Compact Loaders Market Size 2024-2028

The compact loaders market size is forecast to increase by USD 5.87 billion at a CAGR of 9.8% between 2023 and 2028.

What will be the Size of the Compact Loaders Market During the Forecast Period?

How is this Compact Loaders Industry segmented and which is the largest segment?

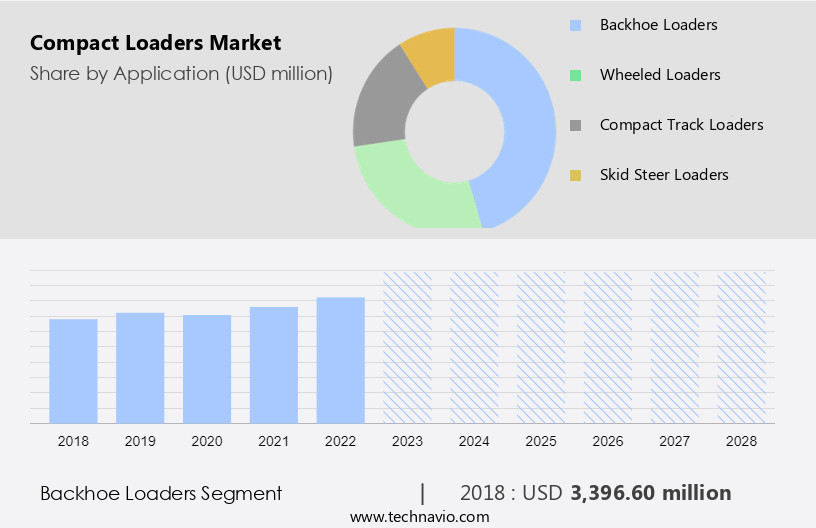

The compact loaders industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Backhoe loaders

- Wheeled loaders

- Compact track loaders

- Skid Steer loaders

- Type

- Construction

- Agriculture

- Industrial

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

The backhoe loaders segment is estimated to witness significant growth during the forecast period. Backhoe loaders are essential machinery In the compact loader market, offering the combined capabilities of a wheel loader and an excavator. These versatile machines cater to various industries, including construction, agriculture, and mining. With a compact design, backhoe loaders excel in navigating tight spaces. Equipped with a front bucket for material handling and a rear digging arm for soil excavation, their functions can be interchanged, expanding their application scope. The construction sector dominates the market for backhoe loaders due to their indispensable role in infrastructure development and road construction, maintenance, and grading activities. These machines' efficiency, automation through remote control and telematics, and versatility, including the use of add-ons and accessories, make them a popular choice for local contractors, urban areas, and challenging terrains.

The compact loader market encompasses wheeled, tracked, and electric models, catering to diverse environmental concerns and DIY culture, rental industry, and the Internet of Things.

Get a glance at the market report of various segments Request Free Sample

The Backhoe loaders segment was valued at USD 3.4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to increasing construction activities and infrastructure development. With rising urbanization and population growth, there is a surge in demand for new residential and commercial infrastructure In the region. Countries such as China, Japan, India, Australia, and others are major contributors to the market, driven by commercial and residential construction projects and investments in infrastructure development. Compact loaders, including wheeled, tracked, and electric models, offer versatility, efficiency, and maneuverability, making them ideal for use in challenging terrains, urban areas, and tight spaces. The compact size and improved capabilities of these loaders make them essential for grading and leveling, paving, snow removal, and material handling applications.

The market is also witnessing advancements in automation, remote control, telematics, GPS, and customizable solutions, enhancing productivity and sustainability. The market in APAC is expected to continue growing steadily during the forecast period, driven by the need for sustainable infrastructure development and the DIY culture and rental industry trends. The Internet of Things and eco-friendly gear are also gaining popularity In the market, aligning with environmental concerns and the push towards sustainable practices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Compact Loaders Industry?

- Rising adoption of compact and efficient compact loaders is the key driver of the market.Compact loaders, a type of building equipment, play a significant role in various construction activities and road projects. Their compact size and superior maneuverability make them ideal for working in tight spaces and challenging terrains, including urban areas and steep slopes. In addition to grading and leveling, paving, snow removal, and maintenance applications, compact loaders are also used in landscaping, agriculture, and mining sectors for clearing land, moving materials, and maintaining grounds. companies In the market are continually innovating to meet the evolving needs of customers. For instance, Manitou Group introduced new compact skid steer loaders and compact track loaders in March 2023, catering to the North American market.

These new products offer increased efficiency through automation, remote control, telematics, GPS, and customizable solutions, including addons and accessories. Moreover, environmental concerns are driving the demand for eco-friendly gear, such as improved undercarriage designs, precision metals, and iron core components. Compact loaders contribute to infrastructure development by enhancing productivity and versatility, making them an essential tool for local contractors, DIY enthusiasts, and the rental industry. The Internet of Things (IoT) is also transforming the compact loader market, enabling on-site workshops, online training modules, and real-time monitoring for increased safety and sustainability. The market encompasses various types, including wheeled compact loaders, tracked compact loaders, and electric compact loaders, catering to diverse applications and customer preferences.

What are the market trends shaping the Compact Loaders market?

- Emergence of smart cities globally is the upcoming market trend.The construction and infrastructure development sector, including road construction and maintenance applications, is witnessing significant advancements with the rise of smart cities. These urban areas prioritize the integration of technology for efficient management of operations, leading to an increased focus on advanced road network systems. companies In the market are poised to capitalize on this trend, as the installation of road safety equipment becomes essential. Compact loaders, available in wheeled, tracked, and electric variants, offer versatility, maneuverability, and efficiency, making them ideal for challenging terrains, tight spaces, and urban areas. With customizable solutions, add-ons, and accessories, these machines cater to various industries, such as building equipment for construction activities, landscaping, agriculture, mining, and logistics.

The compact size, improved track loaders, and lightweight track loaders enable efficient material handling, clearing land, and maintaining grounds. Environmental concerns are addressed through eco-friendly gear, on-site workshops, online training modules, and the Internet of Things. The rental industry benefits from the versatility and automation features, including remote control, telematics, GPS, and precision metals. The market is expected to grow as these machines contribute to infrastructure development, enhancing the overall sustainability and productivity of various sectors.

What challenges does the Compact Loaders Industry face during its growth?

- Stringent environmental regulations is a key challenge affecting the industry growth.In response to global efforts to reduce emissions and promote sustainability, environmental regulatory bodies have implemented stringent exhaust emission standards for factories, vehicles, and equipment. For instance, the European Environment Agency (EEA) has introduced the Stage V regulation, which sets limits on particulate matter (PM) emissions at 0.015 g/kWh and nitrogen oxide (NOx) emissions at 0.4 g/kWh. Additionally, diesel particulate filters (DPFs) must be installed to minimize soot emissions. These regulations impact the building equipment market, particularly compact loaders, which are extensively used in construction activities, road planner surfaces, road construction, maintenance applications, grading and leveling, paving, snow removal, and landscaping.

Compact loaders come in various types, including wheeled and tracked, electric, and crawler models, each with unique features such as maneuverability, versatility, efficiency, automation, remote control, telematics, GPS, and customizable solutions with add-ons and accessories. The compact size and improved maneuverability of these loaders make them ideal for working in tight spaces, challenging terrains, urban areas, and steep slopes. They are also used in agriculture applications for clearing land, moving materials, maintaining grounds, and In the mining sector for infrastructure development. The lightweight track loaders and improved track loaders have gained popularity due to their sustainability and eco-friendly features, such as precision metals, iron core, and rubber tracks.

The on-site workshops, online training modules, and IoT technology further enhance the versatility and efficiency of compact loaders. The rental industry and DIY culture have also contributed to the growth of the compact loader market.

Exclusive Customer Landscape

The compact loaders market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the compact loaders market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, compact loaders market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AB Volvo - The company specializes in providing compact loaders, including Volvo's wheel loader models, to meet various material handling needs. These machines offer superior performance, maneuverability, and versatility, making them ideal for construction, agriculture, and landscaping applications. Compact loaders are known for their ability to work in tight spaces and load materials efficiently. With advanced features such as high torque engines, hydrostatic drives, and excellent traction, these loaders ensure optimal productivity and reduced downtime. The compact loader market continues to grow due to increasing demand for efficient and versatile construction equipment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial NV

- Deere and Co.

- Doosan Corp.

- Hitachi Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- Kubota Corp.

- Liebherr International AG

- Sany Group

- Takeuchi Manufacturing Co. Ltd.

- Terex Corp.

- Wacker Neuson SE

- Xuzhou Construction Machinery Group Co. Ltd.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The compact loader market encompasses a range of building equipment designed for construction activities and various applications. These machines, available in both wheeled and tracked configurations, exhibit compact size and superior maneuverability, making them ideal for use in urban areas, challenging terrains, and tight spaces. Compact loaders are versatile tools, capable of grading and leveling surfaces for road construction and maintenance. They are also employed in paving projects, snow removal, and landscaping applications. In agriculture, they are used for clearing land and moving materials, while In the mining sector, they play a crucial role in infrastructure development. Compact loaders offer increased efficiency through automation, remote control, telematics, GPS, and other advanced technologies.

Customizable solutions, add-ons, and accessories further enhance their versatility. The DIY culture and rental industry have also contributed to the growing popularity of compact loaders. The compact loader market is influenced by several factors. The increasing focus on infrastructure development, particularly in smart cities, has led to a surge in demand for these machines. The lightweight track loaders and improved track loaders have gained significant traction due to their enhanced performance and reduced environmental impact. The market is also driven by the need for versatility and efficiency in various sectors, including construction, logistics, and warehouses. The adoption of the Internet of Things and on-site workshops, along with online training modules, has facilitated the seamless integration of compact loaders into various operations.

Environmental concerns have led to the development of eco-friendly gear and components, such as precision metals and iron core alternatives, In the compact loader market. The mining sector, in particular, has shown a strong interest in compact loaders due to their ability to navigate steep slopes and handle heavy materials. The compact loader market is expected to grow significantly In the coming years, driven by the increasing demand for compact, efficient, and versatile building equipment. The market's continuous evolution is fueled by technological advancements and the evolving needs of various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.8% |

|

Market growth 2024-2028 |

USD 5869.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.69 |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Compact Loaders Market Research and Growth Report?

- CAGR of the Compact Loaders industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the compact loaders market growth of industry companies

We can help! Our analysts can customize this compact loaders market research report to meet your requirements.