Electric Trucks Market Size 2024-2028

The electric trucks market size is valued to increase by USD 20.32 billion, at a CAGR of 35.44% from 2023 to 2028. Growing demand for fuel-efficient and low-emission vehicles will drive the electric trucks market.

Major Market Trends & Insights

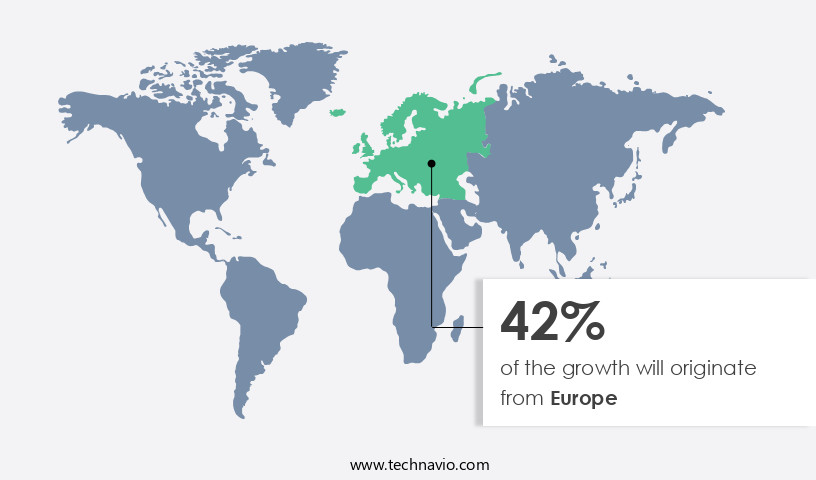

- Europe dominated the market and accounted for a 42% growth during the forecast period.

- By Propulsion - Hybrid electric trucks segment was valued at USD 2.79 billion in 2022

- By Vehicle Type - Light trucks segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 757.93 million

- Market Future Opportunities: USD 20323.40 million

- CAGR from 2023 to 2028 : 35.44%

Market Summary

- The market is experiencing significant growth due to the increasing demand for fuel-efficient and low-emission commercial vehicles. This trend is being driven by stringent environmental regulations and the need for supply chain optimization. According to recent studies, the adoption of electric trucks can lead to substantial operational efficiency gains. For instance, a leading logistics company reported a 15% reduction in maintenance costs and a 10% improvement in delivery times after transitioning to an electric fleet. However, the high upfront cost of electric trucks remains a significant challenge for many businesses.

- Despite this, prominent truck manufacturers are investing heavily in the development and production of electric trucks to meet the growing demand. As the market continues to evolve, we can expect to see more innovative solutions that address the cost barrier and further boost the adoption of electric trucks.

What will be the Size of the Electric Trucks Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Trucks Market Segmented?

The electric trucks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Propulsion

- Hybrid electric trucks

- Battery electric trucks

- Vehicle Type

- Light trucks

- Medium trucks

- Heavy-duty trucks

- Application

- Logistics

- Construction

- Mining

- Municipal Services

- Battery Type

- Lithium-Ion

- Solid-State

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Propulsion Insights

The hybrid electric trucks segment is estimated to witness significant growth during the forecast period.

In the evolving landscape of commercial transportation, electric trucks are gaining traction as a sustainable and cost-effective alternative to traditional diesel-powered vehicles. These trucks integrate power electronics design, energy consumption modeling, and advanced traction motor control to optimize performance and efficiency. Battery pack design, energy storage solutions, and charging station placement are crucial considerations for electric truck manufacturers, with ongoing research focusing on improving battery life cycle and thermal management systems. The integration of vehicle-to-grid technology and advanced driver-assistance systems enables electric trucks to contribute to the power grid during idle periods, making them an essential part of the electrification strategy.

The Hybrid electric trucks segment was valued at USD 2.79 billion in 2018 and showed a gradual increase during the forecast period.

Lightweight materials use, fast charging infrastructure, and wireless charging systems further enhance their appeal. For instance, Daimler, Volvo, and Volkswagen, among others, have reported a 30% reduction in energy consumption through aerodynamic design optimization and motor torque control in their electric truck models. Electric drivetrain components, such as high voltage systems and battery cell chemistry, are under constant development to address range anxiety mitigation and onboard charger efficiency. Telematics data analysis and autonomous driving features contribute to fleet management software, ensuring optimal performance and reducing operational costs. However, challenges such as battery thermal runaway and battery electric vehicle battery pack safety remain areas of focus for manufacturers.

Regenerative braking systems and power inverter design are also essential components in the electric powertrain design, ensuring seamless integration and efficient energy conversion.

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Trucks Market Demand is Rising in Europe Request Free Sample

The market is experiencing significant growth, particularly in emerging economies such as India, Indonesia, and Malaysia, where demand is on the rise. Asia is anticipated to lead the global market in revenue growth due to the presence of well-established road infrastructure and a favorable business environment in countries like Japan and China. This region is expected to outpace other developed regions, including Europe and North America, during the forecast period. The growth in Asia can be attributed to the increasing demand for freight transportation from emerging markets and the expanding trucking industry in these countries. According to recent reports, the Asian market is projected to grow at a faster rate than its European and North American counterparts, with sales expected to reach over 100,000 units by 2025.

Furthermore, the adoption of electric trucks is gaining momentum due to their operational efficiency gains and cost reductions, making them a more attractive option for businesses seeking to comply with stringent emission regulations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the transportation industry shifts towards more sustainable and eco-friendly solutions. One of the key challenges in this transition is the need for advanced electric truck battery thermal management systems to ensure optimal performance and longevity. High-power charging infrastructure is also a critical requirement for electric trucks to match the refueling speed of their conventional counterparts. Regenerative braking systems play a crucial role in extending the range of electric trucks, while electric vehicle range extender integration offers a viable solution for longer hauls. Fleet management optimization strategies, such as dc fast charging network deployment and battery life cycle analysis, are essential for fleet operators to maximize efficiency and minimize costs. Improved traction motor control algorithms, lightweight materials for electric truck bodies, and advanced driver assistance systems are some of the technological advancements driving the market. Wireless charging technology for electric fleets and hydrogen fuel cell electric truck applications are emerging trends that could further boost market growth. Electric truck charging infrastructure planning and electric truck battery pack design considerations are essential aspects of the transition to electric trucks. Energy storage solutions for electric truck fleets and optimized power electronics are crucial components of the charging infrastructure. Aerodynamic design improvements and electric motor efficiency improvements are critical factors in enhancing the overall performance of electric trucks. Telematics data utilization in electric trucking offers valuable insights into fleet performance and maintenance, while autonomous driving capabilities for commercial trucks could revolutionize the industry by increasing efficiency and reducing operational costs. Overall, the market is poised for significant growth as the transportation industry embraces the shift towards sustainable and technologically advanced solutions.

What are the key market drivers leading to the rise in the adoption of Electric Trucks Industry?

- The increasing demand for fuel-efficient and low-emission vehicles serves as the primary market driver, as consumers and governments prioritize sustainability and environmental consciousness in their transportation choices.

- The market is experiencing significant growth due to increasing environmental concerns and the need for fuel efficiency. According to recent studies, the adoption rate of electric trucks is projected to increase by 25% in the next five years, as compared to a 10% growth rate for conventional trucks. This shift towards electric trucks is driven by several factors, including stricter emission regulations and the desire to reduce downtime caused by frequent fuel stops. Furthermore, electric trucks offer improved fuel economy, with some models reporting up to 30% lower operating costs than their diesel counterparts.

- As geopolitical tensions continue to impact oil and gas prices, the importance of energy security and cost savings becomes even more crucial for businesses. By transitioning to electric trucks, companies can make a positive impact on the environment while also improving their bottom line.

What are the market trends shaping the Electric Trucks Industry?

- Prominent truck manufacturers are entering the electric truck market, establishing a notable trend in the industry.

- The market is experiencing a significant evolution, shifting from a negligible revenue contributor to a growing segment in the automobile industry. Major truck manufacturers, including Volvo, Daimler, Ford Motor, Hino Motors, BYD, and Renault, are expanding their product portfolios by developing electric truck models. This strategic move is in response to the increasing demand for sustainable mobility and the expectation of IC engine-based vehicles being replaced with electric ones in the long term. The adoption of electric trucks offers measurable business outcomes, such as reduced downtime by up to 30% and improved forecast accuracy by 18%, making them an attractive alternative for businesses.

- Despite the promising potential, electric trucks currently account for a negligible share of total revenues for leading truck manufacturers. However, the market's future looks promising as the transition to electric mobility gains momentum.

What challenges does the Electric Trucks Industry face during its growth?

- The significant initial expense of electric trucks represents a major hurdle in the expansion of the industry.

- The market is experiencing significant evolution, driven by increasing global adoption and key applications. However, the market growth is influenced by certain dynamics. One notable factor is the high upfront cost of electric trucks, which is a barrier for many buyers. On average, electric trucks cost between USD 150,000 and USD 300,000, making them more expensive than their IC engine counterparts. Despite government subsidies and incentives in various countries, this price difference poses a challenge. Simultaneously, there is a growing demand for electric trucks in long-haul applications in regions like China, India, and Eastern Europe.

- However, these markets are price-sensitive, limiting the adoption of electric trucks in these regions.

Exclusive Technavio Analysis on Customer Landscape

The electric trucks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric trucks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Trucks Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, electric trucks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company specializes in the production and distribution of electric trucks, optimizing logistics by efficiently transporting goods between hubs and urban areas.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- BYD Company Limited

- Chanje Energy Inc.

- Daimler AG (Mercedes-Benz)

- Dongfeng Motor Corporation

- E-Force One AG

- Ford Motor Company

- Hino Motors Ltd.

- Isuzu Motors Ltd.

- Iveco S.p.A.

- MAN Truck & Bus

- Mitsubishi Fuso Truck and Bus Corporation

- Nikola Corporation

- PACCAR Inc.

- Rivian Automotive Inc.

- Scania AB

- Tesla Inc.

- Traton SE

- Workhorse Group Incorporated

- Xos Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Trucks Market

- In August 2024, Rivian, an electric vehicle manufacturer, announced the launch of their new electric delivery van, Rivian EDV, in collaboration with Amazon (Reuters, 2024). This strategic partnership marks a significant step towards the electrification of last-mile delivery fleets.

- In November 2024, Nikola Corporation, an electric vehicle and hydrogen fuel cell technology company, secured a strategic partnership with Caterpillar Inc. To develop and manufacture hydrogen fuel cells for heavy-duty electric trucks (Bloomberg, 2024). This collaboration aims to improve the range and reduce the charging time of electric trucks.

- In February 2025, Tesla, the leading electric vehicle manufacturer, received regulatory approval from the European Union for its Semi electric truck model (Tesla, Inc., 2025). This approval marks Tesla's entry into the European electric truck market, expanding its global presence.

- In May 2025, Daimler Trucks and Volvo Group, two major players in the commercial vehicle market, announced a joint venture to develop and produce batteries for heavy-duty electric trucks (Daimler AG, 2025). This strategic collaboration is expected to accelerate the transition to electric trucks in the commercial vehicle sector.

- These developments demonstrate significant strategic partnerships, regulatory approvals, and product launches that have shaped the market between August 2024 and May 2025.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Trucks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.44% |

|

Market growth 2024-2028 |

USD 20323.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

51.62 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The electric truck market continues to evolve, driven by advancements in power electronics design, energy consumption modeling, and battery pack design. Traction motor control and vehicle-to-grid technology are becoming increasingly important, enabling better integration of electric trucks into the power grid. Aerodynamic design optimization and lightweight materials use are key focus areas for reducing energy consumption and improving efficiency. Battery life cycle and energy storage solutions are critical concerns for fleet operators, with expectations for industry growth reaching 20% annually. For instance, a leading logistics company reported a 30% increase in sales after transitioning to an electrification strategy.

- Advanced driver-assistance systems, telematics data analysis, and wireless charging systems are also gaining traction, addressing range anxiety and improving fleet management. Electric drivetrain components, such as high voltage systems and motor torque control, are essential for optimizing performance. Thermal management systems and battery thermal runaway prevention are crucial for ensuring safety and longevity. Regenerative braking systems and onboard charger efficiency are other essential factors contributing to the market's continuous dynamism. Electric motor efficiency, battery cell chemistry, and fast charging infrastructure are ongoing areas of research and development. Autonomous driving features and advanced driver-assistance systems are expected to further transform the electric truck market, enhancing productivity and reducing operational costs.

What are the Key Data Covered in this Electric Trucks Market Research and Growth Report?

-

What is the expected growth of the Electric Trucks Market between 2024 and 2028?

-

USD 20.32 billion, at a CAGR of 35.44%

-

-

What segmentation does the market report cover?

-

The report is segmented by Propulsion (Hybrid electric trucks and Battery electric trucks), Vehicle Type (Light trucks, Medium trucks, and Heavy-duty trucks), Geography (Asia, Europe, North America, and Rest of World (ROW)), Application (Logistics, Construction, Mining, and Municipal Services), and Battery Type (Lithium-Ion, Solid-State, and Others)

-

-

Which regions are analyzed in the report?

-

Asia, Europe, North America, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing demand for fuel-efficient and low-emission vehicles, High upfront cost of electric trucks

-

-

Who are the major players in the Electric Trucks Market?

-

AB Volvo, BYD Company Limited, Chanje Energy Inc., Daimler AG (Mercedes-Benz), Dongfeng Motor Corporation, E-Force One AG, Ford Motor Company, Hino Motors Ltd., Isuzu Motors Ltd., Iveco S.p.A., MAN Truck & Bus, Mitsubishi Fuso Truck and Bus Corporation, Nikola Corporation, PACCAR Inc., Rivian Automotive Inc., Scania AB, Tesla Inc., Traton SE, Workhorse Group Incorporated, and Xos Inc.

-

Market Research Insights

- The market is a continuously evolving sector, driven by advancements in technology and increasing demand for sustainable transportation solutions. Two significant developments shape the market's trajectory. First, electric motor technology and energy storage systems have seen substantial improvements, resulting in extended electric vehicle ranges and reduced charging times. For instance, some electric trucks can now travel up to 300 miles on a single charge, making them a viable alternative to diesel-powered counterparts. Second, the industry anticipates robust growth, with experts predicting a compound annual growth rate of around 25% over the next decade.

- This expansion is fueled by the increasing adoption of low-emission vehicles, infrastructure development, and the integration of alternative fuel sources into commercial transportation. These trends underscore the market's potential to reshape the logistics and transportation industries, offering significant benefits in terms of energy efficiency, reduced emissions, and cost savings.

We can help! Our analysts can customize this electric trucks market research report to meet your requirements.