Electric Vehicle Battery Adhesives And Sealants Market Size 2025-2029

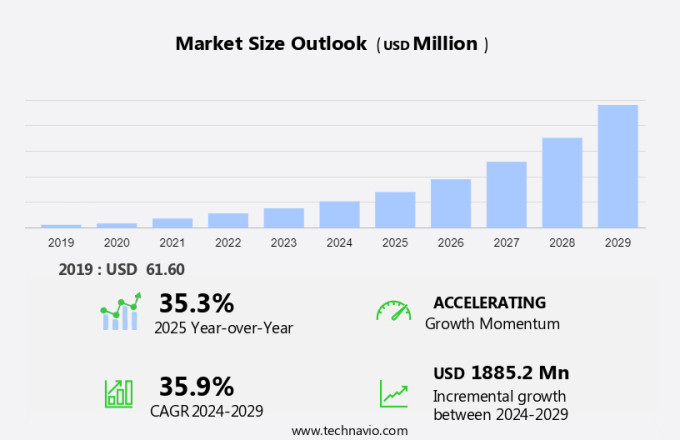

The electric vehicle battery adhesives and sealants market size is forecast to increase by USD 1.89 billion at a CAGR of 35.9% between 2024 and 2029.

- The electric vehicle (EV) battery adhesives and sealants market is experiencing significant growth due to the increasing demand for electric vehicles (EVs) and the need for fire-resistant adhesives and coatings. The temperature sensitivity of EV batteries necessitates the use of specialized adhesives and sealants to ensure their optimal performance and safety. Market trends include the development of high-performance, temperature-resistant adhesives and sealants to address the challenges of battery thermal management.

- Additionally, the growing focus on reducing EV manufacturing costs and improving battery life cycle is driving innovation in the market. The use of biodegradable and recyclable adhesives and sealants is also gaining traction due to increasing environmental concerns. Overall, the market is expected to witness robust growth in the coming years as the adoption of EVs continues to accelerate.

What will be the Size of the Market During the Forecast Period?

- Electric vehicle (EV) battery adhesives and sealants play a crucial role in ensuring the integrity and longevity of battery packs in sustainable transportation. The demand for these adhesives and sealants is driven by the increasing adoption of EVs and the need for reliable charging infrastructure. Battery packs are essential components of EVs, and their proper assembly is vital for battery technology's advancement. Automotive adhesives and sealants are used to bind battery cells together, prevent fluid leakage, and ensure temperature resistance. These materials are also crucial in structural bonding during manufacturing, enhancing manufacturing efficiency and assembly automation. Sustainability is a significant factor in the EV market, and the use of sustainable materials in adhesives and sealants aligns with this trend.

- Similarly, silicone-free adhesives are gaining popularity due to their eco-friendly nature and improved safety regulations. Materials science continues to advance, leading to the development of new adhesive technologies that offer better corrosion resistance, lightweight materials, and improved binding surfaces. The future of the battery adhesives and sealants market is promising, with the adoption rate of EVs expected to increase significantly. The recycling of these materials is also becoming a focus area, ensuring that the production process is as sustainable as possible. The market's growth is further driven by the need for charging infrastructure and the shift towards renewable energy sources in various industries, including automotive, industrial, and aerospace manufacturing.

- In conclusion, battery adhesives and sealants are vital in the production and maintenance of battery packs for sustainable transportation. The market's growth is driven by the increasing adoption of EVs, the need for reliable charging infrastructure, and the trend toward sustainable materials and manufacturing efficiency. The future of this market looks bright, with continued advancements in materials science and a focus on recycling and renewable energy.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Epoxy-based

- Acrylic-based

- Urethane-based

- Silicone-based

- Application

- Thermally conductive adhesives

- Structural adhesives

- Gasketing and sealing

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- France

- Spain

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

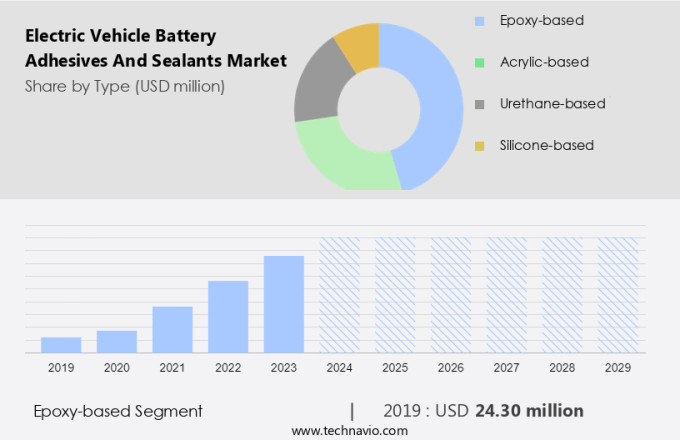

- The epoxy-based segment is estimated to witness significant growth during the forecast period.

Epoxy-based adhesives and sealants play a pivotal role in the global electric vehicle (EV) battery adhesives and sealants market. Their superior mechanical, thermal, and chemical properties make them indispensable for various applications in EV battery systems. Notably, epoxy adhesives offer robust bonding capabilities, ensuring the structural integrity of battery packs. This strength withstands the stresses and strains encountered during vehicle operation, keeping battery components securely attached. Furthermore, epoxy adhesives exhibit excellent resistance to impact and vibration, thereby enhancing the durability and reliability of EV batteries. The increasing adoption of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) due to environmental concerns, tax incentives, and decreasing battery costs is expected to fuel market growth.

Get a glance at the market report of share of various segments Request Free Sample

The epoxy-based segment was valued at USD 24.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

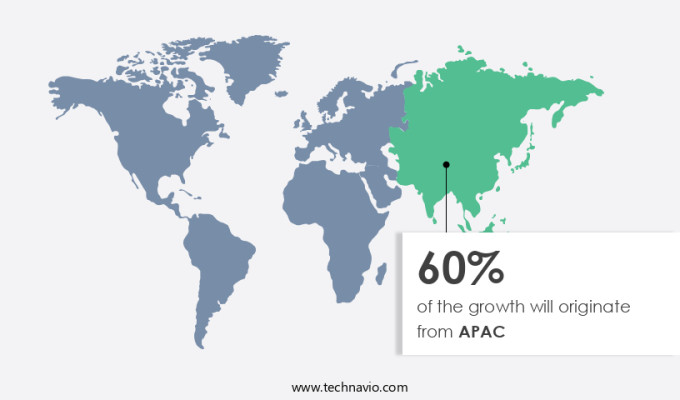

- APAC is estimated to contribute 60% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is experiencing significant growth in the market, driven by increasing electric vehicle adoption and government initiatives. India, a key player in the APAC market, aims to have 30% of private car sales, 70% in commercial vehicles, 40% in buses, and 80% in two- and three-wheelers as electric vehicles by 2030. This translates to an estimated 80 million EVs on Indian roads by the end of the decade.

To support this growth, there is a demand for advanced adhesives and sealants with desirable properties such as moisture resistance, low odor, and compatibility with lightweight fabrication. Epoxy formulations and conductive ink adhesives are gaining popularity due to their ability to ensure temperature stability and conductivity. Manufacturers are investing in research and development to create innovative solutions that meet these requirements and cater to the evolving needs of the electric vehicle industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Electric Vehicle Battery Adhesives And Sealants Market ?

Increasing demand for EVs is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) in various sectors, including transportation. The market is driven by several factors, including government incentives and regulatory support, such as tax credits and subsidies for EV manufacturers and original equipment manufacturers (OEMs). These incentives aim to promote the adoption of electric mobility solutions, which help reduce emissions and decrease the carbon footprint. In the transportation sector, the demand for electric buses is particularly high, with the market valued at approximately USD 17.41 billion in 2021 and projected to reach USD 50.99 billion by 2030.

- Additionally, the growth in the electric bus market is attributed to the benefits of electric mobility, such as weight savings, improved thermal interface bonding, and enhanced crashworthiness. Thermal connection plays a crucial role in the design and manufacturing of electric vehicle battery packs. Thermal interface materials, including adhesives, sealants, and gap fillers, are used to ensure proper thermal conductivity between the battery cells and the surrounding structure. These materials also help insulate the battery pack from external temperatures and prevent moisture intrusion. The market for electric vehicle battery adhesives and sealants also caters to the aerospace and building & construction industries, where lightweight fabrication and quick bonding are essential.

- Epoxies, conductive ink adhesives, and other formulations are used for structural adhesives, thermal interface materials, and insulation in high-voltage battery systems and electrical components. Moreover, the market offers various products, including metal fasteners, adhesive tapes, and films, to cater to the diverse needs of different industries. These products provide flexibility in design and manufacturing, reduce labor costs, and ensure environmental friendliness. In conclusion, the market is witnessing substantial growth due to the increasing demand for electric mobility solutions and the need for efficient thermal management in various industries. The market offers a range of products, including adhesives, sealants, and insulation materials, to cater to the diverse needs of different industries while ensuring flexibility, quick bonding, and environmental friendliness.

What are the market trends shaping the Electric Vehicle Battery Adhesives And Sealants Market?

Fire-resistant adhesives and coatings is the upcoming trend in the market.

- The market is experiencing notable growth due to the rising demand for fire-resistant solutions in response to the increasing adoption of electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs) worldwide. Advanced safety measures, particularly in high-voltage battery systems, are essential to address concerns over emissions, carbon footprint, and crashworthiness. Innovative fire-resistant adhesives and coatings are being developed to ensure the safety and reliability of EV batteries. For instance, Dow's DOWSIL FC-2024 Battery Fire Protection Coating is a one-component silicone solution that offers superior fire resistance and can be precisely applied to the battery pack lid or housing. This trend is driven by the need for lightweight fabrication, quick bonding, and flexibility in manufacturing processes for electric car models, as well as the demand for environmentally friendly solutions.

- Additionally, thermal interface materials, such as structural adhesives, liquid gap fillers, insulation, and thermal interface bonding, are crucial in managing thermal conductivity and maintaining optimal temperature levels in battery systems. The market for electric vehicle battery adhesives and sealants is expected to continue growing as the electric mobility sector expands, with applications ranging from PHEVs and BEVs to electrical components, aerospace, building & construction, and medical treatments. Manufacturers are focusing on developing low odor, quick curing time, and high-performance formulations to meet the evolving demands of the industry.

- Furthermore, the use of conductive ink adhesive and adhesive tapes is gaining popularity due to their ability to provide electrical conductivity while ensuring a strong bond. The market is also witnessing collaborations and joint ventures to enhance manufacturing capabilities and reduce labor costs. However, challenges such as the presence of pollutants, moisture, and temperature and viscosity considerations remain, necessitating ongoing research and development efforts.

What challenges does Electric Vehicle Battery Adhesives And Sealants Market face during the growth?

Temperature Sensitivity is a key challenge affecting the market growth.

- The market in the US is experiencing significant growth due to the increasing demand for electric mobility solutions. These adhesives and sealants play a vital role in the manufacturing of electric vehicle battery packs, including plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs). Thermal management is a key consideration in the design and production of these vehicles, as the battery packs generate substantial heat during operation. Adhesives and sealants are essential for maintaining the structural integrity and thermal management of the battery. They are used to bond various components, fill gaps, and provide insulation, ensuring the safe and efficient operation of the battery.

- Additionally, thermal interface materials, such as epoxies, structural adhesives, and liquid gap fillers, are commonly used for thermal interface bonding. The challenge of managing temperature sensitivity is a significant concern, as battery temperatures can reach up to 80 degrees Celsius or higher. Adhesives and sealants must maintain their strength and adhesion properties under these high-temperature conditions. Other important factors driving market growth include the need for weight savings, improved crashworthiness, and reduced emissions.

- Additionally, joint ventures and manufacturing collaborations between companies are contributing to the development of advanced adhesive and sealant technologies. These solutions must be lightweight, offer quick bonding, and exhibit low odor, temperature resistance, and viscosities suitable for various applications. The market also requires adhesive tapes, films, and conductive ink adhesives for electrical component assembly, as well as insulation materials for high-voltage battery systems. The use of environmentally friendly and low-pollutant adhesives and sealants is also gaining importance, particularly in the building and construction industry. The market for electric vehicle battery adhesives and sealants is expected to continue growing as the demand for electric mobility solutions increases.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers electric vehicle battery adhesives and sealants including SZ1000 sealants, which provide strong sealing to protect EV batteries from water ingress and may be administered autonomously.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arkema

- Ashland Inc.

- Bostik Ltd.

- Dymax Corp.

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- ITW Performance Polymers

- Jowat SE

- L and L Products Inc.

- Parker Hannifin Corp.

- Permabond LLC

- PPG Industries Inc.

- Sika AG

- Uniseal Inc.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric vehicle (EV) industry has experienced remarkable growth in recent years, driven by increasing consumer demand for eco-friendly transportation solutions and advancements in battery technology. As the market for EVs continues to expand, the demand for reliable and efficient battery adhesives and sealants is also on the rise. These essential materials play a critical role in ensuring the thermal connection, structural integrity, and overall performance of electric vehicle battery packs. Battery packs are the heart of electric vehicles, providing the power needed to propel these vehicles forward.

Additionally, the design and manufacturing of these battery packs require the use of various adhesives and sealants. Thermal interface materials, such as epoxies and conductive ink adhesives, are crucial for maintaining optimal thermal conductivity within the battery pack. These materials help manage heat generated during the charging and discharging process, ensuring the battery operates efficiently and safely. Moreover, structural adhesives and liquid gap fillers are employed to secure battery cells and other components within the battery pack. These materials offer weight savings compared to traditional mechanical fasteners, contributing to the overall lightweight fabrication of electric vehicles. Additionally, they provide improved crashworthiness and enhance the overall durability of the battery pack.

In summary, thermal interface bonding is another application where adhesives and sealants play a significant role in the EV industry. This process involves bonding thermal interface materials directly to components to improve their thermal conductivity. In the context of electric vehicles, this process is essential for ensuring the efficient transfer of heat from high-voltage battery systems, which can help extend battery life and improve overall vehicle performance. The use of adhesives and sealants in EV manufacturing also offers environmental benefits. For instance, they help reduce labor costs associated with welding and other traditional manufacturing methods. Furthermore, these materials contribute to the production of more environmentally friendly electric mobility solutions. The EV battery adhesives and sealants market is a dynamic and evolving sector. Companies are continually developing new formulations and technologies to address the unique challenges of manufacturing and integrating battery packs into electric vehicle designs. For example, low odor adhesives and sealants are becoming increasingly popular due to their reduced environmental impact and improved indoor air quality during manufacturing processes. In the construction industry, adhesives and sealants are also playing a significant role in the adoption of electric mobility solutions. Building & construction applications, such as insulation and films, are being developed to improve the energy efficiency of structures and reduce their carbon footprint.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 35.9% |

|

Market growth 2025-2029 |

USD 1.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

35.3 |

|

Key countries |

China, Poland, US, Hungary, South Korea, Japan, India, Germany, France, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch