Chilled Deli Food Market Size 2025-2029

The chilled deli food market size is valued to increase USD 73.1 billion, at a CAGR of 5.6% from 2024 to 2029. Expansion of retail sector will drive the chilled deli food market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 36% growth during the forecast period.

- By Product - Prepared products segment was valued at USD 81.30 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 50.64 billion

- Market Future Opportunities: USD 73.10 billion

- CAGR from 2024 to 2029: 5.6%

Market Summary

- The market represents a significant segment within the global food industry, driven by consumer preferences for convenient, healthy, and ready-to-eat options. Strategic partnerships between retailers and deli food manufacturers have been instrumental in expanding the market's reach and enhancing product offerings. Regulatory guidelines, such as food safety standards and labeling requirements, have also played a crucial role in shaping the market's evolution.

- Despite these opportunities, challenges persist, including rising raw material costs and intense competition. As the market continues to evolve, innovation in product development and supply chain optimization will be key to maintaining competitiveness.

What will be the Size of the Chilled Deli Food Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Chilled Deli Food Market Segmented ?

The chilled deli food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Prepared products

- Meat

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The prepared products segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with a significant focus on prepared products that offer convenience and freshness. These items, including pre-packaged sandwiches and salads, are designed for either ready-to-eat or ready-to-heat consumption, ensuring consumer satisfaction while maintaining product quality through low-temperature storage. With a growing preference for quick, nutritious meals, these products have gained popularity, accounting for approximately 60% of the market share. Key to their success is the implementation of advanced food handling practices, inventory management systems, and distribution network optimization to minimize microbial contamination and extend shelf life. Refrigeration technology, such as temperature monitoring systems and humidity control, plays a crucial role in preserving the products' freshness.

The Prepared products segment was valued at USD 81.30 billion in 2019 and showed a gradual increase during the forecast period.

Bacterial growth inhibition techniques, HACCP compliance, and product labeling requirements ensure food safety regulations are met. Production line efficiency, quality control procedures, and sensory evaluation methods further enhance the market's offerings. Retail display cases and sanitation procedures contribute to maintaining the products' visual appeal and preventing food spoilage mechanisms. The integration of modified atmosphere packaging, temperature abuse indicators, and cold chain logistics further optimizes the supply chain, reducing waste and improving process efficiency. Ultimately, the market's success hinges on its ability to cater to diverse consumer preferences while maintaining the highest standards of food safety and quality.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Chilled Deli Food Market Demand is Rising in North America Request Free Sample

The market in North America is undergoing notable expansion, fueled by inventive retail approaches and an influx of new product introductions. Key industry players are broadening their reach and launching items tailored to emerging consumer preferences. In October 2024, Amazon unveiled a 3,800-square-foot retail space in Chicago's affluent Near North Side district. This latest venture represents Amazon's foray into the supermarket sector, combining the ease of online shopping with the sensory experience of a brick-and-mortar store.

This new store format showcases an extensive selection of chilled deli foods alongside other grocery essentials. The growing popularity of convenient, ready-to-eat options and the increasing number of consumers seeking a seamless shopping experience are major factors contributing to the market's robust dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector in the food industry, characterized by its emphasis on product freshness, quality, and consumer convenience. The market's growth is driven by various factors, including the increasing demand for ready-to-eat and convenient food options, consumer preferences for healthier and natural food choices, and the expanding retail landscape. Packaging plays a crucial role in maintaining the quality of chilled deli food. Effective packaging solutions, such as modified atmosphere packaging (MAP) for deli meats, help extend shelf life and minimize spoilage by controlling the atmosphere inside the package. Moreover, optimizing the cold chain for deli meats is essential to ensure product safety and quality during transportation and storage. To extend the shelf life of chilled deli products, methods like high pressure processing, pulsed electric fields, and ultrahigh temperature processing are being explored. Controlling microbial growth in chilled food packaging is another critical aspect, achieved through the use of antimicrobial agents and biopolymers. Consumer preferences for chilled food are continually evolving, necessitating the need for continuous improvement in chilled deli food processing efficiency. Reducing waste in the chilled food supply chain is a priority, with strategies including better demand forecasting, improved inventory management, and optimized transportation logistics. Regulatory compliance is essential in chilled deli food production, with stringent regulations governing food safety, labeling, and packaging requirements. Temperature measurement during transport and monitoring of hygiene parameters during processing are critical to ensuring regulatory compliance and maintaining product quality. The sensory attributes of chilled food are a significant factor in consumer acceptance. Analyzing factors affecting these attributes, such as texture, flavor, and aroma, is essential to optimize storage conditions and processing methods for chilled deli meats. New food preservation techniques, such as the use of natural preservatives and nanotechnology, are being explored to enhance product quality and extend shelf life. In conclusion, the market is a dynamic and complex industry, requiring a holistic approach to ensure product quality, consumer safety, and regulatory compliance. Effective packaging solutions, optimization of the cold chain, extending shelf life, controlling microbial growth, and improving processing efficiency are all critical aspects of the market's growth and success.

The chilled deli food market continues to expand as consumers increasingly seek convenient, ready-to-eat protein options with extended freshness and quality. One of the primary areas influencing product integrity is the impact of packaging on chilled deli food quality. Innovative packaging technologies—such as vacuum sealing, modified atmosphere packaging, and antimicrobial films—play a critical role in preserving flavor, texture, and safety. To ensure consistent product quality from processing to point of sale, the optimization of the cold chain for deli meats has become essential. This involves maintaining strict temperature control, utilizing real-time monitoring technologies, and streamlining logistics to minimize temperature fluctuations and delays.

A key objective for producers is finding effective methods to extend the shelf life of chilled deli products. Strategies include fine-tuning preservative use, enhancing packaging, and applying high-pressure processing or other non-thermal preservation techniques that maintain sensory and nutritional characteristics while reducing microbial growth.

Understanding the market also requires a thorough evaluation of consumer preferences for chilled food. This includes preferences related to taste, convenience, portion size, labeling transparency, and perceived freshness, all of which inform product innovation and marketing strategies. From a production standpoint, improving efficiency in chilled deli food processing is vital to remaining competitive. Automation, lean manufacturing practices, and real-time quality control systems help increase throughput while maintaining high food safety standards.

Another major concern is sustainability, driving initiatives aimed at reducing waste in the chilled food supply chain. Waste reduction strategies include better demand forecasting, improved inventory management, and the use of recyclable or compostable packaging materials. At the regulatory level, maintaining compliance is non-negotiable. Adherence to food safety standards and regulatory compliance in chilled deli food production ensures that manufacturers meet requirements related to hygiene, labeling, traceability, and temperature control as mandated by national and international authorities.

One of the operational challenges is accurately measuring temperature during chilled deli food transport. Real-time temperature loggers and wireless sensors are now commonly used to monitor conditions throughout the supply chain, helping to ensure product safety and freshness upon arrival. Lastly, the analysis of factors affecting sensory attributes of chilled food is critical in product development. Parameters such as pH, water activity, fat content, and spice formulations are all carefully adjusted to maintain taste, aroma, texture, and visual appeal over the product's shelf life.

As the chilled deli food market continues to grow, success will depend on an integrated approach that combines food science, supply chain efficiency, consumer insight, and regulatory adherence to deliver high-quality, safe, and appealing products to market.

What are the key market drivers leading to the rise in the adoption of Chilled Deli Food Industry?

- The retail sector's expansion is the primary catalyst for market growth. With an increasing consumer base and a rising disposable income, the retail industry's continuous expansion significantly contributes to the market's progression.

- The market is experiencing a noteworthy evolution, fueled by the expanding retail sector. Major retailers, such as Walmart, are broadening their presence with plans to open 150 new stores in the US by 2029. This growth strategy encompasses a significant remodeling project across 47 states, aiming to enhance the shopping experience and cater to the escalating consumer preference for convenient and premium meal solutions.

- The retail sector's expansion signifies a robust market for chilled deli foods, ensuring greater accessibility and availability to meet the increasing demand.

What are the market trends shaping the Chilled Deli Food Industry?

- Strategic partnerships are increasingly prevalent in today's market trends. A professional and knowledgeable approach involves forming alliances to mutually benefit from each other's strengths and expertise.

- The market is undergoing a transformation, marked by a rise in strategic collaborations and acquisitions. This trend is predominantly observed in the UK, where key players are actively pursuing acquisitions to amplify their presence in the convenience and out-of-home food sectors. For instance, in October 2024, Kepak Group finalized the acquisition of Summit Foods, a prominent player known for brands like Snacksters, East St Deli, and Snax on the Go. This strategic move aims to bolster Kepak's influence in the food-to-go and micro-snacking segments within the UK.

- This acquisition is in line with Kepak's growth strategy, focusing on expanding its reach in the UK convenience market. The market's evolution underscores the industry's adaptability and resilience, as companies continually seek opportunities to broaden their product offerings and strengthen their market positions.

What challenges does the Chilled Deli Food Industry face during its growth?

- The growth of the industry is significantly impacted by regulatory guidelines, which present a key challenge that must be addressed by professionals in a knowledgeable and formal manner.

- The market experiences continuous evolution, shaped by stringent regulatory requirements aimed at ensuring food safety and quality. These regulations are essential for preventing foodborne illnesses but present operational and compliance challenges for manufacturers and retailers. One significant requirement involves maintaining chilled deli foods at temperatures below 41 degrees Fahrenheit to inhibit bacterial growth. This necessitates robust refrigeration systems and constant monitoring to maintain safe temperatures.

- Deviations from this range can result in spoilage and potential health risks, emphasizing the importance of temperature control. Another critical aspect is the regular cleaning and sanitization of surfaces that come into contact with food. These regulations ensure consumer safety while posing operational challenges, making adherence a priority for market participants.

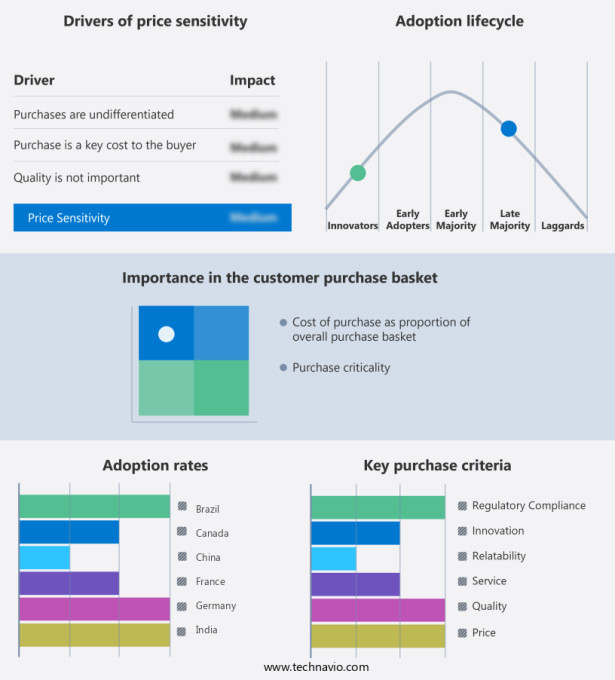

Exclusive Technavio Analysis on Customer Landscape

The chilled deli food market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chilled deli food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Chilled Deli Food Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, chilled deli food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2 Sisters Food Group - This company specializes in providing a range of chilled deli offerings, featuring authentic Italian dishes such as lasagna and pizza.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2 Sisters Food Group

- BONDUELLE SA

- BRF SA

- Cargill Inc.

- Conagra Brands Inc.

- Greencore Group Plc

- Hormel Foods Corp.

- JBS SA

- Kellanova

- Maple Leaf Foods Inc.

- Nestle SA

- Olam Group Ltd.

- PepsiCo Inc.

- Seaboard Corp.

- Smithfield Foods Inc.

- The Kraft Heinz Co.

- Tyson Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chilled Deli Food Market

- In January 2024, Hormel Foods Corporation, a leading food company, announced the launch of its new line of natural and organic deli meats under the Applegate brand (Hormel Foods Corporation, 2024). This expansion aimed to cater to the growing consumer demand for healthier and more natural food options in the market.

- In March 2024, Tyson Foods, Inc. and Beyond Meat, Inc. announced a strategic partnership to develop and produce plant-based deli meats for the North American market (Tyson Foods, Inc., 2024). This collaboration marked a significant shift in the market, as it brought together two major players in the meat and plant-based food industries.

- In May 2024, The Kroger Co. and Owens & Minor, Inc. signed a long-term agreement to expand their partnership in the area of fresh food distribution (The Kroger Co., 2024). This strategic move aimed to improve the availability and freshness of chilled deli foods in Kroger stores, enhancing the overall customer experience.

- In April 2025, the European Commission approved the acquisition of Danish Crown's deli meat business by the Dutch company, Vion Food Group (European Commission, 2025). This merger created a larger European player in the market, allowing for increased economies of scale and potential for geographic expansion.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chilled Deli Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 73.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Germany, France, Japan, South Korea, Canada, Italy, Brazil, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by consumer preferences for fresh, high-quality food and stringent food safety regulations. Microbial contamination control is a top priority, leading to the adoption of energy-efficient refrigeration technology and preservation techniques such as bacterial growth inhibition and shelf life extension. Food handling practices and inventory management systems are optimized to ensure product freshness and reduce food waste. Distribution network optimization and temperature monitoring systems are crucial for maintaining the cold chain, while HACCP compliance and product labeling requirements ensure food safety. Production line efficiency and quality control procedures are essential for meeting consumer demand and reducing waste.

- Consumer preference studies and sensory evaluation methods are used to develop new products and improve existing ones. Modified atmosphere packaging and temperature abuse indicators help extend shelf life and maintain product quality. Retail display cases and sanitation procedures are key components of effective food handling practices. Industry growth in the market is expected to reach double digits in the coming years, driven by increasing demand for convenience and healthier food options. For instance, a leading deli food manufacturer reported a 15% increase in sales due to the introduction of a new line of organic, gluten-free deli meats.

- With the ongoing focus on food safety, energy efficiency, and waste reduction, the market is poised for continued innovation and growth.

What are the Key Data Covered in this Chilled Deli Food Market Research and Growth Report?

-

What is the expected growth of the Chilled Deli Food Market between 2025 and 2029?

-

USD 73.1 billion, at a CAGR of 5.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Prepared products, Meat, and Others), Distribution Channel (Offline and Online), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Expansion of retail sector, Regulatory guidelines

-

-

Who are the major players in the Chilled Deli Food Market?

-

2 Sisters Food Group, BONDUELLE SA, BRF SA, Cargill Inc., Conagra Brands Inc., Greencore Group Plc, Hormel Foods Corp., JBS SA, Kellanova, Maple Leaf Foods Inc., Nestle SA, Olam Group Ltd., PepsiCo Inc., Seaboard Corp., Smithfield Foods Inc., The Kraft Heinz Co., and Tyson Foods Inc.

-

Market Research Insights

- The market continues to evolve, with innovative techniques and technologies shaping its landscape. Two significant trends include the adoption of sous vide cooking methods and controlled atmosphere storage. Sous vide techniques ensure even heating and retain food's natural flavors and textures, leading to a sales increase of up to 25% for some retailers. Moreover, the industry anticipates a growth of 5% annually over the next five years, driven by advancements in refrigerant management, logistics optimization, and inventory control.

- These improvements contribute to maintaining cold chain integrity and reducing waste, ultimately enhancing consumer satisfaction.

We can help! Our analysts can customize this chilled deli food market research report to meet your requirements.