Chemical Warehousing And Storage Market Size 2024-2028

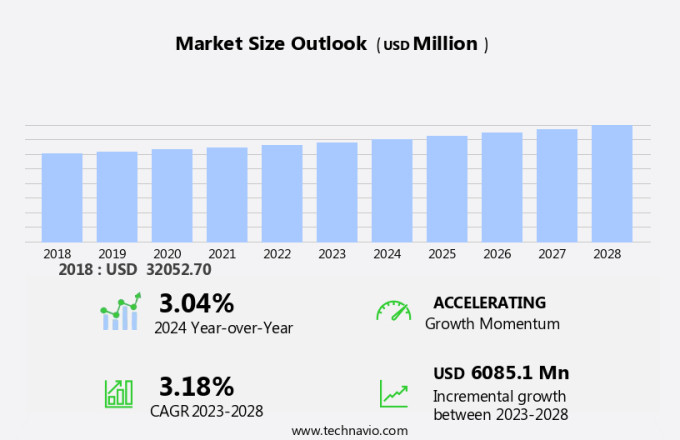

The chemical warehousing and storage market size is forecast to increase by USD 6.09 billion at a CAGR of 3.18% between 2023 and 2028. The market exhibits dynamic growth due to several key factors. The increasing usage of specialty chemicals and additives in various sectors, such as agriculture and textile, fuels the demand for efficient and secure warehousing solutions. Smart warehousing technologies, including automation and real-time inventory management, enhance the operational efficiency of chemical storage facilities and chemical software . Moreover, the implementation of stringent safety standards protocols in the chemical supply chain is crucial to ensure the safe handling and transportation of chemical products.

Plastic resins and other chemical products require substantial infrastructure investments, leading to high operational costs and capital-intensive business models. To address these challenges, market players are exploring innovative solutions like the use of blockchain technology to improve traceability in the logistics sector.

What will be the size of the Chemical Warehousing And Storage Market During the Forecast Period?

The market plays a crucial role in the efficient distribution and management of a diverse range of chemical products. This sector encompasses both general warehouses and specialty chemicals warehouses, catering to various industries such as food and agriculture, e-commerce, and others. Two primary categories of chemicals are stored in these warehouses: hazardous materials and non-hazardous materials. The handling and storage of these chemicals require stringent protocols and practices to ensure safety and regulatory compliance. Facility development for chemical warehousing involves careful planning and adherence to safety standards protocols. Warehouse infrastructure must be designed to accommodate the unique properties of chemical products, including temperature control, containment systems, and proper ventilation.

Moreover, paperwork management is a critical aspect of chemical warehousing and storage. Proper documentation and record-keeping are essential for tracking inventory levels, managing orders, and ensuring regulatory compliance. Safety is a top priority in the chemical warehousing and storage industry. Warehouses must adhere to strict safety standards to protect workers, the environment, and the community. This includes implementing safety procedures, providing adequate training, and maintaining emergency response plans. The integration of technology, such as blockchain technology and warehouse management systems, can enhance the efficiency and security of chemical warehousing and storage operations. These technologies enable real-time tracking of inventory levels, streamline order processing, and improve supply chain transparency.

Furthermore, government focus on the regulation of chemical warehousing and storage is increasing, with a particular emphasis on the handling and storage of dangerous chemicals. Compliance with these regulations is essential for maintaining a strong reputation and avoiding potential legal and financial consequences. In conclusion, the market is a vital component of the chemical supply chain. Proper infrastructure development, adherence to safety standards, and effective paperwork management are essential for ensuring the safe and efficient storage and distribution of chemical products. The integration of technology can further enhance operational efficiency and regulatory compliance.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commodity chemicals

- Specialty chemicals

- Type

- General warehouse

- Specialized warehouse

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

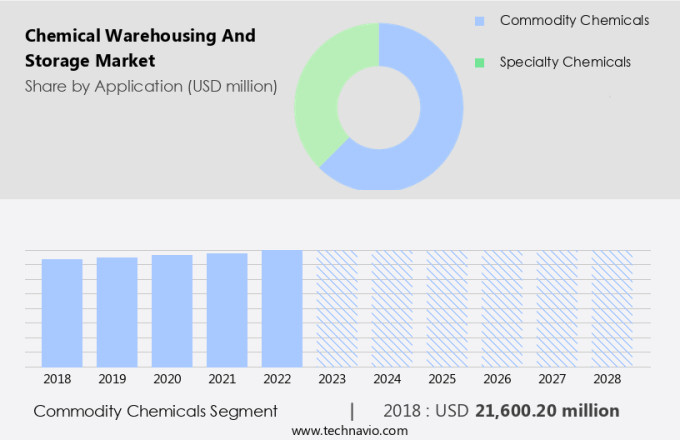

By Application Insights

The commodity chemicals segment is estimated to witness significant growth during the forecast period. The market encompasses the safekeeping of dangerous chemicals, including petrochemicals, inorganic commodity chemicals, and fertilizers. The expansion of the petrochemical segment is primarily attributed to the rising demand for petrochemical products. These substances, derived from oil and gas, are integral to the production of everyday items such as plastics, packaging materials, digital devices, medical equipment, and tires. Consequently, the burgeoning requirements of industries like packaging, transportation, plastics, and healthcare are anticipated to fuel the growth of the petrochemical segment. Furthermore, petrochemicals play a crucial role in advancing sustainable energy systems through various applications in technology. Blockchain technology is increasingly being adopted in warehouse management systems to ensure secure and transparent tracking of chemicals.

Furthermore, the government's focus on enforcing stringent regulations regarding the handling and storage of dangerous chemicals is another significant factor influencing market growth. The geopolitical location of warehouses is also a critical consideration due to the global reach of chemical trade. The clothing industry, farming industry, and medications industry are among the primary end-users of chemicals, with the healthcare industry being a significant consumer of pharmaceutical chemicals. As labor wages continue to rise, efficient warehouse management systems are becoming increasingly important to minimize costs and maintain profitability. Overall, the market is expected to experience steady growth due to the diverse applications of chemicals in various industries and the ongoing development of advanced technologies to improve storage and handling processes.

Get a glance at the market share of various segments Request Free Sample

The Commodity chemicals segment was valued at USD 21.60 billion in 2018 and showed a gradual increase during the forecast period.

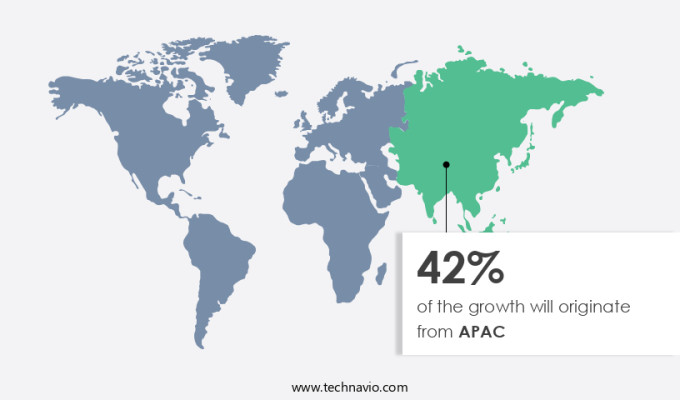

Regional Insights

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the United States and North America is projected to expand at a substantial rate over the coming years. This growth can be attributed to the rising production and consumption of chemical products across various industries, including agriculture, pharmaceuticals, electronics, textiles, construction, automotive, and cosmetics. The demand for both non-hazardous and hazardous materials is expected to impact the development of general warehouses as well as specialty chemicals warehouses. Key markets for chemical warehousing and storage in the region include the United States, Canada, and Mexico. The United States, in particular, is a significant player due to its large and diverse chemical industry.

In addition, the increasing trend of e-commerce in the region is expected to boost the demand for efficient and reliable chemical warehousing solutions. Countries such as the United States, Canada, and Mexico have a well-established chemical industry and a large customer base. The under-penetrated market in these countries, coupled with the increasing number of international companies entering the market, is expected to drive growth in the chemical warehousing and storage sector. Agrochemicals, a critical segment of the chemical industry, are expected to contribute significantly to the growth of the market. The food and agriculture sector's increasing demand for agrochemicals, such as pesticides and fertilizers, is expected to drive the need for specialized warehousing solutions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in international trade is the key driver of the market. The market plays a crucial role in ensuring the smooth distribution and transportation of specialty chemicals and petrochemicals to meet the increasing demand from various industries in APAC and beyond. Proper protocols and practices are essential for managing chemical inventory in specialized handling facilities to maintain safety and adhere to regulations such as the Globally Harmonized System (GHS). Effective inventory management services are vital for chemical warehouses to optimize their operations and ensure timely delivery to customers. Paperwork and documentation are integral parts of chemical warehousing, and accurate record-keeping is essential for maintaining transparency and traceability. With the rise in chemical production and consumption in APAC, there is a growing need for advanced chemical warehouse facilities that can provide specialized handling and storage solutions.

Furthermore, the region's strong manufacturing base and end-user industries, including pharmaceuticals, electronics, textiles, construction, and automotive, require reliable chemical storage solutions to meet their production needs. As consumer purchasing power increases in APAC, the demand for chemicals is expected to grow further, making it essential for chemical warehouses to have strong systems in place to manage inventory, ensure safety, and maintain regulatory compliance. By implementing best practices in chemical warehousing and storage, businesses can optimize their operations, reduce costs, and improve customer satisfaction.

Market Trends

The use of blockchain to improve traceability in logistics is the upcoming trend in the market. Blockchain technology, which consists of a secure and unchangeable chain of records, is revolutionizing the chemical industry by enhancing the efficiency and cost-effectiveness of the chemical supply chain. This technology eliminates the need for a centralized authority to maintain records, enabling multiple users to access or add data without altering existing information. The market is poised for growth due to the increasing adoption of this technology in various sectors, including specialty chemicals, additives, agriculture, and textiles. The use of smart warehousing, where blockchain technology is integrated, ensures adherence to safety standards protocols and provides real-time tracking of chemical products such as plastic resins and other chemical commodities.

Furthermore, the infrastructure development in the chemical production industry and the growing demand for advanced chemical solutions are also contributing factors to the market's growth. Overall, the integration of blockchain technology in the chemical warehousing and storage sector is expected to streamline operations, improve transparency, and enhance overall supply chain security.

Market Challenge

The high cost of operations and capital-intensive business is a key challenge affecting the market growth. The construction of a new chemical warehouse and storage facility is a significant investment that necessitates adhering to various specifications and obtaining necessary certifications. Operational and maintenance costs are also high in this sector. The demand for warehousing solutions is increasing due to various investments, but optimally operating a warehouse is essential. Financial modeling, demand analysis, and infrastructure assessment are crucial elements for a successful and efficient warehouse and storage facility. Given the substantial capital required for manufacturing and setting up a warehouse, the return on investment period is lengthy. In today's market, IT-driven solutions are increasingly being adopted for specialty chemical storage, ensuring workplace safety and addressing environmental concerns.

Furthermore, third-party logistics providers offer solutions for FMCGs and commodity chemicals warehousing, making warehousing more accessible and cost-effective. Flammable liquids and gases require specialized storage solutions, further increasing the complexity of warehouse operations. Ensuring safety protocols and regulatory compliance are critical in the chemical warehousing and storage industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AP Moller Maersk AS - The company offers chemical warehousing and storage for hazardous materials, which are used in explosives and are flammable

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALFRED TALKE GmbH and Co. KG

- Aramex International LLC

- C H Robinson Worldwide Inc.

- Capital Resin Corp.

- CMA CGM SA Group

- Deutsche Bahn AG

- Deutsche Post AG

- DSV AS

- FedEx Corp.

- Goodrich Maritime Services Pvt. Ltd.

- KEMITO

- Kuehne Nagel Management AG

- Nippon Express Holdings Inc.

- Omni Logistics LLC

- Rhenus SE and Co. KG

- SF Express Co. Ltd.

- Singapore Post Ltd.

- SolvChem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Chemical warehousing plays a crucial role in the storage and distribution of various chemical classes, including specialty chemicals, agrochemicals, and commodity chemicals. Warehousing facilities for chemicals come in different forms, ranging from general warehouses to specialized handling facilities for hazardous materials. The e-commerce sector has significantly influenced the chemical warehousing industry, leading to the need for IT-driven solutions and smart warehousing. In the e commerce industry, it's crucial to properly classify agrochemicals, flammable liquids and solids, and other chemicals by their chemical class to ensure the safe handling and transportation of both hazardous and Non hazardous materials, minimizing the risk of accidents due to the hazardous nature of certain chemicals. Safety is a top priority in chemical warehousing, with strict protocols and practices in place for handling and storing both hazardous and non-hazardous materials. The Globally Harmonized System (GHS) is widely adopted for the classification and labeling of chemicals to ensure workplace safety.

Furthermore, facility development for chemical warehousing involves infrastructure development, adherence to safety standards protocols, and the implementation of automation and digital tools, such as smart sensors, robotics, and artificial intelligence (AI). The chemical supply chain relies on efficient transportation and inventory management services to ensure timely delivery of chemical products to various industries, including food and agriculture, textile, pharmaceuticals, and healthcare. Environmental concerns are increasingly becoming a focus area in chemical warehousing, with the adoption of green warehouses and sustainable business operations. Energy conservation and protection of the environment are key considerations in the design and operation of chemical warehouse facilities. The geopolitical location of warehouses is also a critical factor, as it influences global trade reach and labor wages. The chemical warehousing industry serves various sectors, including FMCGs, petrochemicals, construction chemicals, and textile chemicals, among others. Railways, roadways, airways, seaways, and automation are essential modes of transportation for chemical products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.18% |

|

Market growth 2024-2028 |

USD 6.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.04 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALFRED TALKE GmbH and Co. KG, AP Moller Maersk AS, Aramex International LLC, C H Robinson Worldwide Inc., Capital Resin Corp., CMA CGM SA Group, Deutsche Bahn AG, Deutsche Post AG, DSV AS, FedEx Corp., Goodrich Maritime Services Pvt. Ltd., KEMITO, Kuehne Nagel Management AG, Nippon Express Holdings Inc., Omni Logistics LLC, Rhenus SE and Co. KG, SF Express Co. Ltd., Singapore Post Ltd., and SolvChem Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch