Europe Data Center Market Size 2025-2029

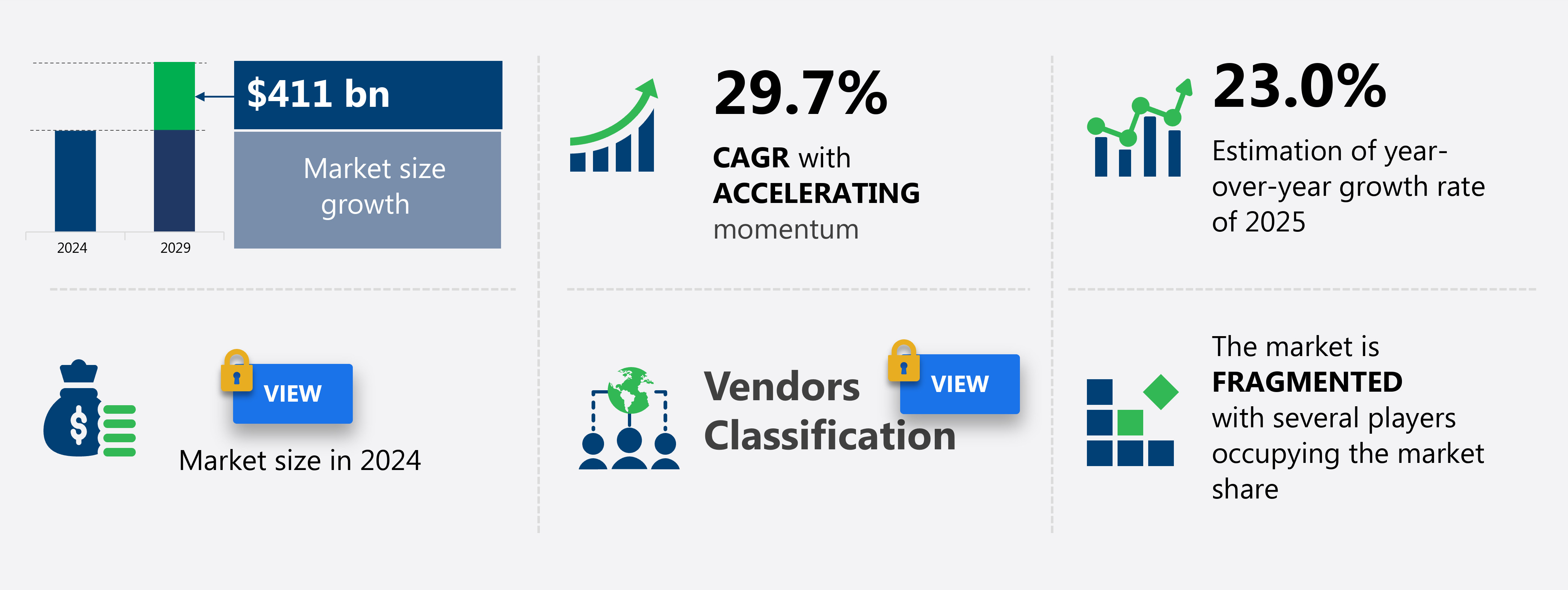

The europe data center market size is forecast to increase by USD 411 billion at a CAGR of 29.7% between 2024 and 2029.

- The European data center market is experiencing significant shifts driven by the increasing adoption of cloud services and the growing importance of data protection regulations. Businesses are increasingly turning to hybrid and multi-cloud environments to optimize their IT infrastructure and improve agility. This trend is expected to continue, as cloud services offer scalability, flexibility, and cost savings. However, the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), poses a challenge for data center operators. Compliance with these regulations requires robust security measures and significant investments in technology and personnel. Another major challenge for the European data center market is the increasing threat of cyber attacks.

- With the growing amount of sensitive data being stored and processed in data centers, cyber security has become a top priority. Data centers must invest in advanced security solutions to protect against cyber threats and ensure the confidentiality, integrity, and availability of their clients' data. Despite these challenges, the European data center market offers significant opportunities for growth. Companies that can effectively navigate these challenges and provide secure, reliable, and cost-effective data center solutions will be well-positioned to capitalize on the growing demand for cloud services and data protection compliance.

What will be the size of the Europe Data Center Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The European data center market is witnessing significant advancements, with the adoption of micro data centers and software-defined data centers (SDDCs) gaining traction. Data center investment continues to flow in, with Real Estate Investment Trusts (REITs) playing a pivotal role. Liquid cooling and immersion cooling are revolutionizing cooling systems, enhancing efficiency and reducing energy consumption. Data center innovation is at the forefront, with trends such as data center interoperability, compliance, and audit gaining importance.

- Hyperscale data centers and edge data centers are shaping the future of the industry, while data center orchestration is streamlining operations. Data center standards are evolving to address these trends, ensuring seamless integration and optimal performance.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Medium and small enterprises

- Large enterprises

- Component

- IT infrastructure

- Power management

- Cooling solutions

- General construction

- Others

- Type

- Hyperscale

- Retail

- Wholesale

- Sector

- BFSI

- Cloud

- E-commerce

- Government

- Others

- Geography

- Europe

- France

- Germany

- The Netherlands

- UK

- Europe

By End-user Insights

The medium and small enterprises segment is estimated to witness significant growth during the forecast period.

The European data center market is experiencing significant growth due to the increasing adoption of artificial intelligence and IT outsourcing. As businesses increasingly rely on data to drive decision-making and remain competitive, there is a rising demand for advanced data center infrastructure. Cooling systems, fiber optic cables, server racks, and other essential components are in high demand. Data center services, including disaster recovery and business continuity solutions, are crucial for organizations seeking to ensure data availability and minimize downtime. Data analytics and machine learning are also driving demand for data center upgrades and expansions. Data center staffing and operations are becoming more complex, necessitating specialized skills and expertise.

Uptime Institute's tier certification is a recognized standard for measuring a data center's reliability and performance. Energy efficiency and green data centers are becoming increasingly important, with providers investing in precision cooling and capacity planning to reduce energy consumption and carbon emissions. Data center design and optimization are also key areas of focus, with providers offering managed services and network switches to help businesses maximize their IT infrastructure's potential. Modular data centers and data center interconnection are also gaining popularity, enabling businesses to scale their operations and improve network connectivity. Data center construction and decommissioning are ongoing processes, with providers offering solutions for both new builds and end-of-life data center disposal.

Power distribution units and uninterruptible power supplies are essential components of any data center infrastructure, ensuring uninterrupted power supply and protecting against power outages. Data center security and monitoring software are also critical, with providers offering advanced solutions to protect against cyber threats and ensure data privacy. Cloud computing is a major trend in the data center market, with providers offering a range of cloud services to meet varying business needs. Data center expansions and relocations are also common, with providers offering managed services and expertise to help businesses navigate these complex processes. In conclusion, the European data center market is dynamic and evolving, with a focus on advanced infrastructure, energy efficiency, and data security.

Providers are offering a range of solutions to meet the varying needs of businesses, from small and medium-sized enterprises to large corporations. Data center services, colocation, managed hosting, and cloud computing are all key areas of growth, with providers investing in innovation and expertise to stay competitive.

The Medium and small enterprises segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Europe Data Center Market market drivers leading to the rise in adoption of the Industry?

- The implementation of data protection regulations serves as the primary catalyst for market growth.

- The European data center market is experiencing significant growth due to the implementation of the General Data Protection Regulation (GDPR) Act 2016/679. This regulation, which is part of EU law, ensures the protection of personal data and privacy for individuals within Europe. To maintain a consistent level of protection, the regulation requires micro, small, and medium-sized enterprises to provide the same level of rights and responsibilities for personal data monitoring across all EU member states. Colocation services, which allow businesses to rent space and housing for their servers, equipment, and connectivity in a third-party data center, are becoming increasingly popular in Europe.

- Business continuity, a critical aspect of data center operations, is a major concern for companies, leading to the demand for advanced data center design, optimization, and network switches. Cloud computing, a technology that delivers on-demand computing resources over the internet, is also driving the market. Data center expansions and relocations are common as businesses seek to accommodate their growing data needs and improve operational efficiency. Modular data centers, which are pre-fabricated and can be easily expanded or contracted, offer a flexible solution for businesses. Machine learning, a subset of artificial intelligence, is being used to optimize data center operations, including predictive maintenance and energy management.

- Tier certification, which rates data centers based on their infrastructure reliability and capacity, is another factor influencing the market. In conclusion, the European data center market is being fueled by the need for data protection, business continuity, and operational efficiency. The use of advanced technologies such as machine learning, cloud computing, and modular data centers is driving innovation and growth in the market.

What are the Europe Data Center Market market trends shaping the Industry?

- The trend in IT infrastructure is shifting towards hybrid and multi-cloud environments. As a professional, I can confirm that this is a significant market development.

- The European data center market has witnessed notable growth in the adoption of modular data centers over the past five years. These pre-fabricated data centers offer enterprises a flexible and scalable IT infrastructure, enabling them to efficiently respond to changing business requirements. Flexenclosure and Schneider Electric are among the providers offering modular data center solutions in Europe. The European market is being driven by both commercial and governmental initiatives, which emphasize energy efficiency, green data centers, data center automation, and data center maintenance.

- Modular data centers are also integral to the emerging trend of edge computing, which brings data processing closer to the source to reduce latency. Additionally, data center certification is a critical factor in ensuring compliance with industry standards and best practices. Data center management, including automation and maintenance, is essential to optimizing operational efficiency and reducing costs.

How does Europe Data Center Market market faces challenges face during its growth?

- Cybersecurity challenges pose a significant threat to industry growth, requiring robust measures to protect against data breaches, hacking attempts, and other digital risks.

- In Europe, the importance of data center security is paramount due to the increasing value of data and the proliferation of cloud computing. Cybersecurity has emerged as a major concern in the data center market as these facilities become prime targets for cybercriminals. The European Union (EU) has taken steps to address this issue through regulations such as the General Data Protection Regulation (GDPR), which mandates data center operators to implement robust technical and organizational safeguards to secure personal data. Artificial intelligence and data analytics are driving the demand for advanced data center services, including disaster recovery and IT outsourcing.

- Data center infrastructure upgrades, such as cooling systems and fiber optic cables, are essential to support the growing workload and ensure optimal performance. Data center staffing remains a critical factor in ensuring the efficient operation of these facilities. Efficient cooling systems are crucial in maintaining the optimal temperature and humidity levels in data centers, ensuring the longevity of server racks and preventing overheating. Fiber optic cables provide high-speed connectivity, enabling businesses to leverage advanced data analytics and artificial intelligence applications. In conclusion, the European data center market is dynamic, with a focus on data security, advanced technologies, and regulatory compliance.

- Data center operators must invest in upgrading their infrastructure and implementing robust cybersecurity measures to meet the evolving needs of businesses and regulatory requirements.

Exclusive Europe Data Center Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Cogeco Communications Inc.

- Colt Technology Services Group Ltd.

- Data4 Group

- Deutsche Telekom AG

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Ltd.

- GTT Communications Inc.

- International Business Machines Corp.

- Meta Platforms Inc.

- Microsoft Corp.

- NTT Communications Corp.

- Pulsant Ltd.

- QTS Realty Trust LLC

- SITRONICS JSC

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center Market In Europe

- In March 2023, Equinix, a leading global data center provider, announced the acquisition of TelecityGroup, a European data center operator, for approximately â¬3.6 billion. This deal expanded Equinix's European footprint, adding 45 data centers and over 1,200 customers (Equinix Press Release, 2023).

- In June 2024, Google and Microsoft, two tech giants, announced a strategic partnership to build subsea cables connecting their data centers in the US and Europe. This collaboration aims to enhance the connectivity and reduce latency for their cloud services (Google Press Release, 2024).

- In September 2024, NTT Communications, a Japanese telecommunications company, unveiled its new hyperscale data center in the UK, with a capacity of 30 MW and an investment of £1 billion. This expansion strengthened NTT's position in the European market (NTT Communications Press Release, 2024).

- In January 2025, the European Union introduced the Data Act, a new regulation aimed at increasing data sovereignty and promoting the use of European data centers. The legislation requires companies to store certain types of data within the EU, potentially driving demand for local data centers (European Commission Press Release, 2025).

Research Analyst Overview

The European data center market continues to evolve, driven by the ever-increasing demand for digital transformation and data-intensive applications across various sectors. Managed services and data center operations remain at the core of this dynamic market, with a focus on energy efficiency and sustainability. Green data centers and data center automation are gaining traction, as organizations seek to reduce their carbon footprint and optimize their infrastructure. Data center maintenance and certification are essential components of ensuring uptime and reliability, while edge computing and data center management enable businesses to extend their reach and improve performance. Data analytics, machine learning, and artificial intelligence are transforming data center operations, enabling more efficient capacity planning and optimizing power distribution units.

The market is also witnessing an increase in data center expansions, relocations, and upgrades, driven by the growing importance of business continuity and disaster recovery. Data center design and construction continue to evolve, with a focus on modular data centers and data center interconnection, enabling improved network infrastructure and precision cooling. The ongoing unfolding of market activities and evolving patterns underscore the importance of staying informed and adaptive in this continuously changing landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.7% |

|

Market growth 2025-2029 |

USD 411 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch