Dicalcium Phosphate Market Size 2025-2029

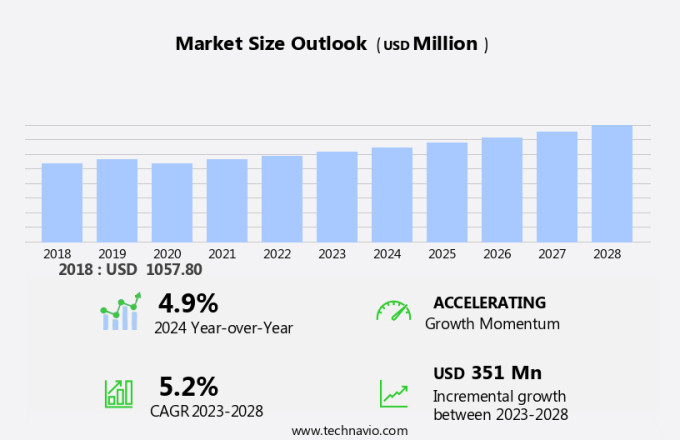

The dicalcium phosphate market size is forecast to increase by USD 379.6 million at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing focus on animal health to prevent disease outbreaks in livestock industries worldwide. The global livestock population continues to expand, leading to an escalating demand for nutritional supplements, including Dicalcium Phosphate, to maintain animal health and productivity. However, this market faces challenges from stringent regulations and policies. The intricacy of global supply chains and the risk of disease transmission have intensified, necessitating a closer examination of feed additives and their ingredients.

- Companies in this sector must navigate these regulations while also addressing the evolving needs of the animal health industry to capitalize on market opportunities and maintain a competitive edge. These regulatory frameworks aim to ensure the safety and quality of Dicalcium Phosphate production and usage, which can add complexity and costs for market participants. Additionally, in the animal feed industry, the rising livestock population and the need to provide essential nutrients for their growth and health are boosting the demand for dicalcium phosphate in livestock feed.

What will be the Size of the Dicalcium Phosphate Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Dicalcium phosphate, a crucial phosphate salt, plays a significant role in various industries, including food, pharmaceuticals, and agriculture. The market for dicalcium phosphate is driven by its applications in ph control, cellular signaling, and as an anti-caking agent in mineral supplements and food preservation. However, adverse effects such as bone resorption and drug interactions necessitate ongoing clinical trials to ensure safety profile and nutritional value. Shelf life and color retention are critical factors influencing market trends, with research focusing on improving enzyme activity and reducing environmental impact. Inorganic phosphates and phosphate esters are gaining popularity due to their versatility in applications like bone formation, cell growth, and protein synthesis.

DNA replication and RNA synthesis also benefit from the use of calcium salts, contributing to the market's growth. Waste management and acid-base balance are essential considerations in the production and application of dicalcium phosphate, with ongoing efforts to minimize environmental impact and optimize efficiency. Phosphorus compounds, including organic and inorganic types, continue to fuel market expansion, as they play essential roles in diverse industries. The market for dicalcium phosphate is expected to remain dynamic, driven by technological advancements, regulatory requirements, and evolving consumer preferences. In the healthcare sector, the focus on oral health and the production of toothpaste and dental products containing dicalcium phosphate for strengthening tooth enamel and promoting healthy gums is driving market growth.

How is this Dicalcium Phosphate Industry segmented?

The dicalcium phosphate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Agriculture

- Animal feed

- Food and beverages

- Pharmaceuticals

- Others

- Product Type

- Feed grade

- Fertilizer grade

- Food grade

- Pharmaceutical grade

- Others

- Distribution Channel

- Supermarkets or hypermarkets

- Specialty stores

- Online stores

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

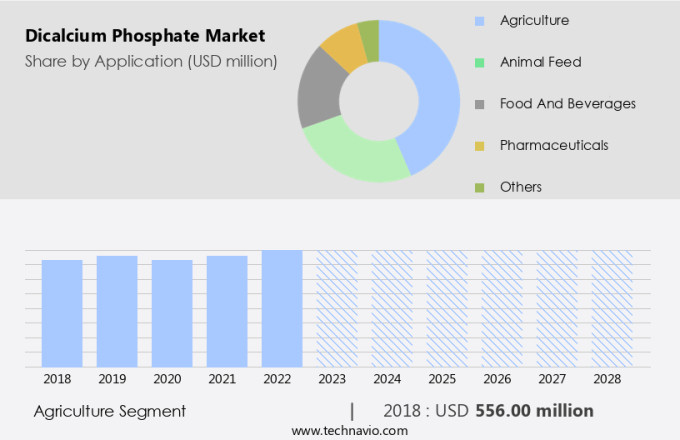

By Application Insights

The agriculture segment is estimated to witness significant growth during the forecast period. In the dynamic market for dicalcium phosphate, various industries continue to leverage its unique properties for diverse applications. The agriculture sector remains a significant driver, with dicalcium phosphate's high phosphorus content and compatibility with various soil types making it an essential component in enhancing soil fertility and crop productivity. As global food demand rises due to population growth and evolving dietary guidelines, farmers increasingly rely on phosphate-based fertilizers to boost yields and improve crop quality. Simultaneously, the livestock sector experiences sustained growth, particularly in poultry and cattle farming, fueled by rising consumption of meat, dairy, and eggs. This trend necessitates the production of nutrient-rich animal feed, where dicalcium phosphate plays a crucial role in supporting bone development, metabolic health, and reproductive efficiency in animals.

The supply chain for dicalcium phosphate remains robust, with phosphate rock as the primary raw material and various manufacturing processes ensuring quality control and consistency. The market's evolving patterns reflect the interplay of various factors, including regulatory compliance, brand loyalty, pricing strategies, and food safety concerns. However, stringent regulations and policies regarding the use of food additives and animal feed additives are challenges that market participants must navigate to ensure continued growth.

The Agriculture segment was valued at USD 580.50 million in 2019 and showed a gradual increase during the forecast period.

In the realm of pharmaceuticals and food processing, dicalcium phosphate anhydrous serves as a vital ingredient in tablet manufacturing, oral hygiene products, and dietary supplements. Its role as a buffering agent, leavening agent, and phosphate source in baking powder further expands its applications. The food industry also utilizes dicalcium phosphate as a food additive, ensuring regulatory compliance and enhancing product quality through purity analysis and particle size distribution control. In the realm of industrial applications, dicalcium phosphate finds use as a flame retardant, yeast nutrient, and in water treatment processes. The market for dicalcium phosphate is further influenced by consumer preferences and product differentiation, with monocalcium phosphate monohydrate and calcium phosphate variants catering to specific applications.

The dicalcium phosphate market is expanding steadily, driven by its versatility across industries such as agriculture, food, and pharmaceuticals. In the glass and ceramics industries, it functions as a polishing agent, enhancing the surface finish of these materials. A major trend includes the shift toward natural calcium sources like bone meal, which enhances sustainability in production. Manufacturers are also exploring combinations with tricalcium phosphate to meet varied nutritional and functional needs. In the food industry, leavening agents incorporating dicalcium phosphate are essential for consistent texture and quality in baked goods. Pharmaceutical applications focus on optimizing the dissolution rate, ensuring efficient nutrient delivery in supplements and tablets.

Regional Analysis

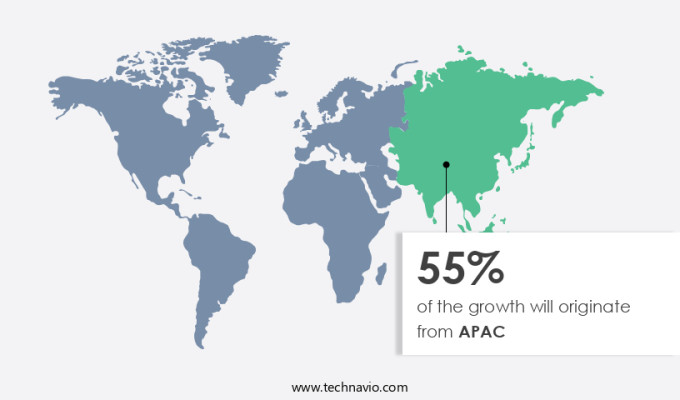

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic global market for dicalcium phosphate, various industries continue to drive demand for this versatile compound. The animal feed sector remains a significant contributor, with the rising demand for high-quality animal feed additives fueled by population growth, urbanization, and changing dietary preferences in the Asia-Pacific (APAC) region. Sustained meat consumption, particularly of poultry and pork, necessitates the use of mineral-rich feed supplements to ensure animal health and productivity. China, as the world's largest producer of swine feed and consumer of pork, plays a pivotal role in this market. Tablet manufacturing is another major application area for dicalcium phosphate, with its use as a binder, filler, and disintegrant in various dosage forms.

In the dietary supplements sector, it is employed as a source of calcium and phosphorus for bone health, often used in combination with other nutrients. Its nutrition value makes it an ideal component in dietary supplements, catering to the growing demand for health and wellness products. Beyond food and pharmaceuticals, dicalcium phosphate finds extensive use in various industries. In oral hygiene products, it functions as a buffering agent and a source of calcium and phosphate ions for tooth remineralization. Dicalcium phosphate anhydrous is a crucial ingredient in baking powder, providing leavening and buffering properties. It is also used as a flame retardant, a phosphate source in water treatment, and a nutrient enrichment agent in food processing. The compound's purity analysis is essential for ensuring regulatory compliance and maintaining brand loyalty in various applications.

The supply chain for dicalcium phosphate involves powder blending, distribution networks, and food additives manufacturing. Quality control measures, including particle size distribution, moisture content, and bulk density, are essential to ensure product consistency and food safety. In the dental industry, it is used in the production of dental cement and bone graft materials. Phosphate rock is a primary raw material for producing dicalcium phosphate through various processes, including calcination and precipitation. Calcium phosphate's versatility and wide range of applications make it a valuable commodity in various industries. Consumer preferences for healthier, more natural products and product differentiation strategies are expected to influence market trends.

Pricing strategies and regulatory compliance remain critical factors in the market's evolution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Dicalcium Phosphate market drivers leading to the rise in the adoption of Industry?

- The primary focus on enhancing animal health to prevent disease outbreaks is the primary market driver. This proactive approach is essential for maintaining the overall health and productivity of livestock populations, thereby reducing the risk of widespread illnesses and economic losses. In the animal feed industry, ensuring animal health and maintaining food safety are top priorities. The food processing industry also relies on dicalcium phosphate due to its ability to improve the texture and stability of various food products.

- Brand loyalty among consumers is a crucial factor driving the demand for high-quality dicalcium phosphate. Adhering to regulatory requirements is essential to maintain consumer trust and avoid potential health risks. As the industry continues to evolve, the focus on functional feed components, such as dicalcium phosphate, will remain a key trend in animal nutrition. Dicalcium phosphate anhydrous, a widely used feed ingredient, plays a significant role in enhancing animal health and regulatory compliance. Its high surface area and quality control make it an effective ingredient in bone health supplements, capsule filling, and flame retardants.

What are the Dicalcium Phosphate market trends shaping the Industry?

- Globally, the livestock population is experiencing a significant growth, which represents an emerging market trend. This expansion in the livestock industry holds potential opportunities for professionals in related fields. The market is experiencing significant growth due to the expanding livestock and poultry industries. The increasing global demand for meat, dairy, and eggs has led farmers to scale up their operations, resulting in a higher need for nutritionally balanced animal feed. Dicalcium phosphate is a crucial component in feed formulations due to its high bioavailability of calcium and phosphorus, which are essential minerals for bone development, fertility, and overall animal health. Its ability to improve feed efficiency and support early-stage growth in poultry and swine makes it an indispensable ingredient in modern animal husbandry.

- Moreover, dicalcium phosphate is used in various industries, including water treatment, food safety, dental cement, and nutrient enrichment. In water treatment, it serves as a phosphate removal agent, while in food safety, it acts as a buffering agent and a source of dietary phosphorus. In dental cement, it enhances the setting properties, and in nutrient enrichment, it improves the nutritional value of food products. The market's growth is driven by the increasing demand for dicalcium phosphate in these industries. The particle size distribution and bulk density of dicalcium phosphate are critical factors that determine its suitability for various applications. In the food industry, the demand for processed foods, tablets, and capsules is increasing, leading to higher usage of dicalcium phosphate as a food additive.

How does Dicalcium Phosphate market faces challenges during its growth?

- The strict regulations and policies in place pose a significant challenge to the expansion and growth of the industry. The market is subject to rigorous regulations, necessitating manufacturers to secure permits and adhere to environmental, health, and safety standards in each target market. Regulations may include product testing, certification, and inspection requirements, which undergo frequent updates, revisions, or expansions. For instance, Regulation (EC) No 1831/2003 is a significant regulation in the European Union governing feed additives. Manufacturers must stay informed of these regulations to ensure their products comply and avoid potential violations. Product differentiation is a key market dynamic, with monocalcium phosphate monohydrate and phosphoric acid being common forms.

- Dicalcium phosphate is used as a food additive for calcium supplementation and as a leavening agent. Distribution networks play a crucial role in ensuring timely and efficient delivery to meet consumer preferences. Pricing strategies are essential for maintaining competitiveness in the market. Quality assurance and stringent regulatory requirements further drive the market's growth, ensuring the production of high-quality dicalcium phosphate. Phosphate rock is the primary raw material used in the production of dicalcium phosphate, and its availability and price fluctuations impact the market's dynamics. Overall, the market for dicalcium phosphate is expected to continue its growth trajectory in the coming years.

Exclusive Customer Landscape

The dicalcium phosphate market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dicalcium phosphate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dicalcium phosphate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Compagnie Financiere et de Participations Roullier - The company specializes in Dicalcium Phosphates, essential for supporting animal growth and well-being, offering a comprehensive range of these vital nutritional supplements for the livestock industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Compagnie Financiere et de Participations Roullier

- EuroChem Group AG

- Guizhou Zerophos Chemical Co. Ltd.

- Hindustan Phosphates Pvt. Ltd.

- J.R. Simplot Co.

- Kunming Chuan Jin Nuo Chemical

- Nitta Gelatin India Ltd.

- Nutrien Ltd.

- OCP Group

- Pioneer Asia Group

- R. K. Phosphates Pvt. Ltd.

- Rubexco Pvt. Ltd.

- Shankus Bio-Sciences Pvt. Ltd.

- Sterling Biotech Ltd.

- The Mosaic Co.

- Yara International ASA

- Yunnan Phosphate Haikou Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dicalcium Phosphate Market

- In January 2024, Arla Foods Ingredients, a global supplier of dicalcium phosphate, announced the expansion of its production capacity by 15% at its facility in Denmark. This expansion aimed to cater to the growing demand for dicalcium phosphate in the food and beverage industry (Arla Foods Ingredients Press Release).

- In March 2024, FrieslandCampina, a leading dairy cooperative, entered into a strategic partnership with a leading Chinese dairy company to produce and market dicalcium phosphate in China. This collaboration aimed to strengthen FrieslandCampina's presence in the Asian market (FrieslandCampina Press Release).

- In May 2024, BASF, a global chemical producer, received regulatory approval from the European Commission for its acquisition of Solvay's phosphates business. This acquisition significantly expanded BASF's portfolio in the market (BASF Press Release).

- In April 2025, Lonza, a Swiss specialty ingredients supplier, launched a new line of organic dicalcium phosphate for use in organic food and beverage applications. This product launch catered to the increasing demand for organic food products and expanded Lonza's product offerings in the market (Lonza Press Release).

Research Analyst Overview

The market exhibits a dynamic and evolving nature, driven by various factors across multiple sectors. In the realm of agriculture, this calcium phosphate derivative finds extensive applications as a nutrient enricher in animal feed, ensuring optimal bone health and growth. Simultaneously, in the pharmaceutical industry, it serves as a crucial component in tablet manufacturing, providing essential calcium supplementation and buffering agents for dosage forms. Moreover, the water treatment sector utilizes dicalcium phosphate to enhance water quality and prevent corrosion. In the food industry, it functions as a leavening agent, a dietary supplement, and a food additive, adhering to stringent food safety regulations. The resulting compound, calcium hydroxy phosphate dihydrate, offers significant benefits in food, pharmaceutical, and industrial applications.

The dental industry leverages it for producing dental cement, while phosphate rock remains a primary source for its production. The market's continuous unfolding is characterized by ongoing research and development, focusing on improving particle size distribution, calcium phosphate purity analysis, and bulk density. Quality assurance and regulatory compliance are paramount, with a strong emphasis on consumer preferences and product differentiation. In the realm of industrial applications, dicalcium phosphate anhydrous is utilized as a flame retardant, while monocalcium phosphate monohydrate is employed in yeast nutrients. The supply chain remains intricate, with distribution networks ensuring seamless delivery and pricing strategies adapting to market fluctuations.

The market's dynamics are further influenced by technological advancements, evolving consumer trends, and regulatory frameworks. As market players navigate these complexities, they must maintain a keen focus on product innovation, quality control, and sustainability to remain competitive. The web hosting services market is rapidly advancing to meet the diverse needs of businesses and developers. Providers are focusing on customer retention by enhancing service reliability and user support. Seamless website migration and domain transfer tools simplify transitions, minimizing downtime. The adoption of cloud computing continues to rise, offering scalable and secure hosting environments. Continuous performance monitoring ensures uptime and fast load speeds, crucial for user satisfaction. Integration of data analytics enables smarter resource allocation and customer insights. Support for open source software fosters flexibility and innovation, attracting a broad developer community. Additionally, affiliate programs are gaining popularity as a strategic channel to drive growth and brand visibility in this competitive landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dicalcium Phosphate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 379.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, India, Japan, South Korea, Brazil, Germany, Australia, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dicalcium Phosphate Market Research and Growth Report?

- CAGR of the Dicalcium Phosphate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dicalcium phosphate market growth of industry companies

We can help! Our analysts can customize this dicalcium phosphate market research report to meet your requirements.