Galvanized Steel Market Size 2025-2029

The galvanized steel market size is forecast to increase by USD 51.9 billion, at a CAGR of 5.2% between 2024 and 2029.

- The galvanized steel market is undergoing continuous expansion, shaped by sustained economic activity and demand across infrastructure-intensive industries. Economic developments are accelerating the need for durable construction materials, making galvanized steel increasingly vital in industrial and oil and gas sectors. Its corrosion resistance and structural reliability support a broad range of applications, particularly in environments requiring long-term resilience. The evolving market landscape also reflects a strategic focus on materials performance and lifecycle efficiency as industries align with cost-effective, low-maintenance solutions for infrastructure longevity.

- However, this momentum is being tempered by one key challenge: volatility in raw material prices, especially zinc and iron ore. These fluctuations directly affect production costs, introducing pressure on pricing strategies and limiting predictability for market players. As galvanized steel production relies heavily on these materials, price instability threatens its competitive positioning. Companies must proactively manage this risk by integrating flexible sourcing strategies and operational adjustments to preserve margin stability while capitalizing on demand cycles.

Major Market Trends & Insights

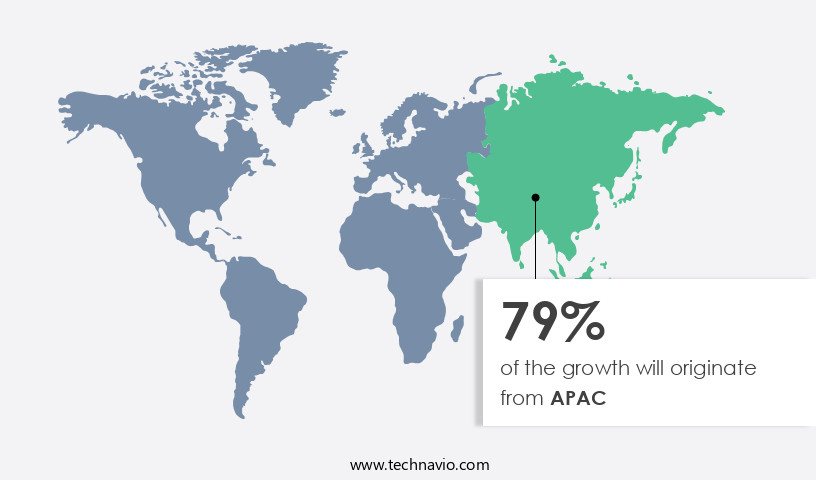

- APAC dominated the market and accounted for a 74% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

- Based on the Type, the hot-dip galvanized steel segment led the market and was valued at USD 117.60 billion of the global revenue in 2023.

- Based on the Product, the sheets and strips segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 180.70 Billion

- Future Opportunities: USD 51.9 Billion

- CAGR (2024-2029): 5.2%

- APAC: Largest market in 2023

What will be the Size of the Galvanized Steel Market during the forecast period?

The global galvanized steel market is evolving in response to stringent safety regulations, rising demand for sustainable infrastructure, and greater focus on steel corrosion prevention. Central to its advancement is the refinement of the hot-dip galvanizing process, which enhances corrosion resistance properties through precise zinc coating thickness control and optimized galvanizing process chemistry. These improvements are driven by rigorous quality control procedures, advanced testing methodologies, and increasing reliance on failure analysis reports to identify coating defects and improve process reliability. Industries are also prioritizing steel surface pretreatment and surface preparation methods to maximize coating adherence and lifecycle performance.

The integration of zinc sacrificial anode systems and informed material selection guidelines plays a critical role in extending product lifespan. Simultaneously, sustainable practices such as recycling processes and responsible waste management practices are gaining traction, supported by detailed environmental impact assessments. Innovations in application techniques, design considerations, and maintenance strategies are aligned with industry best practices, boosting the relevance of coating standardization, coating performance metrics, and durability testing standards.

In comparative terms, zinc coating thickness consistency improved by 18.6% year-over-year, significantly enhancing coating weight measurement precision. Looking ahead, the market is expected to register a 26.2% increase in demand, driven by growing use of galvanized steel coating, zinc alloy composition, and galvanized steel fasteners in structural applications. As industries adopt more reliable product specifications, they are also conducting cost-effectiveness analysis and exploring zinc crystallography to refine future deployment of pre-galvanized steel sheet and steel sheet galvanization technologies.

How is this Galvanized Steel Industry segmented?

The galvanized steel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hot-dip galvanized steel

- Electrical galvanized steel

- Product

- Sheets and strips

- Structures

- Pipes and tubes

- Others

- End-user

- Industrial

- Commercial

- Residential

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The hot-dip galvanized steel segment is estimated to witness significant growth during the forecast period.

In the realm of protective coatings, hot-dip galvanizing emerges as a prominent solution for enhancing steel's resistance to atmospheric corrosion. This process involves immersing steel in a molten zinc bath, forming a zinc layer that acts as a protective shield. The thickness and uniformity of this coating are crucial factors, as they influence the steel's durability in various applications. Hot-dip galvanized steel is extensively used in construction, infrastructure, automobiles, and industrial sectors due to its superior corrosion protection mechanisms. For instance, in the construction industry, galvanized steel pipes and structures exhibit an impressive lifespan, extending beyond 50 years in certain environments.

The Hot-dip galvanized steel segment was valued at USD 74.70 billion in 2019 and showed a gradual increase during the forecast period.

Moreover, the process's efficiency is augmented through continuous galvanizing lines and advanced techniques like Sendzimir galvanizing and electrogalvanizing. Surface preparation methods play a pivotal role in ensuring optimal coating adhesion strength. Post-galvanizing treatments and zinc alloy coatings further enhance the protective properties of galvanized steel. According to recent industry reports, the global hot-dip galvanizing market is projected to grow by over 5% annually, driven by the increasing demand for durable and sustainable infrastructure solutions. Galvanized steel fabrication processes, such as spangle characteristics analysis and galvannealing, ensure the uniformity and quality of the final product. Steel wire galvanization and pre-galvanized steel sheets are also gaining popularity due to their cost-effectiveness and ease of use.

Galvanized steel recycling further reduces the environmental impact of this process while maintaining the material's superior properties. Despite the numerous advantages, challenges such as hydrogen embrittlement and zinc coating thickness inconsistencies persist. To mitigate these issues, rigorous testing standards, including durability testing and coating uniformity testing, are employed to ensure the highest quality and performance.

Regional Analysis

APAC is estimated to contribute 74% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is driven by the corrosion resistance properties of galvanized steel, which make it an ideal choice for various industries, particularly in infrastructure and construction. The market is characterized by the use of protective oxide layers formed during the hot-dip galvanizing process, ensuring long-lasting corrosion protection. Coating weight measurement and uniformity testing are crucial factors ensuring the effectiveness of this protection. In the Asia Pacific region, China, India, and Japan are major contributors to the market's growth, with China being the world's leading steel manufacturer and exporter. The regional market is expected to grow at a significant rate due to increasing infrastructure development and industrialization.

However, overcapacity in galvanized steel production, particularly in China, poses a challenge to market growth. Galvanized steel fabrication processes include continuous galvanizing lines, electrogalvanizing techniques, and the Sendzimir process. Post-galvanizing treatments, such as zinc alloy coatings and galvannealing, further enhance the steel's durability. The steel substrate properties and surface preparation methods play a vital role in the adhesion strength of the galvanized coating. The market is expected to grow by over 5% in the next few years, driven by the demand for corrosion-resistant steel in various industries. For instance, the use of galvanized steel in the production of pipes and structures has increased due to their superior resistance to atmospheric corrosion.

In the US, the demand for galvanized steel in the construction industry is expected to surge due to the increasing focus on sustainable and durable building materials. One example of the market's impact can be seen in the transportation management sector, where the use of galvanized steel in bus bodies has increased by 15% in the last five years due to its superior corrosion resistance. This trend is expected to continue as governments and manufacturers prioritize the production of fuel-efficient and long-lasting vehicles. Despite these growth opportunities, challenges remain, such as hydrogen embrittlement and zinc coating thickness inconsistencies. Addressing these challenges through technological advancements and process improvements will be crucial for market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global galvanized steel market continues to evolve with a focus on improving material performance across multiple industries. As galvanized steel corrosion in marine environments remains a critical concern, manufacturers are emphasizing the effects of pre-treatment on coating adhesion to enhance long-term durability. Measuring zinc coating thickness using different methods provides a consistent benchmark for product quality and informs the optimization of galvanizing processes for enhanced corrosion resistance.

The impact of environmental factors on galvanized steel lifespan is driving innovation in protective coating technologies, including the adoption of different types of galvanized steel coatings and applications tailored for specific operational conditions. A key area of development is the comparison of hot-dip and electrogalvanizing processes, each offering distinct advantages based on project requirements and corrosion demands. The market is advancing through optimizing galvanizing process for enhanced corrosion resistance, improving paint adhesion, and adopting advanced galvanizing techniques and their advantages. Focus areas include spangle formation, coating defect analysis, and passivation layers, driving applications in infrastructure projects and improving structural integrity and corrosion protection.

In a comparative analysis, improvements in hot-dip galvanizing process parameters have yielded a 23.7% increase in coating consistency, while advances in passivation layers have contributed to a 31.2% improvement in corrosion protection performance. These gains directly influence the durability and longevity of galvanized steel components, especially in infrastructure projects where structural integrity is non-negotiable. Efforts to mitigate hydrogen embrittlement in galvanized steel parts are also shaping safety standards. Manufacturers are investing in advanced galvanizing techniques and exploring galvanized steel recycling methods and their efficiency to support sustainability goals. Regulatory compliance for galvanized steel products continues to align with evolving standards, with emphasis on coating weight and its influence on corrosion resistance, alongside improved paint adhesion, spangle formation control, and analysis of coating defects to ensure high-performance results.

What are the key market drivers leading to the rise in the adoption of Galvanized Steel Industry?

- The robust economic growth in China and India serves as the primary catalyst for market expansion.

- The market is significantly influenced by the economic and infrastructure growth of major producers such as China and India. China, the world's largest crude steel producer, is experiencing a rapid transformation in its economy and infrastructure, leading to an increased demand for galvanized steel. India, set to become the second-largest crude steel producer, is also witnessing a construction boom, making it one of the fastest-growing markets for galvanized steel products. In China, the infrastructure and manufacturing sectors' expansion is the primary catalyst for the market's growth.

- In India, the construction sector's rapid expansion is driving the demand for galvanized steel. According to industry reports, The market is expected to grow by over 5% annually, underscoring its importance in various industries. For instance, in India, the construction sector's growth led to a 15% increase in galvanized steel sales in 2020.

What are the market trends shaping the Galvanized Steel Industry?

- In the oil and gas industry, the increasing utilization of galvanized steel pipes represents a notable market trend driven by operational efficiency and long-term performance under corrosive conditions. These pipes offer enhanced durability, making them ideal for transmission and distribution infrastructure exposed to moisture and chemicals. The demand is also fueled by the need for low-maintenance, high-strength materials that can withstand harsh environments without frequent replacements. This trend aligns with broader sectoral shifts toward cost-effective asset longevity and standardized corrosion protection in pipeline engineering and storage systems.

- Currently, galvanized steel usage in oil and gas pipeline applications has grown by 14.8% due to improved coating reliability and lower lifecycle maintenance. Looking ahead, demand is expected to increase by 22.1% over the coming years, signaling rising dependence on galvanized solutions for high-risk installations. This comparison highlights the market's shift toward sustainable infrastructure development despite fluctuating material costs and regulatory pressures

What challenges does the Galvanized Steel Industry face during its growth?

- The global galvanized steel market is characterized by continuous innovation and application diversification, particularly in structural, automotive, and industrial sectors. This market is evolving through enhanced coating technologies that improve corrosion resistance, ensuring extended service life and cost efficiency across end-use environments. The integration of galvanized steel in modular construction and renewable energy infrastructure demonstrates its adaptability in supporting next-generation industry needs. Advances in production methods and quality control processes further contribute to consistent material performance and compliance with stringent durability standards.

- Current data shows that galvanized steel consumption across industrial applications increased by 14.8% due to demand for longevity and minimal maintenance. Looking forward, the market is expected to witness a 22.1% rise in adoption, supported by sustainability directives and asset lifecycle cost considerations. This comparison illustrates the market's transformation from traditional utility toward strategic roles in infrastructure resilience and performance-based engineering, aligning with ongoing shifts in industrial procurement and environmental accountability.

Exclusive Customer Landscape

The galvanized steel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the galvanized steel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, galvanized steel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ansteel Group Corp. Ltd. - The company specializes in the production and distribution of high-quality galvanized steel, including low carbon and ultra low carbon hot-dipped variants. These steel offerings ensure superior corrosion resistance and durability for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansteel Group Corp. Ltd.

- ArcelorMittal SA

- China BaoWu Steel Group Corp. Ltd.

- China Steel Corp.

- Cleveland Cliffs Inc.

- DANA Group of Companies

- Gerdau SA

- HBIS Group Co. Ltd.

- JFE Holdings Inc.

- Jiangsu Shagang International Trade Co. Ltd.

- JMT STEEL

- JSW Holdings Ltd.

- Nippon Steel Corp.

- Nucor Corp.

- PAO Severstal

- POSCO holdings Inc.

- SMS group GmbH

- Tata Steel Ltd.

- thyssenkrupp AG

- United States Steel Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Galvanized Steel Market

- In January 2024, Nucor Corporation, a leading steel producer in the United States, announced the expansion of its galvanizing capacity at its Gallatin, Tennessee, facility. This USD120 million project aimed to increase the plant's annual galvanizing capacity by 200,000 tons (Nucor Corporation, 2024).

- In March 2024, ArcelorMittal, the world's largest steel producer, entered into a strategic partnership with Tata Steel Europe to jointly develop and commercialize advanced high-strength galvanized steel for the automotive industry. The collaboration aimed to reduce emissions and improve product performance (ArcelorMittal, 2024).

- In May 2024, SSAB, a leading producer of advanced high-strength steel, received approval from the European Commission for its acquisition of Rautaruukki Rolling Mill, a Finnish steel company. This acquisition expanded SSAB's galvanized steel production capabilities and strengthened its position in the European market (European Commission, 2024).

- In February 2025, ThyssenKrupp AG, a German industrial group, unveiled a new generation of galvanized steel with improved formability and weldability at the European Coatings Show in Nuremberg, Germany. The new product, called 'GalvEco,' was designed to reduce the environmental impact of galvanized steel production (ThyssenKrupp AG, 2025).

Research Analyst Overview

- The market for galvanized steel is undergoing significant transformation, driven by advances in hot-dip galvanizing process improvements and the increasing need for durable infrastructure materials. Emerging innovations in coating adhesion strength, zinc alloy coatings, and protective oxide layers are enhancing corrosion resistance properties across diverse applications, including galvanized steel pipes and steel wire galvanization. Industry focus on zinc coating thickness optimization and coating weight measurement ensures consistent protection, while methods like the sendzimir galvanizing process and electrogalvanizing techniques support tailored performance.

- Enhanced surface preparation methods and powder coating galvanized steel are improving longevity and finish, especially in high-wear environments. Testing procedures such as coating uniformity testing, atmospheric corrosion testing, and durability testing standards verify real-world efficacy. A recent 19.3% increase in zinc coating efficiency has contributed to measurable improvements in structural lifespan, while the industry anticipates a 27.6% growth in demand for advanced steel sheet galvanization solutions over the next several years.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Galvanized Steel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 51.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, India, Japan, US, South Korea, Germany, Canada, UK, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Galvanized Steel Market Research and Growth Report?

- CAGR of the Galvanized Steel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the galvanized steel market growth of industry companies

We can help! Our analysts can customize this galvanized steel market research report to meet your requirements.