Display Driver Integrated Circuit Market Size 2024-2028

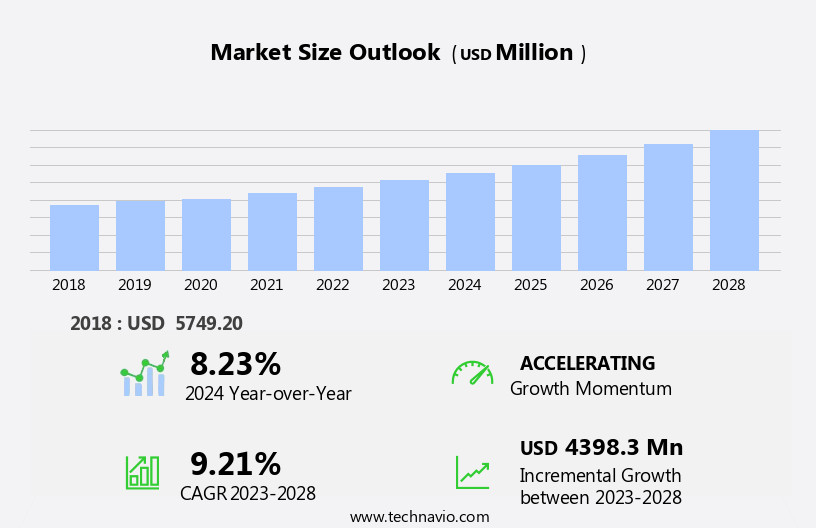

The display driver integrated circuit market size is forecast to increase by USD 4.4 billion at a CAGR of 9.21% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The expansion in Internet of Things (IoT) and the proliferation of smart devices are driving the demand for advanced display technologies. Moreover, mergers and acquisitions (M&A) activities are increasing as companies seek to strengthen their market positions and broaden their product offerings. Additionally, the miniaturization of electronic devices necessitates the use of compact and power-efficient DDICs. These trends are expected to continue shaping the market dynamics In the coming years. The DDIC market is poised for robust growth, offering numerous opportunities for market participants.

What will be the Size of the Display Driver Integrated Circuit (Ddic) Market During the Forecast Period?

- The market encompasses the production and supply of ICs that drive various electronic displays, including those used in handheld devices such as mobile phones and wearable technology, as well as laptops, tablets, and consumer electronics like televisions and personal computers. DDICs play a crucial role in enabling high-resolution images, energy-efficient lighting, and advanced display technologies like AMOLed, HDR, and MicroLED. These ICs interface with application processors and manage analog voltage levels to optimize display performance. The market's growth is driven by the increasing demand for digital data consumption and the expanding use of DDICs in diverse applications, from consumer electronics to the automotive sector. However, supply chain disruptions and the continuous evolution of display technologies, such as OLED panels and flat panel displays, pose challenges for DDIC manufacturers.

How is this Display Driver Integrated Circuit (Ddic) Industry segmented and which is the largest segment?

The display driver integrated circuit (ddic) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Gate driver

- Source driver

- Display Size

- Small

- Medium

- Large

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Type Insights

The gate driver segment is estimated to witness significant growth during the forecast period. The market plays a vital role in powering the advanced functionality of various electronic devices. DDICs act as a bridge between application processors and display devices, enabling the activation of pixels in LCD, LED, OLED, ePaper, CRT, TVs, PCs, and other display technologies. With the proliferation of handheld devices, mobile phones, wearable devices, laptops, tablets, and digital data, the demand for energy-efficient and high-resolution display solutions is escalating. In the consumer electronics sector, DDICs are integral to smartphones, touchscreen displays, instrument clusters, GPS navigation, car entertainment displays, IP cameras, and more. In the automotive sector, DDICs are essential for AMOLED, HDR, and other advanced display technologies.

Manufacturers of DDICs are focused on innovation to meet the evolving demands of the market. The global supply chain for DDICs is influenced by raw material prices, mining activities, and supply chain disruptions. The market is expected to grow significantly due to the increasing adoption of microLED displays, flexible displays, curved displays, and transparent displays in various end-use sectors, including healthcare, banking, transportation, manufacturing hubs, media and entertainment, and more.

Get a glance at the market report of various segments Request Free Sample

The Gate driver segment was valued at USD 4.6 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 67% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In 2023, the Asia-Pacific (APAC) region accounted for a significant share of the global Display Driver Integrated Circuit (DDIC) market due to the high concentration of display device manufacturers and panel producers in the area. Notably, South Korea, Taiwan, Japan, and China are home to major monitor, laptop/notebook, tablet, and TV manufacturers, including Samsung and LG. China, in particular, is emerging as a leading hub for DDIC manufacturers due to the presence of abundant resources, proximity to customer locations, growing domestic demand, and availability of low-cost labor.

The demand for DDICs is anticipated to surge in response to the increasing popularity of LCD devices in China and India. However, the COVID-19 pandemic disrupted production in 2020, with plants in China, India, and Japan temporarily shutting down. Recovery began in the second quarter of 2020, as governments eased regulations and some factories resumed operations with reduced workforces. By 2021, the situation had improved with the implementation of vaccination measures and the relaxation of lockdown restrictions. The demand for electronic devices, such as smart TVs, laptops, smartphones, and tablets, continues to grow, fueling the need for DDICs. For instance, consumer appliance sales in India are projected to increase by 17%-22% by the end of 2024, driving the regional market growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Display Driver Integrated Circuit (Ddic) Industry?

- Expansion in IoT and smart devices is the key driver of the market.The market is experiencing significant growth due to the increasing demand for electronic devices, particularly In the consumer electronics sector. Handheld devices, such as mobile phones and wearable devices, are major contributors to this growth. In the automotive sector, the adoption of advanced display technologies in instrument clusters, GPS navigation, car entertainment displays, and IP cameras is driving the demand for DDICs. Display devices, including LCD, LED, OLED, ePaper, CRT, TVs, and PCs, require DDICs for the activation of pixels. The integration of application processors, analog voltage, microprocessors, microcontrollers, and other semiconductor integrated circuits In these devices necessitates the use of DDICs.

- High-resolution images, energy-efficient lighting, and advanced display technologies such as AMOLED, HDR, and MicroLED displays are fueling the demand for DDICs. The market dynamics are influenced by various factors, including the growth In the retail sector, the increasing popularity of electronic devices, and the expanding use of DDICs in various industries such as healthcare, banking, transportation, and media and entertainment. However, supply chain disruptions and price fluctuations in raw materials, particularly those used in mining activities, can impact the market negatively. Manufacturing hubs in developing regions, such as APAC, the Middle East, Africa, and South America, are observing significant growth In the production of electronic devices, leading to increased demand for DDICs.

- China and India are the largest markets for smartphones in APAC and are experiencing rapid growth, while Africa has shown a noteworthy increase in demand for smartphones. In conclusion, the DDIC market is expected to grow significantly due to the increasing demand for electronic devices, particularly In the consumer electronics sector. The adoption of advanced display technologies and the expanding use of DDICs in various industries are driving the market growth. However, supply chain disruptions and price fluctuations in raw materials can pose challenges to the market.

What are the market trends shaping the Display Driver Integrated Circuit (Ddic) market?

- Rising M and A activities is the upcoming market trend.The global Display Driver IC (DDIC) market is experiencing significant growth due to the increasing demand for electronic devices in various sectors. DDIC manufacturers, such as Renesas and Infineon Technologies, are implementing strategic mergers and acquisitions (M&A) to expand their market presence. By acquiring regional or local players, international companies aim to strengthen their positions In the market, which is expected to intensify competition. For instance, in August 2021, Renesas Electronics Corp. Completed its acquisition of Dialog Semiconductor, a UK-domiciled semiconductor manufacturer. This acquisition added complementary product lines and enhanced Renesas' global position In the automotive, industrial, and IoT markets.

- The competitive landscape In the DDIC market is further driven by product extensions, technology innovations, and M&A activities. DDICs are essential components in various digital devices, including handheld devices like mobile phones and wearable devices, laptops and tablets, and large display devices such as LCD, LED, OLED, ePaper, CRT, TVs, and PCs. These components play a crucial role In the activation of pixels in display devices, enabling high-resolution images and energy-efficient lighting in consumer electronics, automotive sector, and other industries. The market dynamics include the increasing demand for smartphones, touchscreen displays, and advanced display technologies like AMOLED, HDR, MicroLED displays, flexible displays, curved displays, and transparent displays.

- The supply chain for DDICs involves various raw materials, such as those mined for semiconductor integrated circuits, microprocessors, microcontrollers, and other components. The retail sector, consumer electronics, automotive sector, healthcare, banking, transportation, manufacturing hubs, media and entertainment, and other industries are major consumers of DDICs. Market disruptions, such as price fluctuations, may impact the supply chain and, ultimately, the market growth.

What challenges does the Display Driver Integrated Circuit (Ddic) Industry face during its growth?

- Miniaturization of electronic devices is a key challenge affecting the industry growth.The market has experienced significant growth due to the increasing demand for compact electronic devices, such as handheld devices, mobile phones, and wearable devices. To cater to this demand, semiconductor integrated circuit manufacturers have been challenged to embed over 30 different high- and low-voltage circuits and analog functions on a single chip while minimizing board space and maintaining manufacturing costs. This design complexity and cost increase have been offset by the advancement of technology and the emergence of compact devices, including smartphones, tablets, and smartwatches. In the consumer electronics sector, DDICs are essential components in various display technologies, such as LCD, LED, OLED, ePaper, CRT, TVs, PCs, and various types of displays used in automotive applications, including touchscreen displays, instrument clusters, GPS navigation, car entertainment displays, and IP cameras.

- DDICs play a crucial role In the activation of pixels In these displays and enable high-resolution images, energy-efficient lighting, and advanced features like HDR. As the demand for compact and advanced electronic devices continues to grow, DDIC manufacturers must constantly innovate to meet consumer requirements, offering more advanced and compact ICs for various applications In the retail, automotive, healthcare, banking, transportation, manufacturing hubs, media and entertainment sectors, and more. The DDIC market encompasses various types of drivers, including source drivers, gate drivers, and common drivers, and is expected to continue its growth trajectory due to the increasing demand for flat panel displays, flexible displays, curved displays, and transparent displays.

Exclusive Customer Landscape

The display driver integrated circuit (ddic) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the display driver integrated circuit (ddic) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, display driver integrated circuit (ddic) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ams OSRAM AG - The company specializes in providing display driver IC solutions, including the AS1115 LED Driver IC, which supports 64 LED matrix drivers with 16 keys. This advanced technology ensures optimal performance and reliability for various display applications. With a focus on innovation and quality, the company's offerings cater to the growing demand for efficient and high-performance display solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ams OSRAM AG

- Fitipower Integrated Technology Inc.

- FocalTech Systems Co. Ltd.

- Himax Technologies Inc.

- Infineon Technologies AG

- LX Semicon Co. Ltd.

- MagnaChip Semiconductor Corp.

- Novatek Microelectronics Corp.

- NXP Semiconductors NV

- OmniVision Technologies Inc.

- Raydium Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Samsung Electronics Co. Ltd.

- SINOWEALTH Electronic Ltd.

- Sitronix Technology Corp.

- Solomon Systech International Ltd.

- Synaptics Inc.

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role In the electronics industry, particularly In the realm of handheld devices, wearable technology, laptops, tablets, and various digital data applications. These integrated circuits serve as the bridge between the application processor and the display device, enabling seamless communication and control. DDICs are integral to the functioning of various display technologies, including LCD, LED, OLED, E-Paper, CRT, TVs, PCs, and more. They facilitate the activation of pixels In these displays, ensuring high-quality visual output and energy efficiency. In the realm of mobile devices, DDICs are essential components of smartphones and touchscreen displays, enhancing user experience and functionality.

The consumer electronics sector, including handheld devices and wearable technology, is a significant contributor to the DDIC market's growth. The automotive sector also represents a burgeoning market for DDICs, with applications ranging from instrument clusters and GPS navigation to car entertainment displays. DDIC manufacturers face several challenges In the supply chain, including the availability and pricing of raw materials. Mining activities, which provide essential materials for semiconductor manufacturing, can be subject to disruptions, leading to potential supply chain issues. The integration of advanced features, such as HDR and AMOLed, in various display technologies is driving the demand for DDICs with enhanced capabilities.

The trend towards energy-efficient lighting and high-resolution images is also fueling the growth of the DDIC market. Furthermore, the increasing adoption of flexible, curved, and transparent displays is expanding the scope of applications for DDICs. These innovative display technologies require specialized drivers, including source drivers, gate drivers, and common drivers, to function optimally. The retail sector and various industries, including healthcare, banking, transportation, and manufacturing hubs, are also adopting electronic devices in large numbers, leading to a growing demand for DDICs. The integration of DDICs In these applications enhances the functionality and efficiency of electronic devices, from personal computers and televisions to IP cameras and OLED panels.

The DDIC market is characterized by continuous technological advancements and evolving display technologies. The integration of DDIC capabilities into microprocessors, microcontrollers, and other semiconductor integrated circuits is a significant trend, enabling more compact and power-efficient designs. In conclusion, the Display Driver Integrated Circuit market plays a pivotal role In the electronics industry, enabling the seamless communication and control between application processors and various display technologies. The market is driven by the growing demand for advanced display features, energy efficiency, and the increasing adoption of electronic devices across various industries. DDIC manufacturers face challenges In the supply chain, particularly In the availability and pricing of raw materials, but also stand to benefit from the continuous technological advancements and evolving display technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.21% |

|

Market growth 2024-2028 |

USD 4398.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.23 |

|

Key countries |

South Korea, US, China, Japan, and Taiwan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Display Driver Integrated Circuit (Ddic) Market Research and Growth Report?

- CAGR of the Display Driver Integrated Circuit (Ddic) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the display driver integrated circuit (ddic) market growth of industry companies

We can help! Our analysts can customize this display driver integrated circuit (ddic) market research report to meet your requirements.