Peanut Butter Market Size 2024-2028

The peanut butter market size is forecast to increase by USD 1.31 billion at a CAGR of 6% between 2023 and 2028.

- Peanut butter, a popular sandwich spread, continues to be a preferred choice for health-conscious consumers due to its nutritional benefits. With increasing awareness about obesity and chronic diseases, there is a growing demand for low-calorie, high protein food options. Peanut butter, rich in healthy fats, fiber, and essential vitamins and minerals, fits perfectly into this category.

- However, the market faces challenges due to potential allergic reactions to peanuts. To cater to diverse consumer preferences, nutrient spreads made from alternative nuts and seeds are gaining traction. As peanut butter remains a staple in American households, its market growth is expected to remain steady, driven by its versatility as an ingredient in various snacks and dishes.

What will be the Size of the Market During the Forecast Period?

- Peanut butter, a popular sandwich spread, continues to gain traction among health-conscious consumers in the United States. This traditional pantry staple offers numerous nutritional benefits, making it an ideal choice for individuals following high-protein dietary plans or seeking quick, healthy meal options. Peanut butter is renowned for its high protein content, which makes it a go-to food for those aiming to maintain a healthy weight or manage chronic illnesses such as obesity and related chronic diseases. The nutrient-dense spread provides essential nutrients, including healthy fats, fiber, and various vitamins and minerals. The market for nutrient spreads, including peanut butter, has experienced significant growth due to the increasing health consciousness among consumers. The preference for natural, clean-label, non-GMO, gluten-free, and organic products is on the rise. Peanut butter, being a plant-based, versatile, and affordable food, fits perfectly into this trend.

- Moreover, the convenience of single-serve packaging and the increasing popularity of online shopping have contributed to the growth of the market. Western food trends favor quick meals and healthy food options, making peanut butter an excellent choice for those seeking a tasty and nutritious alternative to processed snacks. Peanut butter is available in various flavors, including chocolate and honey flavored, catering to diverse taste preferences. Its lack of preservatives and natural ingredients make it an appealing choice for those following plant-based diets and seeking nutritious, whole food options. In conclusion, the market is poised for continued growth as consumers increasingly prioritize health and wellness in their food choices. With its high protein content, nutritional benefits, and versatility, peanut butter remains a popular and accessible option for quick meals and healthy snacking.

How is this market segmented and which is the largest segment?

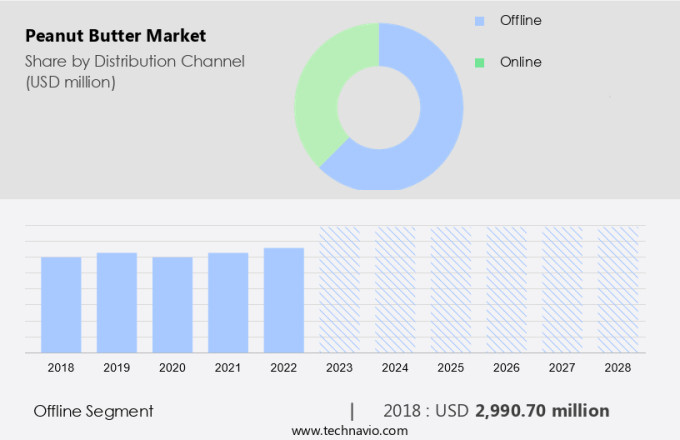

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- South America

- Europe

- UK

- France

- APAC

- China

- Middle East and Africa

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

Peanut butter is a popular health-conscious sandwich spread known for its high protein content and nutritional benefits. Consumers increasingly prefer this nutrient-dense food due to its ability to help manage obesity and reduce the risk of chronic diseases. Major retailers, including Tesco Plc (Tesco), Walmart Inc. (Walmart), and Target Corp. (Target), have recognized this trend and dedicated sections for peanut butter products in their department stores, supermarkets, hypermarkets, convenience stores, and restaurants. companies employ marketing strategies such as branding through signages and discounts on product packages to attract customers. Walmart and Walgreens are long-standing sellers of peanut butter, while the organized retail sector's growth is driven by factors such as geographical presence, ease of production and inventory management, and goods transportation. Supermarkets and hypermarkets feature dedicated aisles for peanut butter, enhancing product visibility and accessibility.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 2.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, Canada, Mexico, and the United States are the primary markets for the expansion of the peanut butter industry. Peanuts are the most popular nut type consumed in the region, and peanut butter is a significant portion of peanut consumption. This region's major consumption occurs primarily as a breakfast and lunch spread. Peanut butter's appeal to the millennial demographic is due to its convenience and health benefits. The United States is the leading producer and consumer of peanut butter in the region, with nearly half of the population deriving their peanut intake from it. The preference for plant-based diets and clean-label foods has influenced the market's growth.

Additionally, consumers are increasingly seeking non-GMO and gluten-free options. E-commerce platforms have made it easier for customers to purchase natural ingredients, including organic peanut butter, which aligns with current organic trends. Peanut oil is another popular ingredient in peanut butter, adding to its health benefits. On-the-go food preferences have also contributed to the market's growth. Peanut butter's versatility makes it an ideal choice for quick snacks and meals. As a result, the market is expected to continue its expansion in the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Peanut Butter Market?

Health benefits associated with peanut butter are the key driver of the market.

- Peanut butter, a popular B2C food item, is beloved by many in the US, particularly within nuclear families. This nutrient-dense, high-protein food is a staple for breakfast items and is known for its crunchy texture. Organic and natural peanut butter varieties are increasingly preferred due to their health benefits. Peanuts, the primary ingredient in peanut butter, offer a wealth of essential nutrients, including vitamins, dietary fiber, and minerals like potassium and magnesium. Peanut butter boasts a protein content higher than other nuts such as hazelnuts, almonds, and cashew nuts.

- Additionally, the health advantages of peanut butter extend beyond basic nutrition. It is believed to have disease-prevention properties, contributing to improved health and antioxidant properties that help combat fatal diseases like cancer and degenerative conditions. Regular consumption of peanut butter is also linked to healthy bone and muscle growth. Moreover, peanut butter is a low-calorie food that aids in weight loss and reduces the risk of gallstones and Type II diabetes. As a versatile spread, it can be incorporated into various dishes, making it a valuable addition to any diet.

What are the market trends shaping the Peanut Butter Market?

Peanut butter as an ingredient in snacks is the upcoming trend in the market.

- Peanut butter has emerged as a popular ingredient in various snack manufacturing processes due to the shift in consumer preferences toward healthier options. The health-conscious population's demand for nutritious snacks has led to an increase in peanut butter's usage in chocolates, biscuits, cookies, snack bars, cheesecakes, milkshakes, and buttermilk. Oreo, a renowned biscuit manufacturer, has introduced peanut butter as a flavor in their biscuits and snack bars. Peanut butter is also used in the production of salted corn and butter puffs by the brand Whole Earth. The versatility of peanut butter in snack manufacturing is evident in its widespread usage, catering to the growing demand for healthier snacking alternatives.

- Additionally, with convenience stores and online platforms offering easy access to these peanut butter-infused snacks, the market for peanut butter is expected to continue its growth trajectory. However, it is essential to note that peanut allergy remains a concern for some consumers, and manufacturers must ensure proper labeling and precautions to cater to this segment of the population.

What challenges does Peanut Butter Market face during the growth?

The risk of allergic reactions is a key challenge affecting the market growth.

- Peanut butter, a popular Western food trend, has gained significant attention among health-conscious consumers in the US market due to its organic offerings. Organic peanut butter, free from synthetic additives and pesticides, is increasingly preferred by those seeking plant-based protein sources. Chocolate-flavored and honey-flavored varieties add taste appeal to this nutritious spread. Single-serve packaging and online shopping have facilitated convenient access to peanut butter for consumers. Food safety regulations are strictly enforced to ensure the safety and quality of these products. With the rise of plant-based protein consumption, peanut butter demand continues to grow.

- However, the prevalence of peanut and peanut butter allergies in the US is a concern, with reactions triggered by skin contact or ingestion of trace amounts. The production process of peanuts, including the use of pesticides, has been identified as a potential contributor to these allergies. Consumers are advised to read labels carefully and choose organic, additive-free options to minimize risks. Peanut allergies, among the most common food allergies in the US, can develop at any age and last a lifetime. The US Food and Drug Administration (FDA) regulates food safety to protect consumers from potential allergens. Adhering to these regulations is crucial for maintaining consumer trust and ensuring product quality.

- In conclusion, the demand for organic, plant-based peanut butter continues to grow in the US market, driven by health-conscious consumers and the convenience of single-serve packaging and online shopping. Food safety regulations play a vital role in maintaining consumer trust and ensuring the safety and quality of these products. Consumers with peanut allergies are advised to choose organic, additive-free options to minimize risks.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Algood Food Co.

- China Kunyu Industrial Co. Ltd.

- Dr. August Oetker KG

- Galdisa USA Inc.

- Hormel Foods Corp.

- ManiLife

- Mars Inc.

- Nuts N More

- NuttZo LLC

- Peanut Butter and Co.

- Pip and Nut Ltd.

- Post Holdings Inc.

- Sonya Foods Pvt. Ltd.

- The Hain Celestial Group Inc.

- The J.M Smucker Co.

- The Kraft Heinz Co.

- The Kroger Co.

- The Leavitt Corp.

- Unilever PLC

- Windmill Organics Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Peanut butter, a popular sandwich spread, has gained significant traction in the food industry due to its nutritional benefits. With an increasing number of health-conscious consumers, the demand for high-protein, nutrient-dense foods has grown. Peanut butter, rich in protein and healthy fats, is a preferred choice for those following high-protein dietary plans. Obesity and chronic diseases have become major health concerns, leading consumers to opt for nutrient spreads that offer health benefits. Peanut butter, free from preservatives and often available in natural and organic varieties, caters to the clean-label trend. The market is witnessing growth due to the convenience factor.

Additionally, with the rise of nuclear families and on-the-go food preferences, peanut butter's versatility as a quick meal or snack option makes it a popular choice. Plant-based diets and food trends favoring natural ingredients have boosted the market for peanut butter. Consumers are increasingly opting for non-GMO, gluten-free, and organic options. Peanut oil, a key ingredient, adds to its health benefits. E-commerce platforms and online shopping have made it easier for consumers to access peanut butter, including single-serve packaging and various flavors like chocolate and honey-flavored. Food safety regulations ensure the production of safe and healthy peanut butter. Peanut allergy is a concern, but innovations in snack alternatives and the availability of smooth and crunchy textures cater to diverse consumer preferences. The market is expected to continue growing, driven by consumer diets and Western food trends.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2024-2028 |

USD 1.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, Canada, UK, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, South America, Europe, APAC, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch