Digital Substation Market Size 2024-2028

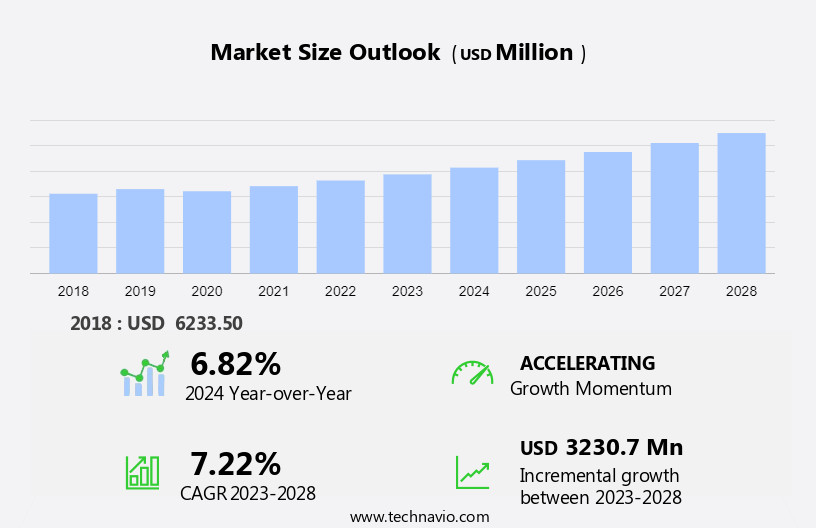

The digital substation market size is forecast to increase by USD 3.23 billion at a CAGR of 7.22% between 2023 and 2028.

What will be the Size of the Digital Substation Market During the Forecast Period?

How is this Digital Substation Industry segmented and which is the largest segment?

The digital substation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Transmission

- Distribution

- Component

- Hardware

- Fiber-optic communication networks

- SCADA systems

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

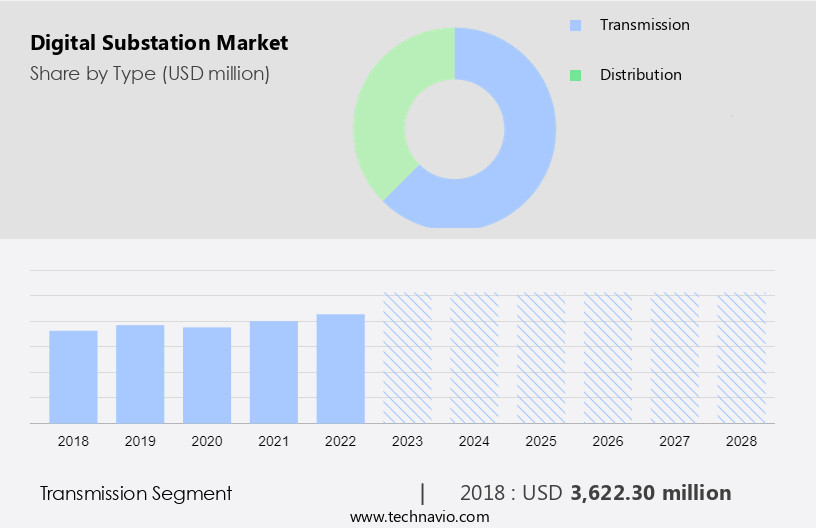

The transmission segment is estimated to witness significant growth during the forecast period. In the power industry, digital substations play a crucial role in automating power system operations through advanced devices such as Programmable Logic Controllers (PLCs). These substations are increasingly being adopted in transformer substations to enhance transmission system monitoring and detect anomalies. The power transmission sector is witnessing a significant push towards reducing transmission and distribution (T&D) losses, leading to increased demand for digital substations. These systems improve signal connectivity, server management, and data acquisition, thereby enhancing overall efficiency. The decline in nuclear and coal-fired power generation is being offset by the surge in renewable energy investments. Digital substations are essential for integrating renewable energy sources into the grid infrastructure and ensuring affordable and uninterrupted electricity supply.

The power industry landscape is undergoing rapid digitalization, driven by technological advancements, regulatory reforms, and industry strategies. Major economies are investing heavily in capital expenditure projects to modernize distribution networks, install smart meters, and build smart grids. The ongoing projects aim to improve service quality, resilience, and future energy distribution through technological solutions like battery technology and industrial development. The industry's focus on automation, communication technology, feedback capabilities, and timely failure corrections is shaping the future of power distribution. Cybersecurity concerns and restrictions on movement due to social distancing measures are influencing the adoption of secure and adaptable technologies. Regulatory mandates, smart grid components, and power distribution reforms are further catalyzing the growth of the market.

Get a glance at the market report of various segments Request Free Sample

The Transmission segment was valued at USD 3.62 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is poised for substantial expansion over the forecast period. Key contributors to this growth include China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. These countries' robust industrial sectors, increasing demand for medium-voltage and low-voltage motors, and substantial investments in power, water and wastewater treatment, food and beverage, and automotive industries are major factors driving the market. Additionally, government initiatives for digitalization, rising standards of living, and a strong industrial base are fueling the adoption of digital substations In the automotive industry in APAC. The region's growing demand for affordable and uninterrupted electricity, coupled with power distribution reforms and industrial strategies, is further boosting market growth.

Technological advancements in communication technology, feedback capabilities, timely failure corrections, fault detection, and smart grid components are also contributing to the market's expansion. Despite budget constraints and ongoing projects, continuous investments in distribution networks, smart meters, smart grids, and aging infrastructure are essential for ensuring high-quality services and improving energy efficiency in developing economies. Key players In the market include Efacec, ABB, and others, who are focusing on providing efficient products and services, improving platforms, and complying with regulatory mandates to meet the evolving needs of utilities and technology providers. The market landscape is characterized by continuous investments, seamless integration, and revenue generation opportunities in major economies, making it an attractive area for investments.

The adoption of energy-efficient technologies, such as battery technology and industrial development, is also driving the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Digital Substation Industry?

- Increasing demand for compact automation solutions is the key driver of the market.The market is witnessing significant growth due to the increasing adoption of SCADA systems in electrical generation, transmission, and distribution systems by electric utilities. The market is driven by technological advancements in voltage segments, the renewable energy sector, and cybersecurity. Sulfur hexafluoride (SF6) and secure technologies are key areas of focus for industry players. Adaptable technologies, regulatory reforms, and investments in grid infrastructure are shaping the industry landscape. R&D spendings and technological platforms are facilitating product adoption, while regulatory mandates and power distribution reforms are influencing industrial strategies. The market is also witnessing continuous investments in distribution networks, smart meters, and smart grids to ensure affordable electricity and uninterrupted power supply.

Despite budget constraints and economic impact, capital expenditure projects are prioritized for efficient products and seamless integration of smart grid components. The market is expected to grow rapidly, with major economies investing in energy-efficient technologies and improving service quality. Efacec's prototype Transformer Station and ABB's Fiber optic cable are notable technological solutions In the market. The market is also witnessing ongoing projects and regulatory bodies' initiatives to promote digitization and smart energy infrastructure. Battery technology and industrial development are key areas of focus for future energy distribution.

What are the market trends shaping the Digital Substation market?

- Increasing focus on expanding capabilities of micro PLCs is the upcoming market trend.Micro PLCs have gained significant traction in industrial automation due to their compact size, cost-effectiveness, and advanced features. Initially designed for controlling small machinery with basic serial communication, these devices now offer high-speed communication capabilities, large program memory, and support for multiple communication protocols. This expansion in functionality enables micro PLCs to manage larger machines and complex systems, making them a versatile solution for various industries. The electrical generation, transmission, and distribution systems sectors, including electric utilities, have embraced micro PLCs for SCADA systems and voltage segment control due to their adaptability and secure technologies. The renewable energy sector's growth has further fueled the demand for micro PLCs, as they facilitate the integration of renewable energy sources into the grid infrastructure.

Cybersecurity concerns have led to the adoption of advanced technologies in micro PLCs, ensuring secure and reliable electrical transactions between supply and demand at load centers. The industry landscape is witnessing continuous investments in R&D spendings and technological platforms to improve product adoption and meet regulatory reforms. The future of micro PLCs lies In their ability to seamlessly integrate with smart energy infrastructure, including smart grids and distribution networks, to provide affordable and uninterrupted electricity. This strategic approach to digitalization and technological advancements is crucial for addressing the challenges of aging infrastructure, improving service quality, and catering to the needs of developing economies.

Despite budget constraints and ongoing projects, investment decisions in capital expenditure projects remain a priority for industrial growth and revenue generation in major economies. The future of micro PLCs is bright, as they offer energy-efficient technologies, continuous improvements, and the ability to adapt to changing market dynamics and regulatory mandates.

What challenges does the Digital Substation Industry face during its growth?

- Concerns over cyber threats is a key challenge affecting the industry growth.The market is experiencing significant growth due to the increasing demand for secure and adaptable technologies in electrical generation, transmission, and distribution systems used by electric utilities. SCADA systems are a crucial component of digital substations, enabling voltage segment management, communication between grid infrastructure, and real-time fault detection and correction. The renewable energy sector's expansion is also driving market growth, as digital substations are essential for integrating renewable energy sources into the grid infrastructure. However, cybersecurity concerns are a major challenge for the market. With the rise of connected devices and web-based communication, networks are becoming increasingly vulnerable to cyberattacks.

Hackers are constantly evolving their tactics, using ransomware and distributed denial of service (DDoS) attacks to gain unauthorized access to critical information. Despite efforts to improve the security of power monitoring and control software, the evolving nature of cyber threats poses a risk to the market. R&D spendings and technological platforms are key areas of focus for industry players, with a strategic approach to product adoption and regulatory reforms playing a significant role in shaping the industry landscape. The implementation of smart energy infrastructure, including smart meters and smart grids, is also driving growth In the market. However, aging infrastructure, budget constraints, and restrictions on movement due to social distancing measures may impact investment decisions and capital expenditure projects.

In conclusion, the market is witnessing rapid digitalization and technological advancements, driven by the need for efficient products and services, uninterrupted electricity, and affordable electricity in major economies. Regulatory mandates and smart grid components are also playing a crucial role in market growth. Despite the challenges posed by cybersecurity threats, the market is expected to continue growing, driven by the ongoing development of industrial strategies and the integration of energy-efficient technologies.

Exclusive Customer Landscape

The digital substation market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital substation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital substation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB - The market encompasses advanced technologies such as Smart Substation Control and Protection (SSC) systems. These solutions enhance electrical grid efficiency and reliability through real-time monitoring, automated fault detection, and improved communication between grid components. The SSC600, an example of digital substation technology, offers enhanced functionality and performance, contributing to the overall growth and modernization of the power transmission and distribution sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB

- Cadillac Automation and Controls

- Cisco Systems Inc.

- Eaton Corp. Plc

- Efacec

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- iGrid T and D

- Larsen and Toubro Ltd.

- Locamation

- Netcontrol Group

- NovaTech LLC

- NR Electric Co. Ltd.

- Open Systems International Inc.

- Schneider Electric SE

- Siemens AG

- Tekvel

- Tesco Automation Inc.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as electrical generation and transmission systems evolve to meet the demands of modern electricity grids. The integration of communication technology and feedback capabilities in substation units has led to the development of SCADA systems, which enable utilities to monitor and control their electrical distribution networks in real-time. The renewable energy sector is a major driver of this digitalization trend, as the adoption of renewable energy sources requires more adaptable and secure technological platforms to ensure the reliable integration of these intermittent resources into the grid. Cybersecurity is a critical concern in this context, as the increasing digitization of electrical infrastructure makes it more vulnerable to cyberattacks.

R&D spendings In the industry landscape have been focused on developing efficient products and improving the resilience of substation units. Technological advancements in areas such as battery technology and automation have enabled the creation of smart energy infrastructure, which offers numerous benefits, including seamless integration of renewable energy sources, improved service quality, and revenue generation opportunities. Regulatory reforms and policies have played a significant role in driving the digitalization of electrical infrastructure. For instance, major economies have implemented power distribution reforms to encourage the adoption of smart grids and smart meters. These reforms have been instrumental in enabling utilities to provide affordable electricity and uninterrupted power supply to their customers.

The industrial sector has also been investing heavily in capital expenditure projects to digitize their electrical infrastructure. Continuous investments in distribution networks, transmission systems, and transformers have led to the deployment of advanced technologies such as fiber optic cables and secure communication systems. Despite the numerous benefits of digital substations, there are challenges that must be addressed. Restrictions on movement and social distancing measures have disrupted ongoing projects, leading to delays and increased costs. Economic impact and budget constraints have also influenced investment decisions, with utilities prioritizing projects based on their potential return on investment. The aging infrastructure in developing economies presents another challenge, as many substations require upgrades to meet modern standards.

Utilities In these regions are adopting a strategic approach to digitization, focusing on the implementation of affordable and efficient technological solutions. In conclusion, the market is experiencing rapid digitalization, driven by technological advancements, regulatory mandates, and the need for more resilient and adaptable electrical infrastructure. Utilities are investing in smart grid components, communication technology, and cybersecurity solutions to ensure the reliable and efficient distribution of electricity. Despite challenges such as economic constraints and aging infrastructure, the future of electrical infrastructure is digital, with a focus on providing high-quality services and integrating renewable energy sources into the grid.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.22% |

|

Market growth 2024-2028 |

USD 3230.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.82 |

|

Key countries |

China, US, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Substation Market Research and Growth Report?

- CAGR of the Digital Substation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital substation market growth of industry companies

We can help! Our analysts can customize this digital substation market research report to meet your requirements.