Dietary Supplement Contract Manufacturing Market Size 2025-2029

The dietary supplement contract manufacturing market size is valued to increase USD 46.35 billion, at a CAGR of 12.4% from 2024 to 2029. High prevalence of obesity will drive the dietary supplement contract manufacturing market.

Major Market Trends & Insights

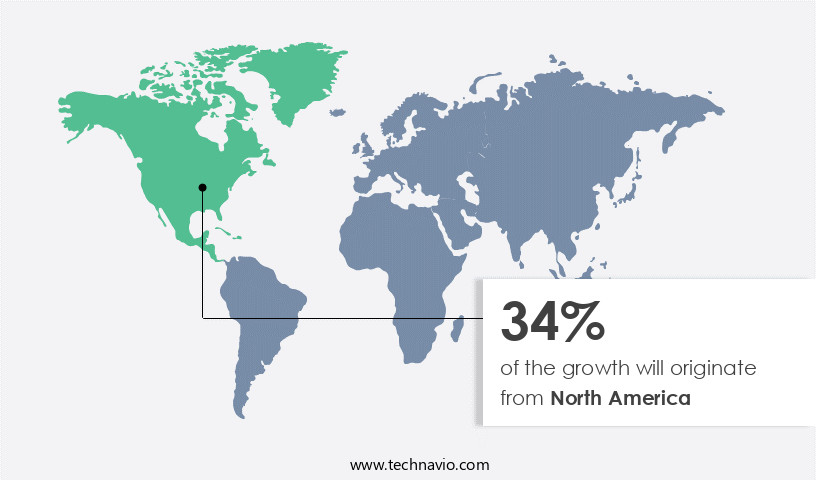

- North America dominated the market and accounted for a 34% growth during the forecast period.

- By Product - Protein and amino acid segment was valued at USD 14.47 billion in 2023

- By Formulation - Tablets segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 177.32 billion

- Market Future Opportunities: USD 46.35 billion

- CAGR from 2024 to 2029 : 12.4%

Market Summary

- The market has experienced significant growth in recent years, driven by increasing consumer awareness and preference for healthier lifestyle choices. The global market for dietary supplements is projected to reach a value of USD 226.2 billion by 2027, growing at a steady pace. This expansion is fueled by various factors, including the rising prevalence of chronic diseases, the growing geriatric population, and the increasing acceptance of dietary supplements as an alternative to prescription medication. Despite this promising outlook, the market faces challenges, such as stringent regulatory requirements and the need for transparency and quality assurance.

- Contract manufacturers play a crucial role in addressing these challenges by providing specialized expertise, advanced technology, and cost-effective solutions. They enable businesses to produce high-quality dietary supplements while adhering to regulatory guidelines and maintaining competitive pricing. The market is characterized by continuous innovation and technological advancements. For instance, the adoption of advanced manufacturing technologies, such as continuous manufacturing and nanotechnology, is revolutionizing the production process, enhancing product quality, and reducing costs. Additionally, the increasing popularity of personalized nutrition and functional foods is driving demand for customized dietary supplements, further expanding the market's scope. In conclusion, the market is a dynamic and evolving industry, driven by consumer trends, regulatory requirements, and technological advancements.

What will be the Size of the Dietary Supplement Contract Manufacturing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Dietary Supplement Contract Manufacturing Market Segmented?

The dietary supplement contract manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Protein and amino acid

- Multivitamin

- Weight management and meal replacer supplements

- Others

- Formulation

- Tablets

- Capsules

- Gummies

- Others

- Service

- Manufacturing

- Packaging

- R&D

- Regulatory Consulting

- End-User

- Nutraceutical Companies

- Pharmaceutical Companies

- Food & Beverage Companies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The protein and amino acid segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and evolving industry, with protein and amino acid supplements commanding a substantial share due to their vital role in muscle growth, recovery, and overall health maintenance. These supplements, sourced primarily from whey, casein, soy, and egg whites, offer a complete protein profile, containing all nine essential amino acids that the human body cannot produce naturally. In July 2024, The Coconut Collab, a UK-based plant-based coconut yogurt brand, entered this market with Protein Yog, a dairy-free yogurt providing 10 grams of protein per serving. This launch underscores the ongoing demand for innovative, plant-based protein solutions.

The Protein and amino acid segment was valued at USD 14.47 billion in 2019 and showed a gradual increase during the forecast period.

The manufacturing process for these supplements involves various stages, including inventory management, capsule filling, powder blending, tablet compression, liquid filling, and quality assurance systems. Good manufacturing practices (GMP) are strictly adhered to during the entire process, from raw material testing and deviation investigation to production scheduling and order fulfillment. Additionally, contract manufacturing agreements, supplier audits, and risk management are crucial elements in this industry, ensuring the highest standards of product labeling, material handling, and cleanroom manufacturing. With a focus on custom formulation development, ingredient sourcing, and GMP certification, contract manufacturers prioritize capacity planning and change control to maintain efficient and effective operations.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Dietary Supplement Contract Manufacturing Market Demand is Rising in North America Request Free Sample

The market is witnessing significant evolution, with North America leading the global landscape due to technological advancements and stringent quality standards. In October 2023, Vitaquest International, a prominent player, expanded its capabilities by acquiring a powder processing facility from Pharmachem Laboratories. This acquisition incorporates Ashland's fluidized bed process technologies, enhancing particle and powder engineering for the food, beverage, and dietary supplement industries. This strategic move enables Vitaquest to boost production efficiency and product quality, catering to the increasing demand for high-performance dietary supplements.

According to recent reports, the global dietary supplement market size was valued at over USD 140 billion in 2020 and is projected to reach USD 220 billion by 2028, growing at a steady pace. This growth is attributed to the rising health consciousness and increasing consumer preference for natural and organic products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has experienced significant growth in recent years, driven by increasing consumer demand for personalized and high-quality nutritional products. This market encompasses the production of dietary supplements on behalf of other companies, offering various services such as formulation development, custom manufacturing, and scale-up processes. Costs in the market can vary greatly depending on the specific requirements of each project. These costs include raw materials, labor, equipment usage, and regulatory compliance fees. Contract manufacturers adhere to strict regulations, including those set by the Food and Drug Administration (FDA) for dietary supplement GMP compliance and regulations. Quality control and assurance are essential components of the contract manufacturing process. Manufacturers employ advanced technologies and best practices to ensure the highest standards are met. This includes implementing robust quality control systems, validating manufacturing processes, and conducting stability studies. The custom supplement manufacturing process begins with formulation development services, where manufacturers collaborate with clients to create unique and effective supplement formulations. Scale-up processes are then employed to manufacture supplements in large quantities while maintaining consistency and quality. Dietary supplement manufacturing facilities must adhere to stringent requirements, including proper equipment, environmental conditions, and record-keeping systems. Contract manufacturing agreements outline the terms and conditions of the partnership between the manufacturer and the client, ensuring transparency and accountability. Outsourcing supplement manufacturing offers significant cost savings compared to in-house production. However, it is crucial to carefully evaluate potential contract manufacturers to minimize risks associated with quality, regulatory compliance, and intellectual property protection. In conclusion, the market offers various benefits, including cost savings, access to specialized expertise, and improved efficiency. By adhering to strict regulations, employing advanced technologies, and following best practices, contract manufacturers ensure the production of high-quality, effective dietary supplements.

What are the key market drivers leading to the rise in the adoption of Dietary Supplement Contract Manufacturing Industry?

- The high prevalence of obesity serves as the primary market driver, as a significant portion of the population seeks solutions to combat this health concern.

- The market experiences continuous growth due to the escalating obesity rates across numerous regions. According to the Centers for Disease Control and Prevention (CDC), over 40% of American adults are classified as obese, with similar prevalence observed among men and women. This issue is pervasive, with at least 20% of adults residing in every U.S. State living with obesity. In 16 states, obesity rates among White adults surpass 35%.

- In contrast, the National Family Health Survey (NFHS-5) in India reveals a significant disparity in obesity rates between urban and rural populations. These statistics underscore the urgent need for effective health interventions and the expanding role of dietary supplement contract manufacturers in addressing this global health concern.

What are the market trends shaping the Dietary Supplement Contract Manufacturing Industry?

- The trend in the market involves capacity additions. It is a mandatory action for businesses.

- The market is undergoing substantial growth, fueled by escalating consumer preference for diverse and health-conscientious products. A recent development in this sector is CAPTEK Softgel International's expansion with a new 60,000-square-foot gummy supplement manufacturing facility in La Mirada, California, USA. This facility, inaugurated in March 2024, specializes in gummy supplement production, offering comprehensive solutions that encompass turnkey gummy formulations, custom flavorings, and bottling services. The starch-free production lines enable the facility to produce a multitude of gummy varieties, including those based on pectin, agar, carrageenan, gelatin, and their combinations.

- This versatility encourages innovation and caters to consumers with specific dietary needs, such as those requiring gluten-free products.

What challenges does the Dietary Supplement Contract Manufacturing Industry face during its growth?

- The growth of the industry is significantly impacted by regulatory requirements, which pose a significant challenge that must be addressed by professionals in a knowledgeable and formal manner.

- The market is subject to intricate regulatory oversight, with the Food and Drug Administration (FDA) governing both finished products and their components in the United States. Dietary supplements are distinctly regulated under the Dietary Supplement Health and Education Act of 1994 (DSHEA), which mandates manufacturers and distributors to ensure their offerings are free from adulteration and misbranding. To comply with the Federal Food, Drug, and Cosmetic Act, as amended by DSHEA and FDA regulations, these entities must meticulously assess the safety and labeling of their products prior to market release.

- This stringent regulatory environment underscores the importance of rigorous quality control processes and thorough compliance with established guidelines.

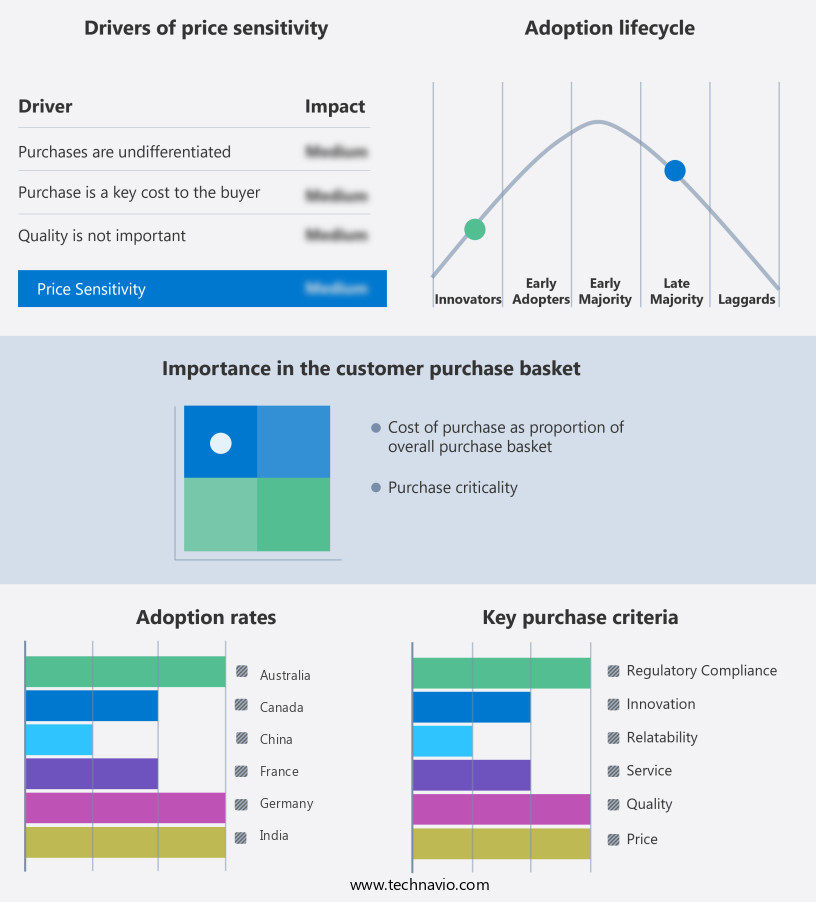

Exclusive Technavio Analysis on Customer Landscape

The dietary supplement contract manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dietary supplement contract manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Dietary Supplement Contract Manufacturing Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, dietary supplement contract manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aenova Group - This company specializes in providing dietary supplement manufacturers with high-quality contract services for modified cellulose binders, such as Klucel Nutra, and hydroxypropyl methylcellulose products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aenova Group

- Arjuna Natural Pvt Ltd

- Capsugel (Lonza)

- Catalent, Inc.

- Church & Dwight Co., Inc.

- DSM Nutritional Products

- Eurofins Scientific SE

- Glanbia PLC

- Hermes Pharma GmbH

- Kaged Muscle

- Lonza Group AG

- Nutrilo GmbH

- Piramal Pharma Solutions

- Robinson Pharma, Inc.

- Sakura Pharma Co., Ltd.

- Sirio Pharma Co., Ltd.

- SFI Health (formerly Schwabe North America Inc.)

- Swiss Caps AG

- Tishcon Corp.

- Vitakem Nutraceutical Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dietary Supplement Contract Manufacturing Market

- In January 2024, Nutraceutical Corporation, a leading dietary supplement contract manufacturer, announced the launch of its new state-of-the-art manufacturing facility in California, increasing its production capacity by 50% (Nutraceutical Corporation Press Release, 2024).

- In March 2024, DSM Nutritional Products and BASF Corporation formed a strategic partnership to expand their dietary supplement offerings by combining DSM's nutritional ingredients and BASF's production capabilities (Bloomberg, 2024).

- In May 2024, NBTY, Inc., a prominent dietary supplement contract manufacturer, completed a USD 100 million funding round to invest in research and development and expand its global reach (SEC Filing, NBTY, Inc., 2024).

- In January 2025, the U.S. Food and Drug Administration (FDA) approved the use of a new dietary ingredient, BioActive Iron, for use in dietary supplements, marking a significant regulatory approval for the industry (FDA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dietary Supplement Contract Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market growth 2025-2029 |

USD 46.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for personalized and high-quality nutritional products. This dynamic industry encompasses various processes, including capsule filling, powder blending, and liquid filling, among others. Inventory management and manufacturing process validation are crucial components, ensuring efficient production and maintaining product integrity. Quality assurance systems, such as supplier audits and raw material testing, are integral to delivering consistent and safe finished goods. For instance, a leading contract manufacturer experienced a 25% increase in sales due to their commitment to good manufacturing practices and custom formulation development. The industry is projected to grow by 7% annually, reflecting the ongoing demand for contract manufacturing services.

- Effective risk management, order fulfillment, and nutritional labeling are essential for maintaining customer satisfaction and regulatory compliance. Contract manufacturing agreements, batch record review, and production scheduling are vital elements in managing supply chain complexities. Cleanroom manufacturing and GMP certification are crucial aspects of the manufacturing process, ensuring a controlled environment and adherence to strict quality standards. Change control, product labeling, and material handling are additional critical components in maintaining a robust and efficient manufacturing process. Overall, the market showcases continuous growth and innovation, with a focus on delivering high-quality, customized products while ensuring regulatory compliance and operational efficiency.

What are the Key Data Covered in this Dietary Supplement Contract Manufacturing Market Research and Growth Report?

-

What is the expected growth of the Dietary Supplement Contract Manufacturing Market between 2025 and 2029?

-

USD 46.35 billion, at a CAGR of 12.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Protein and amino acid, Multivitamin, Weight management and meal replacer supplements, and Others), Formulation (Tablets, Capsules, Gummies, and Others), Geography (North America, Europe, APAC, Middle East and Africa, and South America), Service (Manufacturing, Packaging, R&D, and Regulatory Consulting), and End-User (Nutraceutical Companies, Pharmaceutical Companies, and Food & Beverage Companies)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

High prevalence of obesity, Regulatory requirements

-

-

Who are the major players in the Dietary Supplement Contract Manufacturing Market?

-

Aenova Group, Arjuna Natural Pvt Ltd, Capsugel (Lonza), Catalent, Inc., Church & Dwight Co., Inc., DSM Nutritional Products, Eurofins Scientific SE, Glanbia PLC, Hermes Pharma GmbH, Kaged Muscle, Lonza Group AG, Nutrilo GmbH, Piramal Pharma Solutions, Robinson Pharma, Inc., Sakura Pharma Co., Ltd., Sirio Pharma Co., Ltd., SFI Health (formerly Schwabe North America Inc.), Swiss Caps AG, Tishcon Corp., and Vitakem Nutraceutical Inc.

-

Market Research Insights

- The market is a dynamic and complex industry, continually evolving to meet the demands of consumers and regulatory bodies. Two key statistics highlight its growth and complexity. In a recent contract manufacturing agreement, a leading supplier increased production capacity by 25% to meet the surging demand for a specific supplement. In this market, manufacturers focus on various aspects to deliver high-quality products. They optimize processes through ingredient specifications, quality by design, and process optimization. They also consider packaging materials, excipient selection, documentation control, and waste reduction.

- Personnel training, manufacturing scale-up, cleaning validation, preventive maintenance, and labeling regulations are other essential elements. The industry prioritizes compliance requirements, calibration procedures, and sanitation procedures, ensuring the production of safe and effective dietary supplements. Record keeping, distribution logistics, production efficiency, and supply chain traceability are also crucial for maintaining transparency and reliability. Manufacturers invest in equipment qualification, product traceability, design of experiments, data integrity, cost analysis manufacturing, and yield optimization to improve their capabilities and meet the evolving needs of their clients. Shelf life testing, statistical process control, and process capability analysis are essential for ensuring product quality and consistency.

We can help! Our analysts can customize this dietary supplement contract manufacturing market research report to meet your requirements.