Cell Culture Consumables Market Size 2024-2028

The cell culture consumables market size is forecast to increase by USD 48.27 billion at a CAGR of 31.31% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The production of cell culture-based viral vaccines is on the rise, leading to increased demand for consumables. Single-use technologies are gaining popularity due to their advantages in reducing contamination risks and simplifying manufacturing processes. However, the market also faces challenges, such as the high risk of cell culture contamination, which necessitates the use of advanced sterilization techniques and stringent quality control measures. These factors collectively shape the growth trajectory of the market.

What will be the Size of the Cell Culture Consumables Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for novel therapeutics, particularly In the biotechnology industry for treating chronic diseases such as cancer, cardiovascular ailments, autoimmune disorders, and various infectious diseases including viruses like rotavirus, polio, hepatitis, and chickenpox. Seed funding and research investments in stem cell therapies and gene therapy have fueled the market's expansion. The pharmaceutical industry's shift towards biologics and biosimilars also contributes to the market's growth. Cell culture media, essential for producing biological products, is a key driver of market demand. The advancements in cell biology, including the development of cell therapy solutions, further boost market growth.

- The increasing internet penetration rate facilitates global market expansion, enabling research collaborations and knowledge sharing among biotech companies and medical institutions. Overall, the market is poised for continued growth as it plays a crucial role In the development and production of medical drugs and vaccines.

How is this Cell Culture Consumables Industry segmented and which is the largest segment?

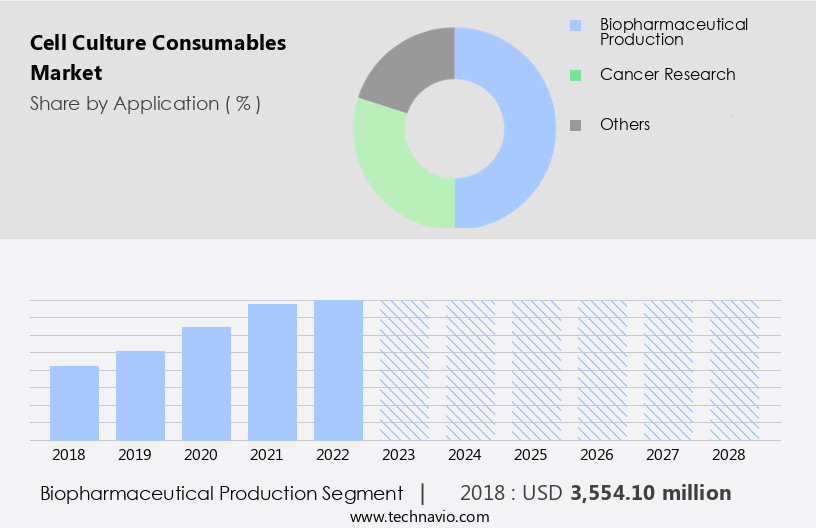

The cell culture consumables industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Biopharmaceutical production

- Cancer research

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

- The biopharmaceutical production segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, primarily driven by the biopharmaceutical sector. This sector's dominance can be attributed to the continuous demand for media, sera, and reagents in cell culture applications, including vaccine production for chronic diseases such as polio, rubella, chickenpox, mumps, and measles. The increasing incidence of these diseases and the subsequent need for novel therapeutics have propelled manufacturers to invest in cell culture methods for drug discovery and development. Furthermore, the biotechnology industry's focus on biological products, particularly in areas like cancer, cardiovascular ailments, autoimmune disorders, and neurological disorders, has contributed to the market's expansion. Microcarrier-based technologies have emerged as a popular choice for large-scale production, catering to the requirements of customers In the pharmaceutical and biopharmaceutical sectors.

Regulatory requirements and healthcare markets' increasing expenditure on drug research activities further fuel the market's growth. The integration of technology, such as artificial intelligence and data analytics, in cell culture processes enhances efficiency and productivity. The market is poised for continued growth, driven by the increasing demand for medical drugs and healthcare products.

Get a glance at the Cell Culture Consumables Industry report of share of various segments Request Free Sample

The Biopharmaceutical production segment was valued at USD 3.55 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for cell culture consumables holds the largest share In the global industry, driven by advancements in biotechnology and pharmaceuticals. This region's dominance is due to the increasing focus on novel therapeutics for chronic diseases, such as cancer and cardiovascular ailments. Key players like Danaher, Thermo Fisher, General Electric, and Corning, based in North America, are investing heavily in research and development and establishing advanced cell culture processing units. For instance, Thermo Fisher Scientific introduced the first room-temperature stable cell culture media in October 2019. The healthcare sector's growing expenditure and the presence of regulatory requirements In the region further fuel market growth.

The biopharmaceutical sector's drug research activities, including vaccine development for diseases like polio, hepatitis, rotavirus, and chickenpox, also contribute to the market's expansion. Additionally, the integration of artificial intelligence and big data analytics in cell culture technology enhances productivity and efficiency. The market's growth is further supported by the increasing demand for biosimilars and medical devices, as well as the rising healthcare expenditure and internet penetration rate.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cell Culture Consumables Industry?

Rise in production of cell culture-based viral vaccines is the key driver of the market.

- The biotechnology industry's focus on novel therapeutics for chronic diseases, such as cancer, cardiovascular ailments, autoimmune disorders, and neurological disorders, has led to an increased demand for cell culture consumables In the biopharmaceutical sectors. Cell culture technology plays a crucial role In the production of biological products, including stem cell therapies and gene therapy, which are at the forefront of medical research. Cell culture media and microcarrier-based technologies are essential consumables used In the process of developing these advanced therapeutics. The regulatory requirements for these products are stringent, necessitating the use of high-quality cell culture consumables to ensure safety and efficacy.

- The healthcare markets, driven by drug research activities and vaccine development, are significant consumers of cell culture consumables. The production of vaccines for diseases such as polio, hepatitis, chickenpox, and rotavirus, as well as biosimilars, relies on cell culture technology. The use of artificial intelligence and big data analytics In the pharmaceutical industry is driving the demand for cell culture consumables, as these technologies require large-scale cell culture production. The internet penetration rate and healthcare expenditure continue to increase, leading to a growing market for healthcare products, including medical instruments and medical devices that utilize cell culture technology.

- Capital equipment manufacturers are also investing in cell culture technology to produce lifeline curves and optimize healthcare regulatory scenarios. The cell culture technology market is expected to grow significantly In the coming years, driven by the increasing demand for medical drugs and the development of new therapeutic approaches.

What are the market trends shaping the Cell Culture Consumables Industry?

Increased application of single-use technologies is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for novel therapeutics In the biotechnology industry for treating chronic diseases such as cancer, cardiovascular ailments, autoimmune disorders, and neurological disorders. Biopharmaceutical sectors are investing heavily in research activities to develop biological products using cell therapy solutions. Single-use or disposable technologies are gaining popularity in commercial manufacturing facilities due to their efficiency and cost-effectiveness. These technologies enable the production of biopharmaceuticals without compromising product quality, while reducing the footprint of facilities by approximately 20%. The use of microcarrier-based technologies in cell culture production is also on the rise, particularly in areas such as purification, filtration, full-finish, storage, mixing, and upstream production.

- The healthcare markets, driven by drug research activities, are also fueling the demand for cell culture consumables In the production of vaccines, antibiotics, and medical drugs. The application of artificial intelligence and big data analytics in cell culture technology is further enhancing the efficiency and productivity of manufacturing processes. The increasing healthcare expenditure and internet penetration rate, coupled with the growing medical tourism industry, are also contributing to the growth of this market. Capital equipment and medical instruments are essential components of cell culture technology, and their demand is expected to increase as the market expands. The regulatory requirements for cell culture consumables are stringent, and adherence to healthcare regulatory scenarios is crucial for market success.

- The cell culture media market is a significant segment of the market, with stem cell, gene therapy, and virus outbreaks being key areas of focus. Biosimilars and chronic diseases treatments are also driving the demand for medical drugs, further boosting the market growth. Overall, the market is poised for steady growth In the coming years, driven by technological advancements and increasing demand for biopharmaceuticals.

What challenges does the Cell Culture Consumables Industry face during its growth?

High risk of cell culture contamination is a key challenge affecting the industry growth.

- Cell culture consumables play a crucial role In the production of novel therapeutics for chronic diseases, including cancer, cardiovascular ailments, autoimmune disorders, and neurological disorders, In the biotechnology industry. Biopharmaceutical sectors invest significantly in research activities to develop biological products using cell culture technology. However, maintaining the sterility and purity of cell cultures is a significant challenge due to the risk of contamination. Contamination can occur through impurities in cell culture media, water, sera, endotoxins, detergents, plasticizers, gases, and equipment. Chemical contamination can lead to adulteration of media, presence of impure water, endotoxin production, free radical generation, and plasticizer leakage.

- Biological contamination can result from cross-contamination between different cell lines or microorganisms. Microcarrier-based technologies have gained popularity in cell culture production to address the challenges of large-scale production and contamination. Customers In the healthcare markets, including the pharmaceutical industry, require stringent regulatory requirements to ensure the safety and efficacy of medical drugs, vaccines, antibiotics, and gene therapy. Advancements in technology, such as artificial intelligence and big data analytics, enable the optimization of cell culture processes and the development of personalized cell therapy solutions. The internet penetration rate and increasing healthcare expenditure drive the demand for healthcare products and medical devices, further boosting the market.

- Capital equipment manufacturers focus on technology innovation to meet the growing demand for cell culture technology in various applications. Cell culture consumables are essential for drug research activities in various therapeutic areas, including virus outbreaks such as polio, hepatitis, and chickenpox, and the development of biosimilars for chronic diseases treatments. The market for cell culture consumables is expected to grow significantly due to the increasing demand for medical drugs and the expanding role of biotech companies In the healthcare industry.

Exclusive Customer Landscape

The cell culture consumables market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cell culture consumables market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cell culture consumables market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Agilent Technologies Inc. - The market encompasses essential products for maintaining and growing cells in laboratory conditions. These items include media, serum, filters, and containers. Market growth is driven by the expanding biotechnology industry and increasing research in areas such as stem cells and gene therapy. Advancements in cell culture technology have led to the development of innovative consumables, improving efficiency and reducing contamination risks. As research continues to advance, the demand for high-quality cell culture consumables will persist, ensuring ongoing market expansion.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- Bio Techne Corp.

- Corning Inc.

- Danaher Corp.

- Eppendorf SE

- Euroclone SpA

- FUJIFILM Corp.

- General Electric Co.

- HiMedia Laboratories Pvt. Ltd.

- InvivoGen Corp.

- LGC Science Group Holdings Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Miltenyi Biotec B.V. and Co. KG

- PromoCell GmbH

- Sartorius AG

- Standard BioTools Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role In the biopharmaceutical sector, particularly In the production of novel therapeutics for chronic diseases. Biotechnology industry advancements have led to the development of biological products for various applications, including cancer, cardiovascular ailments, autoimmune disorders, and neurological disorders. These therapies have revolutionized drug research activities and have significant potential in transforming healthcare markets. Cell culture media, an essential component of cell culture technology, plays a pivotal role In the growth and maintenance of cells for research and therapeutic applications. Microcarrier-based technologies have gained popularity due to their ability to enhance cell density and productivity, making them a preferred choice for large-scale production.

The biopharmaceutical sectors' regulatory requirements are stringent, ensuring the safety and efficacy of cell culture-derived products. Compliance with these regulations necessitates the use of high-quality cell culture consumables. The healthcare markets for these cell culture-derived products are expanding, driven by the increasing prevalence of chronic diseases and the growing demand for personalized medicine. The use of cell culture technology in vaccine production, including for rotavirus, polio, hepatitis, and chickenpox, has significantly contributed to the market's growth. Biosimilars, which are less expensive alternatives to branded biologics, are gaining traction In the market due to their cost-effectiveness and regulatory approval.

The emergence of biosimilars has led to increased competition In the market and has driven down prices, making these therapies more accessible to a broader patient population. The pharmaceutical industry's shift towards gene therapy and stem cell therapies has further boosted the demand for cell culture consumables. These advanced therapies require specialized media and equipment, driving the growth of the market. The integration of artificial intelligence and big data analytics in drug discovery and development processes has led to the optimization of cell culture processes, enhancing productivity and reducing costs. These advancements have the potential to revolutionize the biotech industry and create new opportunities for cell culture consumables suppliers.

The healthcare expenditure and internet penetration rate have significantly influenced the market's growth, with the increasing availability of healthcare services and information driving the demand for cell culture consumables. Medical devices and instruments, which are used in conjunction with cell culture technology, have also contributed to the market's growth. The market's capital equipment segment is expected to grow at a significant rate due to the increasing adoption of automated systems and the need for large-scale production. The technology segment is also expected to witness significant growth due to the integration of advanced technologies in cell culture processes. The market dynamics are influenced by various factors, including regulatory scenarios, technological advancements, and customer preferences.

Suppliers must stay abreast of these trends to remain competitive and meet the evolving needs of the biopharmaceutical sector. In conclusion, the market plays a vital role In the biopharmaceutical sector, particularly In the production of novel therapeutics for chronic diseases. The market's growth is driven by various factors, including regulatory requirements, technological advancements, and customer preferences. Suppliers must stay informed of these trends to remain competitive and meet the evolving needs of the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.31% |

|

Market growth 2024-2028 |

USD 48267.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

23.93 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cell Culture Consumables Market Research and Growth Report?

- CAGR of the Cell Culture Consumables industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cell culture consumables market growth of industry companies

We can help! Our analysts can customize this cell culture consumables market research report to meet your requirements.