Data Center Transformation Market Size 2024-2028

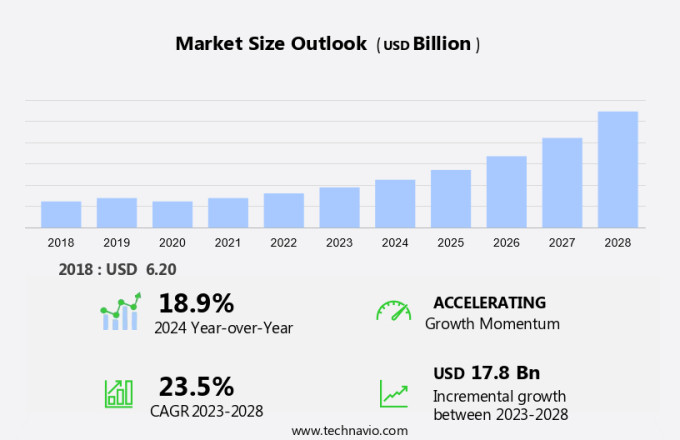

The data center transformation market size is forecast to increase by USD 17.8 billion at a CAGR of 23.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. Hyperscalers' demand for data centers is expanding, leading to increased construction and optimization of these facilities. Data center infrastructure management (DCIM) and automation are becoming increasingly popular to optimize IT resources and improve overall efficiency. Security concerns, particularly around server security, are also driving market growth. Additionally, the trend toward cloud computing and data center colocation is continuing, with businesses seeking to leverage the benefits of cloud services while maintaining control over their data. Proactive maintenance and optimization of the data center ecosystem are essential to ensure business continuity and mitigate potential risks. As the market evolves, organizations must stay informed about the latest trends and challenges to make informed decisions about their data center strategies.

What will be the Size of the Market During the Forecast Period?

-

Data centers play a crucial role in the digital transformation of businesses, enabling the deployment and operation of IT resources, including cloud-based architectures and on-premises systems. The landscape is evolving, with an increasing focus on proactive maintenance, data security, and IT resources optimization. Data Center Infrastructure Management (DCIM) is a key aspect of data center transformation. DCIM tools help organizations manage their ecosystem, ensuring efficient use of resources and reducing downtime. Proactive maintenance, achieved through DCIM, is essential for minimizing disruptions and ensuring program availability. Data security is another critical concern for businesses undergoing data center transformation. With the rise of cloud traffic and the Internet of Things (IoT), securing data centers against cyber threats is more important than ever. Software-optimized data centers and IT infrastructures can help mitigate risks, ensuring data privacy and compliance.

-

Similarly, data center relocation is another trend. As businesses grow, they may need to move their data centers to accommodate their expanding IT needs. Colocation providers offer solutions for businesses looking to relocate their data centers, providing access to cloud service providers and enterprise resource planning (ERP) systems. Cloud-based architectures and SaaS-based applications are driving data center traffic, necessitating the optimization of data centers to handle increased demand. Big data analytics is another factor contributing to transformation, requiring large amounts of storage and processing power. IT infrastructure optimization is a key objective for businesses undergoing transformation. Local data centers offer the advantage of reduced latency and improved performance for applications that require real-time processing. Data center services, including hardware configurations and cooling systems, are essential for optimizing IT infrastructures. Moreover, cloud traffic, IoT devices, and big data analytics all contribute to this complexity.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Servers

- Power management

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

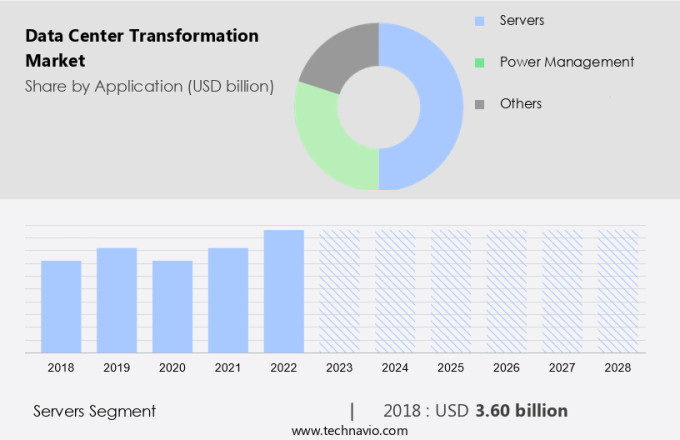

- The servers segment is estimated to witness significant growth during the forecast period.

Data centers are essential infrastructure for businesses to manage and process their IT resources effectively. Servers, a key component of data centers, facilitate the running of applications, data processing, and data storage. Servers comprise processors, memory, network, and various ports. They can function as storage servers by integrating direct-attached storage (DAS), network-attached storage (NAS), or storage-attached network (SAN) devices. In today's digital landscape, data centers undergo continuous transformation to optimize IT resources and enhance data security. Cloud computing has significantly impacted the data center ecosystem, leading to the adoption of cloud services, colocation, and data center relocation. Proactive maintenance is a crucial aspect of data center optimization, ensuring uninterrupted operations and minimizing downtime.

Furthermore, web servers, a type of data center server, are responsible for hosting domain names and IP addresses. They utilize hypertext transfer protocol and client/server model to gather content from a website page and deliver it to users. Other data center servers include application servers, database servers, and file servers, each designed to perform specific functions within the data center infrastructure. As businesses prioritize data security and optimization, data center transformation becomes an essential strategy.

Get a glance at the market report of share of various segments Request Free Sample

The servers segment was valued at USD 3.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

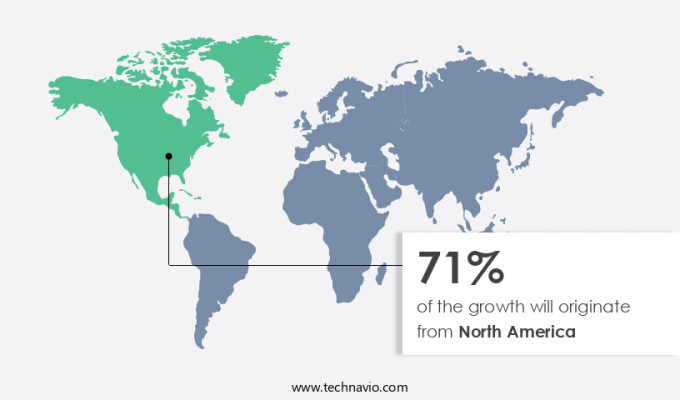

- North America is estimated to contribute 71% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market has experienced significant growth due to the increasing demand for advanced IT infrastructure and the region's dominance in cloud computing, artificial intelligence, and IoT applications. Companies in sectors such as technology, finance, and healthcare are investing heavily in data center modernization to ensure scalability, flexibility, and data security. The shift to remote work models as a result of the COVID-19 pandemic has accelerated the need for improved data storage and processing capabilities, leading organizations to prioritize transformation strategies that include cloud migration, edge computing, and virtualization. Furthermore, the government's focus on cybersecurity and data protection has spurred investments in secure data infrastructure, adding momentum to the market.

Furthermore, cloud-based architectures, such as SaaS-based applications, are increasingly popular as they offer cost savings and ease of use. The increasing volume of cloud traffic and the integration of IoT devices generate massive amounts of data, necessitating big data analytics capabilities. Cloud service providers play a crucial role in facilitating these transformations, offering managed services and advanced technologies to help organizations navigate the complexities of data center modernization.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Data Center Transformation Market?

Demand planning and expansion by hyperscalers is the key driver of the market.

- The market is projected to expand significantly over the coming years due to the rising demand for advanced IT infrastructure solutions from Colocation Providers and Enterprises. Enterprise Resource Planning (ERP) systems are increasingly relying on strong Data Backup Services and Disaster Recovery solutions to ensure business continuity. This, in turn, is driving the need for optimization and consolidation services to enhance infrastructure efficiency.

- Furthermore, the adoption of Automation Services and Infrastructure Management Services is on the rise to reduce operational costs and improve agility. Physical Security remains a top priority, with advanced access control systems and surveillance technologies being implemented to safeguard critical data. The increasing number of hyperscale data centers (HDCs) globally, estimated to be over 600 as of 2022, will further fuel market growth.

What are the market trends shaping the Data Center Transformation Market?

Increased use of DCIM and automation is the upcoming trend in the market.

- The Shift Towards Advanced Data Center Management Solutions Data Center Infrastructure Management (DCIM) software has become a crucial component in managing modern data center facilities. This software enables remote monitoring and management of the entire data center infrastructure, including program availability, hardware configurations, and environmental factors. companies are increasingly offering advanced DCIM solutions to cater to the growing demands for energy efficiency and reduced carbon emissions. The integration of DCIM systems in colocation data centers is a significant trend, allowing infrastructure service providers to monitor key data center ambient factors such as temperature, humidity, and power consumption remotely.

- These advanced systems provide predictive analysis to prevent system failures and minimize maintenance costs. Cloud services, IT and telecommunications, oil and gas, and e-commerce industries are among the major adopters of DCIM solutions due to their data-intensive nature. DCIM software's ability to optimize energy usage and reduce operational costs makes it an essential investment for these industries. Despite the higher Capital Expenditure (CAPEX) associated with these advanced technologies, the benefits of DCIM software outweigh the costs. The growing emphasis on data security and regulatory compliance further strengthens the need for DCIM solutions in data center operations. In summary, DCIM software plays a pivotal role in transforming data center infrastructure, enabling remote management, predictive analysis, and energy efficiency.

What challenges does Data Center Transformation Market face during its growth?

Growing concerns over server security is a key challenge affecting the market growth.

- In today's digital landscape, the integration of telecommunication technologies, such as 5G, and emerging trends like edge computing, hybrid cloud, and digital transformation, have significantly impacted IT infrastructures. The proliferation of connected devices and cloud computing has led to an increased reliance on cloud infrastructure and software-optimized data centers. However, this shift brings new challenges, particularly in the realm of cybersecurity. As enterprises move toward cloud services and the Internet of Things (IoT), they face an elevated risk of cyber-attacks.

- Cybercriminals are increasingly targeting IT infrastructures, exploiting vulnerabilities to gain unauthorized access to enterprise servers. These attacks can result in significant data breaches, compromising sensitive information for extended periods and potentially leading to the shutdown of small businesses. Strict data protection regulations, such as the General Data Protection Regulation (GDPR), are being enforced to mitigate these risks. To address these challenges, organizations must invest in strong cybersecurity measures and stay updated on the latest security best practices.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Arctiq

- Atos SE

- Bytes Technology Group Plc

- Cisco Systems Inc.

- Dell Technologies Inc.

- General Datatech LP

- GreenPages Inc.

- HCL Technologies Ltd.

- InknowTech Pvt. Ltd

- International Business Machines Corp.

- Microsoft Corp.

- Mindteck India Ltd.

- Nippon Telegraph and Telephone Corp.

- Open Text Corp.

- Rahi Systems

- Schneider Electric SE

- Tech Mahindra Ltd.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Data centers have undergone significant transformation in recent years, driven by the increasing adoption of cloud computing and digital transformation initiatives. Cloud-based architectures have become a popular choice for businesses seeking to optimize their IT resources and improve data security. Proactive maintenance, optimization, and automation services have become essential for ensuring the reliability and efficiency of data centers. The ecosystem includes various stakeholders such as cloud service providers, colocation providers, system integrators, and telecommunication companies. Mid-sized data centers are a growing segment, as they offer cost advantages and flexibility for businesses. Data security is a top priority, with AI, machine learning, and other advanced technologies being used to enhance security measures.

Moreover, IoT and big data analytics are driving increased traffic, requiring optimization services and infrastructure management. Disaster recovery and data backup services are also critical components of the data center ecosystem. Physical security and consolidation services are important for ensuring the safety and efficiency of on-premises systems. Cloud traffic is expected to continue growing, with 5G technology and edge computing playing a key role in enabling faster and more efficient data transfer. Hybrid cloud solutions are becoming increasingly popular, allowing businesses to leverage the benefits of both cloud and on-premises systems. IT infrastructure optimization is a key focus area, with software-optimized data centers and local data centers becoming more common.

Furthermore, ERP systems and SaaS-based applications are driving demand for these services, while connected devices and program availability require strong infrastructure and reliable hardware configurations. The IT and telecommunications industries, including oil and gas and e-commerce, are major consumers of these services. Disaster recovery and business continuity are critical considerations for all organizations, making these services an essential component of digital transformation initiatives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.5% |

|

Market Growth 2024-2028 |

USD 17.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.9 |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch