E-Prescribing Market Size 2024-2028

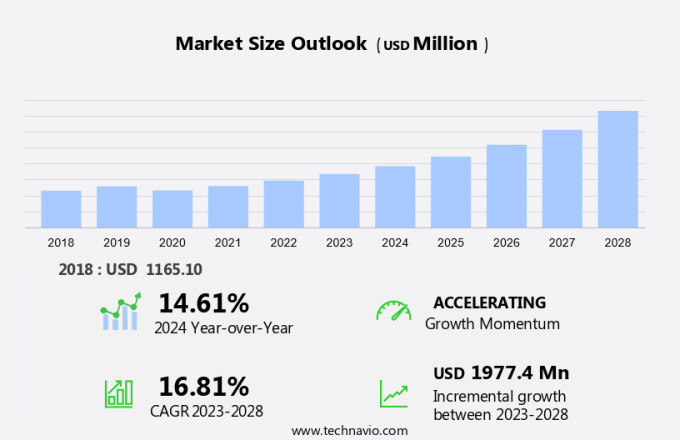

The E-prescribing market size is forecast to increase by USD 1.98 billion at a CAGR of 16.81% between 2023 and 2028. The market is experiencing significant growth due to the increasing need for automation across various departments in hospitals and nursing homes. The use of Internet-enabled mobile devices in healthcare IT is a major trend, enabling physicians to prescribe medications remotely and reducing the risk of errors. However, privacy and data security concerns remain a challenge, as sensitive patient information must be protected. Cost savings are also a driving factor, as e-prescribing reduces the likelihood of prescription errors and associated deaths, resulting in significant cost savings for healthcare providers and health alliance plans. CVS Caremark Corporation and other industry players are capitalizing on this trend by offering comprehensive e-prescribing solutions to hospitals, nursing homes, and individual physicians. The market is expected to continue growing, as the benefits of e-prescribing become increasingly apparent.

In the realm of healthcare technology, e-prescribing has emerged as a transformative solution, revolutionizing the way prescriptions are written and managed. This digital approach offers numerous benefits, including prescription accuracy, improved patient safety, and reduced costs. Electronic connectivity between clinicians, pharmacies, and health plan formularies enables real-time access to patient eligibility, medication history, and health alliance plans. At the point of care, e-prescribing applications facilitate medication orders, reducing medication errors, adverse drug events, and even deaths. By integrating drug interactions, allergy alerts, and health plan formularies, e-prescribing minimizes the risk of errors and enhances patient safety. Hospitals, nursing homes, pharmacies, and CVS Caremark Corporation are among the key adopters of this technology.

Furthermore, the cost savings derived from reduced medication errors, improved patient outcomes, and streamlined workflows make e-prescribing an indispensable tool for physicians and health care providers managing medications for their patients.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premise

- Cloud-based

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Deployment Insights

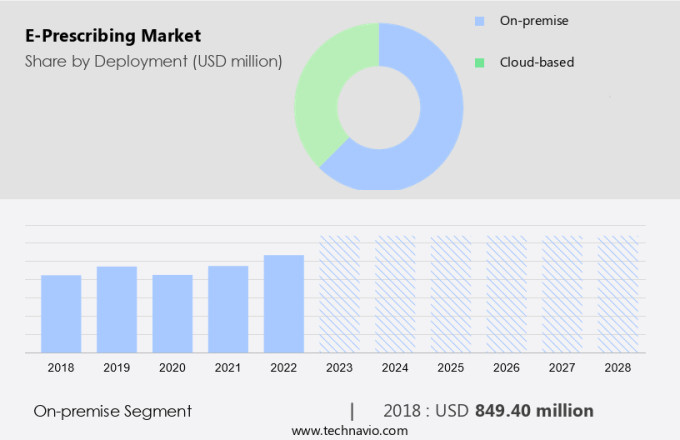

The on-premise segment is estimated to witness significant growth during the forecast period. The market is experiencing notable growth due to the implementation of patient eligibility and medication history checks at the point of care. E-prescribing applications offer numerous benefits, including reduced medication errors and adverse drug events. The on-premises segment in the market is anticipated to expand at a considerable rate, owing to the enhanced security and protection provided by on-premise solutions. On-premise solutions require the acquisition of licenses or software copies, and the entire software solution is installed and managed on the company's premises. This proximity to on-premise electronic health record (EHR) systems enables seamless integration and data sharing. However, the high costs associated with managing and maintaining the data on a company's premises may hinder the adoption of on-premise solutions during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The on-premise segment was valued at USD 849.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

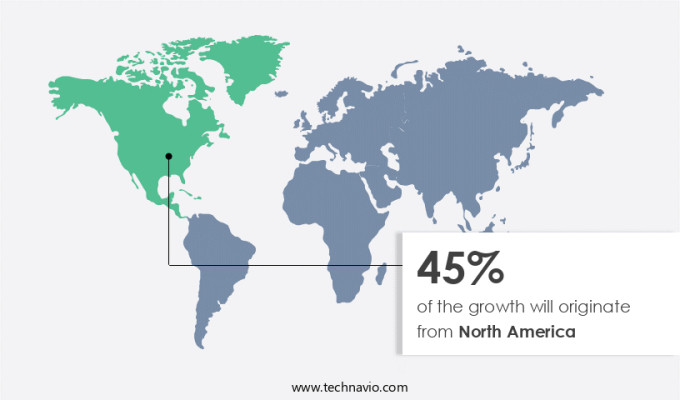

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In 2023, North America holds a substantial share of The market due to the rising prevalence of chronic conditions like cancer and cardiovascular diseases (CVDs). Similarly, heart diseases, including coronary artery disease, are common health issues in North America, as per the Centers for Disease Control and Prevention (CDC). The adoption of advanced technologies in e-prescribing, increasing healthcare expenditure, and the presence of numerous market players contribute to the market's growth in the region.

Furthermore, E-prescribing applications offer several benefits, such as improved patient eligibility verification, medication history access, and point-of-care prescription processing. These features help reduce medication errors and adverse drug events, ultimately enhancing patient safety and satisfaction.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing need for automation across departments is the key driver of the market. The healthcare industry is witnessing a significant shift towards healthcare technology to enhance prescription accuracy, ensure patient safety, and reduce costs. With the increasing prevalence of chronic diseases and an aging population, there is a pressing need to streamline the prescription process and increase clinician efficiency.

Furthermore, electronic connectivity between clinicians, pharmacies, and health plans is essential for seamless medication management. IT solutions facilitate automated data collection, storage, and analysis, enabling faster diagnosis and treatment. Furthermore, electronic prescriptions help in adhering to health plan formularies, reducing prescription errors, and minimizing the time spent on manual prescription processing. By leveraging technology, healthcare providers can improve patient care, reduce costs, and enhance overall system productivity.

Market Trends

Increasing use of Internet-enabled mobile devices in healthcare IT is the upcoming trend in the market. The market in the health care technology sector has witnessed significant growth in recent years, driven by the need for prescription accuracy, patient safety, and cost savings. Electronic connectivity between clinicians, pharmacies, and health plans has become essential for streamlined communication and efficient workflows.

Furthermore, this digital transformation allows for real-time access to health plan formularies, reducing prescription errors and ensuring patients receive the most effective medications. With the increasing use of mobile devices in healthcare, patients can now connect with their healthcare providers for instant clarification on dosages or other prescription-related queries. Moreover, automated message reminders from hospitals keep patients informed about follow-up appointments and doctor availability, enhancing the overall patient experience.

Market Challenge

Privacy and data security concerns is a key challenge affecting the market growth. E-prescribing, a significant advancement in health care technology, has revolutionized the way prescriptions are managed, enhancing prescription accuracy and ensuring improved patient safety. By leveraging electronic connectivity between clinicians, pharmacies, and health plans, this system enables seamless transfer of vital patient information, including formulary coverage and medication history.

Furthermore, this technological innovation not only streamlines the prescription process but also reduces costs associated with traditional methods. Data, such as patients' health records and clinical information, is securely shared among authorized parties, maintaining confidentiality and building trust within the healthcare ecosystem. Federal and state guidelines ensure the security and privacy of e-prescribing solutions, making it a reliable and efficient alternative to traditional prescription methods.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ALLSCRIPTS HEALTHCARE SOLUTIONS INC.: The company offers e prescribing such as transmit prescriptions via SureScripts secure national electronic network to the pharmacies of their patient choice.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- athenahealth Inc.

- Change Healthcare Inc.

- CompuGroup Medical SE and Co. KGaA

- Computer Programs and Systems Inc.

- Constellation Software Inc.

- DrFirst Inc

- eClinicalWorks LLC

- Epic Systems Corp.

- General Electric Co.

- Henry Schein Inc.

- iMedX Inc.

- McKesson Corp.

- Medical Information Technology Inc.

- NextGen Healthcare Inc.

- Oracle Corp.

- Surescripts RxHub LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

E-prescribing, a vital component of healthcare technology, has revolutionized the prescription process by enabling clinicians to transmit prescriptions electronically to pharmacies. This innovation brings numerous benefits, including prescription accuracy, improved patient safety, and reduced costs. Electronic connectivity between clinicians, pharmacies, health plan formularies, and patient eligibility and medication history databases facilitates point-of-care prescribing, minimizing medication errors, adverse drug events, and even deaths. E-prescribing applications offer features such as drug interaction checks, allergy alerts, and medication history databases, enhancing prescriber efficiency and office billing system usability. The office environment benefits from increased workflow, reduced complexity, and financial considerations. Controlled substances are also subject to national standards, ensuring security and addressing privacy concerns.

However, the implementation of e-prescribing involves financial considerations and addressing the complexity of workflows in various settings, including hospitals, nursing homes, and health alliance plans. Electronic prescriptions offer significant time and money savings for pharmacists, patients, and prescribers, streamlining the process and reducing the reliance on handwritten prescriptions. In managed health care systems, electronic prescribing can help reduce prescribing errors by allowing pharmacists to access a patient's prescription history and allergies, ultimately improving patient safety and ensuring appropriate financial considerations are made regarding drug insurance coverage. The Health Alliance Plan health plan formulary provides pharmacists with essential information from a patient's medical record to guide financial considerations when prescribing drugs, ensuring that both efficacy and cost-effectiveness are prioritized in patient care. This transformation in prescribing methods contributes to improved patient care and outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.81% |

|

Market growth 2024-2028 |

USD 1.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.61 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 45% |

|

Key countries |

US, UK, Japan, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALLSCRIPTS HEALTHCARE SOLUTIONS INC., athenahealth Inc., Change Healthcare Inc., CompuGroup Medical SE and Co. KGaA, Computer Programs and Systems Inc., Constellation Software Inc., DrFirst Inc, eClinicalWorks LLC, Epic Systems Corp., General Electric Co., Henry Schein Inc., iMedX Inc., McKesson Corp., Medical Information Technology Inc., NextGen Healthcare Inc., Oracle Corp., and Surescripts RxHub LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch