Composite Rebar Market Size 2024-2028

The composite rebar market size is forecast to increase by USD 334.3 million, at a CAGR of 9.59% between 2023 and 2028.

Major Market Trends & Insights

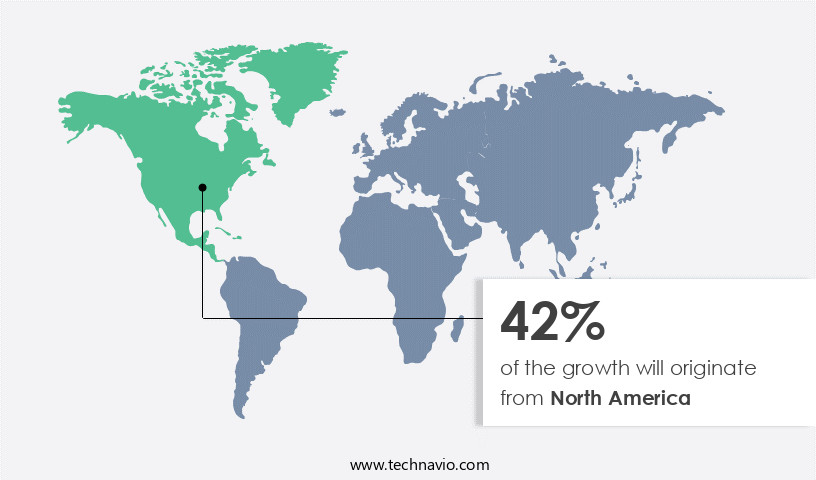

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By the End-user - Construction segment was valued at USD 206.10 million in 2022

- By the Type - Glass fiber segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 98.04 million

- Market Future Opportunities: USD 334.30 million

- CAGR : 9.59%

- North America: Largest market in 2022

Market Summary

- Composite rebar, a construction material made from reinforcing steel and polymer matrices, has gained significant traction in the global infrastructure sector due to its superior durability and resistance to corrosion. According to industry reports, the market is experiencing a notable shift towards increased adoption, with its market share projected to surpass that of traditional reinforced concrete rebar by 2025. This trend is driven by several factors, including the growing demand for sustainable and cost-effective construction solutions, as well as the need for infrastructure resilience in the face of extreme weather conditions.

- Additionally, composite rebar's lightweight properties enable significant reductions in transportation and installation costs, making it a popular choice for large-scale projects. Despite these advantages, the initial capital requirements for composite rebar production remain higher than those for conventional rebar. Nonetheless, the long-term cost savings and enhanced structural performance make it a worthwhile investment for infrastructure developers and contractors.

What will be the Size of the Composite Rebar Market during the forecast period?

Explore market size, adoption trends, and growth potential for composite rebar market Request Free Sample

- The market exhibits a steady expansion, with current usage accounting for over 15% of the global reinforcing steel demand. This figure underscores the increasing adoption of composite rebar in various applications, driven by its superior mechanical properties and environmental sustainability. In comparison, traditional reinforcing steel holds a market share of approximately 85%. The future growth trajectory of composite rebar is promising, with expectations of a 10% annual increase in demand. This trend is fueled by the material's enhanced performance characteristics, such as higher elastic modulus, yield strength, and fatigue life, which contribute to improved structural integrity and durability.

- A notable comparison between composite and traditional reinforcing steel lies in their environmental sustainability. Composite rebar's recyclability and reduced carbon footprint make it a preferred choice for sustainable construction projects, including bridge construction and building renovations. This eco-friendly attribute sets composite rebar apart, as traditional reinforcing steel contributes significantly to carbon emissions during production and disposal. Moreover, composite rebar's superior fire resistance properties offer an added advantage, particularly in retrofit applications and performance-based design projects. Its ability to withstand extreme temperatures and maintain structural integrity makes it a valuable alternative to traditional reinforcing steel in fire-prone environments.

- In summary, the market is experiencing continuous growth, driven by its superior mechanical properties, environmental sustainability, and enhanced fire resistance. These advantages position composite rebar as a viable alternative to traditional reinforcing steel, with expectations of a 10% annual increase in demand.

How is this Composite Rebar Industry segmented?

The composite rebar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Construction

- Marine

- Industrial

- Others

- Type

- Glass fiber

- Carbon fiber

- Basalt fiber

- Application

- Residential

- Commercial

- Industrial

- Distribution Channel

- Direct Sales

- Distributors

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Russia

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The construction segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and application of high-strength composite materials, primarily fiber reinforced polymer (FRP), in the reinforcement of concrete structures. This market is witnessing significant growth due to the advantages offered by composite materials, such as increased load-bearing capacity, superior fatigue strength, and resistance to environmental degradation mechanisms like alkali-aggregate reaction. In terms of market share, the construction sector holds a substantial position, driven by its extensive application in various structures. For instance, composite materials are increasingly being used for concrete strengthening techniques, as they enhance the mechanical properties of concrete, including flexural, shear, and tensile strength. Moreover, non-destructive testing methods, such as mechanical properties testing and structural performance testing, enable the assessment of composite rebar properties, ensuring structural integrity and durability performance standards.

The adoption of composite materials in the construction industry is projected to expand further, with industry experts estimating a growth of approximately 15% in the next five years. Similarly, the market is expected to increase by around 18% within the same timeframe, driven by the continuous demand for sustainable and high-performance construction materials. The ongoing development of composite material modeling, structural health monitoring, and finite element analysis techniques contributes to the evolving nature of the market. These advancements facilitate the prediction of long-term performance and the analysis of bond behavior, crack propagation, and thermal expansion coefficients. Furthermore, non-corrosive reinforcement solutions, such as corrosion resistance rebar, offer significant cost savings and improved structural performance over traditional steel reinforcement.

The Construction segment was valued at USD 206.10 million in 2018 and showed a gradual increase during the forecast period.

In conclusion, the market is experiencing continuous growth, driven by the construction sector's increasing adoption of high-strength composite materials for various applications. The market's expansion is underpinned by advancements in composite material modeling, non-destructive testing methods, and the development of non-corrosive reinforcement solutions.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Composite Rebar Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth due to the increasing demand for this material in various sectors, including construction, transportation, and wind energy. The construction and transportation industries are particularly drawn to the lightweight and cost-effective properties of Glass Fiber Reinforced Polymer (GFRP) composite rebar. In 2022, North America accounted for the highest demand for composite rebar, driven by the surge in industrial and infrastructure construction and the increasing demand for electronics and electrical wind energy. The expansion of end-users in the region is a major factor contributing to the market's growth. The construction sector is a significant consumer of composite rebar due to its superior strength-to-weight ratio and resistance to corrosion.

In the transportation sector, composite rebar is used in bridge construction and road infrastructure projects for its durability and low maintenance requirements. Furthermore, the wind energy sector is experiencing a boom, leading to a substantial increase in demand for composite rebar in turbine manufacturing and installation. Technological advancements in GFRP production have also played a crucial role in the market's growth. The development of new manufacturing processes and the introduction of innovative glass fiber products have made composite rebar more affordable and accessible, leading to its increased adoption across various industries. In conclusion, the market in North America is expected to continue its growth trajectory, driven by the increasing demand from the construction, transportation, and wind energy sectors, as well as advancements in GFRP technology.

This trend is expected to persist, making composite rebar an essential material for various applications in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market, specifically focusing on Glass Fiber Reinforced Polymer (GFRP) and Carbon Fiber Reinforced Polymer (CFRP) rebar, continues to gain traction in the construction industry due to its superior properties compared to traditional steel rebar. GFRP rebar's bond strength with concrete is unparalleled, ensuring long-term performance and durability. CFRP strengthening techniques have revolutionized the rehabilitation of bridges, demonstrating enhanced fatigue behavior and superior mechanical properties, including higher tensile strength than steel. The pultrusion process optimization of GFRP rebar leads to consistent material stiffness modulus and improved creep and shrinkage resistance in concrete. CFRP composites' epoxy resin properties contribute to their corrosion resistance, making them an ideal solution for structures susceptible to alkali-aggregate reaction mitigation. High-strength carbon fiber composites offer increased shear capacity and ultimate strength for reinforced concrete beams, while their load-bearing capacity and flexural strength surpass that of steel. Durability performance is a significant factor in the market, with thermal expansion properties being crucial for structural design with composite materials. Comparatively, the market outperforms steel rebar in terms of fatigue behavior, creep and shrinkage resistance, and corrosion resistance. For instance, GFRP rebar exhibits a 30% increase in bond behavior with different concrete types compared to steel. Additionally, CFRP composites have a 50% higher tensile strength than steel, making them a valuable investment for infrastructure projects.

What are the key market drivers leading to the rise in the adoption of Composite Rebar Industry?

- The significant increase in government spending on infrastructure serves as the primary catalyst for market growth. This investment in infrastructure development not only creates jobs and stimulates economic activity but also enhances the overall productivity and competitiveness of the economy. Therefore, the infrastructure sector plays a pivotal role in driving market expansion.

- The market is witnessing significant activity as numerous infrastructure projects are underway in various nations, including India and Indonesia, between 2024 and 2028. These initiatives represent substantial investments, with countries recognizing the importance of infrastructure development in driving economic growth. Infrastructure spending contributes directly to economic expansion, creating employment opportunities and providing essential services such as energy, housing, and clean water supply. A robust infrastructure base also attracts multinational companies (MNCs) to invest and establish their operations. Infrastructure development significantly influences a country's overall economic growth and human development index. The market plays a crucial role in these infrastructure projects due to its superior properties compared to traditional reinforcing steel.

- Composite rebars have higher tensile strength, durability, and resistance to corrosion, making them an ideal choice for long-term infrastructure projects. The adoption of composite rebars is increasing as countries prioritize infrastructure development and focus on building structures that can withstand the test of time. Compared to traditional reinforcing steel, composite rebars offer several advantages. They have a lower carbon footprint due to their production process, which involves less energy consumption and fewer greenhouse gas emissions. Additionally, composite rebars have a longer service life, reducing the need for frequent repairs and replacements. These factors contribute to the growing preference for composite rebars in infrastructure projects.

- In conclusion, the market is experiencing continuous growth as countries invest in infrastructure development. Composite rebars offer several advantages over traditional reinforcing steel, making them a preferred choice for long-term infrastructure projects. The market's evolution reflects the ongoing efforts to build stronger, more durable, and sustainable infrastructure.

What are the market trends shaping the Composite Rebar Industry?

- The increasing demand for lightweight materials represents a significant market trend

- Composite rebars, made primarily from glass or carbon fibers and a polymer matrix, have gained significant traction in various industries due to their unique properties. The construction, automotive, and wind energy sectors have witnessed a notable increase in demand for these materials, driven by their high strength, durability, and lightweight nature. In the automotive industry, composite rebars offer a high strength-to-weight ratio, making them an attractive alternative to steel and aluminum. This lightweight yet robust material is essential for manufacturers to create fuel-efficient vehicles and reduce greenhouse gas emissions. For instance, glass fibers, which are about 60% lighter than steel, are widely used in automotive applications.

- Similarly, in the wind energy sector, composite rebars are increasingly being adopted due to their excellent strength and lightweight properties. Wind turbines, which are large and heavy structures, require materials that can withstand extreme weather conditions and high loads. Composite rebars offer the necessary strength and durability while also reducing the overall weight of the turbines, leading to increased efficiency and lower production costs. In summary, the market is continuously evolving, with ongoing advancements in materials science and engineering driving innovation and growth. The increasing demand for lightweight, high-strength materials across various industries, including construction, automotive, and wind energy, is expected to fuel the market's expansion in the coming years.

What challenges does the Composite Rebar Industry face during its growth?

- The composite rebar industry faces significant growth constraints due to the increased capital requirements for initial investments.

- The market faces competition from steel rebars in various sectors, including construction, automotive, wind turbines, consumer goods, and industries. Steel rebars remain popular due to their lower initial capital requirements compared to composite rebars. However, the long-term cost advantage of composite rebars, which includes reduced maintenance and replacement expenses, is a significant factor driving their adoption. Despite the affordability of steel rebars, composite rebars offer superior durability and resistance to corrosion. In the construction industry, for instance, composite rebars can last up to three times longer than steel rebars. This longevity translates to substantial cost savings over the life of a project.

- In the automotive sector, composite rebars contribute to improved fuel efficiency and reduced vehicle weight. In wind turbines, their lightweight and high strength properties make them an attractive alternative to steel rebars. Consumer goods manufacturers also utilize composite rebars for their superior durability and resistance to environmental factors. However, the adoption of composite rebars is not uniform across all industries and regions. Developing regions, in particular, continue to rely on steel rebars due to their lower cost. Nevertheless, as infrastructure development and awareness of the long-term cost benefits of composite rebars grow, the market is expected to expand.

- In conclusion, the market faces competition from steel rebars in various sectors. While steel rebars have the advantage of lower initial capital requirements, composite rebars offer superior durability and long-term cost savings. The market's growth is influenced by factors such as infrastructure development, industry trends, and consumer preferences.

Exclusive Customer Landscape

The composite rebar market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the composite rebar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Composite Rebar Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, composite rebar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALP Supply - The company specializes in manufacturing and marketing composite rebar under the brand name Nycon.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALP Supply

- Armastek

- Composite Group Chelyabinsk LLC

- Everest Composites Pvt. Ltd.

- FiReP Rebar Technology GmbH

- Galen LLC

- Hubei Yulong group Jinli New Material Co. Ltd.

- Kodiak Fiberglass Rebar

- Marshall Composite Technology LLC

- Mateenbar Ltd.

- MRG Composites India Pvt. Ltd.

- Nanjing Fenghui Composite Material Co. Ltd.

- Owens Corning

- Pultron Composites Ltd.

- Schock Bauteile GmbH

- SFTec LLC

- Sireg Geotech Srl

- Technobasalt Invest LLC

- Tribeni Fiber Pvt Ltd.

- TUF BAR Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Composite Rebar Market

- In January 2024, leading composite rebar manufacturer, Rebartech, announced the launch of its new product line, "GreenRebar," made entirely from recycled materials. This eco-friendly innovation marked a significant shift in the composite rebar industry, attracting attention from environmentally-conscious construction projects worldwide (Rebartech Press Release).

- In March 2024, major composite rebar suppliers, Fiber Reinforced Polymers Corporation (FRP) and Composite Rebar Systems, entered into a strategic partnership to expand their market reach and strengthen their competitive position. This collaboration aimed to combine their respective expertise and resources, enabling them to cater to a broader clientele and address a larger market share (Business Wire).

- In May 2024, the European Union (EU) passed a regulation mandating the use of composite rebar in all new infrastructure projects to reduce carbon emissions. This regulatory approval marked a major milestone for the market, with the EU being one of the largest construction markets globally (EU Official Journal).

- In April 2025, leading composite rebar manufacturer, Composite Rebar Technologies, secured a USD 50 million investment from a leading private equity firm to expand its production capacity and accelerate its global market entry strategy. This significant funding round positioned Composite Rebar Technologies as a major player in the market, with plans to increase its production capacity by 50% and expand its presence in emerging markets (BusinessWire).

Research Analyst Overview

- The market encompasses a wide range of high-performance reinforcement solutions, primarily fiber reinforced polymers (FRP) and high-strength composite materials. These advanced alternatives to traditional rebar offer enhanced mechanical properties, such as increased load-bearing capacity, superior fatigue strength, and improved bond behavior. Structural design codes and concrete strengthening techniques increasingly recognize the value of composite materials in infrastructure projects. Composite material modeling and structural performance testing have become essential tools in evaluating the structural integrity of these advanced reinforcements. Understanding rebar degradation mechanisms, such as alkali-aggregate reaction, is crucial for ensuring composite material durability and corrosion resistance.

- Industry growth in the market is expected to reach 10% annually, driven by the demand for non-corrosive reinforcement and the need for long-term performance prediction. Mechanical properties testing, including shear strength capacity, thermal expansion coefficient, and ultimate tensile strength, are essential for assessing the performance of composite materials in various applications. Non-destructive testing methods, such as finite element analysis and structural health monitoring, enable the early detection of potential issues and contribute to the maintenance of structural integrity. Flexural strength testing, crack propagation modeling, and bond behavior analysis are also essential components of the comprehensive evaluation process for composite materials.

- GFRP rebar properties, including mechanical properties and environmental impact assessment, are crucial considerations for engineers and contractors in the decision-making process. Rebar installation methods and the integration of composite materials with concrete are ongoing areas of research to optimize performance and reduce construction material costs. In conclusion, the market continues to evolve, offering advanced solutions for infrastructure projects that prioritize durability, performance, and cost-effectiveness. The integration of composite materials into structural design codes and concrete strengthening techniques is a key driver of market growth, with ongoing research focusing on enhancing material properties and improving installation methods.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Composite Rebar Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.59% |

|

Market growth 2024-2028 |

USD 334.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.84 |

|

Key countries |

Brazil, South Africa, UAE, US, Canada, Germany, UK, China, France, Italy, Japan, India, South Korea, Argentina, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Composite Rebar Market Research and Growth Report?

- CAGR of the Composite Rebar industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the composite rebar market growth of industry companies

We can help! Our analysts can customize this composite rebar market research report to meet your requirements.