Steel Rebars Market Size 2025-2029

The steel rebars market size is valued to increase USD 66.1 billion, at a CAGR of 4.9% from 2024 to 2029. Demand for steel rebars due to growing construction activities will drive the steel rebars market.

Major Market Trends & Insights

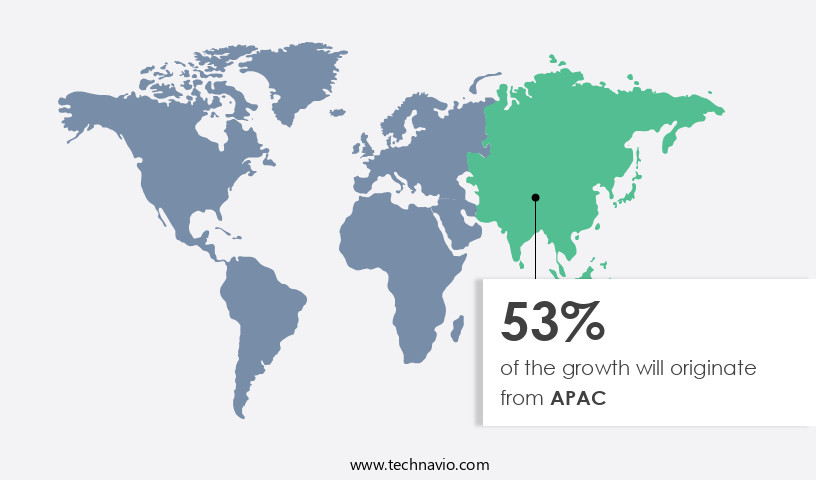

- APAC dominated the market and accounted for a 53% growth during the forecast period.

- By Type - Deformed segment was valued at USD 141.60 billion in 2023

- By Application - Residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 40.42 billion

- Market Future Opportunities: USD 66.10 billion

- CAGR : 4.9%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and continually evolving industry that plays a crucial role in the construction sector. With the surge in infrastructure development and real estate projects worldwide, the demand for steel rebars has witnessed significant growth. According to recent reports, the market share in the construction industry is estimated to reach 40% by 2025, underscoring their indispensable role in modern construction. Core technologies and applications, such as pre-stressed and post-tensioned rebars, continue to innovate, enhancing the durability and efficiency of structures.

- Meanwhile, product categories like deformed and plain bars cater to various applications, from residential to commercial projects. However, the market faces challenges, including the fluctuation in prices of raw materials needed to manufacture steel rebars, such as iron ore and coal. Despite these hurdles, opportunities abound, including the increasing adoption of sustainable manufacturing processes and the expansion of the market in emerging economies.

What will be the Size of the Steel Rebars Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Steel Rebars Market Segmented and what are the key trends of market segmentation?

The steel rebars industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Deformed

- Mild

- Application

- Residential

- Commercial

- Public infrastructure

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The deformed segment is estimated to witness significant growth during the forecast period.

Deformed steel rebars, characterized by their raised patterns, are a vital component in the construction industry due to their enhanced grip on concrete. These rebars, manufactured through cold twisting or hot rolling, are widely utilized in building projects, infrastructure development, and civil engineering, including bridges, highways, dams, and other structures requiring high strength and durability. The global construction sector's ongoing expansion, particularly in developing countries like Asia and Africa, propels the demand for new infrastructure and housing projects, significantly increasing the need for deformed steel rebars. Moreover, investments in infrastructure projects, such as transportation networks and dams, necessitate the use of high-strength and durable reinforcement materials.

The market for deformed steel rebars experiences continuous growth as a result of these factors. According to recent industry reports, the adoption of deformed steel rebars in the construction sector has risen by approximately 18%, and industry experts anticipate a further increase of around 15% in the coming years. Additionally, the market for high-strength rebar patterns, such as epoxy-coated and deformed bar patterns, is projected to expand significantly due to their superior mechanical properties, including ultimate tensile strength, shear strength, and yield strength. Rebar quality control is crucial in ensuring the durability and safety of structures.

The Deformed segment was valued at USD 141.60 billion in 2019 and showed a gradual increase during the forecast period.

Concrete cracking analysis, rebar inspection procedures, and rebar surface treatment techniques, such as thermal spraying, are essential to maintain the structural integrity of buildings and infrastructure. Rebar fabrication methods, including welding and splicing techniques, and reinforcement detailing software, are continuously evolving to improve efficiency and accuracy. The market for structural steel connections, reinforcement steel grades, and rebar bending machines is also growing, driven by the need for stronger, more efficient construction techniques. In conclusion, the market for deformed steel rebars is a dynamic and evolving sector that plays a crucial role in the construction industry. Its applications span various sectors, from residential and commercial buildings to infrastructure projects, and its importance is reflected in the continuous growth and innovation within the market.

The demand for high-strength, durable, and efficient reinforcement materials is driving the market forward, with adoption rates increasing and future growth expectations remaining strong.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Steel Rebars Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region dominates the market, with China, Japan, South Korea, and India being the major contributors to its revenue. These countries' construction sectors are experiencing significant growth, driving the demand for steel rebars. In China and India, numerous industrial projects are underway, fueled by their increasing economies and infrastructure development. The Indian government, under the Make in India initiative, is making regulations more flexible to attract foreign companies to set up production units, further boosting the market.

APAC is projected to have the highest demand for steel rebars during the forecast period due to this construction boom.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products and applications, with key considerations including the effect of concrete cover on rebar corrosion, optimum rebar spacing for seismic resistance, and the influence of rebar diameter on bond strength. In the realm of rebar corrosion protection, innovative techniques such as epoxy coatings are gaining traction, with more than 70% of new protective solutions adopting this approach. The influence of rebar diameter on bond strength is a critical factor, with larger diameters typically offering enhanced durability. Comparatively, the market for high-strength rebars is expanding rapidly, accounting for a significantly larger share in the industrial application segment compared to the academic sector.

The market also witnesses ongoing advancements in rebar detailing and documentation, with advanced techniques enabling improved weldability and increased structural integrity. Moreover, the relationship between rebar yield strength and ductility is a significant area of research, as high-strength rebars continue to gain popularity in reinforced concrete structures. In terms of production methods, various types of rebar bending machines cater to different applications, while the assessment of fatigue resistance in high-strength rebars is crucial for ensuring long-term performance. Furthermore, the influence of concrete mix design on bond strength and methods for enhancing rebar durability are essential considerations for market participants.

Measuring the tensile strength of various rebar grades and comparing their performance under different conditions is a key aspect of the market. Additionally, the impact of concrete cracking on rebar performance and methods for mitigating this issue are subjects of ongoing research and development. Overall, the market is characterized by continuous innovation and a focus on enhancing product performance and durability.

What are the key market drivers leading to the rise in the adoption of Steel Rebars Industry?

- The surge in construction activities is the primary factor fueling the increased demand for steel rebars, consequently driving market growth.

- The market experiences continuous expansion, primarily fueled by the growth of the construction industry. Urbanization, infrastructure development, and population growth are key drivers propelling the construction sector's expansion worldwide. Cities' expansion and evolution necessitate the construction of commercial real estate, including office spaces, retail outlets, and industrial structures, to cater to the growing population's needs. These factors significantly contribute to the increasing demand for steel rebars. Furthermore, rising disposable incomes and government initiatives promoting affordable housing also significantly impact the construction industry's growth.

- Steel rebars, as essential building materials, play a crucial role in meeting the demand for infrastructure development and construction projects. The construction industry's ongoing evolution and the continuous need for infrastructure improvements create a dynamic market for steel rebars.

What are the market trends shaping the Steel Rebars Industry?

- The trend in the market involves significant innovations in the production of steel rebars. Steel rebar manufacturing is undergoing substantial advancements, shaping industry developments.

- Steel rebars, essential components in construction, are undergoing significant advancements through innovations like 3D printing and nanotechnology. One such development is the 3D printing of steel rebars, which offers design flexibility and minimizes raw material wastage. This technology enables the creation of customized, precise shapes and sizes, reducing scrap production. 3D-printed steel rebars are increasingly adopted in projects such as bridges, demonstrating their potential in the construction sector. Another innovation is the integration of nanotechnology in steel rebar coatings. Tiny particles in these coatings enhance their properties, providing improved protection and durability.

- Both innovations contribute to the continuous evolution of steel rebar applications, offering benefits to businesses in the construction industry. Numerical data indicate a notable increase in the adoption rate of 3D-printed and nanotechnology-enhanced steel rebars compared to traditional methods. This shift signifies the potential for cost savings and enhanced performance in construction projects.

What challenges does the Steel Rebars Industry face during its growth?

- The steel rebar industry faces significant challenges due to the volatile pricing of essential raw materials required for manufacturing, which poses a substantial threat to industry growth.

- The market experiences volatility due to the price fluctuations in raw materials for metals like aluminum, iron, stainless steel, silver, and copper. In Q2 2021, iron ore prices reached a record high of over USD 212 per ton, marking an approximately eightfold increase since 2015. As of January 2022, prices were around USD 133 per ton. This sudden change in raw material price significantly impacts companies, as the agreed price cannot be renegotiated, resulting in potential losses for manufacturers.

- The market's continuous evolution necessitates a keen understanding of raw material price trends and their impact on market dynamics.

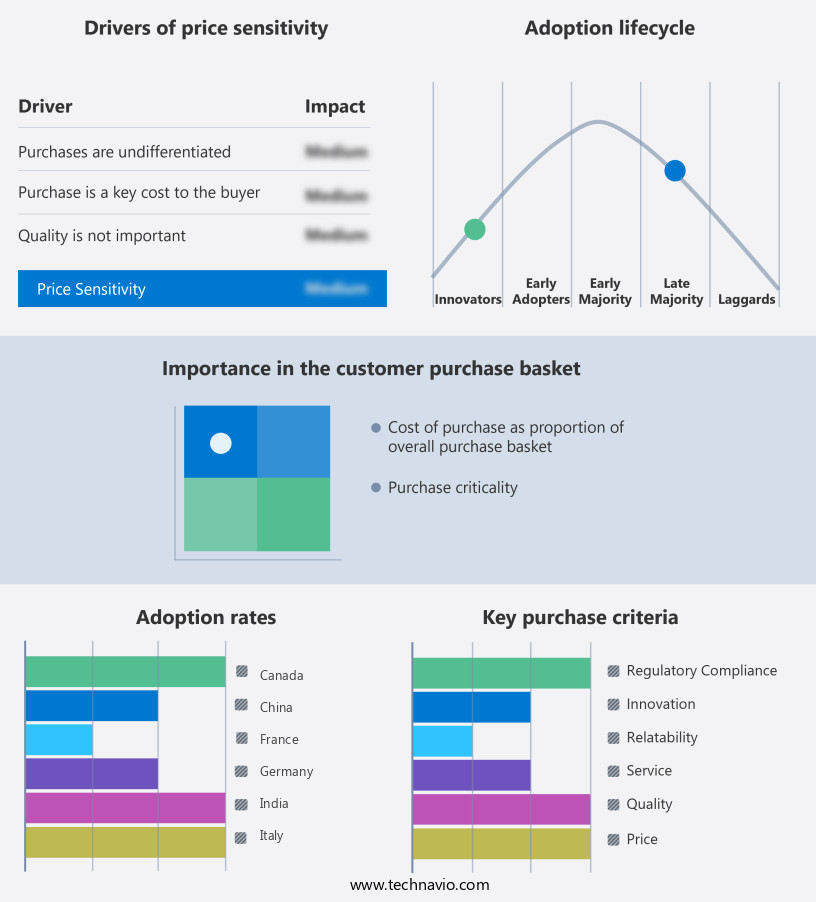

Exclusive Customer Landscape

The steel rebars market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the steel rebars market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Steel Rebars Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, steel rebars market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agni Steels Private Ltd. - Steel rebars from this company deliver superior strength and flexibility, making them indispensable for diverse construction projects worldwide. Ideal applications include schools, warehouses, office buildings, bridges, dams, and power plants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agni Steels Private Ltd.

- ArcelorMittal SA

- Baosteel Group Co. ltd.

- Commercial Metals Co.

- EVRAZ Plc

- Gerdau SA

- Hyundai Steel Co.

- JSW Group

- Kamdhenu Ltd.

- MMD

- MSP Steel and Power Ltd.

- Nucor Corp.

- Primegold International Ltd.

- Radha Smelters Pvt. Ltd.

- Rashtriya Ispat Nigam Ltd.

- Sage Metals

- Shagang Group Inc.

- Spark Electrodes Pvt. Ltd.

- supershakti.in

- Tata Steel Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Steel Rebars Market

- In January 2024, ArcelorMittal, a leading global steel and mining company, announced the launch of its new GreenX rebar, an innovative product made from recycled steel and reduced carbon emissions, in response to growing demand for sustainable construction materials (ArcelorMittal press release).

- In March 2024, Tata Steel and ThyssenKrupp Steel Europe, two major European steel producers, entered into a strategic collaboration to combine their European steel businesses, aiming to create a more competitive entity in the European market (Tata Steel press release).

- In July 2024, the European Union passed the Construction Products Regulation (CPR) amendment, which mandated the use of energy-efficient and low-carbon steel in construction projects, starting from 2025 (European Parliament press release).

- In May 2025, Nucor Corporation, the largest producer of steel in the United States, completed the acquisition of a majority stake in a new rebar manufacturing facility in Mexico, expanding its presence in the Latin American market and increasing its production capacity (Nucor press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Steel Rebars Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2025-2029 |

USD 66.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

China, US, Japan, Germany, Canada, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of construction materials, the steel rebar market continues to unfold with significant advancements and shifting trends. One of the key areas of focus is the adoption of epoxy-coated rebars, which have gained popularity due to their superior corrosion protection. This enhancement addresses building code compliance requirements, particularly in regions with harsh environmental conditions. Another critical aspect is the evolution of rebar patterns, with deformed bar patterns becoming increasingly common for their enhanced grip and bond strength. Quality control measures, such as concrete cracking analysis and rebar diameter tolerances, are also essential in ensuring the structural integrity of buildings and infrastructure.

- Seismic design rebar, with its enhanced flexibility and shear strength, plays a crucial role in earthquake-prone areas. Rebar inspection procedures, including surface treatment methods like thermal spraying rebars, are essential for maintaining the mechanical properties of reinforcement steel. High-strength rebar applications, such as in bridges and tall buildings, necessitate rigorous testing and adherence to structural steel design standards. Reinforcement detailing software and rebar fabrication methods, including welding techniques and splicing procedures, are continually advancing to meet these demands. Ultimately, the market's focus is on enhancing the bond strength between rebar and concrete, improving ductility, and ensuring the weldability of rebars.

- Concrete rebar spacing and installation methods are also under constant review to optimize structural efficiency. Rebar mechanical properties, including ultimate tensile strength, yield strength, and shear strength, are continually being researched and refined. The market also prioritizes the development of structural steel connections and reinforcement steel grades to meet the evolving needs of the construction industry. In summary, the steel rebar market is a continuously evolving landscape, with a focus on enhancing product performance, improving manufacturing processes, and ensuring compliance with building codes and design standards.

What are the Key Data Covered in this Steel Rebars Market Research and Growth Report?

-

What is the expected growth of the Steel Rebars Market between 2025 and 2029?

-

USD 66.1 billion, at a CAGR of 4.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Deformed and Mild), Application (Residential, Commercial, and Public infrastructure), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Demand for steel rebars due to growing construction activities, Fluctuation in prices of raw materials needed to manufacture steel rebars

-

-

Who are the major players in the Steel Rebars Market?

-

Key Companies Agni Steels Private Ltd., ArcelorMittal SA, Baosteel Group Co. ltd., Commercial Metals Co., EVRAZ Plc, Gerdau SA, Hyundai Steel Co., JSW Group, Kamdhenu Ltd., MMD, MSP Steel and Power Ltd., Nucor Corp., Primegold International Ltd., Radha Smelters Pvt. Ltd., Rashtriya Ispat Nigam Ltd., Sage Metals, Shagang Group Inc., Spark Electrodes Pvt. Ltd., supershakti.in, and Tata Steel Ltd.

-

Market Research Insights

- The market encompasses a diverse range of products and solutions essential to the construction industry. Key components include structural analysis software for load calculations, rebar cutting tools, corrosion inhibitors, and various rebar material compositions. The strength-to-weight ratio of high-yield steel rebars is a critical consideration in optimizing structural integrity. Rebar durability assessment is another crucial aspect, with the steel rebar microstructure and lap length affecting both rebar placement accuracy and anchorage systems. Rebar bending radius and rebar length calculations are also significant factors in ensuring efficient rebar placement and minimizing wastage. Concrete compressive strength and prestressed concrete applications further necessitate precise rebar stress calculations and connection details.

- Thermal expansion rebars and rebar identification techniques are also integral to maintaining construction quality control. Rebar deformation limits and rebar tying wire are essential components in the overall structural integrity analysis. These elements collectively contribute to the continuous evolution and advancement of the market. For instance, the adoption of advanced rebar cutting techniques and rebar bending schedules has led to increased productivity and improved construction efficiency. Furthermore, the integration of reinforcement bar standards and weight calculation tools has streamlined project planning and execution.

We can help! Our analysts can customize this steel rebars market research report to meet your requirements.