of industries and organizations.

How is this Calibration Management Software Industry segmented?

The calibration management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Locally installed (On-Premises)

- Cloud-based

- Application

- Large enterprise

- Small and medium enterprise

- Industry

- Manufacturing

- Healthcare

- Aerospace and Defense

- Pharmaceuticals

- Energy and Utilities

- Component

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

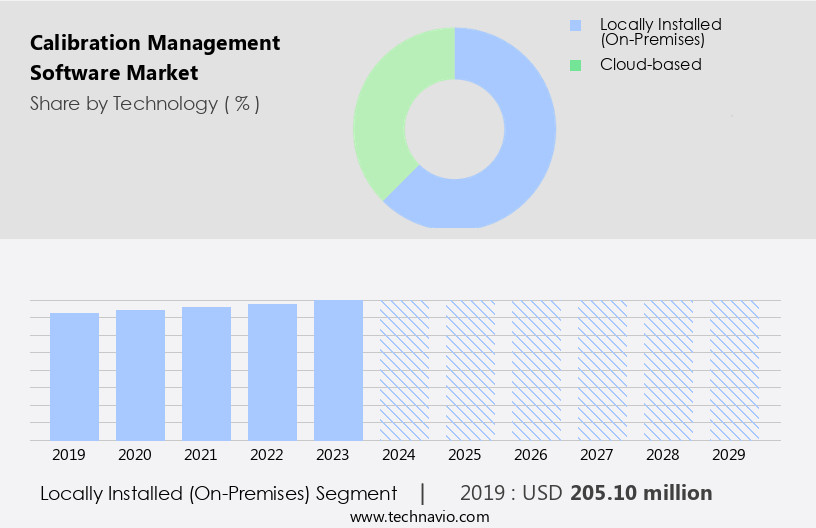

By Technology Insights

The locally installed (on-premises) segment is estimated to witness significant growth during the forecast period.

Calibration management software plays a crucial role in ensuring the accuracy and reliability of various industrial measurements. Locally installed software is currently the preferred choice in the market due to its enhanced security features. With end-users having exclusive access to the data, the risk of data breaches is significantly reduced. This type of software is a permanently licensed solution installed on the users' systems, managed by industrial operators, and essential for multi-user and multi-site implementation. The software supports various calibration types, including weight, sensor, instrument, electronic, field, thermal, laboratory, volume, and pressure calibration. Calibration scheduling, data acquisition, and analysis are streamlined, reducing downtime and improving efficiency.

Calibration certificates and reports are generated, ensuring compliance with regulatory requirements. Calibration management systems enable asset management, inventory management, and work order management. They also provide audit trails, preventative maintenance, and calibration history records. Calibration costs are monitored, and equipment maintenance is scheduled, ensuring the longevity of calibration equipment. Cloud-based calibration solutions are gaining traction due to their flexibility and accessibility. They offer real-time data access, automated calibration, and error analysis. Calibration procedures are standardized, ensuring consistency across the organization. Torque, flow, and hardware calibration are also supported. Calibration due dates are tracked, and data logging ensures an accurate record of calibration events.

The Locally installed (On-Premises) segment was valued at USD 205.10 million in 2019 and showed a gradual increase during the forecast period.

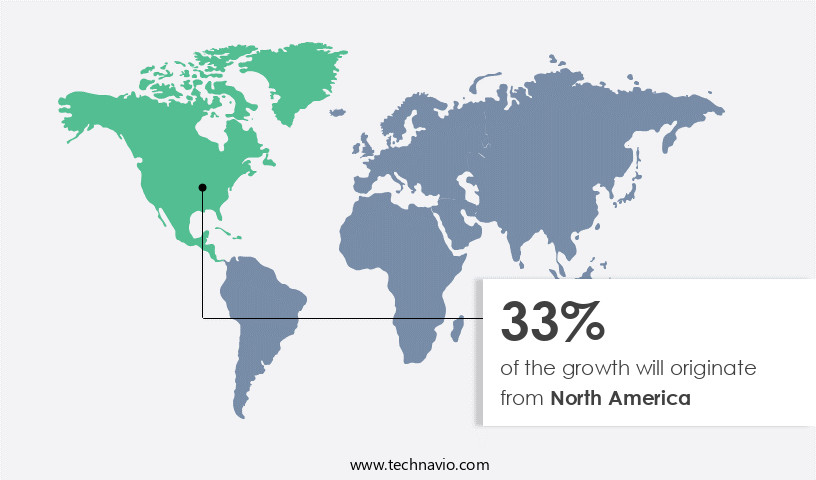

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is witnessing significant growth due to the increasing demand for ensuring calibration effectiveness in various industries. This market caters to various calibration requirements, including weight calibration, sensor calibration, on-site calibration, instrument calibration, electronic calibration, field calibration, data acquisition, and more. The use of calibration management systems facilitates calibration scheduling, reduces downtime, and ensures regulatory compliance. In the US, the oil and gas industry's growth, driven by shale oil production, significantly contributes to the market's expansion. Power generation and the automotive sector are other major industries that invest heavily in calibration management software for maintaining the productivity of their equipment and ensuring measurement accuracy.

Calibration management software solutions cater to various calibration types, such as thermal, volume, pressure, and torque calibration, and offer features like automated calibration, error analysis, and preventative maintenance. The software also ensures calibration history tracking, calibration due dates, and the generation of calibration reports. Cloud-based calibration solutions and mobile calibration applications further enhance the flexibility and efficiency of the calibration process. Calibration equipment inventory management and work order management are other essential features of calibration management software. Calibration procedures and quality assurance are crucial aspects of industries that rely on precise measurements. Calibration management software solutions provide a centralized platform for managing calibration data, reference standards, and measurement uncertainty, ensuring data analysis and audit trails.

Calibration costs and equipment maintenance are essential factors for industries, and calibration management software offers solutions to optimize these aspects while maintaining calibration efficiency and ensuring regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving landscape of industrial automation, the market plays a pivotal role in ensuring precision and accuracy. This market encompasses innovative solutions designed to streamline calibration processes, optimize workflows, and minimize downtime. Key players offer features such as real-time monitoring, automated scheduling, and reporting capabilities. Calibration management software facilitates regulatory compliance, reduces costs, and enhances overall efficiency. It integrates seamlessly with various hardware systems, including data loggers, calibrators, and sensors. Additionally, it supports multiple industries, including manufacturing, pharmaceuticals, and oil & gas, catering to diverse calibration needs. The software's user-friendly interfaces enable easy data access, while its scalability accommodates businesses of all sizes. With continuous advancements in technology, the market is poised to revolutionize the way organizations manage their calibration processes.

What are the key market drivers leading to the rise in the adoption of Calibration Management Software Industry?

- The calibration process automation is a significant market driver, enhancing efficiency and ensuring accuracy in various industries.

- Calibration management software plays a crucial role in optimizing the calibration process for various industries, including power stations, offshore platforms, refineries, and process plants. This software streamlines calibration operations by automating planning, scheduling, and documenting outputs for sensor, instrument, thermal, and electronic calibration. Industries that rely on equipment operating in extreme or remote conditions report up to a 30% reduction in calibration-related downtime after implementing automated systems.By ensuring the accuracy of devices in remote locations, calibration management software minimizes process failures and reduces equipment failure costs and waste.

- Furthermore, it requires fewer calibration technicians on-site, leading to labor cost savings of up to 25% and lower maintenance expenses. Effective deployment of this software is essential for industries that rely on precise measurement and data acquisition, such as those in the energy sector. With comprehensive functionality, calibration management software enhances calibration effectiveness and improves overall operational efficiency.

What are the market trends shaping the Calibration Management Software Industry?

- The emphasis on predictive maintenance and data analytics is a significant market trend. By implementing advanced technologies for predictive maintenance and leveraging data analytics, organizations can proactively address potential equipment failures and optimize operational efficiency. As of 2023, nearly 60% of large-scale manufacturers have implemented predictive calibration tools to minimize unexpected equipment failure.

- Calibration management software plays a crucial role in ensuring the accuracy and reliability of laboratory and volume equipment by facilitating proactive calibration scheduling. Integrated with predictive analytics, this software enables organizations to analyze data on equipment performance, usage patterns, and environmental factors to identify potential issues before they lead to unplanned downtime. By optimizing calibration schedules based on actual usage and equipment condition, organizations can minimize unnecessary downtime and reduce costs. Cloud-based calibration software offers the added benefits of real-time data access and remote calibration capabilities, making it ideal for mobile applications. Compliance management features, such as audit trails and calibration certificates, ensure regulatory requirements are met.

- Data analysis tools allow for trend analysis and correlation identification, further optimizing calibration intervals and improving overall equipment performance. With nist traceable calibration reports, organizations can maintain a record of calibration history and ensure the traceability of their measurement results. Calibration management software is an essential tool for organizations seeking to maximize equipment performance, minimize downtime, and maintain regulatory compliance.

What challenges does the Calibration Management Software Industry face during its growth?

- The growth of the industry is threatened by the looming danger of cyber-attacks, which poses a significant challenge that necessitates robust security measures to mitigate potential risks and ensure business continuity.

- Calibration management software plays a crucial role in ensuring regulatory compliance and maintaining equipment performance in process and discrete industries. With the adoption of torque calibration and software calibration solutions, preventative maintenance and data logging have become essential for quality assurance. Calibration due dates are strictly enforced to minimize downtime and maintain mechanical calibration. However, the increasing use of remote calibration and connected technologies brings new challenges, particularly in the area of cybersecurity. Although software providers secure their servers with firewalls and protections, the potential risks of unauthorized access and data manipulation are significant. Preventing data leakages is essential to maintain the integrity of calibration history and calibration costs.

- Multiple tampering in connecting networks can also lead to data theft. As industries continue to embrace smart manufacturing technologies, it is essential to prioritize cybersecurity measures and repeated software upgrades to mitigate these risks. As industries increasingly embrace smart manufacturing and Industry 4.0 technologies, prioritizing frequent software updates and cybersecurity certifications is essentia The need for a secure environment is paramount to ensure the reliability and accuracy of calibration procedures.

Exclusive Customer Landscape

The calibration management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the calibration management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, calibration management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACG Infotech Ltd. - This company specializes in calibration management solutions, encompassing thermal, mechanical, and dimensional metrology services to ensure precision and accuracy in various industries. Our software streamlines calibration processes, improving operational efficiency and enhancing product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACG Infotech Ltd.

- Ape Software Inc.

- AVL List GmbH

- Business Analysis Ltd.

- CompuCal Calibration Solutions

- CyberMetrics Corp.

- Espresso Moon LLC

- Fortive Corp.

- Hexagon AB

- Humpage Technology Ltd.

- IndySoft Corp.

- Nagman Instruments and Electronics Pvt. Ltd.

- P.J. Bonner and Co. Ltd.

- Prime Technologies Inc.

- Productivity Quality Systems Inc.

- Quality America Inc.

- Qualityze Inc.

- QUBYX Software Technologies LTD.

- Sarlin Oy Ab

- Techgate LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Calibration Management Software Market

- In January 2024, Hexagon's Metrology business, a leading provider of calibration management software, announced the launch of its new version, PC-DMIS 2024 R1. This release introduced advanced features for automated calibration workflows and real-time data analysis (Hexagon press release, 2024).

- In March 2024, Sensia, a calibration software specialist, entered into a strategic partnership with Schneider Electric, a global energy management and automation company. This collaboration aimed to integrate Sensia's calibration software with Schneider Electric's EcoStruxure platform, enhancing asset performance and predictive maintenance capabilities (Schneider Electric press release, 2024).

- In May 2025, CalibrationHQ, a calibration management software provider, secured a significant investment of USD12 million in a Series B funding round led by Insight Partners. This investment will support the company's continued growth and expansion into new markets (CalibrationHQ press release, 2025).

- In the same month, the European Union's Medical Devices Regulation (MDR) came into effect, requiring stricter calibration and validation requirements for medical devices. This regulation is expected to drive increased demand for calibration management software solutions in the European medical device industry (EU Commission press release, 2020).

Research Analyst Overview

- The market is witnessing significant growth due to the increasing demand for efficient and accurate calibration processes in various industries. Customizable reports and access control features enable businesses to tailor calibration workflows to their specific needs, ensuring compliance with regulatory requirements. Data backup and integration with ERP systems facilitate seamless data transfer and improve operational efficiency. Historical data analysis allows for trend identification and root cause analysis, enabling preventive actions and reducing downtime. Maintenance contracts and calibration verification ensure equipment reliability and minimize risks associated with non-calibrated instruments. Calibration outsourcing and validation services offer cost savings and expertise, while document management and calibration workflow automation streamline processes and enhance data security.

- Web portals and integration with LIMS provide real-time data access and data visualization, enabling trend analysis and workflow optimization. User roles, barcode scanning, and RFID tracking ensure data accuracy and streamline workflows. API integration, service level agreements, and software integration with CMMS and EAM systems facilitate data sharing and improve overall equipment effectiveness. Corrective actions and user interface enhancements further optimize calibration processes and improve overall business performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Calibration Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 77.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, France, India, Brazil, Italy, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Calibration Management Software Market Research and Growth Report?

- CAGR of the Calibration Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the calibration management software market growth of industry companies

We can help! Our analysts can customize this calibration management software market research report to meet your requirements.