Consumer Biometrics Market Size 2024-2028

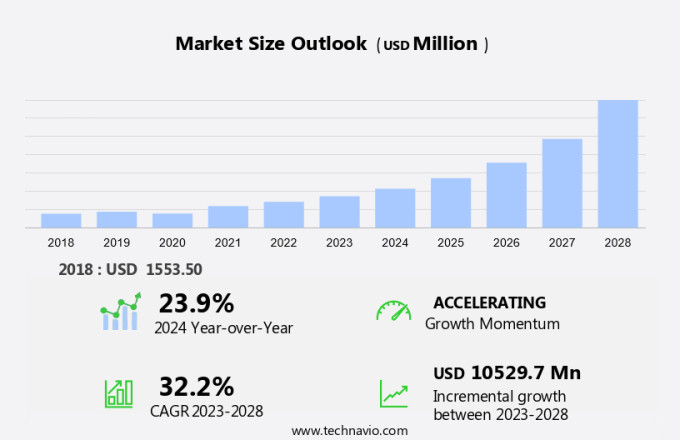

The consumer biometrics market size is forecast to increase by USD 10.53 billion at a CAGR of 32.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of machine learning technologies for behavior recognition. Companies like Vision-Box are leading this trend with their Seamless Journey Platform, which utilizes multi-factor authentication (MFA) for secure identification. Software solutions and cloud-based technologies are also driving the market, enabling more convenient and efficient identity verification.

- However, cyber threats and identity theft remain challenges, necessitating advanced security measures. National ID programs and digital transformation initiatives in smart city projects further fuel market growth. Data security and privacy concerns continue to be a priority, with solutions incorporating the latest encryption techniques to ensure protection. The adoption of biometric-enabled payment cards also adds to the market's expansion, offering a more secure and convenient payment experience for consumers.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing adoption of biometric technologies in various sectors. Biometric systems are no longer confined to high-security applications but are increasingly being integrated into consumer electronics for enhanced security and convenience. Biometric technologies such as fingerprint sensors and facial recognition are becoming commonplace in smartphones and other consumer devices. These technologies offer a more secure and efficient alternative to traditional passwords and PINs for identity verification and authentication. Biometric-as-a-Service (BaaS) providers are also gaining traction, offering businesses and Small and Medium Enterprises (SMEs) the ability to integrate biometric authentication into their systems without the need for extensive development resources.

- Additionally, data security and privacy concerns are driving the demand for biometric technologies. Biometric authentication provides a more secure and reliable method of identity verification compared to traditional methods. Deep learning algorithms and artificial intelligence (AI) are being integrated into biometric systems to improve accuracy and efficiency. The shipment of biometric sensing modules is expected to increase significantly in the coming years due to the growing adoption of biometric technologies in various applications. Biometric systems are being used for identity verification in customer interactions, mobile payments, and secure identity management in various industries, including human resource management. Connectivity and digitization are also driving the growth of the market.

- Further, biometric systems are being integrated into various IoT devices and wearables, providing a more secure and convenient method of authentication and identity verification. Biometric security is becoming increasingly important in the digital age, with the rise of cyber threats and data breaches. Biometric authentication offers a more secure and reliable method of identity verification, reducing the risk of unauthorized access to sensitive information. In conclusion, the market in North America is experiencing steady growth due to the increasing adoption of biometric technologies in various sectors. Biometric systems offer a more secure and convenient method of identity verification and authentication, addressing the growing concerns around data security and privacy. The integration of AI and deep learning algorithms is improving the accuracy and efficiency of biometric systems, making them an essential component of secure identity management and customer interactions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Mobile

- PC

- Payments

- Access

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- Spain

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

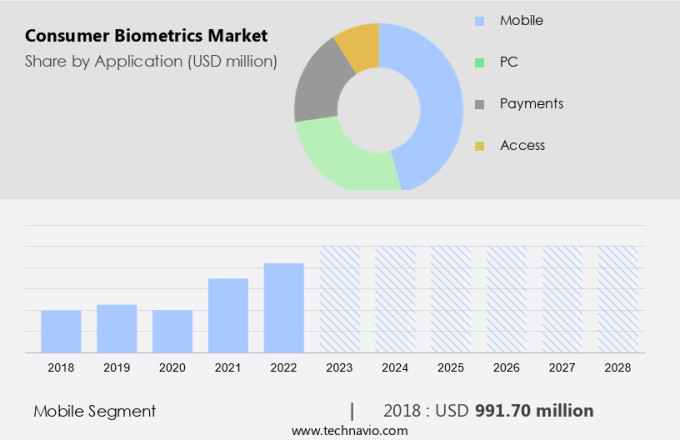

- The mobile segment is estimated to witness significant growth during the forecast period.

Biometrics, a technology that identifies and verifies individuals based on unique biological characteristics, is increasingly being adopted as a more convenient and efficient alternative to traditional passwords and PINs for securing mobile devices. With the growing concern for mobile phone security, particularly in relation to theft and data loss, biometrics offers a solution by utilizing sensors such as cameras, touchscreens, and microphones on smartphones for facial, fingerprint, iris, retina, and voice recognition. Machine learning algorithms enable behavior recognition and multi-factor authentication (MFA) for added security. These software solutions are often cloud-based, allowing for seamless integration into various applications and systems.

Also, as cyber threats and identity theft continue to be a concern in the digital transformation era, biometrics plays a crucial role in securing national ID programs and smart city projects. Companies such as Vision-Box offer comprehensive biometric solutions to ensure a seamless journey for users while maintaining the highest level of security.

Get a glance at the market report of share of various segments Request Free Sample

The mobile segment was valued at USD 991.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

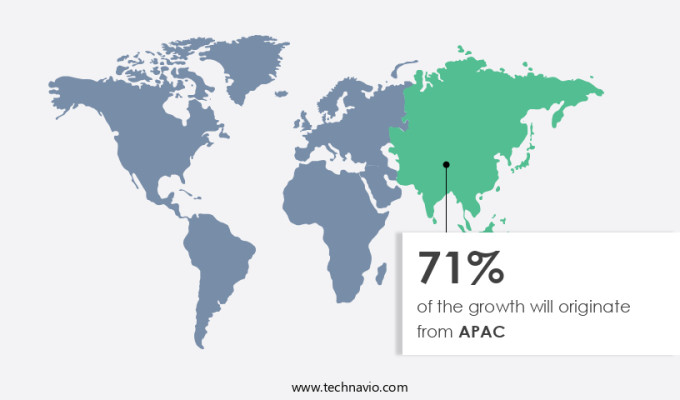

- APAC is estimated to contribute 71% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In developing economies of Asia Pacific, including China, India, and Indonesia, the growing purchasing power of consumers is driving demand for advanced electronic devices, such as smartphones, tablets, and personal computers. Notably, there is a surging interest in smartphones from companies like Samsung, Xiaomi, Apple, and Vivo, due to their inclusion of biometric sensors, such as in-display fingerprint scanners. This trend is expected to continue as smartphone sales in these regions increase.

Additionally, the advent of biometric-enabled payment cards will further fuel the expansion of the market in Asia Pacific. Biometric authentication, which includes voice recognition and fingerprint scanning, is becoming increasingly important for secure identity management and customer interactions. With the ongoing digitization and the need for connectivity, biometric authentication offers a convenient and reliable solution for both businesses and individuals. In conclusion, the rising demand for premium electronic devices and the integration of biometric sensors in these devices are key factors driving the growth of the market in Asia Pacific.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Consumer Biometrics Market?

Growing adoption of smartphones is the key driver of the market.

- The global market for consumer biometrics is witnessing substantial growth due to the increasing reliance on advanced security systems. With the rise in document fraud and cybersecurity threats, there is a growing demand for more secure authentication methods. Single-factor authentication, such as passwords and PINs, are no longer considered sufficient. Sensing authentication through biometric data, including face recognition, fingerprint recognition, palm print recognition, and signature recognition, is becoming increasingly popular. Artificial intelligence plays a crucial role in enhancing the accuracy and efficiency of these biometric systems. Cloud-based solutions enable seamless integration and accessibility of these systems. Behavioral biometrics, which analyzes user behavior patterns, adds an additional layer of security.

- Additionally, data leaks and privacy concerns have heightened the need for secure authentication methods. Consumers are increasingly adopting biometric security systems to protect their sensitive information. Software companies are investing heavily in developing advanced biometric solutions to cater to this growing demand. In conclusion, the market is witnessing significant growth due to the increasing need for secure authentication methods, advanced security systems, and the convenience offered by biometric technology. The integration of artificial intelligence and cloud-based solutions is further enhancing the capabilities of these systems. The market is expected to continue its growth trajectory in the coming years.

What are the market trends shaping the Consumer Biometrics Market?

The emergence of biometric-enabled payment cards is the upcoming trend in the market.

- The market has witnessed significant growth due to the integration of biometric systems in consumer electronics for enhanced security. Fingerprint sensors and facial recognition technology are becoming increasingly common in smartphones and laptops. Biometric-as-a-Service (BaaS) providers offer businesses, including Small and Medium Enterprises (SMEs), the opportunity to incorporate biometric technology into their operations for data security. However, privacy concerns remain a challenge in the implementation of these systems. Advancements in Artificial Intelligence (AI), including deep learning and neural networks, are driving the development of more sophisticated biometric systems. These technologies enable more accurate and efficient biometric authentication. Biometric-enabled payment cards, embedded with fingerprint sensors, are a recent innovation in the market.

- Similarly, these cards allow users to make contactless payments at Point-of-Sale (POS) terminals without entering a PIN code. The cards' sensors scan the user's fingerprint during the transaction, ensuring a secure and convenient payment process. Users can also enroll in the program and receive their card at home, making the process more accessible. In conclusion, the market is experiencing growth due to the integration of biometric systems in consumer electronics and financial services. The use of AI technologies is driving the development of more accurate and efficient biometric authentication systems. Biometric-enabled payment cards offer a convenient and secure payment solution, and the trend is expected to continue as businesses and consumers seek to enhance data security.

What challenges does Consumer Biometrics Market face during the growth?

Data security and privacy concerns is a key challenge affecting the market growth.

- Consumers face numerous security risks when using smartphones for transactions and daily activities, including data breaches, identity theft, and unsecured Wi-Fi networks. Biometric technology, which includes contact, non-contact, and combined functionality, offers a solution to these concerns. The military and defense sectors have been utilizing biometric technology for several years to ensure security and accuracy. Similarly, healthcare, banking and finance industries are increasingly adopting this technology to enhance security and improve user experience. Contact functionality uses physical touch for biometric identification, while non-contact functionality uses sensors to detect biometric data without contact. Combined functionality offers both contact and non-contact capabilities.

- Moreover, military and defense organizations, as well as public safety initiatives, have been using biometric technology for identification and access control. In addition, smartphone manufacturers are integrating biometric technology into their devices to offer secure payment solutions and enhance user experience. E-passports and e-visas also use biometric technology for identification and authentication. However, it is essential to ensure that these technologies are used responsibly and do not infringe on consumers' privacy. The collection and use of personal data should be transparent and in accordance with privacy policies. According to recent studies, over a thousand mobile applications collected user information without proper authorization, highlighting the importance of privacy policies and user consent.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allegion Access Technologies

- Apple Inc.

- ASSA ABLOY AB

- Aware Inc.

- IDEMIA France SAS

- IDEX Biometrics ASA

- Leidos Holdings Inc.

- NEC Corp.

- NEXT Biometrics Group ASA

- Nuance Communications Inc.

- OmniVision Technologies Inc.

- ON Semiconductor Corp.

- Precise Biometrics AB

- Princeton Identity

- Qualcomm Inc.

- Safran SA

- Shenzhen Goodix Technology Co. Ltd

- STMicroelectronics International NV

- Synaptics Inc.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of biometric systems in consumer electronics. Biometric technologies such as fingerprint sensors, facial recognition, and voice recognition are becoming increasingly popular for enhancing security and convenience in various applications. Biometric-as-a-Service (BaaS) providers are offering software solutions that enable Small and Medium Enterprises (SMEs) to integrate biometric authentication into their systems without the need for extensive development resources. Data security and privacy concerns are driving the demand for biometric systems as they offer more secure identity verification methods compared to traditional passwords. The integration of artificial intelligence (AI), deep learning, neural networks, and machine learning algorithms in biometric systems is enabling advanced behavior recognition and multi-factor authentication (MFA) capabilities.

Moreover, the shipping and logistics industry, digital transformation initiatives in smart cities, and national ID programs are some of the major sectors driving the growth of the biometrics market. Biometric sensors are being integrated into various consumer electronics, including smartphones, to offer seamless customer interactions and secure identity management. Cyber threats, identity theft, and document fraud are some of the key challenges that the biometrics market is addressing through advanced security systems and cloud-based technologies.

In conclusion, the integration of biometric sensors in mobile payments and online transactions is expected to further boost the market growth. The increasing purchasing power and smartphone sales are also contributing to the growth of the biometrics market. Biometric sensors are being integrated into various applications, including human resource management, security systems, and military and defense applications. The use of biometrics in public safety initiatives, e-passports, and e-visas is also expected to drive market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.2% |

|

Market growth 2024-2028 |

USD 10.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

23.9 |

|

Key countries |

US, China, India, Germany, Canada, Japan, UK, Spain, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch