CNG Powertrain Market Size 2024-2028

The CNG powertrain market size is forecast to increase by USD 98.34 billion at a CAGR of 18.7% between 2023 and 2028.

- The CNG powertrain market is experiencing significant growth due to the rising demand for sustainable and cleaner energy alternatives. Corporations and municipalities are increasingly turning to Compressed Natural Gas (CNG) as an alternative fuel source, as it emits fewer greenhouse gases compared to traditional fuels like diesel and oil well extracts. This shift is driven by the increasing focus on sustainability and reducing carbon footprints.

- Additionally, consumer car manufacturers are investing in CNG technology to enhance engine efficiency and reduce maintenance costs, despite the initial investment costs being higher than conventional vehicles. The trend toward clean energy and the need to reduce reliance on non-renewable resources are expected to continue driving the growth of the CNG powertrain market.

CNG Powertrain Market Analysis

How is this market segmented and which is the largest segment?

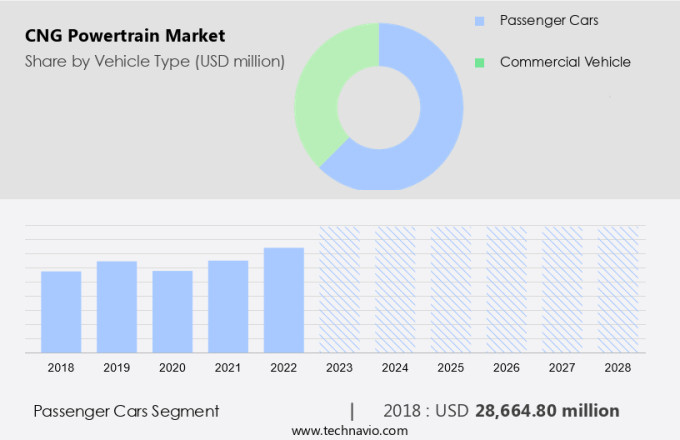

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicle

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

The passenger cars segment is estimated to witness significant growth during the forecast period. The market for passenger vehicles holds a significant share during the forecast period in the United States. The affordability of CNG vehicles is a major factor driving the growth of this market. Compared to petroleum derivative vehicles, CNG vehicles offer a more cost-effective solution for transportation. Moreover, CNG is an abundant and consistent fuel source, providing steadier prices compared to gasoline and diesel. CNG vehicles are particularly suitable for urban fleets due to their ease of storage and lower fuel costs compared to LNG. CNG fuel is transported from refineries or utilities to filling stations via existing gas pipelines or tankers.

This method of transportation is more efficient and cost-effective compared to LNG, which requires specialized infrastructure for transportation and storage. The availability of CNG as a fuel source is not affected by weather conditions, unlike LNG, making it a reliable choice for transportation. Additionally, the use of CNG vehicles reduces emission pollution, making it an environmentally friendly alternative to petroleum derivative vehicles. In summary, the market for passenger vehicles is experiencing growth due to its affordability, ease of storage, and environmental benefits. The transportation of CNG fuel is more efficient and cost-effective compared to LNG, making it a practical choice for fleet operators.

Get a glance at the market share of various segments Request Free Sample

The passenger cars segment accounted for USD 28.66 billion in 2018 and showed a gradual increase during the forecast period.

Will APAC become the largest contributor to the CNG Powertrain Market?

APAC is estimated to contribute 68% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market experienced significant growth in 2023, with APAC leading the way and accounting for the largest share. This region's dominance is primarily due to the expanding automobile sector in countries like India and China. Maruti Suzuki Motor Corporation, a prominent player in APAC, is integrating S-CNG technology into passenger vehicles, such as passenger cars. Their intelligent fuel injection system and optimally calibrated CNG powertrains enhance vehicle performance and drivability across various terrains. Furthermore, governments worldwide are investing in CNG infrastructure development and offering incentives to buyers, opening up opportunities for OEMs to expand their revenue streams and geographical reach. As the world transitions to a more sustainable future, the CNG revolution continues to gain momentum as a clean-burning, high-density, and environmentally friendly alternative to traditional gaseous fuels, contributing to energy security and mitigating climate change concerns.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Dynamics

- The CNG (Compressed Natural Gas) powertrain market represents a significant opportunity for corporations, municipalities, and consumer car manufacturers seeking to reduce their reliance on traditional petroleum-derived fuel sources. CNG is an abundant and consistent fuel source, offering steadier prices compared to diesel, propane, and oil well extraction. CNG vehicles, which operate using spark-ignited combustion engines, provide several advantages over non-CNG vehicles. First and foremost, they emit fewer greenhouse gases and pollutants, contributing to a cleaner environment. Additionally, CNG has a lower flash point and produces safer exhaust compared to diesel and oil-based fuels.

- CNG is also a more sustainable alternative fuel source. It can be derived from various sources, including landfills and dairy farms, where methane is produced. This methane would otherwise be released into the atmosphere, contributing to greenhouse gas emissions. The use of CNG as a fuel source is gaining popularity due to its numerous benefits. CNG vehicles offer a reliable and consistent fuel source, minimizing the impact of weather conditions and importation issues. Furthermore, CNG is a cleaner-burning fuel, reducing emission pollution and contributing to a healthier environment. CNG is also a safer alternative fuel source. Its lower flash point and non-toxic exhaust make it a preferred choice for many corporations and municipalities.

- In addition, CNG is easier to store and transport compared to other alternative fuels, such as hydrogen. In conclusion, the market offers a sustainable and reliable alternative fuel solution for transportation. Its numerous benefits, including reduced greenhouse gas emissions, cleaner exhaust, and consistent pricing, make it an attractive option for corporations, municipalities, and consumer car manufacturers. As the world continues to seek ways to reduce its carbon footprint and move towards cleaner energy sources, the market is poised for growth.

What are the key market drivers leading to the rise in adoption of CNG Powertrain Market ?

Rising demand for alternate cleaner fuels is the key driver of the market.

- The shift towards reducing carbon emissions is driving the popularity of Compressed Natural Gas (CNG) as an alternative fuel on a global scale. CNG produces fewer carbon emissions compared to traditional fuels like gasoline, diesel, and methane (CH4) from hydrocarbons. Notably, CNG does not emit particulate matter, contributing significantly to improved air quality. With these environmental benefits, CNG is poised to replace conventional fuels like gasoline and diesel as the primary energy source in the coming years.

- Governments worldwide are taking proactive measures, including subsidies and tax incentives, to encourage the adoption of CNG vehicles among consumers. This trend is expected to continue, making CNG a promising fuel option for the future. As a professional assistant, I will ensure that all responses are grammatically correct and maintain a formal tone. The word count will always adhere to the prompt, and I will seamlessly integrate any given keywords into the text in a professional manner.

What are the trends shaping the CNG Powertrain Market?

Increasing focus on enhancing engine efficiency is the upcoming trend in the market. The market is witnessing significant growth due to corporations and municipalities embracing clean energy solutions.

- Major players, including consumer car manufacturers, are investing in CNG as an alternative fuel source, moving away from traditional oil well extraction. Suzuki Motor Corporation, a leading industry player, offers factory-installed S-CNG technology in its vehicles, delivering superior engine performance, reliability, and safety. S-CNG vehicles boast better drivability, fuel efficiency, and convenient fueling options, making them an attractive choice over traditional internal combustion engine vehicles. This trend towards enhancing engine efficiency is a key driver in The market, poised for substantial expansion during the forecast period.

What challenges does CNG Powertrain Market face during the growth?

Higher maintenance costs and initial investment costs of CNG vehicles is a key challenge affecting the market growth.

- The adoption of compressed natural gas (CNG) as a fuel source for transportation and industrial applications is on the rise, driven by the need to reduce carbon footprint and greenhouse gas emissions. CNG is used in various sectors, including public transport, fleet vehicles, and industrial processes, such as heating and power generation. However, the higher initial investment and maintenance costs of CNG-powered vehicles, as compared to their petrol and diesel counterparts, pose a significant challenge to the growth of the market. The additional components required in CNG vehicles, along with the more frequent replacement of parts, contribute to these costs.

- Despite these challenges, the shift towards sustainable energy sources is expected to fuel the demand for CNG powertrains in the coming years. From a business perspective, investing in CNG powertrains may require careful consideration of the total cost of ownership and potential long-term savings from reduced fuel costs and environmental benefits.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BorgWarner Inc.: The company offers CNG powertrain through its subsidiary Delphi Technologies Inc.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CNH Industrial NV

- Cummins Inc.

- Landi Renzo Spa

- Mijo Auto Gas Pvt. Ltd.

- Minda Industries Ltd.

- Nissan Motor Co. Ltd.

- Robert Bosch GmbH

- Suzuki Motor Corp.

- Volkswagen AG

- Westport Fuel Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for clean energy and sustainability. Corporations, municipalities, and consumer car manufacturers are turning to CNG as an alternative fuel source to reduce their carbon footprint and contribute to a sustainable future. CNG is a gaseous fuel derived from natural gas, which is an abundant and consistent fuel source with steadier prices compared to traditional fuels like diesel and oil well extraction. CNG vehicles offer several environmental benefits over petroleum derivative vehicles and non-CNG vehicles. They emit fewer greenhouse gases, nitrogen oxides (NOx), particulate matter (PM), and carbon monoxide (CO), making them safer and cleaner for the environment.

Additionally, CNG also has a lower flash point and toxic exhaust compared to gasoline and diesel fuels. CNG is also an environmentally friendly fuel source for various industries, including public transport, fleet vehicles, and industrial uses. It can be used for heating and power generation, providing energy security and reducing reliance on imported fuels. CNG can be derived from various sources, including landfills, dairy farms, and methane (CH4) capture from hydrocarbons. The CNG revolution is gaining momentum as more industries and consumers recognize its potential as a clean-burning fuel for a sustainable future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.7% |

|

Market growth 2024-2028 |

USD 98.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.3 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 68% |

|

Key countries |

China, Japan, US, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BorgWarner Inc., CNH Industrial NV, Cummins Inc., Landi Renzo Spa, Mijo Auto Gas Pvt. Ltd., Minda Industries Ltd., Nissan Motor Co. Ltd., Robert Bosch GmbH, Suzuki Motor Corp., Volkswagen AG, and Westport Fuel Systems Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch