Commercial Aircraft Passenger Service Unit (Psu) Market Size 2024-2028

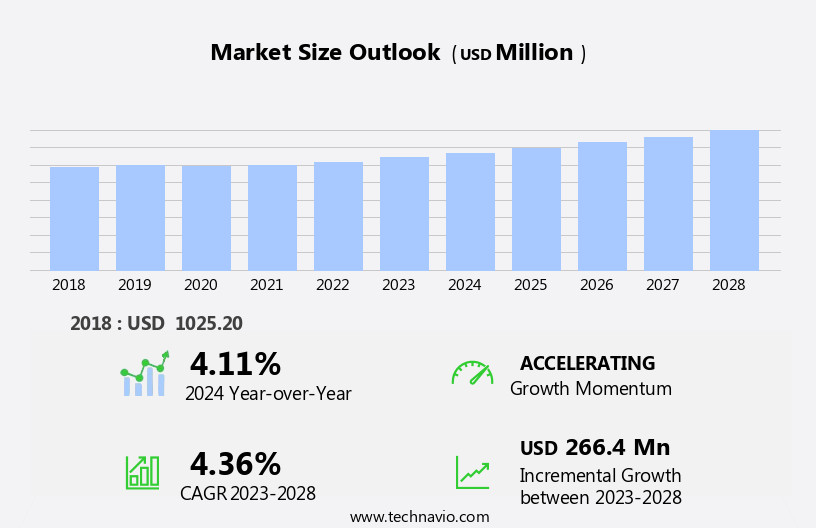

The commercial aircraft passenger service unit (psu) market size is forecast to increase by USD 266.4 million, at a CAGR of 4.36% between 2023 and 2028.

- The market is witnessing significant growth, driven by the development of sleek and attractive PSUs that enhance the safety and comfort level of aircraft. These advanced PSUs cater to the evolving needs of passengers, offering improved functionality and aesthetics in the aviation industry. However, this market faces challenges as well. The cost pressure on the aviation supply chain poses a significant obstacle, necessitating efficient production methods and cost optimization strategies.

- Manufacturers must strike a balance between delivering high-quality PSUs and maintaining affordability to remain competitive. As the market continues to evolve, companies must focus on innovation and cost efficiency to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Commercial Aircraft Passenger Service Unit (Psu) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamic market activities. Suppliers in this sector are continually innovating to meet the evolving needs of airlines and passengers. System upgrades and integration are key focus areas, with suppliers integrating advanced technologies such as oxygen systems, environmental control systems, wireless connectivity, and in-flight entertainment (IFE) software. Ongoing certification standards and regulatory compliance are essential for maintaining operational efficiency and ensuring passenger safety. Technical documentation and power distribution are critical components of PSUs, requiring meticulous attention to detail and adherence to industry standards. Life cycle cost optimization is a significant concern, with suppliers offering retrofit solutions and energy efficiency improvements.

Maintenance procedures and supply chain management are essential for ensuring component reliability and reducing warranty claims. Training programs and remote diagnostics are becoming increasingly important for improving operational efficiency and reducing downtime. Cabin lighting, smoke detection, galley equipment, and cabin management systems are all crucial elements of PSUs, with suppliers focusing on human factors and passenger experience to enhance comfort and safety. Aircraft modifications and cabin pressure control are also areas of ongoing development, with digital transformation and data analytics playing a growing role in optimizing performance metrics and improving quality control. The PSU market is subject to various market dynamics, including material sourcing, supplier networks, IFE content, and passenger service units.

These elements are interconnected, with each impacting the other and requiring a holistic approach to ensure seamless integration and optimal functionality. In conclusion, the commercial aircraft PSU market is a dynamic and evolving sector, with ongoing developments in technology adoption, product lifecycle management, and regulatory compliance driving innovation and growth. Suppliers must remain agile and responsive to meet the changing needs of airlines and passengers while ensuring operational efficiency, safety, and cost optimization.

How is this Commercial Aircraft Passenger Service Unit (Psu) Industry segmented?

The commercial aircraft passenger service unit (psu) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Narrow-body aircraft

- Wide-body aircraft

- Regional aircraft

- Component

- AC vents

- Loud speakers

- Automatically deployable oxygen masks

- Lighting system components

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

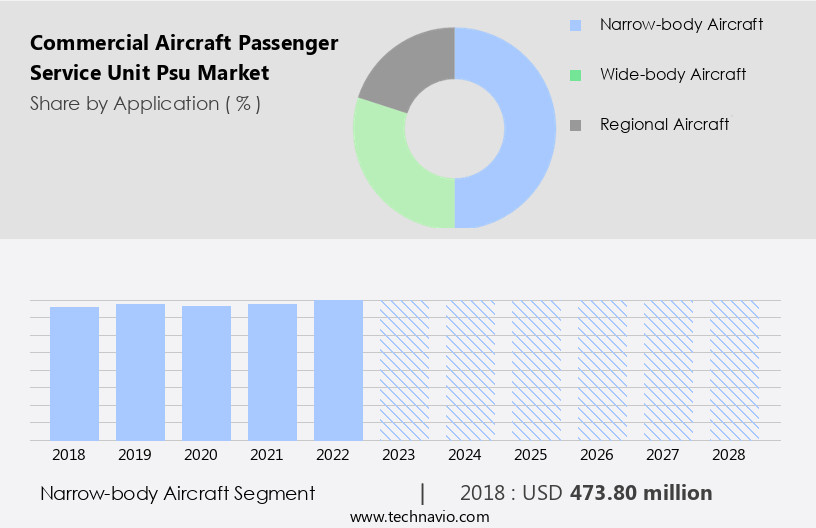

By Application Insights

The narrow-body aircraft segment is estimated to witness significant growth during the forecast period.

Narrow-body aircraft, characterized by their single-aisle design and twin-engine setup, continue to dominate the commercial aviation sector due to their operational efficiency. Airline operators in both emerging and developed economies prioritize these aircraft to optimize their profit margins, influenced by factors such as average load and seasonality. The market is witnessing an increase in aircraft Original Equipment Manufacturers (OEMs) delivering upgraded versions of narrow-body aircraft to cater to the modernization needs of low-cost carriers (LCCs). These upgrades enable LCCs to tap into new market opportunities and maintain competitiveness with the latest aircraft generations. Technology adoption in the narrow-body aircraft market is a significant trend, with advancements in power consumption, cabin management systems, and in-flight entertainment (IFE) systems.

Training programs and regulatory compliance are essential aspects of the industry, ensuring operational efficiency and safety standards. Cabin lighting, smoke detection, galley equipment, and oxygen systems are integral components undergoing continuous innovation. Product lifecycle management plays a crucial role in the market, with system upgrades, system integration, and maintenance procedures ensuring the longevity of aircraft. Remote diagnostics, supply chain management, and warranty claims help in cost optimization and performance metrics. Industry standards, component reliability, and retrofit solutions are essential factors in the digital transformation of the narrow-body aircraft market. Energy efficiency, air conditioning, weight reduction, and user interface are critical considerations in the design and development of narrow-body aircraft.

Data analytics and cabin pressure control are essential features enhancing passenger comfort and safety. The market's focus on digital transformation, material sourcing, and IFE content is driving innovation and efficiency in the narrow-body aircraft sector.

The Narrow-body aircraft segment was valued at USD 473.80 million in 2018 and showed a gradual increase during the forecast period.

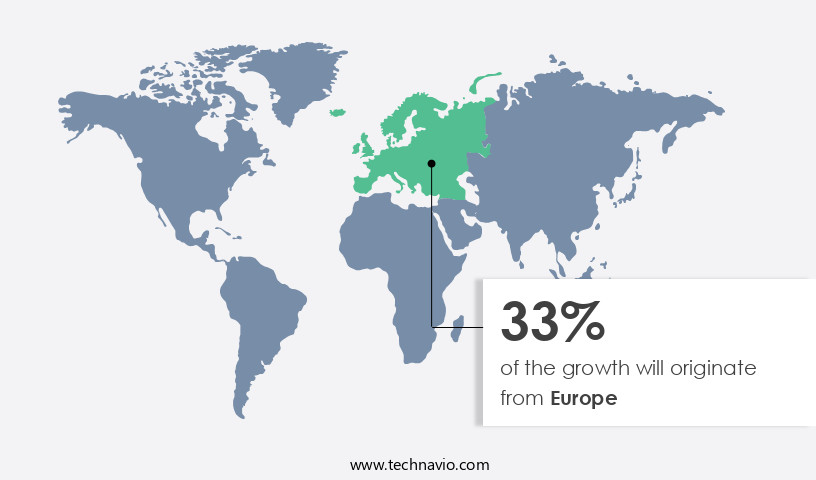

Regional Analysis

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American commercial aircraft market is characterized by its maturity and strong aviation industry, particularly in the United States. Key players, such as Boeing and Bombardier, are based in the region and have seen increased demand due to rising air traffic. This trend has driven Tier-1 and Tier-2 suppliers to expand their manufacturing capabilities. For example, Zodiac Aero Evacuation Systems, a subsidiary of ZODIAC AEROSPACE, has supplied evacuation slides for Boeing's commercial aircraft catalog since its launch. Technological advancements are also shaping the market, with a focus on power consumption, operational efficiency, and regulatory compliance. Training programs, technology adoption, and product lifecycle management are crucial for maintaining high-quality passenger service units.

Cabin lighting, smoke detection, galley equipment, cabin management systems, and aircraft modifications are essential components of the in-flight experience. Remote diagnostics, supply chain management, and maintenance procedures are vital for ensuring optimal performance and cost efficiency. System upgrades, system integration, and oxygen systems are essential for meeting certification standards and providing technical documentation. Environmental control systems, wireless connectivity, and in-flight entertainment are key factors in enhancing passenger comfort and safety. Component reliability, retrofit solutions, energy efficiency, air conditioning, and weight reduction are important considerations for both manufacturers and airlines. Digital transformation, material sourcing, and in-flight entertainment content are also driving innovation in the market.

User interface, data analytics, cabin pressure control, and passenger service units are essential for providing a seamless and enjoyable travel experience. Safety standards, warranty claims, durability testing, and passenger experience are critical areas of focus for ensuring customer satisfaction and regulatory compliance. Cost optimization, performance metrics, and quality control are essential for maintaining profitability and competitiveness in the market. In conclusion, the North American commercial aircraft market is dynamic and evolving, driven by technological advancements, increasing air traffic, and the need for operational efficiency and regulatory compliance. The market is characterized by a focus on passenger comfort, safety, and cost optimization, with key players investing in research and development to meet these demands.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft Passenger Service Unit (Psu) Industry?

- The development of advanced, sleek, and attractive Power Supply Units (PSUs) is a significant market driver, as these innovations enhance aircraft safety and passenger comfort levels.

- Commercial Aircraft Passenger Service Units (PSUs) are essential components that offer a blend of comfort, safety, and service features in modern aircraft. These units, which include air vents, reading lights, flight attendant call buttons, loudspeakers, and oxygen masks, are integrated into one sleek unit placed above the passenger seat. The industry's focus on enhancing customer convenience and making aircraft cabins more spacious has led to the preference for sleeker PSUs over conventional, bulky units. Technological advancements have played a significant role in the evolution of PSUs. Cabin lighting, smoke detection, galley equipment, and cabin management systems are some of the advanced features integrated into these units.

- Power consumption and operational efficiency are critical factors driving technology adoption in PSUs. Regulatory compliance and installation services are also essential considerations in the PSU market. Power consumption is a crucial factor as airlines aim to reduce fuel consumption and improve operational efficiency. Remote diagnostics and testing procedures are essential for maintaining PSUs and ensuring their optimal performance. Training programs for maintenance personnel are also essential to ensure proper installation and maintenance of these advanced systems. Aircraft modifications are another trend driving the PSU market. These modifications involve the integration of new technologies and features into existing aircraft, making them more competitive.

- Product lifecycle management is crucial in this context, ensuring that PSUs remain up-to-date and meet the evolving needs of the industry. In conclusion, the commercial aircraft PSU market is driven by the need for advanced comfort features, operational efficiency, and regulatory compliance. Sleeker designs, advanced technologies, and training programs are essential to meet the evolving needs of the industry. Power consumption and remote diagnostics are critical factors in ensuring the optimal performance of these units. Aircraft modifications and product lifecycle management are also essential considerations in this dynamic market.

What are the market trends shaping the Commercial Aircraft Passenger Service Unit (Psu) Industry?

- The development of Power Supply Units (PSUs) integrated with displays is a current market trend. This innovation enables users to monitor power consumption and system performance in real time.

- The market is experiencing significant growth due to the increasing emphasis on enhancing the in-flight passenger experience. PSUs, which provide essential cabin functions such as oxygen systems, power distribution, environmental control systems, and life cycle cost-effective maintenance procedures, are now integrating advanced display technologies. This trend is driven by the rising demand for In-Flight Entertainment (IFE) systems and industry standards requiring improved passenger comfort and convenience. Traditional PSUs have been primarily focused on basic functionalities. However, system upgrades and component reliability have become crucial for airlines to remain competitive. The integration of wireless connectivity, IFE software, and lavatory systems has led to the development of more advanced PSUs.

- These innovations enable passengers to access a range of entertainment and information services, enhancing their overall flying experience. Moreover, certification standards and technical documentation are essential considerations for PSU manufacturers. Compliance with these regulations ensures the safety and reliability of the systems. Power distribution and oxygen systems are critical components of PSUs that require stringent adherence to industry standards. In summary, the Commercial Aircraft PSU market is witnessing a shift towards advanced technologies and integrated systems to cater to the evolving needs of passengers and airlines. This trend is driven by the demand for improved passenger experience, system upgrades, and industry standards.

What challenges does the Commercial Aircraft Passenger Service Unit (Psu) Industry face during its growth?

- The cost pressure in the aviation supply chain represents a significant challenge that can hinder industry growth. This challenge necessitates continuous optimization and efficiency gains to maintain profitability and competitiveness within the sector.

- The market is experiencing significant dynamics due to escalating costs and the need for innovation in the aviation industry. Airlines are under immense pressure to reduce fares to maintain competitiveness, leading to price competition among suppliers. This pressure to cut costs can result in a race to the bottom, compelling suppliers to minimize expenses, including material sourcing and labor costs. Material costs, particularly for plastics and metals, have risen due to increased demand. To counteract these cost pressures, PSU manufacturers are focusing on energy efficiency, weight reduction, and digital transformation. For instance, retrofit solutions for air conditioning and cabin pressure control can enhance energy efficiency.

- User interface and data analytics can optimize in-flight entertainment (IFE) systems, reducing weight and improving the passenger experience. Additionally, human factors engineering and customer support are crucial for enhancing the overall flying experience. Supplier networks play a vital role in the PSU market, as they can impact the cost and quality of materials. Strategic partnerships and collaborations can help suppliers access competitive pricing and high-quality materials, ensuring the production of reliable and efficient PSUs. Furthermore, IFE content providers and digital service providers are essential partners for airlines, as they can offer engaging and immersive content to passengers, differentiating the flying experience and potentially justifying higher fares.

Exclusive Customer Landscape

The commercial aircraft passenger service unit (psu) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft passenger service unit (psu) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft passenger service unit (psu) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aero Mock Ups Inc. - This company specializes in providing commercial aircraft passenger service units, including rolling, canoe, and commuter models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aero Mock Ups Inc.

- Astronics Corp.

- Cabin Crew Safety Ltd.

- Luminator Technology Group

- RTX Corp.

- Safran SA

- Triumph Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft Passenger Service Unit (Psu) Market

- In January 2024, Boeing announced the successful first flight of its new 737 MAX 10 passenger service unit (PSU), featuring improved fuel efficiency and seating capacity. This development marked a significant advancement in the commercial aircraft PSU market, with Boeing aiming to capture a larger share of the mid-size aircraft segment (Boeing, 2024).

- In March 2024, Airbus and Rolls-Royce signed a strategic partnership to collaborate on the development of advanced PSUs for the Airbus A320neo family. This collaboration aimed to enhance the fuel efficiency and overall performance of the aircraft, positioning both companies competitively in the market (Airbus, 2024).

- In May 2025, CFM International, a joint venture between GE Aviation and Safran Aircraft Engines, secured a USD1.5 billion investment from the European Investment Bank to support the production of advanced LEAP-X engines for PSUs. This investment marked a significant boost for the company's growth and its commitment to reducing carbon emissions in the aviation industry (European Investment Bank, 2025).

- In the same month, United Technologies Corporation completed its acquisition of Collins Aerospace, a leading provider of PSUs and aircraft systems. The acquisition expanded United Technologies' portfolio and strengthened its position in the commercial aircraft market, allowing for increased innovation and competitiveness (United Technologies Corporation, 2025).

Research Analyst Overview

- The market is characterized by continuous innovation and adaptation to meet evolving industry demands. Modular design and software updates enable aircraft manufacturers to integrate new technology, such as firmware upgrades for improved system performance. Lightweight alloys and composite materials contribute to reduced carbon footprint and increased fuel efficiency. Repair services leverage additive manufacturing for faster turnaround times and cost savings. Global supply chains ensure the timely delivery of critical components, while compliance audits maintain regulatory standards. System architecture evolves with the integration of artificial intelligence, cloud computing, big data analytics, and machine learning for predictive maintenance. Data security and network protocols safeguard sensitive information.

- Distribution networks streamline spare parts delivery through maintenance contracts and remote access. Safety regulations and certification bodies drive industry collaboration and open standards for interoperability. Technology partnerships and lease agreements foster innovation and cost savings. Sensor technology and aftermarket services optimize fleet performance and enhance the passenger experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft Passenger Service Unit (Psu) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 266.4 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, France, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft Passenger Service Unit (Psu) Market Research and Growth Report?

- CAGR of the Commercial Aircraft Passenger Service Unit (Psu) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft passenger service unit (psu) market growth of industry companies

We can help! Our analysts can customize this commercial aircraft passenger service unit (psu) market research report to meet your requirements.