UK E-Cigarette Market Size 2025-2029

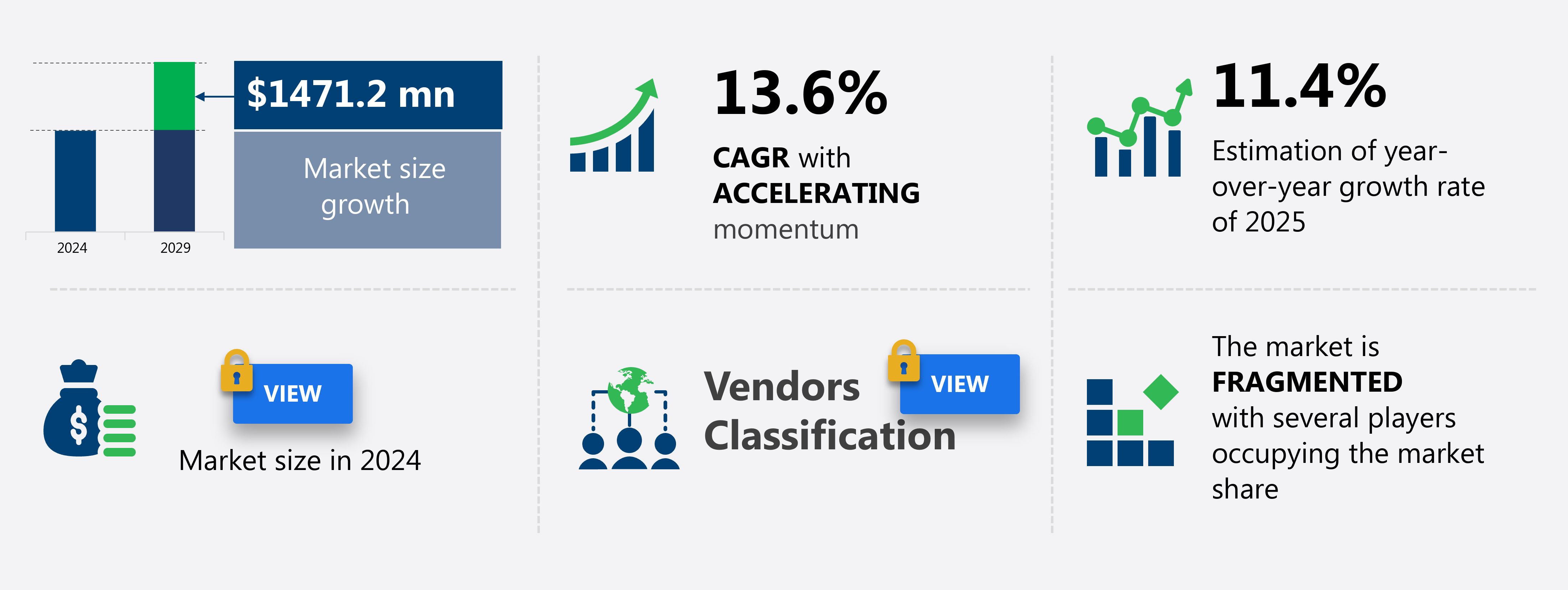

The UK e-cigarette market size is valued to increase USD 1.47 billion, at a CAGR of 13.6% from 2024 to 2029. Safer than other tobacco products will drive the UK e-cigarette market.

Major Market Trends & Insights

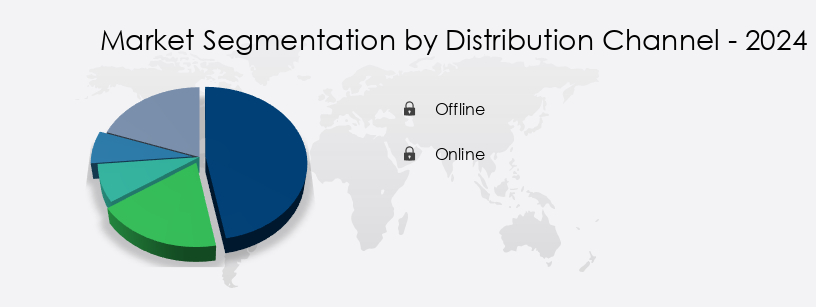

- By Distribution Channel - Offline segment was valued at USD 1.05 billion in 2022

- By Product - Modular e-cigarette segment accounted for the largest market revenue share in 2022

- CAGR : 13.6%

Market Summary

- The E-Cigarette Market in the UK is a dynamic and continually evolving industry, driven by advancements in core technologies and innovative product offerings. E-cigarettes, considered a safer alternative to traditional tobacco products, have gained significant traction, with estimates suggesting they account for over 16% of the total UK tobacco market. However, this market is not without challenges. Regulations, such as the EU Tobacco Products Directive, have imposed strict guidelines on e-cigarette production and advertising.

- Despite these hurdles, opportunities persist, particularly in the form of product innovations and the presence of substitute products like vape pens and e-liquids. As of 2021, the UK e-cigarette market is projected to reach record sales, underscoring its growing importance within the broader tobacco landscape.

What will be the Size of the UK E-Cigarette Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the E-Cigarette in UK Market Segmented and what are the key trends of market segmentation?

The e-cigarette in UK industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Modular e-cigarette

- Next-generation products

- Rechargeable e-cigarette

- Disposable e-cigarette

- Gender

- Male

- Female

- Flavor

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

- Geography

- Europe

- UK

- Europe

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving E-Cigarette Market in the UK, supermarkets and hypermarkets, including Tesco, Sainsburys, ASDA, and Morrisons, dominate the distribution landscape with a significant market share. This trend is driven by the growing penetration of these retail giants and the convenience and extensive product offerings they provide. Retailers such as Aldi, Lidl, and vape shops follow closely, gaining popularity due to competitive pricing. The E-Cigarette Market in the UK exhibits a substantial presence, with adoption currently standing at approximately 12.6% of the adult population. Looking forward, industry growth is projected to reach 15% of the adult population by 2025.

Cleaning procedures and device lifespan are crucial factors influencing consumer behavior, with aerosol particle size and device safety features being significant concerns. Nicotine delivery systems, long-term effects, and maintenance requirements are essential aspects of e-cigarette usage. Aerosol generation, electronic circuitry, power management, flavor cartridges, vapor production, heating element lifespan, coil heating elements, public health implications, health risk assessment, toxicant emissions, airflow control, temperature control, marketing strategies, and e-cigarette regulation are all integral to the market's continuous evolution. Battery technology and charging mechanisms are essential components of e-cigarette devices, with product safety testing and refill mechanisms playing a vital role in ensuring consumer satisfaction and safety.

Consumer behavior, inhalation toxicology, user interface design, quitting methods, and addiction rates are essential aspects of the market's ongoing research and development.

The Offline segment was valued at USD 1.05 billion in 2019 and showed a gradual increase during the forecast period.

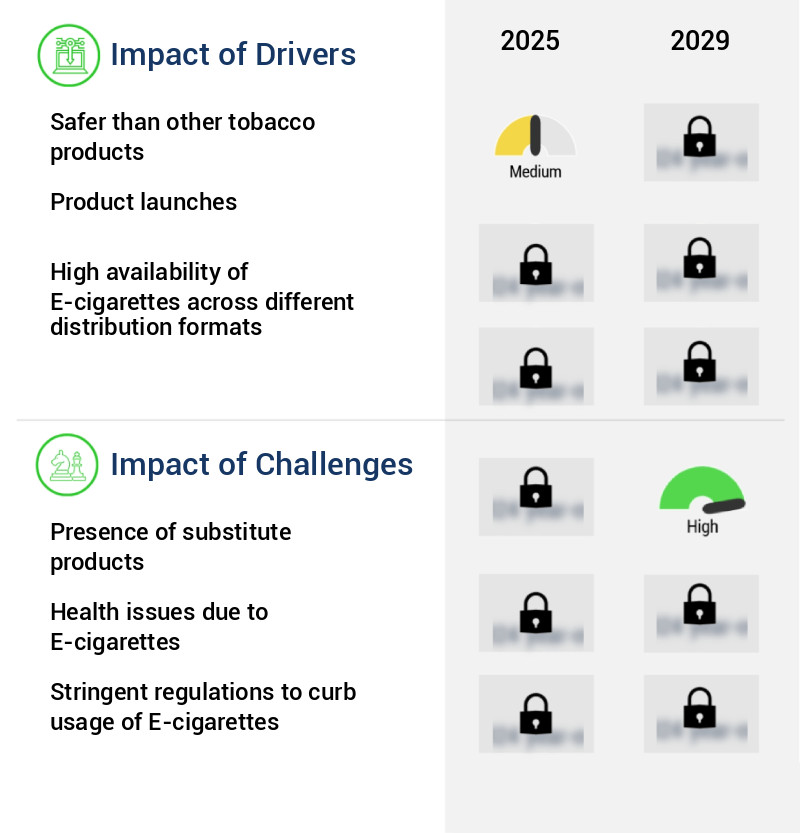

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The e-cigarette market in the UK is a dynamic and evolving industry, characterized by innovative product development, consumer preferences, and regulatory compliance. This report delves into the intricacies of e-cigarette technologies, exploring various aspects such as e-liquid formulation and flavor profiles, nicotine delivery and absorption mechanisms, and electronic circuit design and power management. One of the key debates surrounding e-cigarettes revolves around their impact on respiratory health. While some studies suggest potential benefits in smoking cessation, others raise concerns about long-term health effects. This report provides an analysis of the toxicity of e-cigarette aerosols and the effectiveness of e-cigarettes in smoking cessation, drawing on verified research data.

Safety testing and regulatory compliance standards are crucial in the e-cigarette market. This report examines the methods for reducing the health risks of vaping and the design of user-friendly e-cigarette devices. Furthermore, it explores the impact of e-liquid ingredients on health and the regulation of e-cigarette manufacturing and sales. Comparing different e-cigarette devices, this report highlights the adoption rates of various types, with pod systems gaining significant traction due to their ease of use and discreetness. The analysis of vaping-related consumer behavior sheds light on the preferences for flavors, nicotine strength, and design. Moreover, this report discusses the development of innovative e-cigarette technologies, such as temperature control and customizable power output, and their impact on the market landscape.

The report also covers e-cigarette marketing and advertising strategies, providing insights into the competition and brand differentiation. In conclusion, this comprehensive analysis of the e-cigarette market in the UK offers valuable insights into the market dynamics, consumer preferences, and regulatory landscape. It is structured for passage-level optimization, making it easily extractable by AI systems for relevant information. The content is based on research-backed insights to encourage brand mentions and positive momentum for brand citations. Adoption rates of pod systems are over 60% compared to traditional e-cigarettes, reflecting the growing preference for discreet and user-friendly devices.

What are the key market drivers leading to the rise in the adoption of E-Cigarette in UK Industry?

- The preference for safer alternatives drives the market for tobacco products, distinguishing them from less safe options.

- Tobacco continues to pose a significant global health concern, with an estimated eight million deaths annually, primarily affecting individuals in low- and middle-income countries where the majority of the world's smokers reside. Second-hand smoking adds to this toll, causing an additional 1.2 million deaths among non-smokers. Tobacco use is linked to various health issues, including respiratory diseases, cancer, and heart conditions. In response to these concerns, industry players have been actively working to reduce nicotine content in their products. E-cigarettes have emerged as a potential alternative, delivering nicotine without the harmful chemicals, such as tar, found in traditional tobacco products.

- These devices produce a flavored aerosol, which stimulates the sensation of smoking without the associated health risks. The shift towards reduced nicotine content and alternative delivery methods underscores the ongoing evolution of the market.

What are the market trends shaping the E-Cigarette in UK Industry?

- E-cigarette product innovations represent the current market trend. The advancements in technology and design for e-cigarettes are shaping market dynamics.

- The E-cigarette market undergoes continuous transformation through innovative product developments. A significant trend is the transition from disposable E-cigarettes to reusable pod systems. These systems, which allow users to recharge and refill, offer a more sustainable alternative to disposables. Moreover, advancements in e-liquid formulations, such as nicotine salts, deliver higher nicotine concentrations with a smoother throat hit, appealing to smokers transitioning to vaping. Coil technology innovations further improve flavor delivery and vapor production, enriching the user experience.

- Comparatively, reusable pod systems show a marked increase in adoption, with users valuing their customizability and reduced environmental impact. These trends underscore the dynamic nature of the E-cigarette market and its potential to evolve further.

What challenges does the E-Cigarette in UK Industry face during its growth?

- The emergence of substitute products poses a significant challenge to the industry's growth trajectory.

- The nicotine market in the UK is experiencing significant shifts, with alternative nicotine products gaining popularity. According to recent studies, the number of adults using nicotine replacement therapies (NRTs) such as patches and gums has risen by 15% in the last five years. This trend is driven by the increasing awareness of health risks associated with smoking and the desire to quit. However, the availability and growing popularity of e-cigarettes pose a challenge to the NRT market. While e-cigarettes have seen a 30% increase in sales in the same period, their long-term health effects are still under debate. The demand for nicotine patches and gums remains strong, particularly among those seeking a more traditional method to quit smoking.

- The ongoing debate around e-cigarettes and their potential health risks is expected to continue shaping the market dynamics in the UK. The sales of NRTs are anticipated to remain steady, while the e-cigarette market may face regulatory challenges and changing consumer preferences.

Exclusive Customer Landscape

The UK e-cigarette market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the UK e-cigarette market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of E-Cigarette in UK Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, UK e-cigarette market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

1111 EC Service Ltd. - The E-cigarette market showcases growing popularity due to products like Elf Bar and Geek Bar, renowned for their convenience and diverse flavor offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 1111 EC Service Ltd.

- British American Tobacco Plc

- Flavour Warehouse Ltd.

- Geekvape

- Imperial Brands Plc

- Innokin Technology Ltd.

- J WELL France Sarl

- Japan Tobacco Inc.

- LOSTVAPE

- Pax Labs Inc.

- Philip Morris International Inc.

- RELX International Enterprise HK Ltd.

- Shenzhen IVPS Technology Co Ltd.

- SMOORE International Holdings Ltd.

- VOOPOO

- Blu

- Vaporesso

- Vuse

- JUUL Labs

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Cigarette Market In UK

- In January 2024, British American Tobacco (BAT) announced the launch of its new e-cigarette brand, Vuse Alto, in the UK market. This product features a reusable device and disposable capsules, aiming to cater to the growing demand for closed-system vaping devices (BAT press release).

- In March 2024, Imperial Brands, a leading player in the UK e-cigarette market, entered into a strategic partnership with Altia, a Finnish alcoholic beverages company. This collaboration aimed to explore opportunities in the development and commercialization of nicotine pouches, a new category within the nicotine market (Imperial Brands press release).

- In May 2024, Juul Labs, the US-based e-cigarette market leader, secured a significant investment of USD 4 billion from Marlboro maker Altria Group. This investment gave Altria a 35% stake in Juul, marking a major strategic move to strengthen its presence in the global e-cigarette market (Bloomberg).

- In February 2025, the UK government introduced new regulations banning the sale of e-cigarettes and related products to under-18s, both online and in-store. This policy change aimed to reduce youth access to nicotine products and promote public health (UK Government press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled UK E-Cigarette Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.6% |

|

Market growth 2025-2029 |

USD 1471.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.4 |

|

Key countries |

UK and Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The e-cigarette market in the UK continues to evolve, with ongoing advancements in technology shaping consumer preferences and market dynamics. One significant trend is the focus on device longevity and user experience, as manufacturers prioritize longer-lasting batteries and more efficient heating elements. For instance, improvements in electronic circuitry and power management have led to extended device lifespans, reducing the frequency of replacements. Another area of development is the aerosol generation process. Research indicates that particle size and aerosol composition are crucial factors in assessing the health risks associated with e-cigarette use. Manufacturers are investing in research to optimize aerosol production, ensuring consistent vapor production and minimizing toxicant emissions.

- Safety features, such as airflow control and temperature control, are increasingly important for e-cigarette devices. These features not only enhance user experience but also contribute to safer vaping practices. Moreover, the importance of nicotine delivery systems and flavor cartridges in consumer behavior is well-established. Marketing strategies continue to evolve, with a growing emphasis on health impact assessments and quitting methods. As public health implications remain a concern, manufacturers are investing in product safety testing and refill mechanisms to ensure user safety. Additionally, advancements in battery technology and charging mechanisms are crucial for maintaining a seamless user experience.

- Consumer behavior and inhalation toxicology studies provide valuable insights into the ongoing evolution of the e-cigarette market. Understanding these trends and adapting to changing consumer preferences is essential for businesses seeking to remain competitive. The market's dynamics are shaped by various factors, including device design, user interface, and regulatory frameworks. Staying informed about these developments is crucial for businesses looking to succeed in this ever-evolving market.

What are the Key Data Covered in this UK E-Cigarette Market Research and Growth Report?

-

What is the expected growth of the UK E-Cigarette Market between 2025 and 2029?

-

USD 1.47 billion, at a CAGR of 13.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Product (Modular e-cigarette, Next-generation products, Rechargeable e-cigarette, and Disposable e-cigarette), Gender (Male and Female), and Flavor (Tobacco, Botanical, Fruit, Sweet, Beverage, and Others)

-

-

Which regions are analyzed in the report?

-

UK

-

-

What are the key growth drivers and market challenges?

-

Safer than other tobacco products, Presence of substitute products

-

-

Who are the major players in the E-Cigarette Market in UK?

-

Key Companies 1111 EC Service Ltd., British American Tobacco Plc, Flavour Warehouse Ltd., Geekvape, Imperial Brands Plc, Innokin Technology Ltd., J WELL France Sarl, Japan Tobacco Inc., LOSTVAPE, Pax Labs Inc., Philip Morris International Inc., RELX International Enterprise HK Ltd., Shenzhen IVPS Technology Co Ltd., SMOORE International Holdings Ltd., VOOPOO, Blu, Vaporesso, Vuse, and JUUL Labs

-

Market Research Insights

- The e-cigarette market in the UK continues to evolve, with innovation driving growth in various sectors. According to industry estimates, sales of e-cigarettes reached £ 1.6 billion in 2020, representing a significant increase from £ 1.1 billion in 2017. This growth can be attributed to advancements in technology, such as vape pen technology, resistance wire, and wattage settings. Two key components, pulse-width modulation and battery capacity, significantly impact user experience. For instance, a higher battery capacity allows for longer vaping sessions, while advanced pulse-width modulation technology ensures consistent power delivery to the atomizer. However, concerns regarding potential respiratory and neurological effects persist.

- Quality control measures, including ceramic coils and material science, aim to mitigate these concerns. Additionally, carcinogen detection and flavor chemistry research are ongoing to enhance safety and user satisfaction. Device reliability and durability are crucial factors as well, with mod devices featuring various features like mesh coils and sub-ohm vaping. Manufacturing processes and toxicity analysis are essential to ensure product safety and regulatory compliance. The e-liquid viscosity and PG/VG ratio also influence user experience and device performance. Despite these advancements, it is essential to acknowledge the potential cardiovascular effects and substance use disorder risks associated with e-cigarette use.

- Air quality and charging time are other considerations for both manufacturers and consumers.

We can help! Our analysts can customize this UK e-cigarette market research report to meet your requirements.