Laser Marking Equipment Market Size 2024-2028

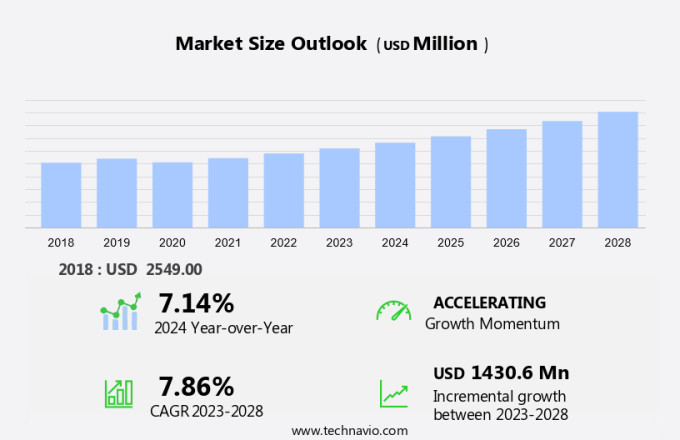

The laser marking equipment market size is forecast to increase by USD 1.43 billion, at a CAGR of 7.86% between 2023 and 2028. The market is witnessing significant growth due to the increasing trend towards automation in various industries. This automation is leading to the adoption of laser marking equipment for marking and coding applications, as it offers high precision, flexibility, and speed. Another trend driving the market is the need for better product traceability, which is essential in industries such as pharmaceuticals, electronics, and food and beverage. However, a challenge facing the market is the lack of skilled operators to handle and maintain these advanced laser marking systems. This requires ongoing training and development programs to ensure a sufficient workforce to meet the growing demand for laser marking technology.

The market is witnessing significant growth due to the increasing automation processes in various industrial verticals, including the medical sector and defense sector. The use of laser marking machines for identifying and branding products, improving process quality, and ensuring industry standards has become increasingly popular. In particular, the medical devices industry is adopting laser marking for product identification and traceability. UV laser marking technology is gaining traction due to its ability to mark various materials, such as polypropylene tubes, without causing material damage. The non-contact nature of laser marking makes it an attractive alternative to traditional marking methods, such as etching and annealing.

Integrated laser marking machines, which combine laser marking with other technologies like sensors and barcode readers, are becoming increasingly popular. These machines offer process improvement and quality control benefits, making them essential for production lines. The defense sector is also adopting laser marking for identification and traceability purposes. Laser marking offers a permanent and reliable marking solution, making it ideal for marking sensitive components and materials. Consumables, such as laser marking consumables, are an essential part of the market. These consumables include marking media and lasers, and their availability and cost-effectiveness play a significant role in the market's growth.

Overall, the market is expected to grow due to the increasing demand for automation, product branding, and quality control in various industries. The market is expected to continue to evolve with advancements in laser marking technology and industry standards.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

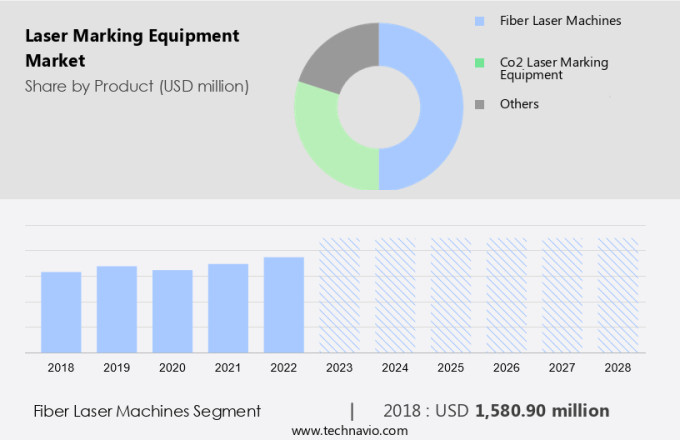

- Product

- Fiber laser machines

- Co2 laser marking equipment

- Others

- Application

- Machine tool

- Electronics and microelectronics

- Automotive

- Medical

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

The fiber laser machines segment is estimated to witness significant growth during the forecast period. Laser marking equipment is a versatile technology finding extensive application across various industries, including healthcare and pharmaceuticals, machine tools, packaging sectors, and the automobile industry. The expanding usage of this technology is driven by improved functionality, operational excellence, and ecological integrity. Small businesses and startups, despite limited budgets, are increasingly adopting laser marking due to its upfront expense being offset by its long-term benefits. Power needs and additional functionalities vary depending on the industry. For instance, in healthcare and pharmaceuticals, laser marking ensures forgery-proof, easy-to-read data on medical devices and components. In contrast, the automobile sector requires durable markings that withstand high temperatures and fluids, such as oil and gas, during mass production.

Macroeconomic factors, including virus containment measures, have further accelerated the adoption of laser marking equipment. The largest end user, the automobile sector, is expected to continue leading the market growth due to the need for maximum precision, speed, high contrast, and thermal stress resistance. Laser marking offers protection against forgery, making it an essential component in industries where component malfunctions can have severe consequences. This versatile technology caters to various industries, offering alphanumeric inscriptions on plastic, metal, auto parts, and components, ensuring high-quality, long-lasting markings.

Get a glance at the market share of various segments Request Free Sample

The fiber laser machines segment accounted for USD 1.58 million in 2018 and showed a gradual increase during the forecast period.

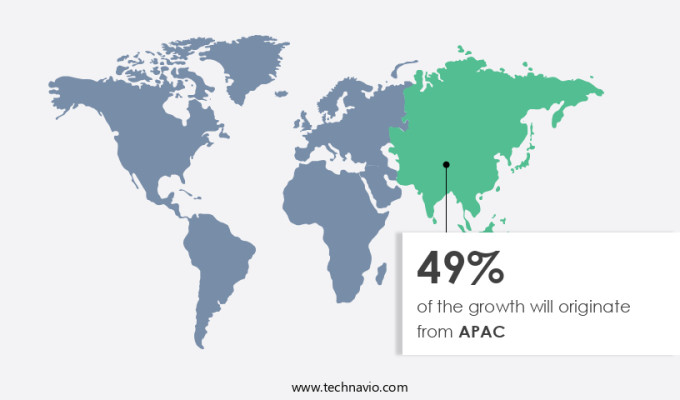

Regional Insights

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Laser marking equipment is a versatile technology finding expanding usage in various industries, including healthcare and pharmaceuticals, machine tools, packaging sectors, and the automobile industry. This technology offers improved functionality, operational excellence, and ecological integrity, making it an attractive option for small businesses and startups with limited budgets. The upfront expense of laser marking equipment can be offset by its long-term benefits, such as laser placement, power needs, and additional functionalities. Macroeconomic factors, such as virus containment measures and mass production needs, have further fueled the demand for laser marking equipment. In the healthcare and pharmaceutical sectors, laser marking is used to create forgery-proof, easy-to-read data on medical devices and components.

In the automobile sector, it is used to create durable markings on auto parts and components, withstanding high temperatures, fluids, oil, and gas. The largest end user of laser marking equipment is the automobile sector, followed by the machine tools and packaging industries. The technology's ability to create high-contrast, maximum precision, and high-speed markings makes it ideal for mass production and protection against forgery. The markings produced by laser marking equipment are known for their durability, withstanding thermal stress and component malfunctions, making it a valuable investment for businesses seeking operational excellence and ecological integrity.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Laser Marking Equipment Market Driver

Increasing in automation in laser marking equipment is the key driver of the market. Laser marking equipment, a form of automation technology, is gaining popularity in various industries due to its non-contact nature and ability to provide permanent identification solutions. This technology utilizes laser beams to engrave, etch, anneal, or mark surfaces without the use of inks, coatings, or exposure to acids, gasoline, oils, or heat. The medical devices industry, in particular, benefits from laser marking as it ensures traceability and product branding, adhering to stringent industry standards. Laser technology, including CO2, green, YAG, and fiber lasers, is employed for marking various materials, from metals and plastics to glass and ceramics. Material compatibility is a crucial factor in selecting the appropriate laser type.

Consumables, such as laser marking pens and fibers, are essential for maintaining the equipment's performance and longevity. The initial investment and implementation costs for laser marking equipment may be high, but the long-term benefits include increased productivity, reduced material damage, and expertise required for labeling processes. Furthermore, advancements in laser technology have expanded its applications to include 3D printing. As automation continues to be a priority for businesses, the demand for laser marking equipment is expected to grow.

Laser Marking Equipment Market Trends

Product marking for better traceability is the upcoming trend in the market. Laser marking equipment is a non-contact marking technology that utilizes laser beams to expose materials to heat, resulting in markings through engraving, etching, or annealing. This method offers advantages such as high precision, durability, and compatibility with various materials, including metals, plastics, and glass. The medical devices industry, in particular, has embraced laser marking for product branding and traceability solutions, ensuring compliance with industry standards. Laser technology enables the creation of permanent and legible markings, reducing the need for labels susceptible to damage from exposure to acids, gasoline, oils, or other harsh environments. With the increasing demand for automation and traceability, laser marking equipment has become an essential investment for industries, despite the initial investment and implementation costs.

Consumables, such as CO2 Laser, Green Laser, YAG Laser, and Fiber Laser, are used in laser marking processes. Training and expertise are crucial for effective implementation and optimal results. The technology's non-contact nature and versatility have led to its expansion into 3D printing applications, further broadening its applications and benefits.

Laser Marking Equipment Market Challenge

Lack of skilled operators for laser marking equipment is a key challenge affecting the market growth. Laser marking equipment, which utilizes laser technology for engraving, etching, annealing, and other labeling processes, has gained considerable traction in the industrial sector. Unlike traditional methods that expose materials to acids, gasoline, oils, or heat, laser marking offers a non-contact nature, ensuring minimal material damage. The equipment caters to various industries, including medical devices, where product branding and traceability solutions are crucial. The laser marking process involves a computer or microprocessor-control system converting digital data into motion control, enabling the execution of marking processes. Though the equipment boasts advanced technology, it necessitates an expert operator for marking operations. Operators are responsible for loading part files into the control system and aligning the bed with the material to be marked.

Laser marking equipment is available in various types, such as CO2 Laser, Green Laser, YAG Laser, and Fiber Laser, each with its unique advantages and material compatibility. Consumables and automation are essential aspects of laser marking, with industry standards ensuring material compatibility and safety. Initial investment and implementation costs, including training and expertise, should be considered before investing in laser marking equipment. The technology's growing applications in 3D printing and identification solutions further expand its market potential.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alpha Laser US Inc. - The company offers a range of advanced laser marking solutions, including the AL in laser welder, AL series laser welders, and the ALFLAK laser welder.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMADA Co. Ltd.

- EMAG GmbH and Co. KG

- Emerson Electric Co.

- Epilog Corp.

- FANUC Corp.

- II VI Inc.

- IPG Photonics Corp.

- Jenoptik AG

- Jinan Xintian Technology Co. Ltd.

- Laser Marking Technologies LLC

- Laserline GmbH

- Laserstar Technologies Corp.

- Morn Laser

- Perfect Laser Co. Ltd.

- Precitec GmbH and Co. KG

- Shenzhen HeroLaser Equipment Co. Ltd.

- Trotec Laser GmbH

- TRUMPF SE Co. KG

- Videojet Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market is expected to witness significant growth due to the increasing automation processes in various industrial verticals, including the medical sector and defense industry. Laser marking machines are increasingly being adopted for marking complex-shaped characters, traceability, inventory control, production flow control, and product quality validation. The market is segmented into UV laser, fiber laser, CO2 laser marking, and galvo laser marking systems. Fiber laser machines are gaining popularity due to their ability to mark on a wide range of materials, including polypropylene tubes, electronic devices, and inclined planes. The integration of sensors, robotics, and barcode readers in laser marking machines is enabling the development of smart factories and improving process efficiency.

The market also caters to the requirements of the surgical and medical sector for marking batch numbers and identifying complex-shaped characters on moving or rotating objects. The use of green laser systems and machine tools in laser marking is further expanding the market's application areas. Overall, the market is driven by the need for traceability, identification, and quality control in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.86% |

|

Market growth 2024-2028 |

USD 1.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.14 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alpha Laser US Inc., AMADA Co. Ltd., EMAG GmbH and Co. KG, Emerson Electric Co., Epilog Corp., FANUC Corp., II VI Inc., IPG Photonics Corp., Jenoptik AG, Jinan Xintian Technology Co. Ltd., Laser Marking Technologies LLC, Laserline GmbH, Laserstar Technologies Corp., Morn Laser, Perfect Laser Co. Ltd., Precitec GmbH and Co. KG, Shenzhen HeroLaser Equipment Co. Ltd., Trotec Laser GmbH, TRUMPF SE Co. KG, and Videojet Technologies |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.