Europe Chiller Market Size 2025-2029

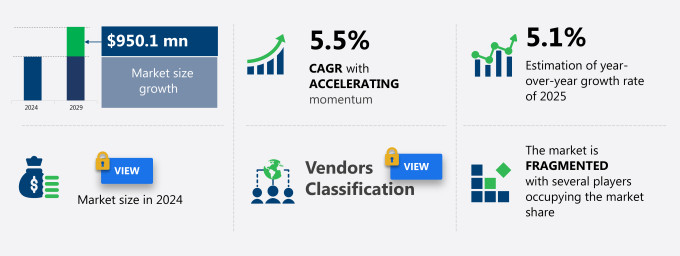

The Europe chiller market size is forecast to increase by USD 950.1 million at a CAGR of 5.5% between 2024 and 2029.

- The chiller market is experiencing significant growth due to the increasing demand for frozen food and beverages. This trend is driven by the changing consumer preferences towards convenient and ready-to-eat food options. Additionally, the advent of smart connected chillers, which offer enhanced energy efficiency and remote monitoring capabilities, is further fueling market growth.

- Emerging trends include IoT-based chillers and heat pumps for residential, commercial, and industrial buildings. However, the high initial investment costs of chillers remain a challenge for market expansion. Prospective buyers are looking for cost-effective solutions and financing options to offset the high upfront costs. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders In the chiller industry.

What will be the Size of the Market During the Forecast Period?

- The Chillers Market encompasses industrial chillers, including water-cooled and air-cooled models, utilized in various sectors such as manufacturing industries, printing, laser cutting, chemicals and petrochemicals, plastics, food and beverages, medical & pharmaceuticals, rubber, and others. These cooling systems are essential for centralized air conditioning, refrigeration, and industrial processes. Chillers use heat-absorbing refrigerants, primarily fluorinated greenhouse gases (F-gases) or hydrochlorofluorocarbons (HCFCs), which are being gradually replaced by natural refrigerants due to environmental concerns.

- Moreover, compressors, including centrifugal, scroll, and screw chillers, are integral components of chiller systems. The screw chiller segment holds a significant market share. Absorption chillers and refrigerant compression chillers are alternative technologies gaining traction due to their energy efficiency and reduced greenhouse gas emissions. The market is expected to grow, driven by increasing demand for energy-efficient cooling solutions and the need for sustainable refrigerants.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

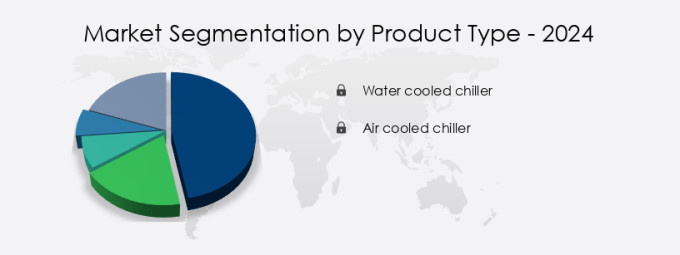

- Product Type

- Water cooled chiller

- Air cooled chiller

- Type

- Screw chillers

- Scroll chillers

- Centrifugal chillers

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Product Type Insights

- The water cooled chiller segment is estimated to witness significant growth during the forecast period.

Water-cooled chillers are an efficient solution for heat removal in industrial processes and air conditioning applications. These systems utilize water as a heat transfer medium, resulting in more effective cooling compared to air-cooled alternatives. The cooling process is particularly efficient in high ambient temperatures, ensuring consistent performance in hot climates. Water-cooled chillers are also more compact than equivalent air-cooled units, making them an attractive option for installations with limited space. Additionally, water-cooled chillers produce lower noise levels, contributing to a quieter operating environment. Water-cooled chillers use various compressor types, including centrifugal, scroll, and screw compressors, to compress the heat-absorbing refrigerant. These systems offer reliable and efficient cooling solutions for manufacturing industries and other applications requiring temperature control.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Europe Chiller Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Chiller Market?

Growing demand for frozen food is the key driver of the market.

- The Chillers market encompasses a range of cooling systems used in various industries, including printing, manufacturing, power plants, and centralized air conditioning. Industrial chillers, such as absorption and water-cooled or air-cooled, utilize chemicals and petrochemicals as heat-absorbing refrigerants, like fluorinated greenhouse gases (F-gases) or F-gases alternatives. These chillers employ compressors, such as centrifugal, scroll, screw, or absorption, to compress the refrigerant and cool the process water or air. The plastics industry is a significant consumer of chillers, prioritizing energy efficiency and sustainable energy systems to reduce energy bills. The product type segment includes water-cooled and air-cooled chillers, while the screw compressor segment dominates the market.

- In addition, the screw chiller segment caters to the plastics industry's specific requirements, ensuring temperature stability for manufacturing processes. Environmental sustainability and energy efficiency regulations, such as the MAC Directive and Ecodesign criteria, influence the Chillers market. Chiller technology is essential for industries like pharmaceuticals, healthcare facilities, and food and beverages, where temperature-sensitive processes demand precise temperature control. The demand for chillers continues to grow in sectors like manufacturing plants, energy plants, schools, telecommunications, airports, shopping malls, and green construction initiatives. IoT-based chillers are increasingly popular due to their energy-saving capabilities and remote monitoring features. Despite the high initial cost and maintenance costs, the benefits of energy efficiency and temperature control make chillers an indispensable investment for various industries.

What are the market trends shaping the Europe Chiller Market?

Advent of smart connected chillers is the upcoming trend In the market.

- The Chiller Market is witnessing significant growth due to the increasing demand for energy-efficient cooling systems in various industries, including manufacturing, power generation, and centralized air conditioning. Chemicals and petrochemicals, printing, plastics, and pharmaceutical production are some sectors that heavily rely on industrial chillers for their temperature-sensitive processes. Chillers come in different types, such as water-cooled and air-cooled, with screw, centrifugal, scroll, reciprocating, and absorption compressors. The adoption of absorption chillers, which use fluorinated greenhouse gases (F-gases) or heat pumps as heat-absorbing refrigerants, is increasing due to their energy efficiency and environmental sustainability. The European Union's MAC Directive and Ecodesign criteria have set strict energy efficiency regulations for chillers, driving the market's growth.

- Furthermore, smart connected chillers are gaining popularity due to their ability to minimize downtime and reduce maintenance costs. These chillers can be accessed and controlled remotely, allowing technicians to perform advanced analytics and monitor performance in real-time. The market for smart connected chillers is expected to grow significantly In the coming years, particularly in industries with high energy consumption, such as plastics, food and beverages, medical and pharmaceuticals, and rubber. Energy efficiency and sustainable energy systems are essential considerations for end-users, leading to an increase in demand for energy-efficient chillers. Despite the high initial cost, the long-term savings on energy bills make these investments worthwhile. The market for chillers is expected to continue growing, driven by the increasing need for reliable and efficient cooling systems in various industries.

What challenges doesEurope Chiller Market face during the growth?

High initial investment costs of chillers is a key challenge affecting the market growth.

- Chillers, a crucial component of cooling systems, are essential in various industries such as manufacturing, power generation, and centralized air conditioning. These high-efficiency systems use chemicals and petrochemicals as heat-absorbing refrigerants, including fluorinated greenhouse gases (F-gases) and natural refrigerants. The demand for energy-efficient and sustainable energy systems is driving the adoption of advanced technologies like absorption chillers, screw compressors, and centrifugal compressors. The printing, plastics, pharmaceutical production, and food and beverages industries heavily rely on chillers for their temperature-sensitive processes. Energy efficiency regulations, such as the MAC Directive and Ecodesign criteria, have set stringent standards for chiller technology. Active energy recovery systems and power plants are also integrating chillers to optimize energy usage.

- However, the high initial cost of these advanced chillers and the maintenance costs associated with their complex components can be a challenge for some industries. The costs of installing chillers, including labor, materials, and infrastructure modifications, can add to the overall investment. Despite these costs, the benefits of energy savings and improved performance make chillers a valuable investment for many industries. The chillers market is segmented by product type, including water-cooled and air-cooled chillers, and by application, including plastics, manufacturing, power generation, and others. The screw chiller segment is expected to dominate the market due to its energy efficiency and versatility.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Carrier Global Corp. - The company offers chillers such as Global Chiller, AquaSnap, AquaForce, and Sea Horse.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Daikin Industries Ltd.

- Danfoss AS

- FlaktGroup Holding GmbH

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- Ingersoll Rand Inc.

- Johnson Controls International Plc

- Kaltra GmbH

- Kirloskar Group

- LG Corp.

- MIDEA Group Co. Ltd.

- Mitsubishi Electric Corp.

- Modine Manufacturing Co.

- Nortek

- Panasonic Holdings Corp.

- Regal Rexnord Corp.

- Samsung Electronics Co. Ltd.

- Systemair AB

- Trane Technologies Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, a new line of energy-efficient industrial chillers was launched by Trane Technologies, designed to reduce energy consumption in manufacturing and commercial applications. These chillers utilize advanced heat pump technology, aiming to meet Europe's growing demand for sustainable cooling solutions amid stricter environmental regulations.

-

In November 2024, a strategic partnership between Daikin and a leading European supermarket chain was announced to develop and implement advanced chiller systems for their food storage facilities. The collaboration focuses on reducing energy costs and improving refrigeration efficiency through smart, IoT-enabled chiller solutions.

-

In October 2024, Johnson Controls introduced a new hybrid chiller system to the European market, combining both air-cooled and water-cooled technologies. This system is designed to optimize cooling performance and energy efficiency, making it suitable for both commercial and industrial sectors looking to reduce carbon footprints.

-

In September 2024, the acquisition of a European chiller manufacturer by Carrier Global Corporation was completed, strengthening Carrier's position in the region. The acquisition focuses on expanding its range of commercial and industrial refrigeration solutions, particularly in sectors such as food storage, pharmaceuticals, and large-scale air conditioning systems.

Research Analyst Overview

The chiller market encompasses a broad spectrum of cooling technologies used in various industries to manage temperature requirements. These systems play a crucial role in power generation, manufacturing processes, and centralized air conditioning systems. Industrial chillers, a significant segment within this market, are employed in diverse industries such as pharmaceuticals, plastics, and food and beverages. These chillers are designed to absorb heat from a primary source, typically water or air, and release it into the environment, thereby maintaining optimal temperatures for various processes. Two primary types of industrial chillers are water-cooled and air-cooled.

Moreover, water-cooled chillers use water as the cooling medium, making them more efficient and suitable for large-scale applications. Air-cooled chillers, on the other hand, use ambient air for cooling and are often preferred for smaller installations or remote locations. Compressor technology is a critical component of industrial chillers. Various compressor types, including centrifugal, scroll, screw, and absorption compressors, are used depending on the application's specific requirements. Centrifugal compressors are commonly used in power generation and large-scale industrial processes due to their high efficiency and ability to handle large volumes of refrigerant. The plastics industry is a significant consumer of industrial chillers, with energy efficiency being a key consideration due to the high energy bills associated with this sector.

In addition, advanced chiller technologies, such as screw chillers and absorption chillers, are increasingly being adopted to improve energy efficiency and reduce operational costs. The manufacturing industry, particularly in sectors like healthcare and electronics, relies heavily on temperature-controlled environments for production processes. Chillers play a vital role in maintaining these conditions, ensuring product quality and safety. Environmental sustainability is a growing concern In the chiller market, with regulations such as the Mac Directive and Ecodesign Criteria driving the adoption of energy-efficient and eco-friendly cooling systems. The use of heat pumps, hydro chillers, and IoT-based chillers is on the rise as they offer improved energy efficiency and reduced greenhouse gas emissions.

Furthermore, despite the initial high cost, the long-term benefits of investing in energy-efficient chillers and sustainable energy systems outweigh the expenses. These systems not only help reduce energy bills but also contribute to environmental sustainability and regulatory compliance. The demand for chillers is influenced by various factors, including the size and complexity of the application, energy efficiency requirements, and the availability of sustainable energy sources. The market for chillers is diverse, with applications ranging from residential buildings and commercial spaces to industrial plants and power generation facilities. Therefore, the chiller market is a dynamic and evolving sector, driven by advancements in technology, increasing focus on energy efficiency, and regulatory compliance. Industrial chillers play a crucial role in various industries, from power generation and manufacturing to healthcare and food production, ensuring optimal temperature conditions for diverse applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 950.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

Germany, France, UK, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch