Gastrointestinal Products Market Size 2025-2029

The gastrointestinal products market size is valued to increase by USD 5.38 billion, at a CAGR of 6.5% from 2024 to 2029. Rising prevalence of gastrointestinal disorders will drive the gastrointestinal products market.

Major Market Trends & Insights

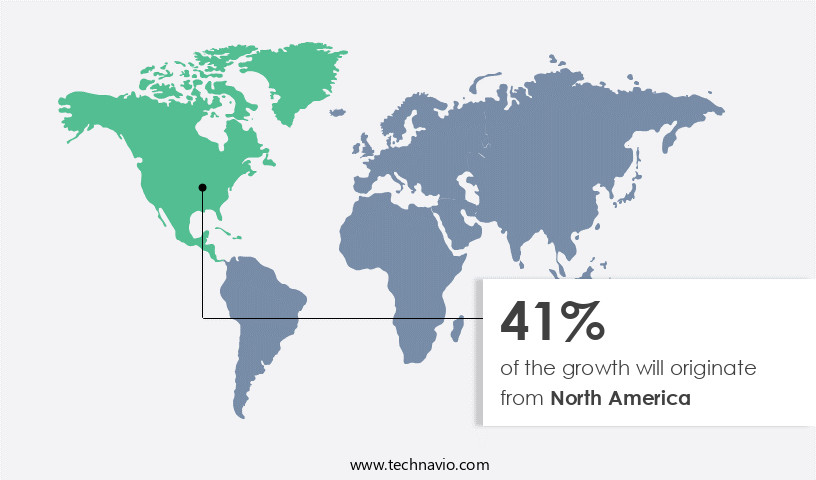

- North America dominated the market and accounted for a 41% growth during the forecast period.

- By Type - Endoscopy devices segment was valued at USD 2.66 billion in 2023

- By End-user - Hospitals segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 75.89 million

- Market Future Opportunities: USD 5376.80 million

- CAGR from 2024 to 2029 : 6.5%

Market Summary

- The market encompasses a broad spectrum of offerings, including medications, medical devices, and diagnostic tools, designed to address a range of disorders affecting the gastrointestinal tract. One significant market trend is the increasing prevalence of gastrointestinal disorders, driven by factors such as aging populations, unhealthy diets, and sedentary lifestyles. This trend underpins the market's growth, with estimates suggesting a value of over USD 150 billion by 2026. Another key development shaping the market is the integration of artificial intelligence (AI) into endoscopic devices. AI-enabled tools offer enhanced diagnostic capabilities, enabling earlier and more accurate identification of gastrointestinal conditions. Regulatory compliance remains a challenge, as stringent regulations ensure the safety and efficacy of gastrointestinal products.

- Despite this, the market continues to evolve, with companies investing in research and development to bring innovative solutions to market. Overall, the market is poised for continued growth, driven by the rising burden of gastrointestinal disorders and technological advancements.

What will be the Size of the Gastrointestinal Products Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Gastrointestinal Products Market Segmented?

The gastrointestinal products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Endoscopy devices

- Motility testing devices

- Ablation devices

- Biopsy devices

- Others

- End-user

- Hospitals

- Ambulatory surgical centers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The endoscopy devices segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of offerings, from diagnostic tools like endoscopy devices to functional foods and supplements, all aimed at promoting gut health and addressing various digestive discomforts. Endoscopy devices, such as gastroscopes and colonoscopies, play a pivotal role in GI diagnostics, enabling healthcare professionals to visualize the digestive tract and identify conditions like ulcers, tumors, inflammation, and even precancerous polyps. These minimally invasive procedures significantly improve patient outcomes, with colonoscopies reducing colorectal cancer mortality by up to 60% when performed regularly. Functional foods and supplements target specific digestive issues, such as lactose intolerance, bloating, and food sensitivities, by leveraging ingredients like probiotics, prebiotic fibers, and digestive enzymes.

Probiotic strains, such as Bifidobacterium and Lactobacillus, enhance gut microbiome health by promoting microbial diversity and immune system modulation. Synbiotic formulations, which combine probiotics and prebiotics, further optimize their efficacy. Prebiotic fibers, like inulin and oligofructose, serve as food for beneficial gut bacteria, fostering a healthy gut microbiota composition. Digestive enzymes, like amylase, protease, and lipase, aid in nutrient absorption and improve gi motility, ensuring optimal digestive function. Gut health markers, such as stool consistency and inflammatory markers, help assess overall gut health and monitor the effectiveness of various interventions. Metagenomic analysis and microbiome profiling offer valuable insights into the gut microbiota composition and its role in various health conditions, including irritable bowel syndrome, inflammatory bowel disease, and celiac disease.

The Endoscopy devices segment was valued at USD 2.66 billion in 2019 and showed a gradual increase during the forecast period.

Fecal microbiota transplantation represents a novel therapeutic approach for restoring a healthy gut microbiome in patients with recurrent Clostridioides difficile infections. The continuous evolution of the GI Products Market reflects ongoing research and development efforts, with a focus on addressing unmet needs and improving patient outcomes. This includes the exploration of new probiotic strains, synbiotic formulations, and innovative delivery systems, as well as the integration of advanced technologies like AI and machine learning to enhance diagnostic accuracy and personalize treatment plans.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Gastrointestinal Products Market Demand is Rising in North America Request Free Sample

The market in North America experiences significant growth due to a high prevalence of gastrointestinal (GI) disorders and an advanced healthcare infrastructure. Approximately 10-15% of the US population, equating to 25-45 million people, suffers from irritable bowel syndrome (IBS) (IFFGD). Colorectal cancer (CRC) is the third most common cancer diagnosis for both men and women, with an estimated 153,000 new cases annually.

This substantial incidence of GI disorders underscores the considerable demand for diagnostic and therapeutic GI products in the region. Furthermore, the aging population in North America contributes to market expansion. The robust healthcare sector and increasing awareness of GI disorders fuel the market's evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing awareness and concern for digestive health. Probiotic effects on gut microbiota and prebiotic impact on short-chain fatty acids have been at the forefront of research in this field. Probiotics, live bacteria and yeasts, help restore balance to the gut microbiome, improving gut microbiome diversity and immune function. Prebiotics, non-digestible fiber, selectively feed beneficial bacteria, enhancing their growth and activity. Intestinal permeability and inflammatory bowel disease (IBD) are major concerns in the gastrointestinal market. Probiotic supplementation and IBS symptoms have shown promising results in clinical trials, providing relief for those suffering from IBD. The impact of prebiotics on gut microbiota composition has also been studied extensively, with prebiotic fiber shown to improve stool consistency and promote a healthier gut. Celiac disease and nutrient absorption are other key areas where gastrointestinal products play a crucial role. Functional foods and digestive health go hand in hand, with many products focusing on improving lactose intolerance through digestive enzyme activity. The gut-brain axis and mental well-being are also gaining attention, with research suggesting a link between gut health and mood. Fecal microbiota transplantation (FMT) for recurrent C. Difficile is a groundbreaking development in the gastrointestinal market. Metagenomic analysis of the gut microbiome in IBD provides valuable insights into the complex interactions between bacteria and the human body. The relationship between dietary fiber and gut health is well-established, with prebiotic fiber playing a critical role in maintaining gut barrier function. Short-chain fatty acids, produced by gut bacteria, have a significant impact on colon health. Probiotic strains and reduction of bloating are other benefits of gastrointestinal products, making them an essential part of a healthy lifestyle. GI transit time and prebiotic intake are also important factors influencing digestive discomfort and probiotic use. Overall, the market is poised for continued growth, driven by the increasing demand for natural solutions to digestive health concerns.

What are the key market drivers leading to the rise in the adoption of Gastrointestinal Products Industry?

- The escalating incidence of gastrointestinal disorders serves as the primary catalyst for market growth in this sector.

- The market is experiencing significant growth due to the increasing prevalence of gastrointestinal (GI) disorders. Conditions such as gastroesophageal reflux disease (GERD) and irritable bowel syndrome (IBS) are becoming more common, with IBS affecting around 25-45 million people in the US, equating to approximately 10%-15% of the population. This widespread prevalence underscores the need for effective diagnostic tools and treatments, driving the demand for GI products.

- GERD is another prevalent condition, impacting a substantial portion of the global population. The heightened demand for solutions to manage these conditions contributes to the robust growth of the market.

What are the market trends shaping the Gastrointestinal Products Industry?

- The integration of artificial intelligence into endoscopic devices is an emerging market trend. This advancement is set to revolutionize the medical field by enhancing diagnostic accuracy and improving procedural efficiency.

- The gastrointestinal (GI) products market is undergoing a significant transformation through the integration of artificial intelligence (AI) into endoscopic devices. This technological innovation is revolutionizing GI diagnostics by enhancing real-time image analysis, improving lesion detection, and facilitating polyp classification. For instance, Medtronic plc's latest offering, ColonPRO, is an advanced software for the GI Genius intelligent endoscopy system. This next-generation software, backed by an expanded dataset, boosts polyp detection accuracy by reducing false positives by approximately 9%.

- Furthermore, it introduces new procedural highlights, streamlining workflows and reducing administrative burdens for healthcare providers, thereby increasing overall efficiency. This trend underscores the potential of AI to revolutionize endoscopic procedures, leading to better patient outcomes.

What challenges does the Gastrointestinal Products Industry face during its growth?

- Compliance with regulatory requirements poses a significant challenge to the industry's growth trajectory. It is essential for businesses to adhere to these regulations to avoid penalties and ensure long-term success.

- The market encompasses a diverse range of devices and diagnostic tools used for the prevention, diagnosis, and treatment of gastrointestinal disorders. Regulatory compliance plays a pivotal role in this market, with manufacturers facing intricate and stringent regulations across various regions. In the US, the Food and Drug Administration (FDA) categorizes gastrointestinal devices into Class I, II, or III based on risk, with Class III devices necessitating Premarket Approval (PMA). Many endoscopic and motility testing devices require 510(k) clearance, demonstrating substantial equivalence to existing devices. Manufacturers must also adhere to the Quality System Regulation (QSR) under 21 CFR Part 820, ensuring proper design, manufacturing, and post-market surveillance.

- In the European Union, the Medical Device Regulation (MDR 2017/745) replaced the previous Medical Device Directive (MDD) in 2021, imposing more stringent safety, clinical data, and post-market surveillance requirements. With the increasing prevalence of gastrointestinal disorders and the growing demand for minimally invasive diagnostic and therapeutic solutions, the market for these products is expected to expand substantially.

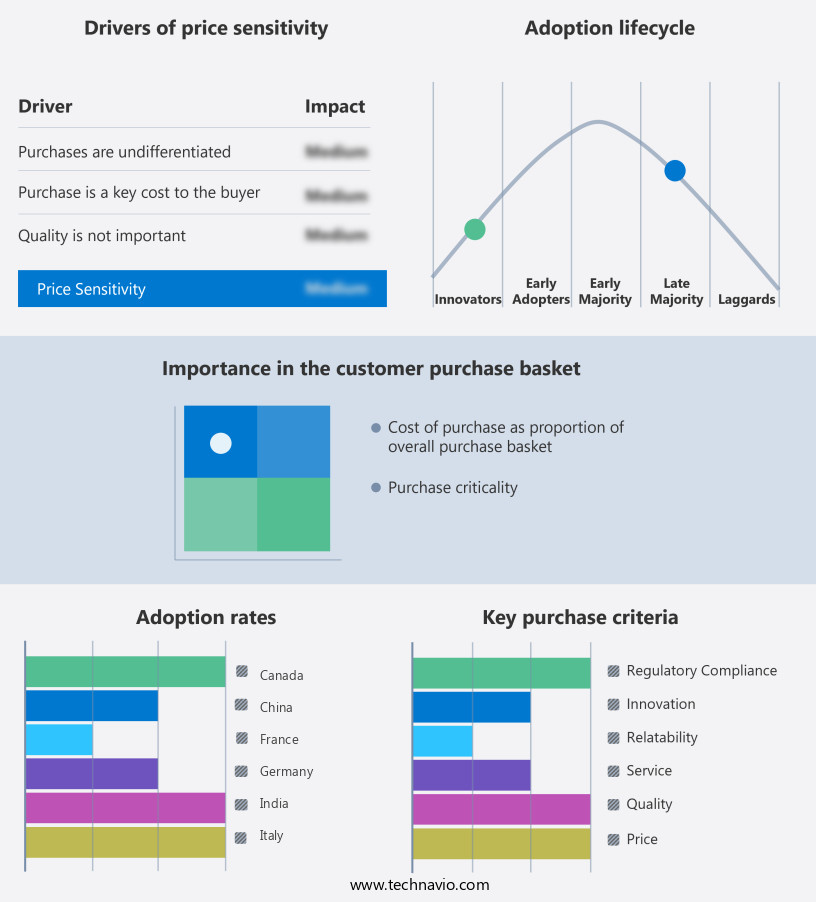

Exclusive Technavio Analysis on Customer Landscape

The gastrointestinal products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gastrointestinal products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Gastrointestinal Products Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, gastrointestinal products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in gastrointestinal health solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- ANGIPLAST Pvt. Ltd.

- Astellas Pharma Inc.

- Bayer AG

- Boston Scientific Corp.

- Dr Reddys Laboratories Ltd.

- FUJIFILM Holdings Corp.

- GlaxoSmithKline Plc

- GPC Medical Ltd.

- Johnson and Johnson

- Leinzett Medical

- Medtronic Plc

- MTW-Endoskopie W. Haag KG

- Mylan

- Nikotech Pvt. Ltd.

- Novartis AG

- Olympus Corp.

- Pfizer Inc.

- Santen Pharmaceutical Co. Ltd.

- Stryker Corp.

- Takeda Pharmaceutical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gastrointestinal Products Market

- In January 2024, Takeda Pharmaceutical Company Limited announced the launch of its new gastrointestinal (GI) product, Entyvio, in South Korea. Entyvio is an integrin inhibitor indicated for the treatment of adults with moderately to severely active ulcerative colitis and Crohn's disease. According to Takeda's press release, the company expects this expansion to strengthen its presence in the Asian market (Takeda Pharmaceutical Company Limited, 2024).

- In March 2024, Pfizer Inc. and Alimentary Health, a leading Irish biotech company, entered into a strategic collaboration to develop and commercialize a novel microbiome-based therapeutic for GI disorders. The financial terms of the agreement were not disclosed in Pfizer's press release (Pfizer Inc., 2024).

- In April 2025, Allergan plc completed the acquisition of VirxImmune, a clinical-stage biotech company specializing in the development of novel immunotherapies for GI diseases. The deal, valued at approximately USD 1.3 billion, is expected to enhance Allergan's gastrointestinal portfolio and accelerate its research and development efforts (Allergan plc, 2025).

- In May 2025, the European Commission granted marketing authorization for Shire plc's Firazyr, an intravenous C1 inhibitor, for the treatment of acute attacks of hereditary angioedema (HAE) in adults and adolescents. This approval marks the first-ever intravenous C1 inhibitor for the treatment of HAE in Europe, expanding Shire's therapeutic offerings in the GI space (Shire plc, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gastrointestinal Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 5376.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Germany, China, Japan, UK, France, Canada, Italy, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by growing consumer awareness and research into the intricacies of gut health. Short-chain fatty acids, produced by the gut microbiome, have emerged as key players in colon health and inflammatory bowel syndrome (IBS) management. Probiotic efficacy, a critical factor in gut health, is under constant scrutiny, with new probiotic strains and synbiotic formulations being developed to address lactose intolerance, bloating reduction, and digestive discomfort. The prevalence of food sensitivities and intestinal permeability issues has led to increased demand for functional foods and digestive enzymes. Metagenomic analysis and microbiome profiling are increasingly used to understand the gut microbiota composition and its role in gut barrier function, immune system modulation, and even the gut-brain axis.

- The market for gastrointestinal products is expected to grow at a robust pace, with industry analysts projecting a 10% annual increase in sales. For instance, a leading probiotic brand reported a 15% sales increase in the past year due to the introduction of a new probiotic strain specifically designed for IBS sufferers. This trend is reflective of the ongoing efforts to address the diverse needs of consumers and the continuous unfolding of market activities.

What are the Key Data Covered in this Gastrointestinal Products Market Research and Growth Report?

-

What is the expected growth of the Gastrointestinal Products Market between 2025 and 2029?

-

USD 5.38 billion, at a CAGR of 6.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Endoscopy devices, Motility testing devices, Ablation devices, Biopsy devices, and Others), End-user (Hospitals, Ambulatory surgical centers, and Others), and Geography (North America, Asia, Europe, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Asia, Europe, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising prevalence of gastrointestinal disorders, Regulatory compliance

-

-

Who are the major players in the Gastrointestinal Products Market?

-

Abbott Laboratories, ANGIPLAST Pvt. Ltd., Astellas Pharma Inc., Bayer AG, Boston Scientific Corp., Dr Reddys Laboratories Ltd., FUJIFILM Holdings Corp., GlaxoSmithKline Plc, GPC Medical Ltd., Johnson and Johnson, Leinzett Medical, Medtronic Plc, MTW-Endoskopie W. Haag KG, Mylan, Nikotech Pvt. Ltd., Novartis AG, Olympus Corp., Pfizer Inc., Santen Pharmaceutical Co. Ltd., Stryker Corp., and Takeda Pharmaceutical Co. Ltd.

-

Market Research Insights

- The market for gastrointestinal products is a dynamic and continually evolving industry, with a focus on delivering nutritional value and therapeutic benefits to consumers. Two key statistics illustrate the market's growth and significance. First, sales of gastrointestinal products in the United States have experienced a steady increase of approximately 5% annually over the past decade. Second, industry experts anticipate that this trend will continue, with growth expectations reaching up to 7% per year through 2025. One notable example of market dynamics comes from the rise in demand for functional ingredients that support metabolic pathways and improve patient-reported outcomes.

- For instance, a recent study showed that a specific fiber supplement led to a 30% reduction in inflammation markers in participants with irritable bowel syndrome. This improvement in gut health has contributed to the increasing popularity of gastrointestinal products, as consumers seek solutions to manage their symptoms and enhance their overall well-being.

We can help! Our analysts can customize this gastrointestinal products market research report to meet your requirements.