Dry Mix Mortar Additives And Chemicals Market Size 2024-2028

The dry mix mortar additives and chemicals market size is forecast to increase by USD 13.79 billion at a CAGR of 4.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The rapid increase in construction projects is driving market demand, as these additives and chemicals enhance the durability and strength of the mortar. Additionally, the demand from the marine industry is expanding, as dry mix mortar additives and chemicals are essential for waterproofing and corrosion resistance in marine applications.

- However, the lack of customization In the production process poses a challenge for market growth. Producers must address this issue by offering more tailored solutions to meet the unique requirements of various industries and applications. Overall, the market is expected to continue its growth trajectory, driven by these trends and the increasing demand for high-performance construction materials.

What will be the Size of the Dry Mix Mortar Additives And Chemicals Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to the increasing demand for high-performance mortars in various construction sectors. Mortar properties such as bonding strength, water retention, and resistance to abrasion and waterproof performance are key factors driving market growth. These additives and chemicals are used extensively in residential, commercial, and industrial construction projects, including plastering, flooring, and waterproofing applications.

- Additionally, eco-friendly construction practices are also influencing market trends, with the increasing use of re-dispersible powders and polymer dispersions as sustainable alternatives to traditional additives. Additionally, the demand for additives that enhance adhesion, accelerate setting times, and improve cement grout and wall putty performance is on the rise. Key applications for dry mix mortar additives and chemicals include reinforced concrete, masonry activities, prefabricated buildings, desalination plants, and waterproofing slurries. Market growth is expected to continue as the construction industry continues to evolve and adopt new technologies and sustainable practices.

How is this Dry Mix Mortar Additives And Chemicals Industry segmented and which is the largest segment?

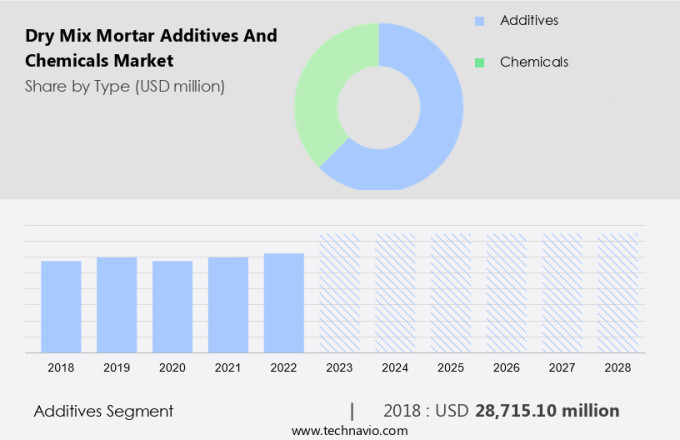

The dry mix mortar additives and chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Additives

- Chemicals

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

- The additives segment is estimated to witness significant growth during the forecast period.

The additives segment of the global dry mix mortar market consists of re-dispersible polymer powder, plasticizers, defoamers, cellulose ether, air-entraining agents, and other additives. Re-dispersible polymer powder, a crucial additive, enhances adhesion to the substrate and provides abrasion resistance. Obtained through spray-drying ethylene-vinyl acetate polymer, it is a free-flowing, water-soluble white powder. Upon contact with water, these powders redisperse into liquid emulsions, replicating the original emulsions' properties. Enhancing bending and flexural strength, impact resistance, durability, and abrasion resistance in dry mix mortar, re-dispersible polymer powder is a valuable addition to the construction industry. These additives contribute significantly to the production of waterproofing, insulation, energy-efficient buildings, and sustainable building materials. They are essential for modernization renovations, smart city projects, and ecofriendly and biobased additives.

Get a glance at the Dry Mix Mortar Additives And Chemicals Industry report of share of various segments Request Free Sample

The additives segment was valued at USD 28.72 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 73% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific is projected to expand due to the growing construction industry In the region. Countries such as India, Vietnam, Thailand, and Malaysia are experiencing significant growth in construction activities, driven by low labor costs and minimal regulations. For instance, China's plan to develop ten industrial parks In the Guangdong-Hong Kong-Macao Greater Bay Area under the one town with one thematic industry policy is expected to boost market growth, with the government investing approximately USD 565-USD 570 million. Eco-friendly construction practices are also gaining popularity, leading to increased demand for additives such as re-dispersible powders and polymer dispersions, which enhance adhesion, abrasion resistance, and waterproof performance in mortar. Key additives like anticaking agents ensure the smooth flow of dry mix mortar, improving productivity and efficiency.

Market Dynamics

Our dry mix mortar additives and chemicals market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Dry Mix Mortar Additives And Chemicals Industry?

Rapid increase in road and bridge construction is the key driver of the market.

- Dry mix mortar additives and chemicals play a crucial role in enhancing the properties of mortar in various construction applications. In the US market, these additives and chemicals are extensively used in residential, commercial, and industrial construction projects. For instance, in residential construction, they improve bonding strength, water retention, and adhesion in plastering and flooring applications. In commercial and industrial construction, they ensure construction quality, energy efficiency, and sustainability in waterproofing, insulation, and prefabricated buildings. The construction industry's shift towards eco-friendly and sustainable building materials is driving the demand for ecofriendly additives, biobased additives, and nanotechnology in dry mix mortar additives and chemicals.

- Additionally, smart city projects and modernization renovations also require innovative mortar chemicals for IoT monitoring, construction technology, and delayed hardening. The US construction industry's focus on green construction norms and sustainable practices is increasing the demand for sustainable additives and recycling solutions. The home decoration industry, cement, cement grouts, sand, admixtures, wall putty, reinforced concrete, masonry activities, tile adhesives, tile joint fillers, floor screeds, machinery installation, and desalination plants are some of the major sectors utilizing dry mix mortar additives and chemicals. The US infrastructure development sector's growth, with investments in roads, bridges, and other construction activities, is expected to boost the demand for these additives and chemicals.

- For instance, the American Society of Civil Engineers estimates that the US needs to invest approximately USD 2 trillion in infrastructure over the next ten years. This investment will create a significant demand for construction materials, including dry mix mortar additives and chemicals. In addition, the US market is expected to grow significantly due to the increasing demand for sustainable and eco-friendly construction materials, government investments in infrastructure development, and the growing construction activities in various sectors.

What are the market trends shaping the Dry Mix Mortar Additives And Chemicals Industry?

Demand from the marine industry is the upcoming market trend.

- The market in the US is witnessing significant growth due to increasing investments in various construction sectors, including residential, commercial, and industrial. Mortar properties such as bonding strength, water retention, and adhesion are crucial factors driving the demand for these additives and chemicals. In the residential sector, the trend toward energy-efficient buildings and sustainable practices is leading to increased use of eco-friendly additives, biobased additives, and nanotechnology. In commercial and industrial construction, applications such as plastering, flooring, waterproofing, insulation, and construction quality require specialized mortar solutions. The construction technology industry is also embracing innovative mortar chemicals for prefabricated buildings, desalination plants, and infrastructure development.

- Additionally, construction activities in sectors like home decoration, cement, cement grouts, sand, admixtures, wall putty, reinforced concrete, masonry activities, tile adhesives, tile joint fillers, floor screeds, machinery installation, and delayed hardening are major consumers of dry mix mortar additives and chemicals. The need for smart additives, IoT monitoring, and sustainable practices is also driving market growth. Key trends include the use of re-dispersible powders, polymer dispersions, anticaking agents, and accelerators. In the US, the market for dry mix mortar additives and chemicals is expected to grow steadily, driven by the increasing demand for high-performance mortars in various construction applications. The market is also being influenced by green construction norms and the availability of recycling solutions. The use of these additives and chemicals in modernization renovations, smart city projects, and eco-friendly construction is further expected to fuel market growth.

What challenges does the Dry Mix Mortar Additives And Chemicals Industry face during its growth?

Lack of customization in the production process of dry mix mortar additives and chemicals is a key challenge affecting the industry's growth.

- The market faces a challenge due to the lack of customization in production processes. With the construction industry's increasing demand for durable and cost-effective solutions, the inability of manufacturers to tailor products to specific project requirements can hinder market growth and competitiveness. Different construction projects necessitate unique formulations of dry mix mortar that cater to varying environmental conditions, application methods, and performance standards. However, many producers rely on standardized formulations, which may not meet the specific needs of diverse markets, particularly in regions with distinct climatic or regulatory requirements. Customization is essential for enhancing mortar properties such as bonding strength, water retention, and resistance to abrasion and waterproof performance. These properties are crucial for various applications, including residential, commercial, and industrial construction, plastering, flooring, waterproofing, insulation, and construction quality in energy-efficient buildings and sustainable building materials.

- Moreover, the use of eco-friendly additives, biobased additives, nanotechnology, recycling solutions, and sustainable practices aligns with green construction norms and smart city projects, modernization renovations, and IoT monitoring in construction technology. Infrastructural development and construction activities, such as prefabricated buildings, desalination plants, and machinery installation, require delayed hardening and accelerators. The home decoration industry, cement, cement grouts, sand, admixtures, wall putty, reinforced concrete, masonry activities, tile adhesives, tile joint fillers, floor screeds, and machinery installation also benefit from innovative mortar chemicals. By addressing the need for customization, producers can cater to diverse markets and meet specific project requirements, ultimately driving growth In the market.

Exclusive Customer Landscape

The dry mix mortar additives and chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dry mix mortar additives and chemicals market report also include key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dry mix mortar additives and chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altana AG

- Ashland Inc.

- BASF SE

- Celanese Corp.

- CEMEX SAB de CV

- CHT Germany GmbH

- Clariant International Ltd

- Compagnie de Saint-Gobain SA

- Don Construction Products Inc.

- Dow Inc.

- Evonik Industries AG

- Holcim Ltd.

- Innospec Inc.

- Mapei SpA

- Nouryon Chemicals Holding B.V.

- Qingdao Oubo Chemical Co. Ltd.

- Sidley Chemical Co. Ltd.

- Sika AG

- The Euclid Chemical Co.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction industry continues to evolve, driven by the need for improved performance, sustainability, and efficiency. Dry mix mortar additives and chemicals play a crucial role in enhancing the properties of mortar, enabling the delivery of high-quality structures in various sectors, including residential, commercial, and industrial construction. Mortar additives and chemicals contribute significantly to the overall performance of the mortar mix. They improve bonding strength, water retention, and other essential properties, ensuring the durability and longevity of structures. In the realm of residential construction, these additives help create stronger, more energy-efficient homes. In commercial and industrial applications, they contribute to the construction of structures that can withstand heavy loads and harsh conditions. Plastering and flooring are two essential applications where dry mix mortar additives and chemicals make a significant impact. For plastering, these additives ensure better adhesion and improved waterproof performance, resulting in smoother, more durable finishes. In flooring applications, they contribute to enhanced abrasion resistance, ensuring the longevity of the flooring system. Waterproofing and insulation are critical aspects of modern construction. Dry mix mortar additives and chemicals play a significant role in enhancing the waterproof performance of mortar, making structures more resilient against water damage.

Additionally, they contribute to the insulation properties of the mortar, helping to create energy-efficient buildings that adhere to green construction norms. The construction industry's shift towards sustainable practices has led to an increased focus on eco-friendly additives and biobased alternatives. Nanotechnology and recycling solutions are being explored to create innovative mortar chemicals that reduce the environmental impact of construction activities. Sustainable practices, such as the use of re-dispersible powders and polymer dispersions, are gaining popularity as they offer improved performance and reduced environmental impact. Smart city projects and modernization renovations require mortar additives and chemicals that can meet the demands of advanced construction technology. Accelerators and delayed hardening agents are essential in these applications, enabling the use of prefabricated buildings and machinery installation. In the home decoration industry, wall putty and tile adhesives benefit from the addition of smart additives, which can include IoT monitoring and construction technology. The construction industry's evolution is driven by the need for improved performance, sustainability, and efficiency. Dry mix mortar additives and chemicals play a crucial role in enabling the delivery of high-quality structures across various sectors.

From residential and commercial construction to industrial applications, plastering, flooring, waterproofing, insulation, and more, these additives and chemicals are essential in creating structures that meet the demands of modern construction. In addition, the market for dry mix mortar additives and chemicals is dynamic and evolving, driven by the need for improved performance, sustainability, and efficiency In the construction industry. From enhancing bonding strength and water retention to contributing to eco-friendly and smart construction practices, these additives and chemicals are essential in creating structures that meet the demands of modern construction.

|

Dry Mix Mortar Additives And Chemicals Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market growth 2024-2028 |

USD 13.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.6 |

|

Key countries |

China, Japan, India, Indonesia, US, Turkey, Germany, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dry Mix Mortar Additives And Chemicals Market Research and Growth Report?

- CAGR of the Dry Mix Mortar Additives And Chemicals industry during the forecast period

- Detailed information on factors that will drive the Dry Mix Mortar Additives And Chemicals growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dry mix mortar additives and chemicals market growth of industry companies

We can help! Our analysts can customize this dry mix mortar additives and chemicals market research report to meet your requirements.