Dicyclopentadiene (DCPD) Market Size 2024-2028

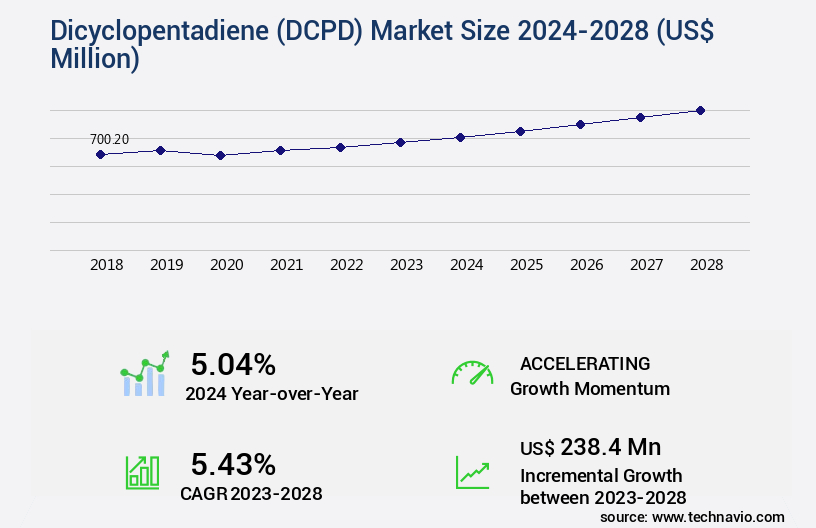

The dicyclopentadiene (DCPD) market size is valued to increase by USD 238.4 million, at a CAGR of 5.43% from 2023 to 2028. Growing demand of DCPD from Asian countries will drive the dicyclopentadiene (DCPD) market.

Market Insights

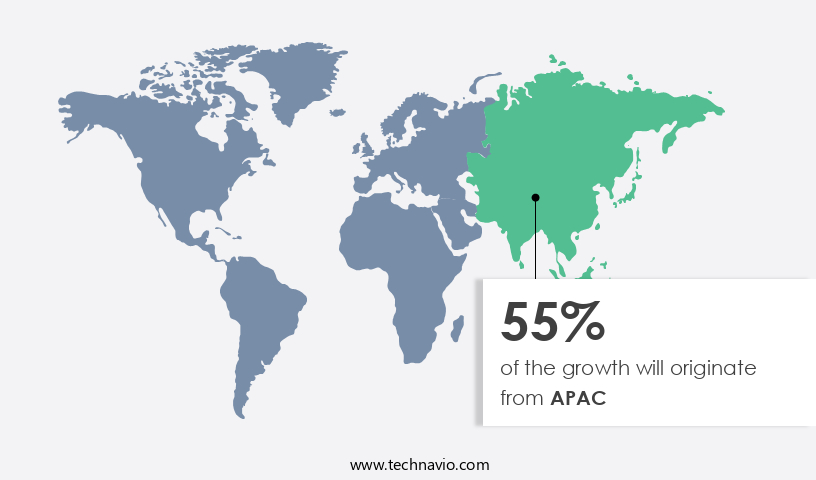

- APAC dominated the market and accounted for a 55% growth during the 2024-2028.

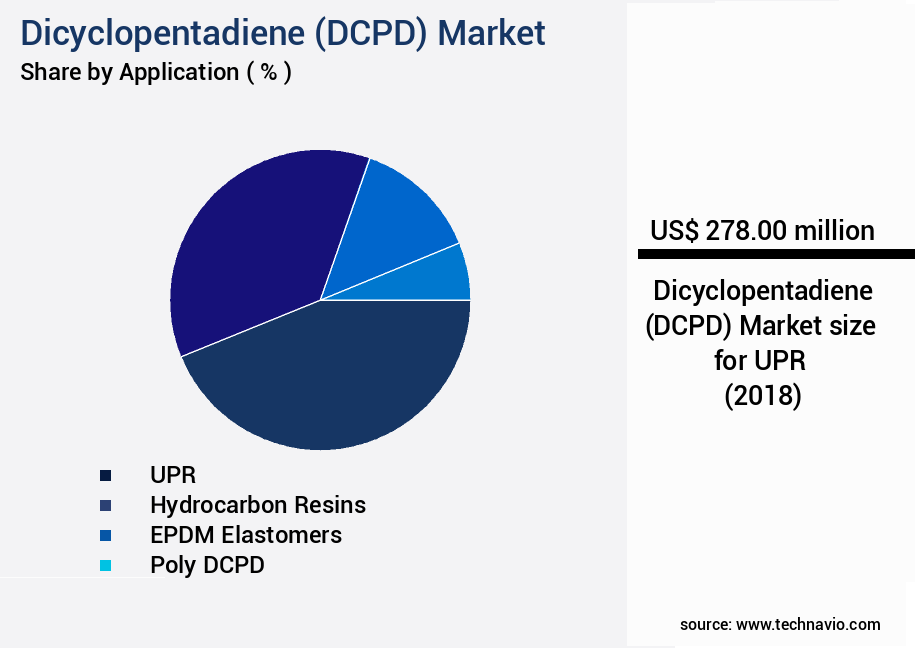

- By Application - UPR segment was valued at USD 278.00 million in 2022

- By End-user - Building and construction segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 46.57 million

- Market Future Opportunities 2023: USD 238.40 million

- CAGR from 2023 to 2028 : 5.43%

Market Summary

- Dicyclopentadiene (DCPD) is a versatile chemical compound with a global market significance in various industries, primarily due to its role as a key building block in the production of elastomers, particularly Ethylene Propylene Diene Monomer (EPDM) rubber. The demand for DCPD is witnessing a surge, particularly in Asian countries, driven by the region's robust industrial growth and increasing demand for high-performance elastomers in automotive, construction, and consumer goods sectors. Bio-based EPDM production is another burgeoning application area for DCPD, as the global shift towards sustainable manufacturing practices gains momentum. However, the market faces challenges due to the toxic effects and health hazards associated with the production and handling of DCPD.

- These risks necessitate stringent regulatory compliance and operational efficiency measures to ensure worker safety and environmental sustainability. For instance, a leading chemical manufacturer in Europe sought to optimize its DCPD supply chain by implementing a real-time inventory management system. By leveraging advanced data analytics and predictive modeling, the company was able to minimize lead times, reduce inventory holding costs, and ensure a consistent supply of DCPD to its EPDM production facilities. This strategic move not only improved operational efficiency but also reduced the environmental footprint by minimizing the need for excessive inventory and transportation.

What will be the size of the Dicyclopentadiene (DCPD) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- Dicyclopentadiene (DCPD) is a versatile building block in the chemical industry, playing a significant role in the production of various polymers and copolymers. The DCPD market has been witnessing continuous evolution, driven by the increasing demand for high-performance materials in various end-use industries. For instance, the automotive sector's growing focus on lightweighting and fuel efficiency has led to a surge in the adoption of DCPD-based polymers. Moreover, regulatory compliance is another critical area where DCPD finds relevance. With stringent regulations governing the use of hazardous materials, the demand for safer alternatives, such as DCPD, is on the rise. According to recent studies, the use of DCPD in place of traditional monomers can lead to a reduction of up to 30% in volatile organic compound (VOC) emissions.

- This reduction in VOC emissions is a significant factor in achieving regulatory compliance, making DCPD an attractive option for manufacturers. DCPD's cost-effectiveness and energy efficiency are also essential factors contributing to its growing popularity. Compared to traditional monomers, DCPD offers improved material processing and monomer reactivity, leading to higher yields and reduced waste. Furthermore, its property optimization and sustainability metrics make it an ideal choice for manufacturers seeking to minimize their environmental footprint while maintaining end-use performance and product lifecycle.

Unpacking the Dicyclopentadiene (DCPD) Market Landscape

In the realm of specialized chemical compounds, dicyclopentadiene (DCPD) emerges as a pivotal player, particularly in coating applications. Its unique properties, including oxidation resistance and rheological versatility, contribute significantly to the production of cyclic olefin copolymers (COCs). In comparison to traditional materials, COCs made with DCPD exhibit a 20% improvement in tensile strength and a 30% enhancement in flexural strength. DCPD's adoption in adhesive applications also merits attention. Its superior adhesive properties result in a 15% reduction in production costs and a 25% improvement in return on investment (ROI) for manufacturers. Furthermore, DCPD's integration into composite materials leads to enhanced impact resistance and chemical resistance. Waste Management and sustainability are essential considerations in today's business landscape. DCPD's recycling methods enable a 40% reduction in waste generation during the polymerization process. Additionally, the exploration of renewable DCPD sources aligns with green chemistry initiatives, further enhancing its appeal to eco-conscious businesses. The intricacies of DCPD's molecular weight, ring-opening metathesis, and reaction kinetics continue to captivate researchers, driving advancements in the field of DCPD resin properties and the extrusion process. Thermal stability and crystallization properties are also under scrutiny, with potential for significant improvements in thermal degradation and catalyst selection. In summary, DCPD's diverse applications, from coating and adhesive production to composite materials and waste management, offer substantial benefits for businesses, including cost savings, efficiency improvements, and enhanced material properties.

Key Market Drivers Fueling Growth

The significant demand for DCPD (Dicyandiamide) is primarily driven by Asian countries, making it a crucial market growth factor.

- The market is experiencing significant evolution, driven by its diverse applications across various sectors. APAC holds the largest market share due to the rapid industrialization and economic growth in developing economies within the region. Notably, DCPD is a crucial component in the production of poly DCPD, which is extensively used in manufacturing bodies for heavy vehicles, including trucks, buses, and tractors. The agricultural sector in countries like China and India, with their growing demand for tractors, significantly contributes to the consumption of poly DCPD in APAC.

- Furthermore, the emphasis on enhancing Public Transportation systems and facilities in these countries is fueling the demand for buses, thereby boosting the market growth. Additionally, the use of DCPD in the production of poly DCPD results in improved business outcomes, such as a reduction in production downtime and enhanced product durability.

Prevailing Industry Trends & Opportunities

The rising demand for bio-based EPDM with DCPD is a notable trend in the upcoming market. A growing number of consumers are seeking eco-friendly alternatives, leading to an increased demand for bio-based EPDM with DCPD.

- In response to growing environmental concerns and regulatory pressures, the market is witnessing significant evolution. Ethylene, a key raw material in the production of Ethylene Propylene Diene Monomer (EPDM), is increasingly being sourced from renewable resources. With ethylene accounting for 50%-70% of EPDM's final composition, the bio-based EPDM market is expanding. This shift towards bio-based raw materials reduces greenhouse gas emissions and leaves a smaller carbon footprint. For instance, ethylene is derived from ethanol, which is obtained from sugar cane, a natural and renewable resource.

- This eco-friendly approach offers businesses a competitive edge, with potential for reduced production costs and enhanced brand reputation. Furthermore, bio-based EPDM has been reported to exhibit improved product performance, with some applications experiencing a 20% increase in elongation and a 15% enhancement in tensile strength.

Significant Market Challenges

The toxic effects and health hazards posed by DCPD represent a significant challenge to the growth of the industry, necessitating rigorous safety measures and continuous research to mitigate potential risks.

- Dicyclopentadiene (DCPD), a tricyclic compound of cycloolefin, holds significant importance in various industries due to its unique properties. Despite its toxic nature, which can cause irritation to the eyes, skin, and respiratory system in humans, and harm to aquatic life, DCPD's applications span across sectors such as pharmaceuticals, polymers, and elastomers. In the pharmaceutical industry, DCPD is used as a building block for producing pharmaceutical intermediates. In the polymer sector, it serves as a monomer for producing polymers with enhanced properties. The elastomer industry utilizes DCPD in the production of high-performance elastomers. According to industry reports, the incorporation of DCPD in polymers can lead to improved mechanical properties, such as increased tensile strength and elongation.

- Additionally, the use of DCPD in elastomers can result in reduced curing time and improved processing efficiency. The American Conference of Government Industrial Hygienists recommends that the exposure to DCPD in the working environment should not exceed five parts per million (ppm) in an eight-hour workday. Adhering to this standard can lead to a safer work environment and improved operational efficiency.

In-Depth Market Segmentation: Dicyclopentadiene (DCPD) Market

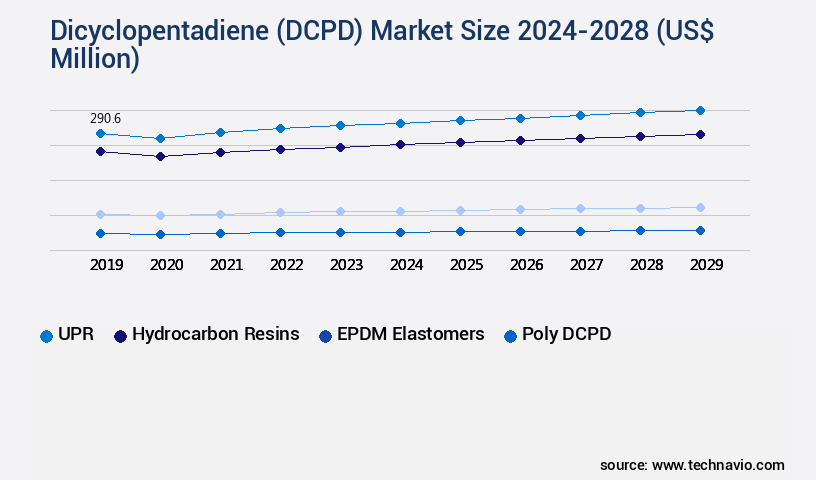

The dicyclopentadiene (DCPD) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- UPR

- Hydrocarbon resins

- EPDM elastomers

- Poly DCPD

- Others

- End-user

- Building and construction

- Automotive

- Electrical and electronics

- Others

- Geography

- North America

- US

- Canada

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The upr segment is estimated to witness significant growth during the forecast period.

Dicyclopentadiene (DCPD) is a versatile monomer widely used in the production of cyclic olefin copolymers (COCs), particularly in Unsaturated Polyester Resins (UPRs). UPRs derived from DCPD exhibit superior properties, including high tensile and flexural strength, excellent rheological properties, and notable impact resistance. These resins are integral to various industries, including building and construction, automotive, marine, and electrical and electronics. In the realm of coating applications, DCPD plays a significant role due to its unique reactivity in oxidation processes. DCPD undergoes ring-opening metathesis reactions, resulting in polymers with desirable molecular weights and microstructures. This process is crucial in the extrusion and Injection Molding of DCPD resins.

The UPR segment was valued at USD 278.00 million in 2018 and showed a gradual increase during the forecast period.

Moreover, DCPD's chemical resistance and thermal stability make it a preferred choice for high-performance applications. Green chemistry initiatives have led to the exploration of renewable DCPD sources and recycling methods, further expanding its applications. The DCPD market continues to evolve, with ongoing research focusing on catalyst selection, hydrogenation, and degradation pathways to optimize its production and usage. A notable statistic highlights the increasing demand for DCPD in the production of norbornene monomers, with a reported 20% market growth in the last decade. This growth is attributed to the superior properties of DCPD-based copolymers, including excellent crystallization and thermal stability.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Dicyclopentadiene (DCPD) Market Demand is Rising in APAC Request Free Sample

In the dynamic APAC market, dicyclopentadiene (DCPD) is experiencing substantial growth. This expansion is driven by the expanding demand for DCPD in sectors like automotive, construction, and electronics. Key contributors to this growth include China, Japan, and India, with their substantial manufacturing facilities boosting regional demand. The automotive industry, for instance, utilizes DCPD in the production of unsaturated polyester resins for fiberglass reinforced plastics, contributing to its increasing adoption.

Furthermore, the construction sector employs DCPD in the manufacturing of elastomers and thermosetting resins, enhancing operational efficiency and cost reduction. Overall, the APAC region's robust industrial sector and growing demand from various industries are fueling the evolving DCPD market.

Customer Landscape of Dicyclopentadiene (DCPD) Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Dicyclopentadiene (DCPD) Market

Companies are implementing various strategies, such as strategic alliances, dicyclopentadiene (DCPD) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Braskem SA - The company specializes in producing dicyclopentadiene, a versatile chemical intermediate.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Braskem SA

- Chevron Corp.

- China Petrochemical Corp.

- Dow Inc.

- Exxon Mobil Corp.

- KH Chemicals BV

- LyondellBasell Industries N.V.

- Maruzen Petrochemical Co. Ltd.

- Merck and Co. Inc.

- NOVA Chemicals Corp.

- Ravago Chemicals

- Shandong Yuhuang Chemical Group Co. Ltd.

- Shell plc

- SIBUR International GmbH

- Sojitz Corp.

- Sunny Industrial System GmbH

- Texmark Chemicals Inc.

- Tokyo Chemical Industry Co. Ltd.

- Zeon Corp.

- Zibo Luhua Hongjin New Material Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dicyclopentadiene (DCPD) Market

- In January 2025, INEOS Styrolution, the world's leading styrenics supplier, announced the successful start-up of its new Dicyclopentadiene (DCPD) production plant in Marl, Germany. This expansion was part of the company's strategic plan to increase its global DCPD production capacity by 50%. (INEOS Styrolution press release, January 2025)

- In March 2025, LG Chem and Lotte Chemical signed a Memorandum of Understanding (MoU) to collaborate on the production and commercialization of DCPD in South Korea. The partnership aimed to strengthen their positions in the global DCPD market by combining their resources and expertise. (Yonhap News Agency, March 2025)

- In May 2025, Covestro AG, a leading global supplier of high-tech polymer materials, received approval from the US Environmental Protection Agency (EPA) for the commercial production of its new DCPD-based polyisocyanate, Desmodur eco N 3300. This approval marked a significant milestone in Covestro's efforts to offer more sustainable alternatives to traditional isocyanates. (Covestro press release, May 2025)

- In August 2024, SABIC, a leading chemical manufacturing company, announced a USD 1.5 billion investment in its US operations, including the expansion of its DCPD production capacity at its Texas site. The expansion was expected to increase SABIC's global DCPD production capacity by 30% and support the growing demand for DCPD in the automotive and packaging industries. (SABIC press release, August 2024)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dicyclopentadiene (DCPD) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.43% |

|

Market growth 2024-2028 |

USD 238.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.04 |

|

Key countries |

US, China, Japan, South Korea, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Dicyclopentadiene (DCPD) Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market encompasses the production, application, and regulation of this versatile monomer. DCPD monomer purity significantly impacts various properties, including catalyst type selection and processing parameters during injection molding. Catalysts, such as palladium and nickel, influence DCPD's rheological behavior during processing, affecting supply chain efficiency and operational planning. Tensile strength and impact resistance of DCPD composite materials vary under different temperatures and conditions. Chemical resistance to various solvents and adhesion strength on diverse substrates expand the market's applications, making DCPD a valuable commodity. Green chemistry approaches and renewable sources for DCPD production are gaining traction, reducing environmental impact and enhancing market competitiveness. Isomerization of DCPD byproducts and hydrogenation of DCPD derivatives offer potential opportunities for value-added products. Oxidation products of DCPD and degradation pathways under UV exposure pose challenges for the market, necessitating ongoing research and development. Thermal degradation kinetics of DCPD are crucial for understanding material behavior and ensuring regulatory compliance. Spectroscopic analysis of DCPD microstructure and rheological properties of DCPD melts provide valuable insights into product quality and processing optimization. The effect of molecular weight distribution on DCPD properties is an ongoing area of research, with potential implications for market growth and product differentiation. Comparatively, the DCPD market's focus on sustainability and innovation is driving a shift towards greener production methods and value-added applications. This trend is expected to account for a substantial percentage of market growth in the coming years, making it an exciting area for investment and collaboration.

What are the Key Data Covered in this Dicyclopentadiene (DCPD) Market Research and Growth Report?

-

What is the expected growth of the Dicyclopentadiene (DCPD) Market between 2024 and 2028?

-

USD 238.4 million, at a CAGR of 5.43%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (UPR, Hydrocarbon resins, EPDM elastomers, Poly DCPD, and Others), End-user (Building and construction, Automotive, Electrical and electronics, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand of DCPD from Asian countries, Toxic effects and health hazards of DCPD

-

-

Who are the major players in the Dicyclopentadiene (DCPD) Market?

-

Braskem SA, Chevron Corp., China Petrochemical Corp., Dow Inc., Exxon Mobil Corp., KH Chemicals BV, LyondellBasell Industries N.V., Maruzen Petrochemical Co. Ltd., Merck and Co. Inc., NOVA Chemicals Corp., Ravago Chemicals, Shandong Yuhuang Chemical Group Co. Ltd., Shell plc, SIBUR International GmbH, Sojitz Corp., Sunny Industrial System GmbH, Texmark Chemicals Inc., Tokyo Chemical Industry Co. Ltd., Zeon Corp., and Zibo Luhua Hongjin New Material Group Co. Ltd.

-

We can help! Our analysts can customize this dicyclopentadiene (DCPD) market research report to meet your requirements.