Europe Diagnostic Imaging Market Size 2024-2028

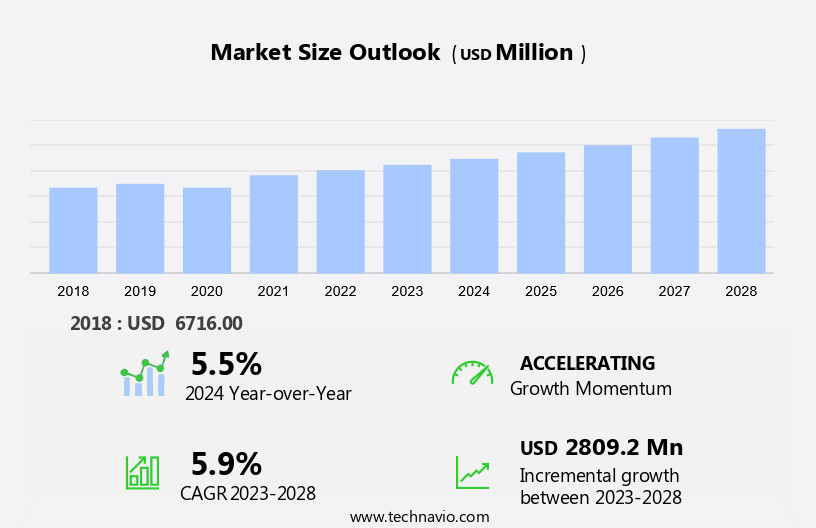

The Europe diagnostic imaging market size is forecast to increase by USD 2.81 billion at a CAGR of 5.9% between 2023 and 2028.

- The is experiencing significant growth due to the rising prevalence of chronic conditions and the integration of advanced technologies such as artificial intelligence (AI) into medical imaging. The use of AI in diagnostic imaging systems, including MRI and CT scanners, enhances image analysis and improves diagnostic accuracy. However, the high costs associated with these imaging modalities remain a challenge for the market. Digital health trends, such as telemedicine, home healthcare, remote patient monitoring, and digital radiology, are also transforming diagnostic imaging, providing greater accessibility and convenience for patients. Emerging technologies like photoacoustic imaging, digital x-ray systems, and image recognition software are further expanding the diagnostic capabilities of the market.

- Precision medicine and the use of biomarkers are also gaining traction, offering personalized treatment plans and improved patient outcomes. The market is expected to continue its growth trajectory, driven by these trends and the ongoing advancements in technology.

What will be the size of the Europe Diagnostic Imaging Market during the forecast period?

- The market is experiencing significant growth due to the rising prevalence of neurological diseases, an increasing focus on image-guided surgery, and the adoption of personalized imaging solutions. Radiology workflow optimization, imaging quality assurance, and imaging data management are key areas of investment to enhance efficiency and accuracy. Innovations in healthcare technology, such as imaging biomarkers, remote diagnostic imaging, and digital health solutions, are transforming the industry. Telemedicine adoption and the integration of artificial intelligence in imaging are also driving market expansion. The market is also witnessing a shift towards cost-effective healthcare, early detection strategies, and remote patient monitoring.

- Additionally, the aging population and the growing demand for home healthcare, geriatric care services, and hospice care are creating new opportunities. Despite these growth drivers, the market faces challenges such as diagnostic imaging restraints, healthcare workforce shortages, and diagnostic equipment hazards. Overall, the European diagnostic imaging market is poised for continued expansion, driven by advancements in medical technology, increasing healthcare accessibility, and a focus on personalized medicine and health equity.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- X-rays

- Ultrasound

- MRI scans

- CT scans

- Others

- Geography

- Europe

- Germany

- UK

- Sweden

- Europe

By Type Insights

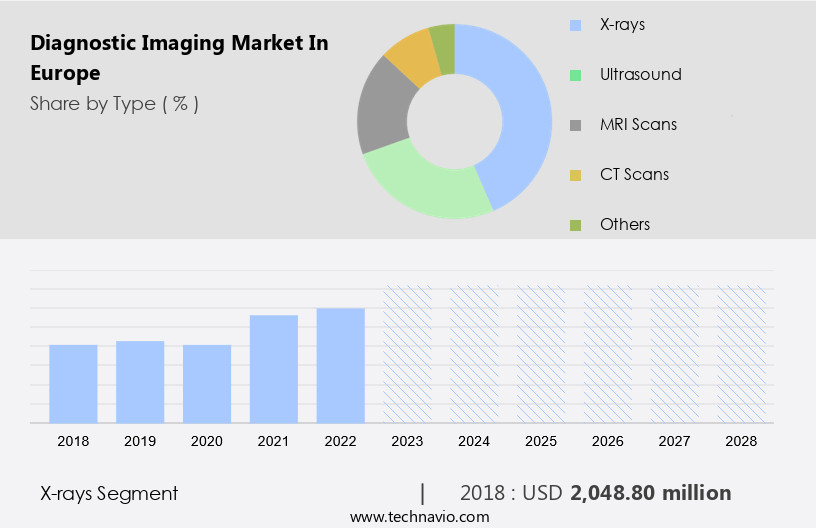

- The X-rays segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the X-ray segment. This expansion is due in part to the increasing adoption of digital radiography (DR) systems, which offer advantages over traditional X-ray systems. The demand for DR systems is driven by the need to diagnose chronic conditions, such as breast cancer and spinal disorders. Conventional X-ray systems have larger image receptors, moderate resolution, and slow processing speeds, and their use has been linked to high radiation doses, posing health risks. In Europe, the elderly population is growing, leading to an increased burden on healthcare infrastructure to diagnose and treat age-related conditions, including cardiovascular conditions, Alzheimer's disease, and trauma.

Advanced diagnostic devices, such as MRI systems, CT scanners, and ultrasound imaging, are essential for early diagnosis and effective treatment. Skilled professionals, including diagnostic medical sonographers, play a critical role in interpreting diagnostic imaging scans and providing clinical analysis. High costs and maintenance costs are significant challenges for the diagnostic imaging industry, but the potential for curative measures and treatments justifies the capital investments. Key diseases targeted by diagnostic imaging include cancer, cardiac abnormalities, aneurysms, respiratory diseases, gastrointestinal issues, and broken bones. Preventive measures and medical intervention are crucial in managing chronic illnesses and age-related conditions. The adoption rate of advanced diagnostic technologies, such as AI and 2D ultrasound, is increasing, providing opportunities for innovation and growth in the diagnostic imaging industry.

Get a glance at the market share of various segments Request Free Sample

The X-rays segment was valued at USD 2.05 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Diagnostic Imaging Market?

Increasing prevalence of chronic conditions in Europe is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of chronic conditions, such as cancer and cardiovascular diseases. According to research, in 2023, there are projected to be 1,958,310 new cancer cases and 609,820 cancer deaths. Furthermore, respiratory diseases, including chronic obstructive pulmonary disease (COPD), asthma, and lung cancer, are on the rise in Europe. This aging population requires advanced diagnostic devices to detect and diagnose these conditions, leading to increased demand for diagnostic systems, such as MRI systems, CT scanners, and diagnostic imaging scans. Diagnostic imaging equipment plays a crucial role in medical intervention, enabling early detection and preventive measures for various diseases, including cardiac abnormalities, aneurysms, and broken bones.

- Trained diagnostic medical sonographers and other skilled professionals operate these systems, providing clinical analysis and imaging technologies, such as 2D ultrasound, Doppler ultrasound, and Magnetic Resonance Imaging (MRI). The high costs associated with these capital investments and maintenance costs necessitate reimbursements from healthcare infrastructure to ensure accessibility for patients.

What are the market trends shaping the Europe Diagnostic Imaging Market?

Integration of artificial intelligence (AI) with diagnostic imaging is the upcoming trend In the market.

- The market experiences growth due to the integration of artificial intelligence (AI) in diagnostic systems. This innovation automates and standardizes complex diagnostic procedures, enhancing diagnostic equipment features and improving patient outcomes. Elderly populations, with their increased susceptibility to age-related diseases such as cancer, Alzheimer's disease, cardiovascular conditions, and respiratory diseases, are significant market drivers. High capital investments in advanced diagnostic devices like MRI systems, CT scanners, and ultrasound equipment are necessary for healthcare infrastructure to meet the demands of this aging population. The adoption rate of these advanced these solutions is increasing due to their ability to provide early and accurate diagnosis, enabling curative measures and treatments for chronic diseases like atrial fibrillation, aneurysms, and broken bones.

- Despite the high costs associated with these systems and maintenance, the benefits of early disease detection and improved patient care outweigh the expenses. Skilled professionals, including diagnostic medical sonographers, play a crucial role in the interpretation of diagnostic imaging scans, ensuring accurate clinical analysis and medical intervention. The integration of AI in imaging technologies, such as MRI and CT scans, assists these professionals by reducing human error and increasing productivity.

What challenges does Europe Diagnostic Imaging Market face during the growth?

High costs associated with diagnostic imaging is a key challenge affecting the market growth.

- The European diagnostic imaging industry is driven by the aging population and the need for early disease detection, particularly in conditions such as cancer, Alzheimer's disease, cardiovascular conditions, and trauma. Advanced diagnostic devices, including MRI systems, CT scanners, and ultrasound imaging, play a crucial role in clinical analysis and medical intervention. However, the high costs associated with these systems and related procedures can pose a challenge. These costs can increase the burden on healthcare infrastructure, including hospitals and clinics.

- The adoption rate of advanced diagnostic technologies, such as AI and 2D ultrasound, is increasing due to their ability to improve diagnostic accuracy and reduce the need for invasive procedures. Despite the high costs, the benefits of early disease detection and improved patient outcomes make them an essential component of healthcare solutions. Skilled professionals, including diagnostic medical sonographers and radiologists, are crucial in ensuring accurate and effective use of this equipment. The industry continues to evolve, with advancements in imaging technologies, such as Closed MRI and Nuclear Imaging, offering new opportunities for curative measures and treatments.

Exclusive Europe Diagnostic Imaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agfa Gevaert NV

- B.Braun SE

- Boston Scientific Corp.

- Esaote Spa

- FUJIFILM Holdings Corp.

- General Electric Co.

- Canon Inc.

- Hologic Inc.

- Konica Minolta Inc.

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Onex Corp.

- Koninklijke Philips N.V.

- Samsung Electronics Co. Ltd.

- Shimadzu Corp.

- Siemens AG

- Shanghai United Imaging Healthcare Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing burden of chronic diseases and the aging population. The elderly demographic, with its higher prevalence of cardiovascular conditions, cancer, Alzheimer's disease, and other health issues, is driving the demand for advanced diagnostic systems. These systems include Magnetic Resonance Imaging (MRI), Computed Tomography (CT) scanners, Diagnostic Imaging Equipment, and Ultrasound devices. The industry is witnessing a high adoption rate of these technologies due to their ability to provide accurate and timely diagnoses. The advanced diagnostic devices enable clinical analysis of various conditions, from cardiac abnormalities and aneurysms to respiratory diseases and gastrointestinal issues.

Moreover, the integration of Artificial Intelligence (AI) and machine learning algorithms in these systems further enhances their capabilities, allowing for faster and more precise diagnoses. The high cost of these equipment and maintenance is a significant challenge for hospitals and clinics. Capital investments in diagnostic systems require careful consideration, and healthcare infrastructure must be able to support the installation and operation of these complex machines. Reimbursements for these scans also play a crucial role in the affordability and accessibility of these services. The aging population's increasing need for medical intervention and curative measures necessitates the availability of skilled professionals to operate and maintain diagnostic equipment.

Furthermore, the technical skill required to operate these advanced systems is essential to ensure accurate diagnoses and effective treatments. The market is expected to continue its growth trajectory due to the increasing prevalence of chronic diseases and the aging population. The adoption of advanced diagnostic technologies, such as MRI systems, CT scanners, and ultrasound devices, will continue to be a key driver of market growth. The integration of AI and machine learning algorithms into diagnostic imaging systems will further enhance their capabilities and efficiency. The high cost of diagnostic imaging equipment and maintenance remains a challenge for healthcare providers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 2.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch