Cookies Market Size 2025-2029

The cookies market size is valued to increase USD 32.33 billion, at a CAGR of 7.3% from 2024 to 2029. Growing emphasis on product premiumization will drive the cookies market.

Major Market Trends & Insights

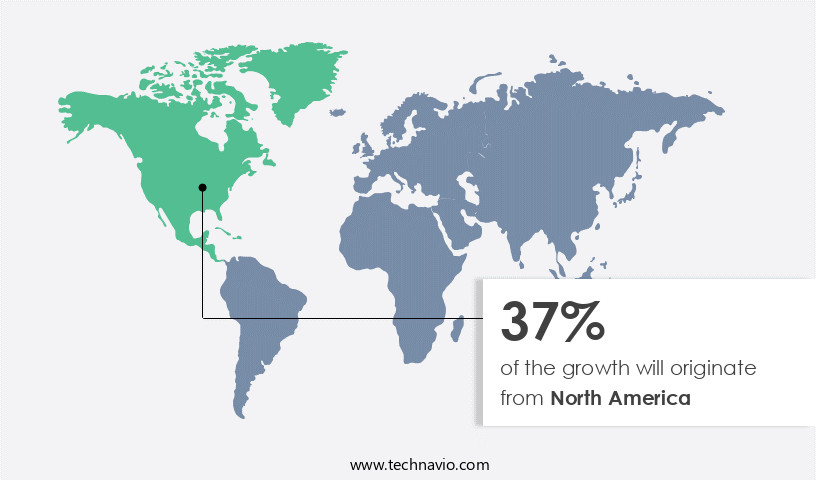

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Type - Plain and butter-based cookies segment was valued at USD 20.08 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 81.37 billion

- Market Future Opportunities: USD 32.33 billion

- CAGR from 2024 to 2029 : 7.3%

Market Summary

- The market represents a dynamic and continually evolving business landscape, characterized by advancements in core technologies and applications, shifting consumer preferences, and regulatory developments. Technological innovations, such as automation and digitalization, are revolutionizing cookie production, enabling higher efficiency and product customization. Simultaneously, the growing emphasis on product premiumization and the popularity of clean labeled cookies are driving market growth. According to recent market research, The market is projected to account for over 15% of the total baked goods market share.

- However, the market faces challenges from rising energy costs for bakery processors and increasing health consciousness among consumers. Despite these hurdles, opportunities abound, particularly in emerging markets and niche segments, making the market an intriguing and exciting space to watch.

What will be the Size of the Cookies Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cookies Market Segmented ?

The cookies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Plain and butter-based cookies

- Chocolate-based cookies

- Bar Cookies

- Drop Cookies

- Distribution Channel

- Offline

- Online

- Packaging

- Rigid Packaging

- Flexible Packaging

- Others

- Consumer Type

- Retail/Household

- Institutional/Foodservice

- Retail/Household

- Institutional/Foodservice

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The plain and butter-based cookies segment is estimated to witness significant growth during the forecast period.

The cookie market continues to evolve, with data analytics playing a pivotal role in shaping consumer preferences and market trends. Cookies, including browser cookies, JavaScript cookies, and web server cookies, are essential for session management, user tracking, and website personalization. Their lifespan and storage vary, with some being temporary and others persistent, while secure cookies ensure data privacy and protection against cookie theft. GDPR compliance is a significant concern, necessitating cookie consent and policy adherence. Manufacturers employ various cookie attributes, such as same-site and cross-site, to optimize user experience and tracking. Session identifiers and user preferences are stored in client-side and server-side storage, respectively.

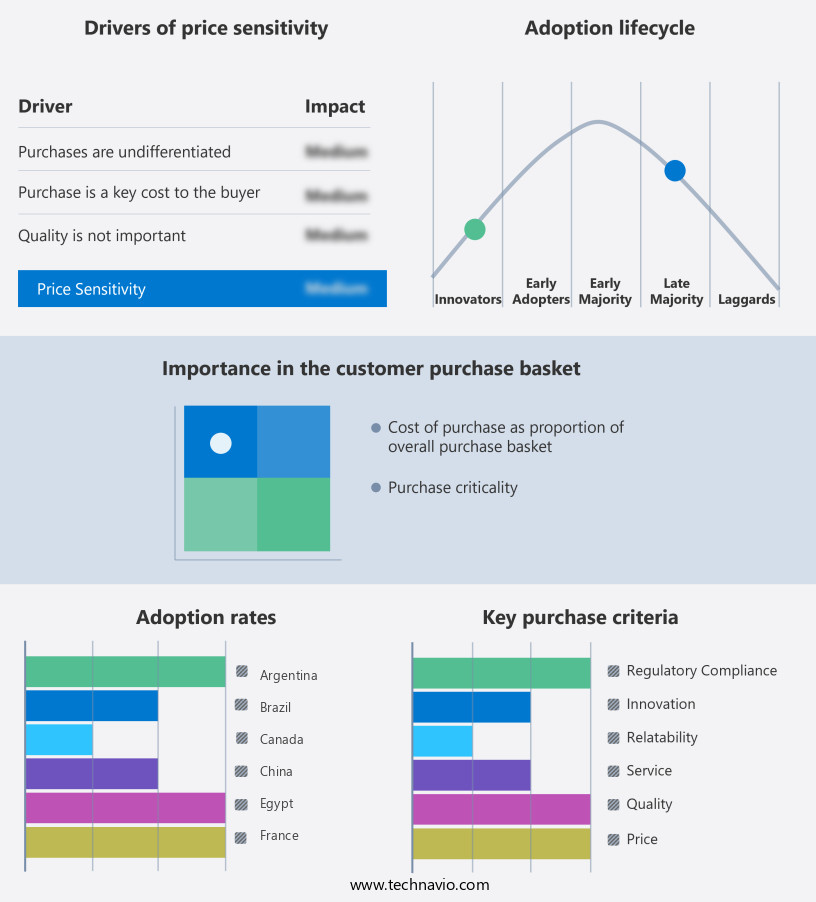

The market is competitive, with players like Mondelez, Britannia Industries, Mayora Group, and Parle Products offering a range of cookies. In developing countries, price sensitivity drives innovation in packaging and advertising. According to recent reports, the cookie market is expected to grow at a CAGR of 3.5% from 2021 to 2026, reflecting ongoing activities and evolving patterns.

The Plain and butter-based cookies segment was valued at USD 20.08 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cookies Market Demand is Rising in North America Request Free Sample

The market in North America exhibits a dynamic landscape, characterized by expanding consumer preferences and innovative product offerings. Cookies hold a substantial consumer base for both retail and on-trade consumption, including establishments such as coffee shops and cafes. These treats are sought after not only as delightful snacks but also as health-conscious alternatives. Leading manufacturers cater to this demand by producing a diverse range of health-focused and indulgent cookies.

Retail outlets play a crucial role in making essential food items, including cookies, accessible to consumers as part of their daily meals. companies collaborate closely with food and beverage manufacturers to ensure a consistent supply of cookies, responding to evolving market trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a critical aspect of digital business operations, enabling website functionality, user experience personalization, and data collection. Effective implementation of cookie consent banners is essential to comply with data privacy regulations, such as the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Managing third-party cookie usage is a significant challenge, as these cookies can pose risks, including theft and unauthorized access. Techniques for secure cookie handling, like encryption and hashing, can mitigate these risks. Analyzing cookie data offers valuable insights for website improvement, allowing businesses to optimize user experiences and enhance performance.

Best practices for compliant cookie policies include providing clear, concise information about cookie usage and obtaining explicit user consent. Effective methods for user preference storage and protecting user privacy via cookie controls are crucial. Strategies for optimizing cookie lifespan and balancing website functionality with user privacy are ongoing concerns. Improving website performance through cookie management is a key benefit, as cookies facilitate user experience customization and streamline processes. Ensuring compliance with data privacy regulations is a primary objective, with penalties for non-compliance potentially reaching into the millions. Enhancing website security by mitigating cookie vulnerabilities is another essential aspect.

Preventing cross-site tracking using appropriate cookie attributes is a growing concern, as users increasingly demand greater control over their digital footprints. Optimizing cookie storage and retrieval mechanisms and implementing robust cookie consent management systems are essential for businesses seeking to maintain data integrity and provide a seamless user experience. Cookies play a vital role in delivering personalized user experiences, enabling authentication and authorization, and detecting and preventing manipulation attempts. Leveraging cookies for these purposes requires a nuanced understanding of their potential risks and benefits. Adoption rates for secure cookie practices vary significantly across industries. For instance, the financial sector often invests more in robust cookie management systems due to the sensitive nature of the data they handle.

In contrast, the retail sector may prioritize user experience customization over security, resulting in a higher reliance on third-party cookies. In conclusion, the market presents a complex landscape, with businesses requiring a deep understanding of best practices for implementing effective cookie consent banners, managing third-party cookie usage, and employing secure cookie handling techniques. The ability to balance website functionality with user privacy, optimize cookie lifespan, and maintain compliance with data privacy regulations is essential for success in this dynamic market.

What are the key market drivers leading to the rise in the adoption of Cookies Industry?

- The increasing focus on product premiumization serves as the primary catalyst for market growth. This trend, characterized by the offering of higher-end features and improved quality to consumers, is a key strategy adopted by businesses to differentiate their offerings and appeal to discerning customers.

- The millennial demographic and rising disposable incomes are driving the demand for premium cookies worldwide. Major companies like Mondelez, Parle Products, and PepsiCo cater to this trend by offering a diverse range of cookies with premium branding, packaging, and positioning. The global health consciousness movement has also influenced consumers to pay more for premium product offerings. companies are differentiating their cookies through the use of premium ingredients, such as dry fruits, seeds, traditional grains, and nuts.

- For instance, Mondelez, through its Tates Bake Shop subsidiary in the US, produces thin-and-crispy premium cookies made from natural and high-quality ingredients. The cookie market's continuous evolution reflects these trends, with a growing emphasis on healthier, more differentiated offerings.

What are the market trends shaping the Cookies Industry?

- The increasing preference for clean-label cookies represents a notable market trend. Clean-label cookies are gaining popularity among consumers.

- In the food industry, transparency and simplicity have become key factors in consumer preference. Clean labeling, a trend that emphasizes clear and recognizable ingredients, is gaining traction in various sectors, including the cookie market. This approach streamlines production by limiting the number of ingredients used, while ensuring that consumers identify these components as healthy. Countries like the US, the UK, and Germany have implemented regulations to promote ingredient transparency, driving the clean labeling trend.

- Manufacturers prioritize using a minimal number of ingredients, ensuring their recognition and perception as wholesome by consumers. The clean labeling movement in the cookie industry underscores the evolving consumer demand for healthier options and increased regulatory focus on product formulation and labeling.

What challenges does the Cookies Industry face during its growth?

- The escalating energy costs pose a significant challenge to the growth of the bakery processing industry.

- The bakery industry is characterized by a substantial energy consumption due to the energy-intensive nature of baking processes. Electricity is a primary energy source, with extensive usage in various bakery operations such as mixing, proving, molding, baking, de-panning, slicing, and cooling. For example, during mixing, electricity is utilized for motors and drives. Industrial ovens are significant energy consumers, with indirect ovens consuming approximately 590 kWh per ton of gas and over 30 kWh per ton for electricity in a week.

- These energy requirements underscore the importance of energy efficiency in the bakery sector. Electricity and gas are essential inputs, driving up operational costs and necessitating continuous exploration for energy-saving technologies and practices.

Exclusive Technavio Analysis on Customer Landscape

The cookies market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cookies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cookies Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, cookies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arcor Group - The Back to Nature Foods Co. LLC subsidiary of the company produces a range of cookies, including Chocolate Chunk, Fudge Mint, Peanut Butter creme, Classic creme, Double creme, and Fudge Striped varieties. This brand caters to diverse consumer preferences, showcasing the company's commitment to offering high-quality, diverse food options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arcor Group

- Bahlsen GmbH and Co. KG

- Barilla G. e R. Fratelli Spa

- Billys Farm

- Biscuit Holding SAS

- Britannia Industries Ltd.

- Campbell Soup Co.

- Deweys Bakery Inc.

- Emmys Organics LLC

- FUEL10K Ltd.

- ITC Ltd.

- Kellogg Co.

- Mondelez International Inc.

- Nestle SA

- Parle Products Pvt. Ltd.

- PepsiCo Inc.

- PT Mayora Indah Tbk

- Starbucks Corp.

- UNIBIC Foods India Pvt. Ltd.

- Yildiz Holding A.S.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cookies Market

- In January 2024, Nabisco, a leading cookie manufacturer, introduced a new line of gluten-free cookies, named "Nabisco Delights," in response to the growing demand for allergy-friendly food options (Nabisco Press Release). In March 2024, PepsiCo, the parent company of Nabisco, announced a strategic partnership with Amazon to sell Nabisco's cookies directly to Amazon customers through its platform, expanding their reach and convenience for consumers (PepsiCo Press Release).

- In April 2025, Mondelez International, another significant player in the market, completed the acquisition of a leading European cookie manufacturer, "Biscuitland," for €1.2 billion, strengthening its position in the European market and increasing its production capacity (Mondelez International Press Release). In May 2025, the European Commission approved a new regulation requiring food companies to label their products with the amount of added sugars, which is expected to impact the market as consumers become more aware of sugar content and make informed purchasing decisions (European Commission Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cookies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 32.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, China, India, Brazil, Japan, Germany, UK, France, South Korea, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving digital landscape, the market continues to unfold with significant activity and shifting patterns. These small text files, essential for data analytics, exhibit varying lifespans and storage capacities. Browser cookies, a key component of web interaction, facilitate user preferences and session management. However, their longevity and manipulation pose challenges, particularly in the context of data privacy regulations like GDPR. Secure cookies, a crucial aspect of browser cookies, offer enhanced protection against cookie theft. JavaScript cookies, another variant, enable client-side storage and dynamic web content. Cross-site tracking and user tracking, facilitated by cookies and tracking pixels, have raised concerns regarding privacy and consent.

- Cookie deletion and expiration play significant roles in managing cookie usage. Session management and server-side storage further extend cookies' functionality. GDPR compliance necessitates clear cookie policies and user consent. Cookie manipulation, a potential security risk, highlights the importance of cookie security. HTTP protocol and third-party cookies contribute to the intricacy of cookie management. First-party cookies originate from the website visited, while third-party cookies come from external sources. Web server cookies and session identifiers further expand the market's complexity. Cookie consent banners and user preferences enable users to control their cookie settings. Authentication methods, such as httponly cookies, offer additional security measures.

- Website personalization and data privacy regulations continue to shape the market, driving ongoing innovation and evolution.

What are the Key Data Covered in this Cookies Market Research and Growth Report?

-

What is the expected growth of the Cookies Market between 2025 and 2029?

-

USD 32.33 billion, at a CAGR of 7.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Plain and butter-based cookies, Chocolate-based cookies, Bar Cookies, and Drop Cookies), Distribution Channel (Offline and Online), Geography (North America, APAC, Europe, South America, and Middle East and Africa), Packaging (Rigid Packaging, Flexible Packaging, and Others), and Consumer Type (Retail/Household, Institutional/Foodservice, Retail/Household, and Institutional/Foodservice)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing emphasis on product premiumization, High energy costs for bakery processors

-

-

Who are the major players in the Cookies Market?

-

Arcor Group, Bahlsen GmbH and Co. KG, Barilla G. e R. Fratelli Spa, Billys Farm, Biscuit Holding SAS, Britannia Industries Ltd., Campbell Soup Co., Deweys Bakery Inc., Emmys Organics LLC, FUEL10K Ltd., ITC Ltd., Kellogg Co., Mondelez International Inc., Nestle SA, Parle Products Pvt. Ltd., PepsiCo Inc., PT Mayora Indah Tbk, Starbucks Corp., UNIBIC Foods India Pvt. Ltd., and Yildiz Holding A.S.

-

Market Research Insights

- The market encompasses various technologies and mechanisms employed to manage session data and user consent in web applications. Two key aspects of this market are cookie consent mechanisms and access control. According to recent estimates, over 60% of websites use some form of cookie consent banner, indicating a significant reliance on user consent for data collection. Meanwhile, the implementation of access control and cookie flags has become increasingly important for web application security, with approximately 35% of websites employing these measures to mitigate risks such as cross-site scripting and session hijacking.

- As the digital landscape continues to evolve, the importance of cookie management, cookie manipulation detection, and data protection remains paramount for businesses seeking to maintain web browser security and user privacy.

We can help! Our analysts can customize this cookies market research report to meet your requirements.