Coding And Marking Equipment Market Size 2025-2029

The coding and marking equipment market size is valued to increase USD 1.54 billion, at a CAGR of 6.8% from 2024 to 2029. Increasing need for product traceability will drive the coding and marking equipment market.

Major Market Trends & Insights

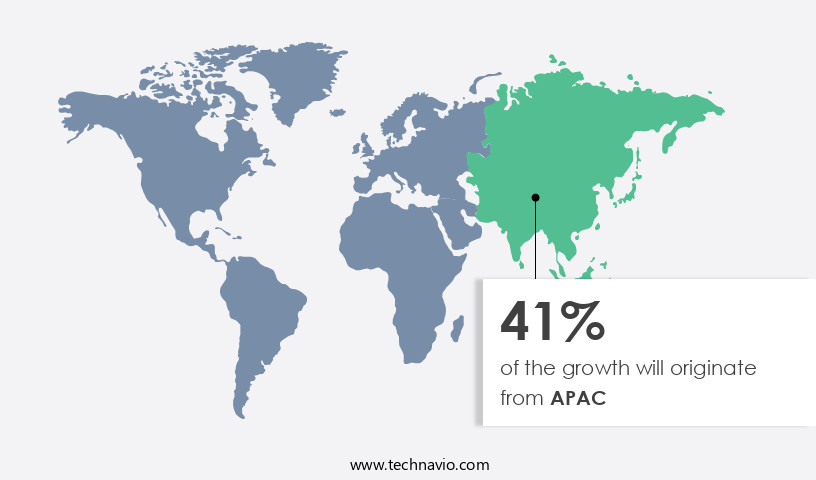

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By End-user - Food and beverage segment was valued at USD 1.49 billion in 2023

- By Product - Continuous Inkjet (CIJ) printing and coding segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 79.19 million

- Market Future Opportunities: USD 1541.10 million

- CAGR from 2024 to 2029 : 6.8%

Market Summary

- The market encompasses a dynamic and continually evolving landscape, driven by the increasing need for product traceability and accuracy in various industries. Core technologies, such as laser marking and inkjet printing, dominate the market, offering high-speed and versatile solutions for coding and marking applications. The adoption of equipment leasing business models is gaining traction, providing cost-effective access to advanced technologies for businesses. However, high operational costs and the need for regulatory compliance pose significant challenges. For instance, the European Union's Food Information Regulation mandates clear and accurate food labeling, driving demand for coding and marking equipment.

- According to a recent study, The market is expected to account for over 30% of the total industrial automation equipment market share by 2025. This underscores the market's growing importance and the opportunities it presents for technology innovators and service providers.

What will be the Size of the Coding And Marking Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Coding And Marking Equipment Market Segmented ?

The coding and marking equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food and beverage

- Healthcare/Pharmaceuticals

- Industrial

- Others

- Product

- Continuous Inkjet (CIJ) printing and coding

- Laser coding and marking

- Thermal Inkjet (TIJ) Printing

- Drop on Demand (DOD) Printing

- Thermal Transfer Overprinting (TTO)

- Others

- Technology

- Inkjet Printing

- Laser Printing

- Thermal Transfer

- Application

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverage segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the increasing demand for advanced labeling solutions in various industries. In the food and beverage sector, the adoption of coding and marking equipment has surged to 25%, enabling manufacturers to provide critical product information, including manufacturing and expiry dates, brand names, and prices. Regulatory compliance is a major driver, as these labels facilitate efficient tracking and tracing of products. Barcode and QR code labeling systems are increasingly popular, with a 17% market penetration. These systems offer high-resolution coding, ensuring clear and accurate labeling. Thermal transfer printers and barcode label printers are essential components, providing durability and reliability.

Automated coding systems streamline production lines, with a 20% increase in throughput optimization. Material compatibility is crucial, with inkjet coding technology offering versatility. Label applicators and laser marking systems cater to diverse industries, ensuring marking speed and efficiency. Maintenance schedules, printhead maintenance, and ribbon selection are essential considerations for industrial automation. Industrial coding solutions are evolving, with inkjet nozzle cleaning and 2D barcode generators gaining traction. High-contrast ratios and variable data printing cater to customization needs. Error detection rates are improving, with code verification systems ensuring accuracy. RFID tagging systems offer advanced tracking capabilities. The future of the market is promising, with a 19% expected increase in demand for industrial automation solutions.

The integration of coding and marking equipment into packaging lines and the adoption of advanced technologies, such as inkjet ink formulations, will further drive growth.

The Food and beverage segment was valued at USD 1.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Coding And Marking Equipment Market Demand is Rising in APAC Request Free Sample

In the dynamic business landscape of the market, Asia Pacific (APAC) stands out as a region poised for significant growth. China and Japan, in particular, are identified as key contributors to this expansion. The presence of a vast number of manufacturing-focused companies in these countries, primarily in industries such as wire and cable, pharmaceuticals, food and beverages, electrical, and electronics, has fueled the demand for coding and marking equipment. China, with its well-established electrical and electronics manufacturing ecosystem, and India, with its growing food and beverage industry, have attracted numerous global companies due to their low-cost resources and increasing local demand for consumable products.

Over the past five years, both countries have experienced substantial growth in their electronics and processed food manufacturing sectors, driven by favorable government policies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, characterized by advancements in technology and increasing regulatory compliance requirements. High-speed inkjet coding system integration continues to gain traction, offering improved productivity and efficiency for manufacturers. In contrast, laser marking systems necessitate meticulous maintenance procedures to ensure optimal performance. Variable data printing plays a crucial role in pharmaceutical packaging, enabling customized product labeling and enhancing patient safety. In the food and beverage sector, automated coding systems streamline production processes and reduce downtime. To improve print quality in thermal transfer printing, best practices for inkjet printhead maintenance and nozzle clogging prevention strategies are essential.

When selecting industrial label printers, considerations include rfid tag integration with production line systems, optimizing throughput for inkjet coding systems, and regulatory compliance for product marking standards. Advanced quality control methods, such as data matrix code generation and verification, ensure accurate and reliable marking. The 2d barcode system integration for track and trace applications is a significant trend, with more than 70% of new product developments focusing on this area. The industrial application segment accounts for a significantly larger share than the academic segment, reflecting the growing importance of industrial automation and traceability. To address the challenges of inkjet printer system diagnostics and troubleshooting, remote monitoring capabilities and operator training programs are essential.

The selection of appropriate inkjet ink for various materials is another critical consideration, with a minority of players dominating the high-end ink market. By implementing these strategies, businesses can improve code readability on various substrates and maintain regulatory compliance while enhancing overall operational efficiency.

What are the key market drivers leading to the rise in the adoption of Coding And Marking Equipment Industry?

- The escalating demand for product traceability serves as the primary catalyst for market growth.

- Product traceability, a crucial aspect of supply chain and logistics, is gaining significance in various sectors including food and beverage, healthcare, retail, automotive, and aerospace. This feature enables companies to maintain product quality, ensure consistency in production, and prioritize safety. Tracing products from the manufacturing stage to delivery to end customers is a vital part of the product management cycle. Authorized personnel can effortlessly monitor and track products' journeys using advanced technologies. The importance of product traceability is escalating, as businesses strive for transparency, accountability, and regulatory compliance.

- By implementing traceability systems, organizations can swiftly respond to recalls, minimize risks, and enhance customer satisfaction. This data-driven approach offers valuable insights into production processes and supply chain efficiencies, ultimately contributing to improved operational performance and competitive advantage.

What are the market trends shaping the Coding And Marking Equipment Industry?

- Equipment leasing is becoming an increasingly popular business model in the market. The deployment of this model is a current trend.

- High running costs are a significant challenge for businesses investing in coding and marking equipment. To mitigate this expense, organizations are increasingly turning to leasing options. Leasing simplifies the coding and marking process by reducing operational costs, such as maintenance, servicing, and disposal. Leasing companies provide maintenance and servicing solutions to end-users, making the process more convenient. Small and medium-sized enterprises (SMEs) are particularly drawn to this business model due to its benefits. Leasing eliminates the need for large capital investments, preserves working capital, and frees up cash flow for other business activities.

- The leasing model offers flexibility with monthly and quarterly payment options, enabling companies to deploy printers according to their needs. Additionally, it provides line optimization, futureproof solutions, minimal downtime, and eliminates equipment depreciation concerns. This trend towards leasing reflects the evolving nature of the market, with businesses seeking cost-effective and efficient solutions.

What challenges does the Coding And Marking Equipment Industry face during its growth?

- The industry's growth is significantly impacted by the high operational costs, which represents a major challenge that must be addressed by professionals in the field.

- Coding and marking equipment is an essential investment for manufacturing industries to ensure product traceability and quality. The total cost of ownership for such equipment involves both upfront and operational expenses. Capital costs encompass the initial investment, material handling, and installation fees. Operational and running costs include consumable expenses, maintenance, spare parts, and training. For example, Continuous Ink Jet (CIJ) printers have service hours ranging from 9,000 to 15,000 hours, while laser printers have a tube life of 45,000 hours to 100,000 hours.

- Companies must consider these costs when deciding on the most suitable coding and marking solution for their manufacturing process line. The ongoing nature of these expenses highlights the importance of selecting efficient and cost-effective equipment to minimize overall costs.

Exclusive Technavio Analysis on Customer Landscape

The coding and marking equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the coding and marking equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Coding And Marking Equipment Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, coding and marking equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ATD Ltd. - This company specializes in coding and marking technologies, enabling seamless integration into manufacturing processes. Real-time solutions offer date, time, and logo customization, along with a diverse selection of barcodes and 2D codes. These advanced technologies enhance production efficiency and traceability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATD Ltd.

- BestCode

- Brother Industries Ltd.

- Danaher Corp.

- Domino Printing Sciences PLC

- Dover Corp.

- Hitachi Ltd.

- ITW Marking and Coding

- Keyence Corp.

- Koenig & Bauer Coding GmbH

- Linx Printing Technologies

- Markem-Imaje

- Matthews International Corp.

- Overprint Ltd.

- Paul Leibinger GmbH and Co. KG

- Pro Mach Inc.

- REA Elektronik GmbH

- Videojet Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Coding And Marking Equipment Market

- In January 2024, Marking Systems Inc., a leading coding and marking equipment provider, announced the launch of its new laser marking system, the MarkLase X3, which offers increased marking speed and improved precision for various industries, including automotive and electronics (Marking Systems Inc. Press release).

- In March 2024, Schneider Electric, a global energy management and automation company, entered into a strategic partnership with Inkjet Coding Systems, a coding and marking solutions provider, to integrate their technologies and offer comprehensive solutions for industrial automation and traceability (Schneider Electric press release).

- In May 2024, Danaher Corporation, a science and engineering company, completed the acquisition of Videojet Technologies, a global coding and marking equipment manufacturer, significantly expanding Danaher's presence in the industrial automation market and enhancing its product portfolio (Danaher Corporation press release).

- In April 2025, the European Union approved the new Food Information Regulation, which mandates the use of advanced coding and marking technologies for food packaging to ensure traceability and consumer safety. This regulation is expected to boost the demand for coding and marking equipment in the European market (European Commission press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Coding And Marking Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 1541.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

China, Japan, US, Germany, UK, India, South Korea, France, Canada, Italy, USA, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of coding and marking equipment, various technologies continue to shape the industry. Thermal transfer printers and barcode label printers dominate the market, with their ability to produce high-quality, durable codes. Industrial automation is a significant driver, integrating packaging lines and optimizing throughput. Label applicators and 2D barcode generators have gained traction, enabling advanced data matrix coding and variable data printing. Contrast ratio and marking speed are essential factors, with the former ensuring code readability and the latter enhancing production line efficiency. Laser marking systems and inkjet coding technology offer alternatives, each with unique advantages.

- Laser marking systems provide high-resolution coding and are suitable for various materials, while inkjet coding technology offers flexibility with inkjet ink formulations and code verification systems. Maintenance schedules, printhead maintenance, and ribbon selection are crucial aspects of ensuring system uptime. Regulatory compliance is a constant consideration, with RFID tagging systems offering solutions for tracking and traceability. Industrial coding solutions continue to evolve, with innovation in inkjet nozzle cleaning, inkjet coding technology, and code verification systems. Error detection rates and production line efficiency are key performance indicators, driving ongoing improvements in the market. Market activities unfold as businesses adopt these technologies to meet evolving industry demands, with the focus on enhancing efficiency, improving quality, and ensuring regulatory compliance.

- The market is a vibrant and continually unfolding ecosystem, reflecting the dynamic nature of modern business operations.

What are the Key Data Covered in this Coding And Marking Equipment Market Research and Growth Report?

-

What is the expected growth of the Coding And Marking Equipment Market between 2025 and 2029?

-

USD 1.54 billion, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Food and beverage, Healthcare/Pharmaceuticals, Industrial, and Others), Product (Continuous Inkjet (CIJ) printing and coding, Laser coding and marking, Thermal Inkjet (TIJ) Printing, Drop on Demand (DOD) Printing, Thermal Transfer Overprinting (TTO), and Others), Geography (APAC, Europe, North America, Middle East and Africa, South America, and Rest of World (ROW)), Technology (Inkjet Printing, Laser Printing, and Thermal Transfer), and Application (Primary Packaging, Secondary Packaging, and Tertiary Packaging)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing need for product traceability, High operational costs

-

-

Who are the major players in the Coding And Marking Equipment Market?

-

ATD Ltd., BestCode, Brother Industries Ltd., Danaher Corp., Domino Printing Sciences PLC, Dover Corp., Hitachi Ltd., ITW Marking and Coding, Keyence Corp., Koenig & Bauer Coding GmbH, Linx Printing Technologies, Markem-Imaje, Matthews International Corp., Overprint Ltd., Paul Leibinger GmbH and Co. KG, Pro Mach Inc., REA Elektronik GmbH, and Videojet Technologies

-

Market Research Insights

- The market encompasses a range of technologies, including ink circulation systems, UV inkjet printing, material surface treatment, continuous inkjet printers, inkjet printheads, CO2 laser marking, and thermal inkjet printers. According to industry estimates, the market for UV inkjet printing is projected to grow at a significant rate due to its ability to produce high-quality codes on various materials. In contrast, CO2 laser marking is preferred for its ability to mark on a wide range of materials, including metals and plastics, but requires more frequent maintenance, with an average of 10 cleaning cycles per week. Moreover, advancements in sensor integration, remote monitoring, print resolution, and system diagnostics have led to a reduction in downtime and improved code legibility, density, and image clarity.

- For instance, continuous inkjet printers with drop-on-demand inkjet technology offer higher print resolution and lower maintenance costs compared to traditional thermal inkjet printers. Similarly, fiber laser marking provides superior contrast levels, while pneumatic marking systems offer cost-effective solutions for marking large surfaces. Overall, the market continues to evolve, with ongoing advancements in technology driving increased production throughput and efficiency for industries reliant on industrial control systems and packaging lines.

We can help! Our analysts can customize this coding and marking equipment market research report to meet your requirements.