Desiccants Market Size 2025-2029

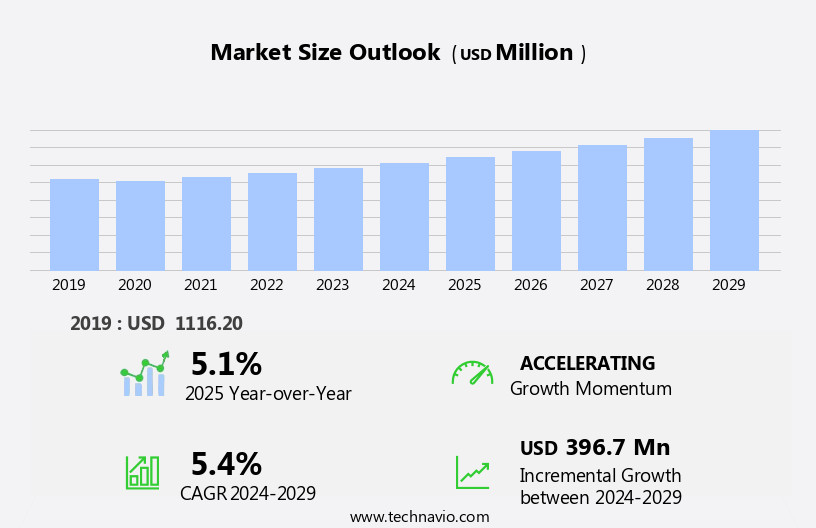

The desiccants market size is forecast to increase by USD 396.7 million, at a CAGR of 5.4% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for moisture control in various industries, particularly in packaging. This trend is driven by the need to maintain product quality and extend shelf life. Another factor fueling market growth is the rising demand for eco-friendly and biodegradable desiccants, as consumers and businesses prioritize sustainability. However, competition from alternative moisture control solutions, such as modified atmospheric packaging and refrigeration, poses a challenge to market growth. Producers must innovate and differentiate their offerings to remain competitive in this market. Overall, the market is expected to continue its expansion in the coming years, driven by these key trends and challenges.

What will be the Size of the Desiccants Market During the Forecast Period?

- The desiccant market encompasses a range of moisture absorption technologies and applications, primarily focused on humidity control for product preservation. Key industries include food packaging, pharmaceutical, and agricultural sectors, where desiccants mitigate moisture damage and ensure product shelf life extension. Desiccants come in various forms, such as humidity indicator cards, moisture absorbers, and desiccant bags, each designed for specific applications. Market dynamics reflect increasing demand for sustainable packaging solutions, with a focus on innovation and environmental protection. Regulations play a crucial role in shaping the desiccant industry, particularly in areas of safety and product quality assurance.

- Desiccant materials continue to evolve, with ongoing research into new moisture absorption technologies and materials. Desiccant suppliers and manufacturers cater to diverse client needs, offering customized solutions for humidity control. The final product cost is influenced by factors such as desiccant type, manufacturing process, and application requirements. As consumers prioritize healthy lifestyles and demand high-quality products, desiccants remain an essential component of various industries' packaging strategies.

How is this Desiccants Industry segmented and which is the largest segment?

The desiccants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Silica gel

- Clay desiccants

- Molecular sieves

- Calcium chloride

- Activated carbon

- End-user

- Food packaging

- Pharmaceuticals

- Electronics

- Automotive

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Spain

- South America

- Middle East and Africa

- APAC

By Type Insights

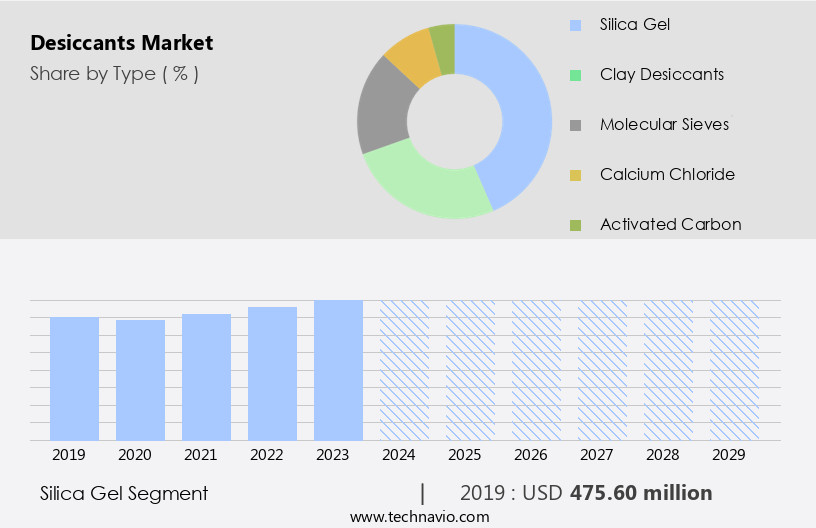

- The silica gel segment is estimated to witness significant growth during the forecast period.

Silica gel is a significant segment In the market, renowned for its superior moisture absorption properties. This desiccant is extensively used across various industries due to its effectiveness in maintaining low humidity levels, ensuring product integrity and longevity. In food packaging, silica gel is indispensable, preserving the freshness and quality of perishable goods such as snacks and dried fruits by inhibiting moisture-related spoilage. The pharmaceutical sector relies heavily on silica gel to safeguard medications from moisture, which can adversely impact their efficacy and shelf life. Other industries, including medical devices, air conditioning systems, and insulated windows, also employ silica gel for moisture control.

Zeolites and other dehydrating agents are additional desiccants used in diverse applications, from chemical assimilation and food processing to moisture-proof product packaging and humidity control in electronic equipment. The market encompasses a wide range of applications, driven by the need for moisture control in various industries and consumer consciousness for product preservation and healthier lifestyles. The market is subject to stringent rules and regulations, particularly In the pharmaceutical and healthcare sectors, to ensure product safety and efficacy. Silica gel desiccants, along with other desiccants like calcium chloride and activated alumina, play a pivotal role in maintaining the required moisture levels in various applications, from food processing and packaging to medical devices and electronics.

Get a glance at the Desiccants Industry report of share of various segments Request Free Sample

The silica gel segment was valued at USD 475.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

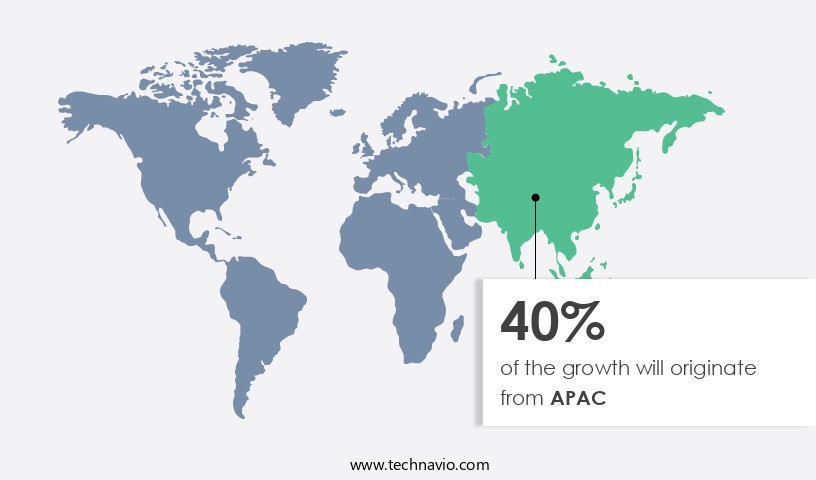

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) region leads The market due to industrialization, urbanization, and expanding manufacturing sectors. Key economies, such as China, India, Japan, and South Korea, drive demand in industries like food packaging, pharmaceuticals, automotive, and electronics. In India, the food and beverage packaging market is projected to grow from USD 33 billion in 2023 to USD 46 billion by 2028. Desiccants are essential for these industries to maintain product quality and shelf life by controlling moisture. Silica gel, zeolites, calcium chloride, and activated alumina are common desiccants used in various applications. Effective moisture control is crucial for industries dealing with fragile products, such as medicines, insulated windows, and electronic components, to prevent moisture damage and ensure compliance with stringent rules.

Desiccants are also used in air conditioning systems, moisture-proof product packaging, and e-commerce to maintain product quality and extend shelf life. The market is cost-effective and sustainable, making it an attractive solution for food processing, nutritional value preservation, and exports. Desiccants work through physical absorption and chemical assimilation, making them effective in various climatic conditions. They are also used in vaccine production, medical devices, and dried fruits. However, material shortages and environmental impact are concerns that need to be addressed.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Desiccants Industry?

Increasing demand for moisture control in packaging is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for moisture control in various industries, particularly in food and beverage, pharmaceuticals, and electronics. Desiccants, such as silica gel and zeolites, play a vital role in preserving product quality and preventing damage caused by moisture. In food packaging, desiccants help maintain a dry environment, ensuring that perishable items like dried fruits, snacks, and cereals remain fresh and retain their nutritional value for extended periods. This not only reduces waste but also enhances consumer satisfaction. In the pharmaceutical sector, desiccants are used to prevent moisture-induced damage to medical devices and medicines, ensuring their efficacy and compliance with stringent rules.

- Additionally, desiccants are employed in air conditioning systems and insulated windows to control humidity levels, minimizing economic losses due to moisture damage. As consumer consciousness towards healthier lifestyles grows, the demand for cost-effective and sustainable desiccant solutions is increasing. Desiccants also serve as crucial dehydrating agents in food processing, ensuring the safety and shelf life of processed foods. The market's growth is further driven by the need for moisture barriers in e-commerce and transportation to prevent spoilage and damage to fragile products. Despite the environmental impact and material shortage concerns, desiccants remain a cost-effective and essential solution for moisture control.

What are the market trends shaping the Desiccants Industry?

Rising demand for eco-friendly and biodegradable desiccants is the upcoming market trend.

- The market is experiencing a shift towards eco-friendly and sustainable solutions due to stricter regulations and consumer consciousness. Natural desiccants derived from biodegradable clay, starch-based polymers, and alternative silica sources are gaining popularity. The food, healthcare, electronics, and packaging industries are major consumers of desiccants, with a focus on maintaining quality and extending shelf life. Key industries include food processing, medical devices, and air conditioning systems.

- Desiccants play a crucial role in preventing moisture damage, degradation, and spoilage, especially for fragile products like medicine, snacks, dried fruits, and vaccines. The market is driven by the need for cost-effective, high-efficacy solutions that comply with stringent rules and meet quality standards. Research and development in desiccant wheel dryers, oxidation inhibitors, and active packaging solutions continue to shape the market landscape.

What challenges does the Desiccants Industry face during its growth?

Competition from alternative moisture control solutions is a key challenge affecting the industry growth.

- The market faces growing competition from alternative moisture control solutions, such as moisture barrier films and anti-humidity sachets. These alternatives offer comparable or superior performance in specific applications, making them attractive options for businesses. For instance, moisture barrier films create a physical barrier against moisture, effectively protecting products requiring long-term storage or sensitivity to humidity. Anti-humidity sachets, on the other hand, are easy to use and versatile, gaining popularity across various industries. Silica gel desiccants remain a significant player In the market due to their efficacy in absorbing moisture. They are widely used in industries like medicine, food processing, and electronics, where maintaining quality and shelf life is crucial.

- Other desiccants, such as zeolites and calcium chloride, are also used due to their chemical assimilation properties. In the healthcare sector, desiccants play a vital role in preserving the efficacy of medical devices and pharmaceutical products by controlling humidity levels. Strict rules governing the handling and storage of these products necessitate the use of cost-effective and sustainable desiccants. Desiccants are also essential in food processing, particularly for dried fruits, snacks, and cereals, where moisture control is crucial for maintaining product quality and nutritional value. In the context of exports, desiccants help mitigate economic losses due to moisture damage during transportation.

Exclusive Customer Landscape

The desiccants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the desiccants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, desiccants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Absortech - The company offers desiccants such as AbsorGel Pouch D, AbsorGel Pouch X, AbsorTerra, AbsorGel Sheet, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGM Container Controls

- Clariant International Ltd.

- Desi Chemistry

- Desicca Chemical Pvt. Ltd.

- DesiccantPak

- Dry Pak Industries Inc.

- Evonik Industries AG

- Filtration Group

- FUJI SILYSIA CHEMICAL LTD.

- Impak Corp.

- Micro-Pak Ltd.

- OhE Chemicals Inc.

- Sanner GmbH

- Super Dry Desiccant India Pvt. Ltd.

- Topdry

- TROPACK Packmitel GmbH

- WISESORBENT TECHNOLOGY LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Desiccants are essential substances that play a crucial role in various industries by mitigating the detrimental effects of excessive moisture. These hygroscopic substances, which include silica gel, zeolites, calcium chloride, and activated alumina, among others, work by physically absorbing moisture from their surroundings. The demand for desiccants is driven by the need to maintain optimal climatic conditions in various applications. In the medical field, desiccants are used to preserve the efficacy of medicines and medical devices by preventing moisture intrusion, which can lead to degradation and spoilage. In the food industry, desiccants help preserve the nutritional value and shelf life of snacks, dried fruits, and other perishable food items.

Insulated windows, air conditioning systems, and refrigerant-based cooling systems also rely on desiccants to maintain the desired temperature and humidity levels. In the pharmaceutical industry, desiccants help maintain stringent quality standards by controlling the water content in production processes and product packaging. Desiccants are also used In the electronics industry to protect sensitive components from moisture damage. In the food processing industry, desiccants help maintain optimal moisture levels during production, ensuring consistent product quality. In the shipping industry, desiccants are used to protect fragile products from moisture damage during transportation. The use of desiccants is not limited to these industries alone.

Also, they are used In the preservation of vaccines and other biological materials, as well as In the prevention of microbial growth in various applications. In the field of active packaging solutions, desiccants are used to extend the shelf life of processed foods and prevent oxidation. Despite their numerous benefits, the use of desiccants comes with certain challenges. The cost of desiccant equipment and materials can be a significant factor In their adoption. Additionally, the environmental impact of desiccants, particularly those based on non-renewable resources, is a growing concern. To address these challenges, research and development efforts are focused on developing cost-effective, sustainable desiccant solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market Growth 2025-2029 |

USD 396.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, France, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Desiccants Market Research and Growth Report?

- CAGR of the Desiccants industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the desiccants market growth of industry companies

We can help! Our analysts can customize this desiccants market research report to meet your requirements.