Cardiac Monitoring and Cardiac Rhythm Management Devices Market Size 2024-2028

The cardiac monitoring and cardiac rhythm management devices market size is valued to increase USD 7.48 billion, at a CAGR of 5.38% from 2023 to 2028. Increasing prevalence of CVDs globally will drive the cardiac monitoring and cardiac rhythm management devices market.

Major Market Trends & Insights

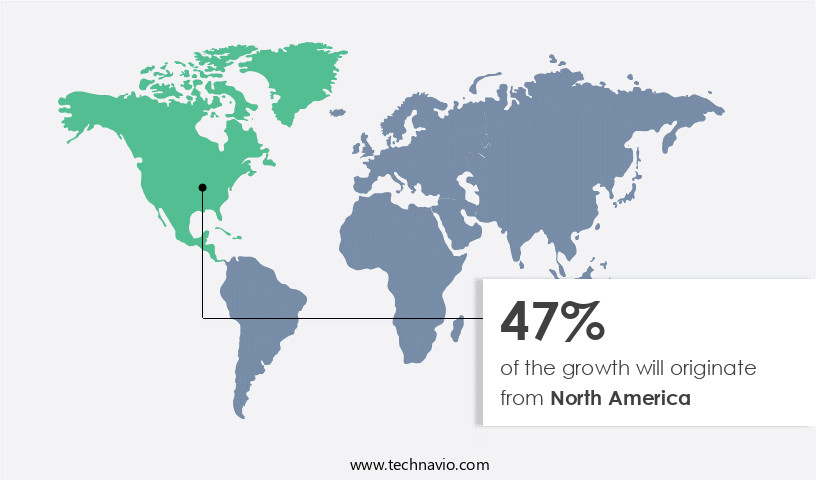

- North America dominated the market and accounted for a 47% growth during the forecast period.

- By Product - CRM devices segment was valued at USD 15.35 billion in 2022

- By End-user - Hospitals segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 46.86 million

- Market Future Opportunities: USD 7476.72 million

- CAGR from 2023 to 2028 : 5.38%

Market Summary

- The market encompasses a continually evolving landscape shaped by advancements in core technologies and applications, service types, and regulatory frameworks. With the increasing prevalence of cardiovascular diseases (CVDs) globally, the market witnesses a growing demand for innovative solutions. According to a study by the American Heart Association, an estimated 2.3 million people in the United States are living with atrial fibrillation, a common arrhythmia requiring cardiac monitoring.

- Strategic initiatives by market companies, such as product launches, collaborations, and partnerships, further fuel market growth. However, the high cost of cardiac monitoring (CM) and cardiac rhythm management (CRM) devices poses a significant challenge. Despite this, opportunities abound, particularly in emerging markets and untapped applications, as the market continues to unfold.

What will be the Size of the Cardiac Monitoring and Cardiac Rhythm Management Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cardiac Monitoring and Cardiac Rhythm Management Devices Market Segmented ?

The cardiac monitoring and cardiac rhythm management devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- CRM devices

- CM devices

- End-user

- Hospitals

- Clinics

- Cardiac care centers

- ASCs

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

The CRM devices segment is estimated to witness significant growth during the forecast period.

Defibrillators are essential medical devices that restore a normal heartbeat by delivering an electric pulse or shock to the patient's heart. These devices are crucial in managing cardiac arrhythmia, which can manifest as an irregular heartbeat that is too slow, too fast, or uneven. Two primary types of defibrillators are implantable cardioverter defibrillators (ICDs) and external defibrillators, which include automated external defibrillators (AEDs) and wearable cardioverter defibrillators (WCDs). ICDs are battery-powered, surgically implanted devices that continuously monitor the heart rhythm. When irregular rhythms are detected, ICDs respond by sending anti-tachycardia pacing (ATP) or delivering an electric shock to the heart.

According to recent reports, approximately 325,000 ICDs are implanted annually worldwide, representing a 20% increase from five years ago. Furthermore, industry experts anticipate that the global ICD market will expand by 15% within the next five years. Cardiac rhythm management is a critical aspect of ICD functionality, with pacing parameters and arrhythmia detection playing significant roles. Tachycardia management, patient outcomes, heart rate variability, and pacemaker implantation are essential considerations in this context. Electrophysiology studies, device longevity, and heart failure monitoring are also essential factors influencing the market's growth. Battery technology, device programming, data acquisition systems, and lead placement techniques are essential ICD components.

Signal processing algorithms, holter monitoring, diagnostic algorithms, ECG monitoring, ventricular tachycardia detection, and therapeutic interventions are essential features that enhance ICD functionality. Biometric data, sensor technology, and defibrillator therapy are other crucial aspects of ICDs. Atrial fibrillation detection, patient data management, event monitoring, shock delivery systems, lead impedance, remote monitoring systems, bradycardia management, telemetry technology, and clinical trial data are some of the emerging trends in the ICD market. These advancements contribute to improved patient outcomes and enhanced device functionality.

The CRM devices segment was valued at USD 15.35 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cardiac Monitoring and Cardiac Rhythm Management Devices Market Demand is Rising in North America Request Free Sample

In North America, the market is experiencing significant expansion, driven by several key factors. The US and Canada are primary contributors to this growth, with their substantial healthcare expenditures on cardiovascular diseases (CVDs) and increasing approvals for advanced cardiac monitoring and rhythm management devices. The market's expansion is further fueled by the growing older population and the rising number of procedures performed using these devices.

The high prevalence of CVDs, coupled with the technological advancements in cardiac monitoring and rhythm management, is leading to increased adoption of these devices in North America. The market's growth is steady and consistent, making it an attractive investment opportunity for industry professionals.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in technology and growing demand for improved patient care. One of the key trends shaping this market is the focus on enhancing pacemaker lead longevity, which has led to significant research and development efforts in lead placement techniques and complication reduction strategies. Another critical area of development is arrhythmia detection algorithm accuracy, with a growing emphasis on atrial fibrillation detection sensitivity and specificity, as well as ventricular tachycardia detection algorithm performance. Remote monitoring systems have become increasingly important, with data security measures being a top priority to ensure patient privacy.

Cardiac resynchronization therapy (CRT) efficacy studies continue to drive innovation in implantable cardioverter defibrillator (ICD) shock delivery systems. Heart rate variability analysis is gaining traction in clinical applications, offering valuable insights into patient conditions and treatment outcomes. ECG monitoring devices are becoming more sophisticated, with battery life prediction algorithms and patient compliance remote monitoring systems playing essential roles in optimizing patient care. In the realm of research and development, therapeutic intervention algorithm development processes, device programming interface user experience designs, and clinical trial data management system validations are key areas of focus. Sensor technology integration and data accuracy assessment are crucial aspects of the market, with signal processing algorithm noise reduction methods being a significant area of investment.

Biometric data privacy and security regulations continue to evolve, requiring innovative solutions to maintain data security while enabling seamless data exchange between healthcare providers and patients. The market is characterized by intense competition, with a minority of players accounting for a significantly larger share of high-end device sales. Adoption rates for advanced cardiac monitoring and management technologies vary widely across regions and segments, with some regions and applications showing notably higher adoption rates than others. Overall, the market is a rapidly evolving industry, driven by technological advancements, growing demand for improved patient care, and regulatory requirements. Companies that can effectively address the challenges of data security, patient compliance, and device performance will be well-positioned for success in this dynamic market.

What are the key market drivers leading to the rise in the adoption of Cardiac Monitoring and Cardiac Rhythm Management Devices Industry?

- The global market is significantly driven by the rising prevalence of cardiovascular diseases (CVDs) representing a major health concern and market growth opportunity.

- The market in the US is experiencing significant expansion due to the rising prevalence of vascular diseases, particularly Peripheral Arterial Disease (PAD). According to the Centers for Disease Control and Prevention (CDC), an estimated 6.5 million Americans aged 40 and above were diagnosed with PAD in 2021. This condition, which affects both men and women equally, is often underdiagnosed due to low awareness, especially in developing economies. Smoking, high cardiac rhythm, atherosclerosis, diabetes, and high cholesterol are contributing factors to the increasing prevalence of PAD.

- These conditions can lead to complications such as heart attacks, strokes, and amputations if left untreated. As a result, there is a growing demand for advanced cardiac monitoring and management devices to improve patient outcomes and reduce healthcare costs. The market for these devices is expected to continue evolving, with innovations in technology and expanding applications across various sectors.

What are the market trends shaping the Cardiac Monitoring and Cardiac Rhythm Management Devices Industry?

- Market companies are increasingly implementing strategic initiatives. This trend is set to shape market dynamics in the upcoming period.

- In the dynamic global the market, key players are continually advancing their research and development (R&D) initiatives to introduce innovative solutions. For instance, Medtronic dedicated approximately 360 million units of investment towards expanding its R&D center in Hyderabad, India, in May 2023. This investment aims to foster advancements in healthcare technology domains, including robotics, imaging, and implantable devices. Simultaneously, in May 2023, Abbott secured US FDA approval for its Assert-IQ insertable cardiac monitor (ICM) device, which boasts extended monitoring capabilities for irregular heartbeats.

- Furthermore, Boston Scientific unveiled its next-generation LUX-Dx II+ ICM system in October 2023, underscoring the ongoing competition and innovation in this sector.

What challenges does the Cardiac Monitoring and Cardiac Rhythm Management Devices Industry face during its growth?

- The escalating costs of Customer Management (CM) and Customer Relationship Management (CRM) devices pose a significant challenge to the industry's growth trajectory.

- The cardiology medical device market encompasses various technologies, including Continuous Monitoring (CM) and Cardio-Respiratory Monitoring (CRM) devices. These devices provide valuable insights into patients' heart and respiratory functions, aiding in the diagnosis and management of cardiac conditions. However, the high costs associated with these devices pose a challenge to their widespread adoption, particularly in developing countries. ECG devices, a type of CM device, range from USD1,000 to USD3,000 depending on the technology and features. Implantable Loop Recorders (ILRs) for arrhythmia detection and unexplained loss of consciousness cost above USD5,000 and up to USD8,000. Besides the device costs, recurring expenses for maintenance and accessories add to the financial burden.

- For instance, a standard resting ECG test requires ten electrodes, generating twelve distinct views of heart electrical activity. The dynamic nature of the cardiology medical device market reflects ongoing advancements and evolving applications across various sectors. Despite the financial challenges, the market continues to expand, driven by technological innovations and increasing awareness of the importance of early cardiac condition detection.

Exclusive Technavio Analysis on Customer Landscape

The cardiac monitoring and cardiac rhythm management devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cardiac monitoring and cardiac rhythm management devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cardiac Monitoring and Cardiac Rhythm Management Devices Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, cardiac monitoring and cardiac rhythm management devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in cardiac monitoring and management through advanced devices, including Ellipse, Entrant, Fortify Assura ICDs, and Jot Dx ICMs. These technologies enable precise detection and intervention for cardiac rhythm disorders, enhancing patient care and outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Adaptive Biotechnologies Corp.

- Asahi Kasei Corp.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- BPL MEDICAL TECHNOLOGIES Pvt. Ltd.

- Cell Microsystems Inc.

- GE Healthcare Technologies Inc.

- Johnson and Johnson

- Koninklijke Philips N.V.

- Medtronic Plc

- MicroPort Scientific Corp.

- Nihon Kohden Corp.

- Osypka Medical GmBH

- Progetti srl

- QIAGEN NV

- SCHILLER AG

- Stryker Corp.

- ZOLL Medical Corp.

- Shree Pacetronix Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cardiac Monitoring And Cardiac Rhythm Management Devices Market

- In January 2024, Medtronic, a leading medical technology company, announced the FDA approval of its new wearable cardiac monitor, the Reveal LINQ II Insertable Cardiac Monitor (ICM). This device is smaller and thinner than its predecessor, offering improved patient comfort and compliance (Medtronic Press Release, 2024).

- In March 2024, Abbott Laboratories and Philips signed a strategic partnership to integrate Abbott's FreeStyle Libre glucose monitoring system with Philips' cardiac rhythm management devices. This collaboration aims to improve the management of heart failure patients by providing real-time glucose monitoring data to healthcare professionals (Abbott and Philips Press Releases, 2024).

- In April 2025, Boston Scientific completed the acquisition of Preventice Solutions, a digital health company specializing in remote patient monitoring. This acquisition strengthens Boston Scientific's remote monitoring capabilities and enhances its offerings in the cardiac rhythm management market (Boston Scientific Press Release, 2025).

- In May 2025, Siemens Healthineers received FDA approval for its new MRI-conditional cardiac resynchronization therapy defibrillator, the Magnetic Resonance-conditional (MR-conditional) Cardeas Tarasys G3. This device enables MRI scans for patients with implanted cardiac devices, improving diagnostic capabilities and patient care (Siemens Healthineers Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cardiac Monitoring and Cardiac Rhythm Management Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.38% |

|

Market growth 2024-2028 |

USD 7476.72 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.44 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of cardiac monitoring and cardiac rhythm management devices, advancements continue to shape the industry. Cardiac resynchronization therapy (CRT), a vital component of this sector, enhances the synchronization of heartbeats in patients with heart failure. Pacing parameters are optimized to improve cardiac output and patient outcomes, with arrhythmia detection playing a crucial role in identifying irregular heart rhythms. Tachycardia management is another significant area of focus, as heart rate variability is monitored to assess the body's response to various conditions. Pacemaker implantation remains a common procedure, with electrophysiology studies guiding the selection of optimal implant locations.

- Device longevity is a critical concern, with ongoing research into battery technology and device programming to extend functionality. Heart failure monitoring is increasingly reliant on data acquisition systems, while lead placement techniques are refined to minimize complications. The implantable cardioverter-defibrillator (ICD) market is driven by advancements in signal processing algorithms, enabling more accurate ventricular tachycardia detection. Therapeutic interventions are enhanced through biometric data integration and sensor technology, with defibrillator therapy and atrial fibrillation detection leading the way. Patient data management and event monitoring are essential aspects of remote monitoring systems, ensuring timely intervention and improved patient care. Shock delivery systems are optimized for efficiency and safety, while lead impedance monitoring ensures optimal device performance.

- Telemetry technology and bradycardia management continue to evolve, offering new possibilities for cardiac rhythm management. Clinical trial data provides valuable insights into the effectiveness of these technologies, shaping the future of the industry.

What are the Key Data Covered in this Cardiac Monitoring and Cardiac Rhythm Management Devices Market Research and Growth Report?

-

What is the expected growth of the Cardiac Monitoring and Cardiac Rhythm Management Devices Market between 2024 and 2028?

-

USD 7.48 billion, at a CAGR of 5.38%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (CRM devices and CM devices), End-user (Hospitals, clinics, Cardiac care centers, and ASCs), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of CVDs globally, High cost of CM and CRM devices

-

-

Who are the major players in the Cardiac Monitoring and Cardiac Rhythm Management Devices Market?

-

Abbott Laboratories, Adaptive Biotechnologies Corp., Asahi Kasei Corp., BIOTRONIK SE and Co. KG, Boston Scientific Corp., BPL MEDICAL TECHNOLOGIES Pvt. Ltd., Cell Microsystems Inc., GE Healthcare Technologies Inc., Johnson and Johnson, Koninklijke Philips N.V., Medtronic Plc, MicroPort Scientific Corp., Nihon Kohden Corp., Osypka Medical GmBH, Progetti srl, QIAGEN NV, SCHILLER AG, Stryker Corp., ZOLL Medical Corp., and Shree Pacetronix Ltd.

-

Market Research Insights

- The market encompasses a range of technologies designed to diagnose, treat, and manage heart rhythm disorders. Heart rate monitoring is a fundamental feature, with device reliability and algorithm optimization ensuring accurate readings. Wireless communication facilitates remote patient monitoring, reducing healthcare costs and improving quality of life. However, device complications, such as lead failure, necessitate system integration and regulatory compliance. Reimbursement models and device programming software play crucial roles in clinical validation and patient safety. Sensor integration and data security are essential for patient compliance and data privacy. Rhythm disturbances require clinical efficacy and regulatory compliance, while medical device regulation and treatment guidelines ensure patient safety.

- Device interoperability and biosignal processing are ongoing priorities for market advancement. Two key data points illustrate the market's evolution: the global cardiac rhythm management devices market size was valued at USD28.5 billion in 2020, with an estimated CAGR of 5.8% from 2021 to 2028. This growth is driven by advancements in technology, increasing prevalence of cardiac rhythm disorders, and the shift towards remote patient monitoring.

We can help! Our analysts can customize this cardiac monitoring and cardiac rhythm management devices market research report to meet your requirements.