Cloud Integration Software Market Size and Trends

The cloud integration software market size is forecast to increase by USD 9.31 billion, at a CAGR of 12.4% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption of cloud-based solutions among large enterprises in various industries, including IT and telecom, healthcare, and manufacturing. This trend is driven by the need for digital transformation and the proliferation of interconnected devices. Hybrid environments are becoming increasingly common, leading to a demand for cloud-integrated solutions that can seamlessly connect on-premises systems with cloud applications. Moreover, pre-configured integration packages are gaining popularity due to their ease of use and quick implementation. However, concerns about data security remain a challenge, as organizations must ensure that their data is protected while being transferred and stored in the cloud. The market is expected to continue growing as businesses seek to streamline their operations and improve efficiency through the use of advanced integration technologies. In summary, the market is witnessing strong growth due to the increasing adoption of cloud solutions by large enterprises in various industries, the need for hybrid environments, and the popularity of pre-configured integration packages. However, data security concerns remain a challenge that must be addressed.

The market is witnessing significant growth as businesses increasingly adopt cloud-based solutions to address the challenges of connecting disparate applications within their IT environment. With the rise of remote work models and distributed teams, the need for scalable storage solutions and real-time data connectivity has become crucial. Cloud integration software enables seamless data transfer between on-premises applications and cloud-based applications. It facilitates the interoperability of various systems, ensuring that data remains consistent and up-to-date across the organization. This is particularly important in industries such as e-commerce, banking, and others that rely on real-time data processing and analysis. The integration of cloud-based applications with edge computing and serverless architectures is also gaining traction. These technologies enable businesses to process data closer to the source, reducing latency and improving overall performance. Moreover, artificial intelligence (AI) and machine learning (ML) repositories can be integrated with cloud-based systems, enabling advanced analytics and automation of workflows.

Cloud migration is another key driver of the market. As more businesses move their operations to the cloud, they require integration solutions to connect their legacy systems with their new cloud-based infrastructure. This ensures a smooth transition and minimizes disruptions to business operations. In the market, cloud integration software is becoming an essential component of digital transformation initiatives. It enables businesses to leverage the benefits of cloud computing while ensuring that their IT systems remain interconnected and functional. The use of automated workflows and real-time data connectivity further enhances operational efficiency and productivity. The market is expected to continue its growth trajectory, driven by the increasing adoption of cloud-based solutions and the need for seamless data integration across various systems and applications. With the continued evolution of technology, cloud integration software will play a critical role in enabling businesses to adapt and thrive in an increasingly digital world.

Market Segmentation

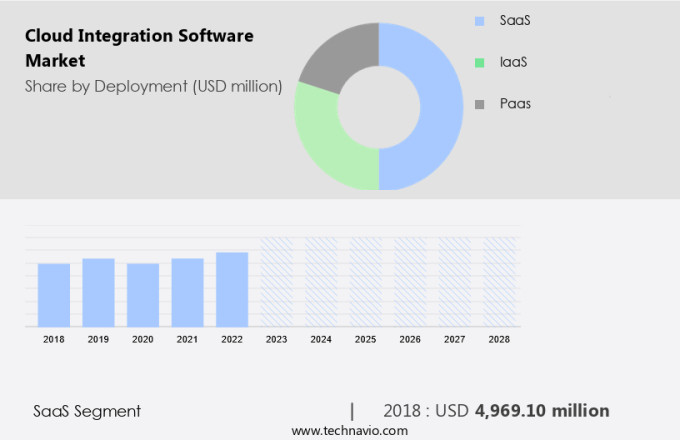

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Deployment

- SaaS

- IaaS

- Paas

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Deployment Insights

The SaaS segment is estimated to witness significant growth during the forecast period. The market is expected to experience significant growth, with SaaS (Software as a Service) being the leading segment. SaaS is a software delivery model where cloud providers host applications and grant access to users via the Internet. This model is popular among various sectors including large enterprises, healthcare, manufacturing, and IT and telecommunications, due to its affordability and scalability.

Get a glance at the market share of various segments Download the PDF Sample

The SaaS segment was valued at USD 4.97 billion in 2018. The SaaS industry's expansion is driven by digital transformation initiatives, the increasing number of interconnected devices, and the need for cloud-integrated solutions with pre-configured integration packages.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

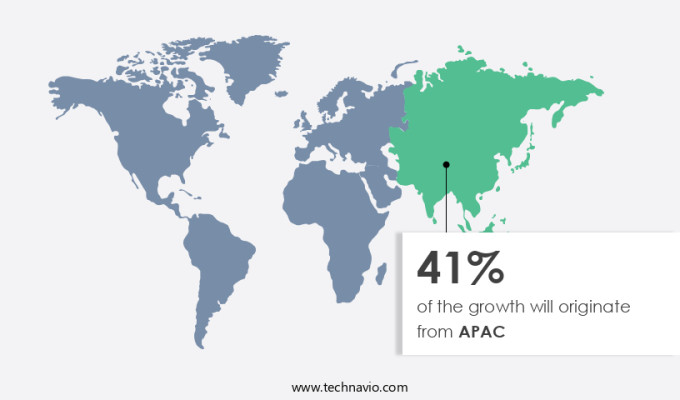

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In the market, North America held a significant market share in 2023. The demand for cloud integration software in the region is driven by the increasing need for scalability, integration, and standardization in various enterprises. North America's early adoption of public cloud services, which began a decade ago, has positioned it as a major contributor to the global market's revenue during the forecast period. The US and Canada are the primary contributors to the market in North America. Cloud integration software enables enterprises to connect various applications and systems, both in the cloud and on-premises, to streamline business processes and improve data flow. In North America, Enterprise Resource Planning (ERP) systems and marketing automation platforms are among the primary applications of cloud integration software.

A centralized platform for cloud-based deployment offers several advantages, including reduced data latency and improved data-driven insights. Hybrid deployment models, which combine both cloud-based and on-premises solutions, are also gaining popularity in the region. IT infrastructure modernization and digital transformation initiatives are driving the adoption of cloud integration software in North America. The market is expected to grow steadfastly, offering significant opportunities for vendors and investors alike.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Cloud Integration Software Market Driver

Increased use of AI-enabled SaaS is notably driving market growth. Artificial Intelligence (AI) is a computer science discipline that employs algorithms, pattern recognition, machine learning, deep learning, and cognitive computing to derive insights from data without human intervention. AI's ability to automate processes, enhance productivity, and deliver precise results in a short time frame has led to its increasing adoption across industries. The market encompasses various segments, including Application Integration, Process Integration, Data Source segment, and E-commerce data integration. In the Application Integration segment, AI is utilized to automate workflows, streamline processes, and improve customer experiences. In the Process Integration segment, AI-driven tools enable seamless data exchange between applications and systems. The Data Source segment leverages AI to ensure data accuracy, consistency, and security.

In the E-commerce data integration segment, AI-powered solutions facilitate real-time data synchronization and personalized customer experiences. IoT (Internet of Things) is another area where AI plays a significant role in processing and analyzing vast amounts of data generated by connected devices. Cloud Migration is another key application area for AI in the market. AI-driven tools simplify the migration process, ensuring minimal downtime and data loss. The Financial Services and Banking sectors are major adopters of AI in Cloud Integration, using it to enhance security, streamline operations, and improve customer experiences. Thus, such factors are driving the growth of the market during the forecast period.

Cloud Integration Software Market Trends

Increasing acceptance of PaaS is the key trend in the market. Cloud integration software plays a vital role in connecting disparate applications, enabling seamless data transfer between on-premises and cloud-based environments. This integration is crucial in today's IT landscape, where businesses increasingly rely on a mix of cloud computing and traditional on-premises applications. With the rise of remote work models and distributed teams, cloud integration software becomes even more indispensable. PaaS (Platform as a Service) is a popular cloud model that offers a comprehensive solution for application development and deployment. It provides developers with essential resources for creating and managing applications, from simple cloud-based solutions to complex, cloud-enabled enterprise applications. PaaS offers several advantages, including software development tools, application programming interfaces, operating systems, storage, and infrastructure. By utilizing PaaS, businesses can focus on their core competencies, leaving the intricacies of IT infrastructure to the cloud service provider.

This results in increased efficiency, scalability, and flexibility. Cloud integration software is essential for businesses aiming to optimize their IT environment and adapt to the evolving digital landscape. It enables seamless communication between cloud-based and on-premises applications, ensuring data consistency and accuracy. Furthermore, it offers scalable storage solutions, which are vital for businesses dealing with large volumes of data. With the increasing adoption of cloud computing and the growing need for remote work models, cloud integration software is set to play a significant role in the future of business technology. Thus, such trends will shape the growth of the market during the forecast period.

Cloud Integration Software Market Challenge

Concerns about data security is the major challenge that affects the growth of the market. In today's business landscape, numerous organizations, both small and large, adopt cloud integration software solutions, such as Software as a Service (SaaS), due to their cost-effective, scalable, and user-friendly nature. These solutions enable quick and affordable access to software applications for end-users. For instance, SaaS solutions offer scalability, which is crucial for emerging enterprises. Cloud integration software solutions provide several functionalities, including enhanced IT services and increased flexibility in data access. However, security concerns are a significant challenge associated with cloud-integrated software. Data security is a major concern in the digital age, with reports of cyber-attacks and data breaches being common.

Industries such as Insurance, Public Sector Utilities, Media and Entertainment, and Telecommunication are increasingly adopting cloud integration software to streamline their operations. Encryption is a crucial security measure used to protect data in transit and at rest. Automation of business processes is another key benefit of cloud integration software, leading to increased efficiency and productivity. Despite the advantages, security concerns persist. Data encryption is essential to secure data during transmission and storage. It is crucial for organizations to implement security measures to mitigate risks and ensure data privacy. Hence, the above factors will impede the growth of the market during the forecast period.

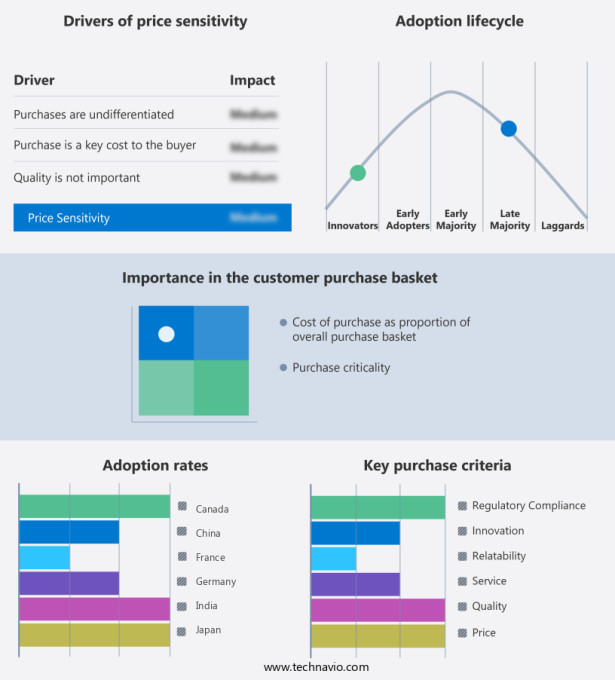

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture PLC - The company offers cloud integration softwares such as Accenture Cloud Platform, which includes big data analytics, data decommissioning, testing as a service, and infrastructure as a service provisioning and management.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Capgemini Services SAS

- Cisco Systems Inc.

- Cloudticity LLC

- Cognizant Technology Solutions Corp.

- DXC Technology Co.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- Informatica Inc.

- Infosys Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Plantronics Inc.

- Salesforce Inc.

- SAP SE

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Businesses are increasingly relying on cloud-based solutions to manage their IT environments, particularly when dealing with disparate applications and remote work models. Cloud integration software plays a crucial role in enabling seamless data transfer between on-premises applications and cloud-based applications, ensuring real-time data connectivity and automated workflows. Large enterprises, IT and telecommunication companies, healthcare providers, manufacturing firms, and various other industries are embracing cloud-integrated solutions to streamline their operations and drive digital transformation. These industries deal with vast amounts of data from interconnected devices, requiring scalable storage solutions and data integration capabilities. Cloud integration software offers pre-configured integration packages to simplify the process of connecting various applications, enabling real-time data connectivity and automated workflows. It caters to hybrid environments, allowing businesses to deploy cloud-based, on-premises, or hybrid solutions based on their specific needs.

Moreover, cloud integration solutions facilitate data migration, ensuring data-driven insights and minimizing data latency. They cater to various industries, including banking, financial services, insurance, public sector utilities, media and entertainment, and telecommunication. Encryption and automation are essential features that ensure data security and streamline processes. Cloud integration software also supports various applications, such as customer relationship management, enterprise resource planning, marketing automation, and e-commerce data integration. Edge computing and serverless architectures are emerging trends in cloud integration, while artificial intelligence and machine learning offer advanced capabilities to enhance business processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market Growth 2024-2028 |

USD 9.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.2 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 41% |

|

Key countries |

US, Canada, Germany, UK, China, Japan, France, India, South Korea, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture PLC, Alphabet Inc., Amazon.com Inc., Capgemini Services SAS, Cisco Systems Inc., Cloudticity LLC, Cognizant Technology Solutions Corp., DXC Technology Co., HCL Technologies Ltd., Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., Informatica Inc., Infosys Ltd., International Business Machines Corp., Microsoft Corp., Oracle Corp., Plantronics Inc., Salesforce Inc., SAP SE, and TIBCO Software Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.