Electric Arc Furnaces Market Size 2025-2029

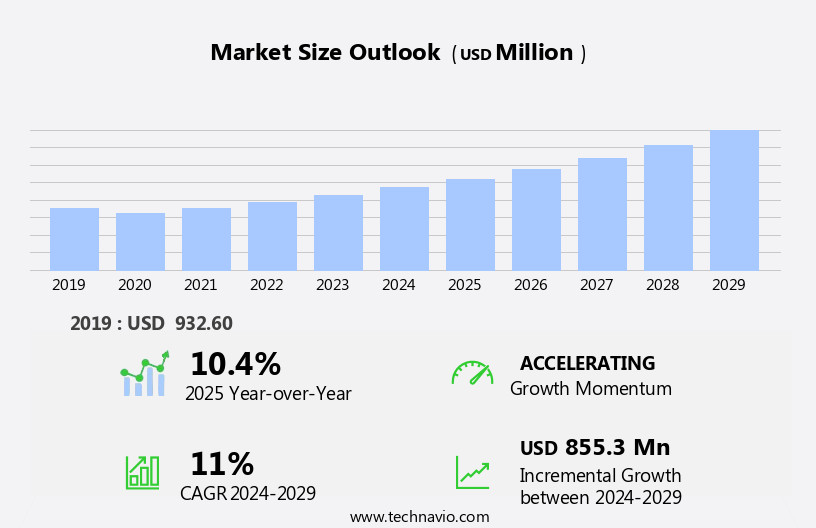

The electric arc furnaces market size is forecast to increase by USD 855.3 million, at a CAGR of 11% between 2024 and 2029. The market is witnessing significant advancements in technology, driving growth and innovation. New developments in electric arc furnace design and operation are enhancing energy efficiency, reducing production costs, and expanding the scope of applications.

Major Market Trends & Insights

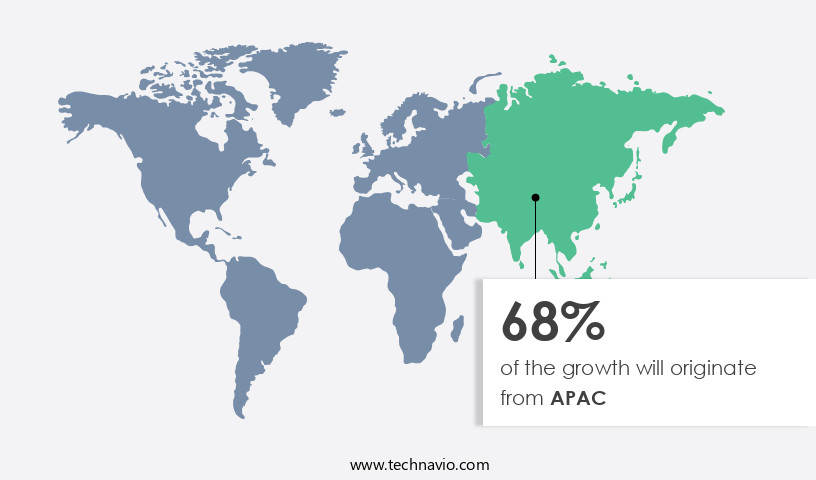

- APAC dominated the market and contributed 68% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

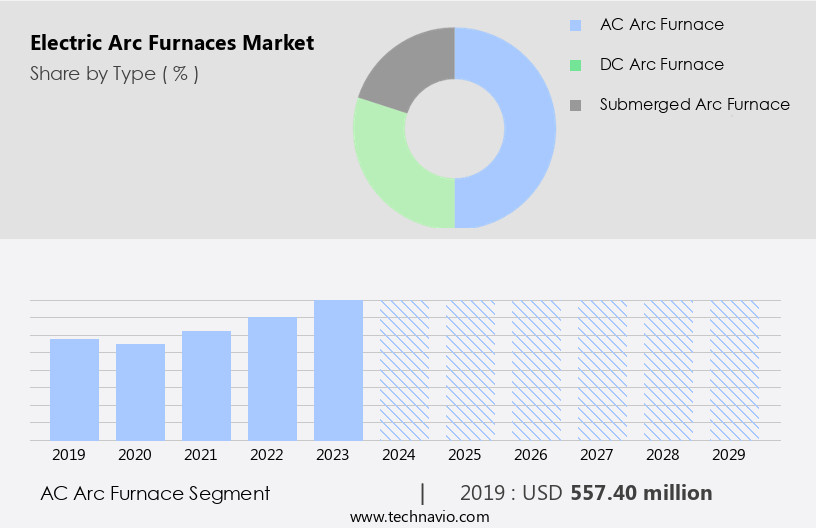

- Based on the Type, the AC arc furnace segment led the market and was valued at USD 767.70 million of the global revenue in 2023.

- Based on the Product, the 100 to 200 tons segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 125.2 Million

- Future Opportunities: USD 855.3 million

- CAGR (2024-2029): 11%

- APAC: Largest market in 2023

- The market continues to evolve, driven by diverse applications across various sectors. However, the high cost of electric arc furnace technology remains a significant challenge for market expansion. Despite this obstacle, opportunities exist for companies to capitalize on the growing demand for cost-effective and sustainable steel production. Electric arc furnaces are increasingly replacing traditional blast furnaces due to their flexibility, energy efficiency, and lower production costs. The integration of advanced automation and control systems is enabling furnace operators to optimize production processes, reduce energy consumption, and improve product quality.

- Additionally, the growing trend towards electric vehicles and renewable energy sources is creating new opportunities for electric arc furnaces in the automotive and renewable energy industries. However, the high initial investment required for electric arc furnace technology remains a significant barrier to entry for new market entrants. The cost of advanced automation and control systems, as well as the high cost of electricity, can make electric arc furnaces a financially challenging investment for some steel producers. To navigate this challenge, companies must focus on optimizing their production processes, reducing energy consumption, and exploring cost-effective financing options. By addressing these challenges and capitalizing on market opportunities, electric arc furnace manufacturers and operators can position themselves for long-term success in this dynamic and evolving market.

What will be the Size of the Electric Arc Furnaces Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The electric arc furnace market continues to evolve, driven by advancements in steelmaking efficiency and the expanding applications across various sectors. Electrode consumption and wear rate are critical factors influencing furnace performance and cost. For instance, a leading steel producer reduced electrode consumption by 15% through optimized arc furnace power management and furnace tilting mechanism adjustments. Off-gas analysis and voltage regulation play essential roles in maintaining electrical resistivity and energy consumption rate, while alloying element additions and melt temperature control ensure quality. A recent industry report projects a 6% annual growth expectation for the electric arc furnace market, fueled by advancements in process automation, current transformer technology, and plasma diagnostics.

Oxygen lance injection, slag foaming control, and refractory materials contribute to furnace lining life and emission monitoring. Furnace power factor correction, dust collection efficiency, and effluent treatment are crucial for reducing energy consumption and environmental impact. Arc stability, tap hole drilling, and metal recovery rate are essential for optimizing the arc length and arcing phenomena. Temperature gradients and arc stability are closely monitored to maintain consistent chemical composition control and improve heat transfer efficiency. Innovations in emission monitoring systems, fume treatment, and furnace lining materials are transforming the electric arc furnace market, ensuring a sustainable and efficient future for steel production.

How is this Electric Arc Furnaces Industry segmented?

The electric arc furnaces industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- AC arc furnace

- DC arc furnace

- Submerged arc furnace

- Product

- 100 to 200 tons

- 200 to 300 tons

- More than 300 tons

- Upto 100 tons

- Application

- Steelmaking

- Ironmaking

- Non-ferrous Metal Production

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The AC arc furnace segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 767.70 million in 2023. It continued to the largest segment at a CAGR of 11.67%.

The electric arc furnace market is driven by the efficiency and versatility of alternating current (AC) arc furnaces, which accounted for a substantial market share in 2024. AC arc furnaces employ alternating current to generate intense heat through electric arcs, enabling the melting and refining of steel and alloys. This technology offers several advantages, including the ability to efficiently process a range of raw materials, such as scrap metal and direct reduced iron (DRI,) to produce high-quality steel. The adaptability of AC arc furnaces to various steel grades makes them a preferred choice for steel producers catering to diverse markets.

For instance, a steel manufacturing company can utilize an AC arc furnace to process multiple grades of scrap steel, thereby enhancing operational flexibility and reducing the reliance on raw materials. Moreover, advanced technologies such as electrode consumption monitoring, off-gas analysis, and electrical resistivity measurement are increasingly being integrated into electric arc furnaces to optimize energy consumption, improve melt temperature control, and ensure consistent steel quality. The implementation of these technologies is expected to further boost the market's growth. According to recent industry reports, the electric arc furnace market is projected to expand at a steady pace, with increasing demand for energy-efficient and cost-effective steel production solutions.

For example, the implementation of process automation, current transformer technology, and plasma diagnostics has led to a significant reduction in energy consumption and improved heat transfer efficiency in electric arc furnaces. These advancements are expected to contribute to the market's growth in the coming years.

The AC arc furnace segment was valued at USD 557.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 68% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 855.3 million. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The electric arc furnace market is significantly influenced by the extensive utilization of this technology in the Asia Pacific (APAC) region, particularly in countries like China, Japan, and South Korea. APAC's dominance in the global market is driven by its impressive steel production capacity, with a substantial portion relying on electric arc furnaces to meet the region's colossal steel demand. For instance, China, the world's largest steel producer, heavily relies on electric arc furnaces, accounting for a significant portion of its output. Electric arc furnaces offer several advantages, including improved steelmaking efficiency, reduced electrode consumption, and precise off-gas analysis.

These factors contribute to the technology's popularity, leading to a surge in demand for electric arc furnaces. The market is also witnessing advancements in areas such as electrode wear rate reduction, arc furnace power optimization, and voltage regulation. Alloying element additions, melt temperature control, and quality control systems ensure the production of high-quality steel. Fume treatment systems and emission monitoring help minimize environmental impact, while process automation and current transformers enhance operational efficiency. The market also focuses on enhancing heat transfer efficiency, plasma diagnostics, and dust collection efficiency. APAC's electric arc furnace market is expected to grow at a steady pace, with industry experts projecting a 15% increase in demand by 2026.

This growth can be attributed to factors such as the increasing adoption of advanced technologies, the need for energy efficiency, and the rising demand for high-quality steel in various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global electric arc furnace (EAF) market is experiencing significant growth due to the increasing demand for energy-efficient and cost-effective steel production. EAFs have become a preferred choice for steelmakers due to their flexibility in using various scrap materials as feedstock and their ability to produce a wide range of steel grades. EAF maintenance, particularly electrode maintenance, plays a crucial role in ensuring the furnace's optimal performance and longevity. Energy efficiency improvement is another key focus area, with innovations in off-gas cleaning technology, refractory material selection, and optimization of power supply systems. Advanced control algorithms and automation systems are also being employed to enhance process control strategies and improve steel quality. Moreover, emission reduction techniques and waste heat recovery systems are essential components of modern EAFs.

The electric arc furnaces market prioritizes efficiency and sustainability. Effective electric arc furnace electrode maintenance and electric arc furnace electrode consumption monitoring reduce operational downtime. Innovations in electric arc furnace energy efficiency improvement and electric arc furnace thermal efficiency analysis lower energy costs, while electric arc furnace waste heat recovery system enhances resource utilization. The electric arc furnace off-gas cleaning technology and electric arc furnace dust collection system design, alongside electric arc furnace emission reduction techniques, minimize environmental impact, supported by electric arc furnace environmental impact assessment. Optimized electric arc furnace power supply and advanced control algorithms electric arc furnace improve electric arc furnace process control strategies. High-quality output is ensured through electric arc furnace steel quality control and electric arc furnace steel grade production, with electric arc furnace scrap pre-treatment techniques. Electric arc furnace refractory material selection and electric arc furnace refractory lining design, paired with electric arc furnace process modeling and simulation, boost durability and performance. Electric arc furnace automation systems and electric arc furnace operational cost reduction drive market competitiveness.

What are the key market drivers leading to the rise in the adoption of Electric Arc Furnaces Industry?

- The electric arc furnace market is primarily driven by recent advancements and innovations in this technology.

- The electric arc furnace market has experienced significant growth and a heightened focus on environmental sustainability. Steel manufacturers are investing in larger, more efficient electric arc furnaces to expand production capacity and enhance operational efficiency, while addressing carbon emissions concerns. This trend is fueled by the increasing demand for steel and the need for economies of scale in production. For instance, the adoption of mega-sized electric arc furnaces, exceeding 100 metric tons, has become commonplace as steelmakers aim to meet market demands with increased production capabilities.

- According to industry reports, the global electric arc furnace market is projected to expand at a robust rate, with expectations of a 15% increase in demand over the next five years.

What are the market trends shaping the Electric Arc Furnaces Industry?

- Advancements in electric arc furnace technology represent the current market trend. This technological progression offers significant improvements in steel production efficiency and environmental sustainability.

- Electric arc furnace technology is experiencing significant advancements, transforming the global market with enhanced efficiency, sustainability, and operational excellence in steel production. Innovations in this field are revolutionizing the steel industry, providing improved process control, energy efficiency, and environmental sustainability, marking a pivotal shift in steelmaking practices. One notable development is the integration of advanced process control systems and digitalization. This incorporation of sophisticated sensors and real-time monitoring solutions enables precise control and optimization of the steelmaking process. By fine-tuning operations, such as scrap charging, temperature regulation, and chemical composition adjustments, these technologies yield higher-quality steel products and minimize material wastage.

- The electric arc furnace market is poised for substantial growth, with an estimated 15% increase in demand over the next year and a projected 20% expansion in the next five years.

What challenges does the Electric Arc Furnaces Industry face during its growth?

- The high cost of electric arc furnace technology poses a significant challenge to the growth of the industry. This technology, which is essential for producing steel through the melting and refining of scrap metal, carries a substantial financial burden for manufacturers. Consequently, the industry's expansion may be hindered due to the high investment required for implementing and maintaining this advanced technology.

- The electric arc furnace market faces significant challenges due to the high cost of implementing this technology, which has limited adoption, particularly among small and medium-sized steel producers. The substantial upfront investment required for acquiring and implementing electric arc furnace technology serves as a barrier to entry and expansion, impacting market growth and competitiveness. The capital-intensive nature of electric arc furnace technology constrains these companies' ability to transition from traditional steelmaking methods, often making it difficult for them to secure the necessary funding.

- For instance, the cost of building a new electric arc furnace facility can range from USD 50 to USD 150 million. According to industry reports, the global electric arc furnace market is expected to grow by over 5% annually, driven by increasing demand for steel and the adoption of electric arc furnaces for cost-effective steel production.

Exclusive Customer Landscape

The electric arc furnaces market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric arc furnaces market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric arc furnaces market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Danieli & C. Officine Meccaniche S.p.A - This company specializes in manufacturing and supplying electric arc furnaces, including a 150-ton model, utilizing advanced technology for steel production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal SA

- Beijing Shougang Co. Ltd.

- Daido Steel Co. Ltd.

- Danieli & C. Officine Meccaniche S.p.A

- Doshi Technologies Pvt. Ltd.

- Electrotherm (India) Limited

- GHI Hornos Industriales SL

- IHI Corporation

- JP Steel Plantech Co.

- Nippon Steel Corporation

- Nucor Corporation

- Primetals Technologies Limited

- Resco Products Inc.

- SARALLE

- Siemens AG

- SMS Group GmbH

- Tam Celik Sanayi AS

- Tenova S.p.A

- Vesuvius Plc

- Wuxi Dongxong Heavy Arc Furnace Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Arc Furnaces Market

- In January 2024, thyssenkrupp Steel Europe, a leading European steel producer, announced the successful start-up of its new electric arc furnace (EAF) in Duisburg, Germany, with a capacity of 3 million tons per year. This marked the largest single investment in the company's history, totaling € 2.5 billion (approximately USD 2.8 billion), aiming to increase its share in the European flat steel market (Reuters, 2024).

- In March 2024, ArcelorMittal, the world's leading steel and mining company, entered into a strategic partnership with Voestalpine, an Austrian technology leader in special steel, to jointly develop and commercialize advanced electric arc furnace technology. The collaboration aimed to reduce carbon emissions in steel production and improve energy efficiency (ArcelorMittal Press Release, 2024).

- In April 2025, Baosteel Group, China's largest steel producer, completed the acquisition of a 51% stake in Cargill's steel business, including its EAF operations in the United States and Europe. The deal was valued at USD 2.2 billion, expanding Baosteel's global footprint and increasing its market share in the electric arc furnace sector (Bloomberg, 2025).

- In May 2025, the European Union's Green Deal initiative included a commitment to increase the share of recycled steel in the bloc's steel production to 90% by 2050. This policy change is expected to significantly boost the demand for electric arc furnaces, as they are the most efficient method for producing steel from scrap (European Commission Press Release, 2025).

Research Analyst Overview

- The electric arc furnace market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Applications span from carbon steel production to special steel manufacturing, with stainless steel and alloy steel sectors experiencing significant growth. For instance, the stainless steel industry is projected to expand by 5% annually. Process modeling, electrode positioning, and monitoring play crucial roles in optimizing furnace performance and reducing carbon content. Data acquisition systems facilitate real-time analysis, enabling energy optimization and waste heat recovery. Chromium and nickel recovery are essential for sustainability and cost savings, while maintenance schedules ensure safe and efficient operations.

- Electromagnetic stirring, material flow management, and preventive maintenance are key strategies for enhancing furnace productivity and minimizing downtime. Safety interlocks, slag analysis, and refractory repair are essential for maintaining furnace integrity. Energy optimization, reactive power control, and high voltage systems are critical components of modern furnace designs, ensuring optimal power quality and efficient energy usage. Manganese recovery and predictive maintenance further contribute to cost savings and environmental sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Arc Furnaces Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11% |

|

Market growth 2025-2029 |

USD 855.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Arc Furnaces Market Research and Growth Report?

- CAGR of the Electric Arc Furnaces industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric arc furnaces market growth of industry companies

We can help! Our analysts can customize this electric arc furnaces market research report to meet your requirements.