Carrier Wi-Fi Equipment Market Size 2024-2028

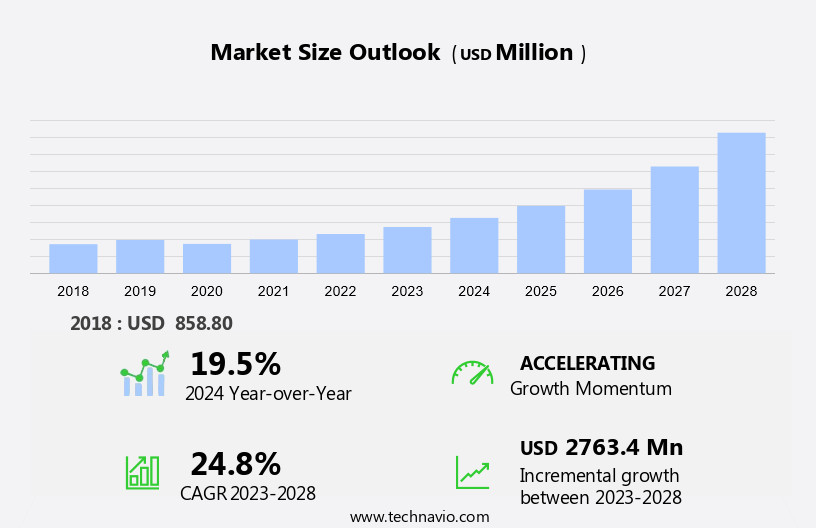

The carrier wi-fi equipment market size is forecast to increase by USD 2.76 billion at a CAGR of 24.8% between 2023 and 2028.

- The Carrier Wi-Fi market is experiencing significant growth due to the increasing number of mobile users and the rising demand for high-speed data. With the digital transformation and the proliferation of IoT technologies, the need for reliable and efficient Wi-Fi access points is becoming increasingly important. Telecom operators are investing heavily in Carrier Wi-Fi solutions to provide interior coverage and improve network performance.

- Furthermore, the emergence of 5G networks is further fueling the demand for Carrier Wi-Fi, as it enables seamless connectivity and supports high-speed data transfer. Inferior network infrastructure in developing regions presents an opportunity for market growth. Wi-Fi 6-compatible equipment is gaining popularity due to its ability to handle large volumes of data traffic from connected devices. This report provides a comprehensive analysis of the market trends, growth drivers, and challenges shaping the future of the Carrier Wi-Fi market.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for high-speed internet and the need for reliable network management support. Telecom operators are increasingly investing in Carrier-grade Wi-Fi equipment to offer better interior coverage and reduce mobile data traffic, especially in areas with network congestion. Wi-Fi access points have become an essential component of modern network infrastructure, enabling seamless connectivity for smart devices and supporting digital transformation initiatives. With the proliferation of IoT technologies and the rise of 5G technology, the need for high-speed data transfer and network capabilities has become more critical than ever. Carrier Wi-Fi equipment is essential for network offloading, allowing telecom operators to utilize unlicensed Wi-Fi spectrum to reduce the burden on cellular networks. The use of Wi-Fi 6-compatible technology in Carrier Wi-Fi equipment ensures high-speed internet and improved network performance, making it an attractive option for both residential and enterprise customers.

- Furthermore, network security is a major concern for telecom operators, and Carrier Wi-Fi equipment provides carrier-grade security features to protect against security threats in open networks. The use of virtualized network functions and cloud-based management systems further enhances network capabilities and allows for efficient management of Wi-Fi infrastructure. Passpoint technology, a key feature of Carrier Wi-Fi equipment, enables seamless and secure connectivity for users, reducing the need for manual configuration and improving user experience. With the increasing usage of smartphones and the growing popularity of smart devices, the demand for reliable and high-performance Wi-Fi infrastructure is expected to continue to grow. Thus, the market is an essential component of modern network infrastructure, enabling high-speed internet, reliable network management support, and reducing mobile data traffic. The use of advanced technologies such as Wi-Fi 6, virtualized network functions, and cloud-based management systems further enhances network capabilities and provides carrier-grade security features, making it an attractive option for telecom operators looking to meet the growing demand for reliable and high-performance Wi-Fi infrastructure.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fixed carrier

- Mobile carrier

- Third party

- Geography

- APAC

- China

- North America

- Canada

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

- The fixed carrier segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth due to the increasing demand for high-speed internet among mobile users. Carrier Wi-Fi refers to Wi-Fi access points installed and managed by telecom operators to provide interior coverage and high-speed data to their subscribers. This technology allows users to access the internet via a cable that carries the broadband signal from the receiver to the router, offering faster download speeds compared to other options. In response to the growing need for high-speed data, companies in the Carrier Wi-Fi Market are continually updating their equipment and services. For example, Nokia Corp. And MediaTek made history in October 2021 by successfully aggregating the 5G Standalone (5G SA) spectrum using 3 Components Carrier (3CC) aggregation.

Furthermore, the adoption of Carrier Wi-Fi technology is on the rise as businesses undergo digital transformation and the Internet of Things (IoT) becomes increasingly prevalent. Wi-Fi 6-compatible equipment is becoming more common as the demand for connected devices grows. According to recent statistics, the number of connected devices is projected to reach 50 billion by 2030. In summary, the market is thriving due to the increasing demand for high-speed internet and the growing number of connected devices. Telecom operators are continuously updating their equipment and services to meet these demands and stay competitive. The integration of advanced technologies like 5G SA and Wi-Fi 6 is expected to further drive market growth.

Get a glance at the market report of share of various segments Request Free Sample

The fixed carrier segment was valued at USD 323.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

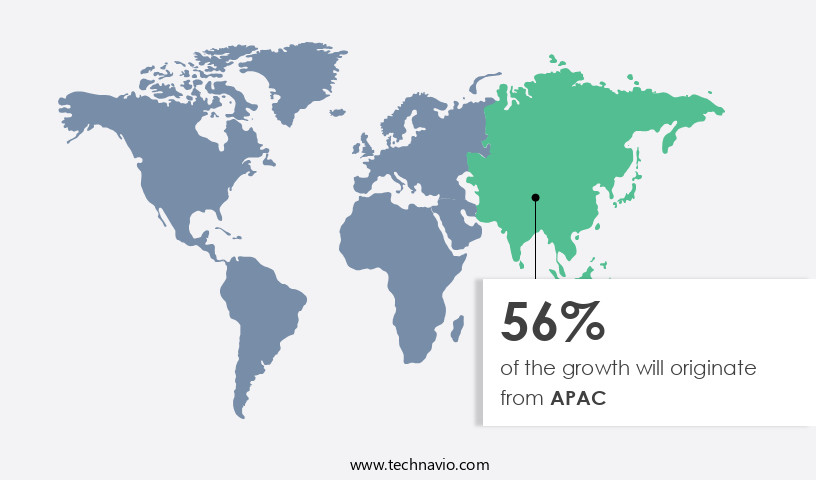

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region presents a significant opportunity for carrier Wi-Fi equipment due to the increasing demand for high-speed internet and connectivity solutions, fueled by the growing usage of smartphones and smart devices. In India, for example, the telecom subscriber base reached 1.199 billion in March 2023, marking a slight decrease from the previous year. However, this figure underscores the vast potential for communication services in the region. With the shift towards remote work and home networking, digital infrastructure, including access points, SSD controllers, and gateways, has become essential.

Furthermore, government initiatives to develop smart cities and urban areas are driving the demand for advanced connectivity solutions. The deployment of 5G technology in countries like China and South Korea is also contributing to the growth of the market in APAC. Telecom operators are investing in Wi-Fi infrastructure to cater to the increasing mobile data traffic and meet the demands of bandwidth-intensive applications. Ensuring security is a crucial consideration for carrier Wi-Fi equipment as the use of smartphones and smart devices continues to grow.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Carrier Wi-Fi Equipment Market ?

Growing demand for smartphones and connected devices is the key driver of the market.

- The proliferation of 5G technology and the Internet of Things (IoT) has led to a significant increase in the demand for Wi-Fi access, particularly in the US and other major markets. With the shift towards remote work and home networking, digital infrastructure, including access points, controllers, and gateways, has become essential. The growing number of connected devices, driven by the widespread use of smartphones, puts pressure on existing telecom networks, leading to network congestion. Wi-Fi offloading has emerged as a viable solution to mitigate network congestion and enhance user experience.

- According to recent studies, the US is expected to have over 300 million smartphone users by 2024, creating a substantial demand for advanced Wi-Fi equipment. Digital transformation initiatives in various industries are further fueling this trend.

What are the market trends shaping the Carrier Wi-Fi Equipment Market?

The emergence of the 5G network is the upcoming trend in the market.

- The market is experiencing significant growth due to the increasing deployment of 5G wireless networks and the development of 5G networks in various regions. In January 2020, Huawei completed 5G New Radio testing using a 2.5 GHz spectrum, marking a milestone in the progress of 5G technology. This achievement will accelerate research and development efforts and contribute to the establishment of global standards for 5G networks. Carrier Wi-Fi Equipment plays a crucial role in providing wide-area mobility and network management support for cellular offloading in 5G networks. The use of unlicensed Wi-Fi spectrum for network capabilities is becoming increasingly popular due to its cost-effectiveness and ability to handle high data traffic.

- However, security concerns associated with open networks remain a significant challenge. Carrier-grade security is essential to ensure the confidentiality, integrity, and availability of data transmitted over Carrier Wi-Fi networks. Brocade Communications, among other companies, offers advanced security solutions to address these concerns. Network management support and seamless integration with RAN networks are also critical factors in the selection of Carrier Wi-Fi Equipment.

What challenges does Carrier Wi-Fi Equipment Market face during the growth?

Inferior network infrastructure in developing regions is a key challenge affecting market growth.

- Carrier Wi-Fi equipment plays a crucial role in ensuring seamless communication and live streaming experiences, particularly for Voice-over-Internet Protocol (VoIP) services, which encompass voice and video calls, as well as music and video streaming. These services are typically subscription-based, with consumers paying for a set period of time. However, once the subscription expires, users lose access to the data. Several countries, including India, Bangladesh, the Central African Republic, Nepal, and Haiti, lack the necessary Internet network and telecom infrastructure to support advanced carrier Wi-Fi equipment. In many Asian countries, 4G technology is still in its infancy. Carrier Wi-Fi equipment consists of various components, such as antennas, power supplies, and cabling infrastructure.

- Furthermore, these components are essential for both indoor and outdoor applications, including smart cities, cloud deployment, on-premises deployment, and public Wi-Fi hotspots. Smart City Initiatives and the integration of blockchain technology are driving the demand for advanced carrier Wi-Fi equipment. Network security is also a significant concern, as the increasing number of Wi-Fi hotspots makes networks more vulnerable to cyberattacks. Antennas are a critical component of carrier Wi-Fi equipment, as they transmit and receive wireless signals. Power supplies ensure the continuous operation of the equipment, while cabling infrastructure connects the various components.

- In the US, carrier Wi-Fi equipment is used extensively in various industries, including healthcare, education, hospitality, and transportation. The demand for reliable and high-speed Wi-Fi networks is increasing, particularly in public areas such as airports, malls, and parks. Thus, carrier Wi-Fi equipment is an essential component of modern communication infrastructure. Its various components, including antennas, power supplies, and cabling infrastructure, are necessary for both indoor and outdoor applications. The increasing demand for high-speed Wi-Fi networks in various industries, coupled with the integration of emerging technologies such as blockchain and smart cities, is driving the growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Actelis Networks Inc.

- Adtran Holdings Inc.

- ALE International

- Alepo

- Broadcom Inc.

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- Edgewater Wireless Systems Inc.

- embedUR Systems

- Enea AB

- Extreme Networks Inc.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Motorola Solutions Inc.

- NETGEAR Inc.

- Nokia Corp.

- Telefonaktiebolaget LM Ericsson

- Ubiquiti Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Carrier Wi-Fi equipment plays a crucial role in enabling wide-area mobility by providing high-speed internet connectivity to mobile users. With the increasing demand for data traffic from various bandwidth-intensive applications, telecom operators are turning to carrier-grade Wi-Fi solutions to offload mobile data traffic and enhance network capabilities. These solutions offer carrier-grade security, network management support, and are compatible with the latest Wi-Fi 6 technology. The carrier Wi-Fi market is witnessing significant growth due to digital transformation initiatives in enterprises and the rapid digitalization of various industries. The convergence of 5G technology and Wi-Fi infrastructure is further boosting the market growth.

Furthermore, carrier-grade Wi-Fi solutions are essential for smartphone usage in indoor applications, such as home networking and remote work, as well as in outdoor applications, such as public Wi-Fi hotspots and smart cities. Security concerns are a major factor driving the adoption of carrier-grade Wi-Fi equipment, especially in open networks. These solutions offer advanced security features to protect against cyber threats and ensure the privacy of mobile users. The use of virtualized network functions, cloud-based management, and Passpoint technology further enhances the network capabilities and user experience. The Internet of Things (IoT) and fintech innovations, such as digital banking, are also driving the demand for carrier-grade Wi-Fi solutions. These technologies require high-speed internet connectivity and low latency, making carrier Wi-Fi an ideal choice for enabling seamless connectivity and unified communications. The market is expected to continue growing as more industries embrace digital transformation and the use of smart devices becomes increasingly prevalent.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.8% |

|

Market growth 2024-2028 |

USD 2.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

19.5 |

|

Key countries |

China, US, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch