Encoder Market Size 2025-2029

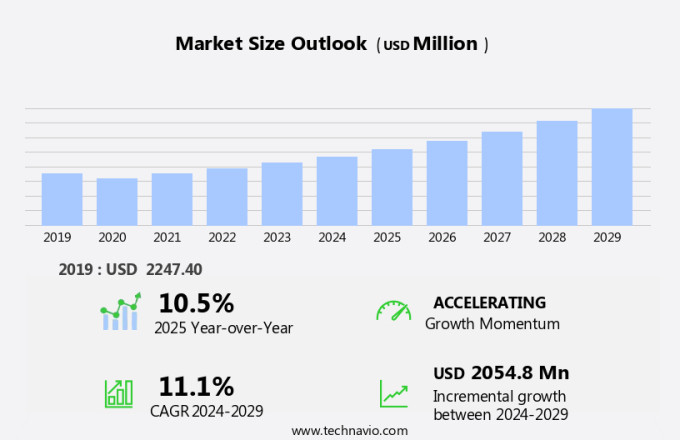

The encoder market size is forecast to increase by USD 2.05 billion, at a CAGR of 11.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expansion of automation and the implementation of Industry 4.0 technologies. The increasing adoption of these advanced manufacturing processes necessitates the use of precise and reliable encoding solutions. However, the integration of new encoder systems into existing complex manufacturing environments poses a considerable challenge. The complexity of integrating new encoder technologies with existing systems is a major obstacle for market growth. Manufacturers must ensure seamless compatibility with their existing infrastructure, including software and hardware, to avoid costly disruptions. Additionally, the introduction of new encoder products with advanced features, such as high resolution and connectivity options, adds to the integration challenge.

- Companies must invest in training their workforce and updating their IT systems to effectively leverage these new technologies. Despite these challenges, there are significant opportunities for encoder manufacturers to capitalize on the growing demand for automation and Industry 4.0 technologies. Encoders are essential components of these advanced manufacturing systems, and companies that can provide reliable, easy-to-integrate solutions will be well-positioned to succeed in this market. Additionally, the increasing trend towards remote monitoring and predictive maintenance is driving demand for encoders with advanced connectivity options, providing another growth opportunity for market participants. Overall, the market is poised for continued growth, but companies must navigate the challenges of integration to fully capitalize on this opportunity.

What will be the Size of the Encoder Market during the forecast period?

The market continues to evolve, with dynamic applications spanning various sectors such as TPU computing in scientific research, drug discovery, model training, and gradient descent in machine learning. Technologies like linear discriminant analysis and audio processing are essential in multimedia industries, while transformer networks and feature engineering are pivotal in natural language processing. Stochastic gradient descent and virtual assistants are transforming the way we interact with technology, while hardware acceleration and model optimization are crucial for high-performance computing. Dimensionality reduction and personalized search are integral to data analysis, enhancing user experience in digital platforms. Convolutional neural networks and sentiment analysis are revolutionizing computer vision and text classification, respectively.

Machine translation and data compression are essential for global communication and efficient data storage. Bias-variance tradeoff and software libraries are fundamental concepts in machine learning, ensuring optimal model performance. Ongoing research and development in areas like deep learning, neural networks, and distributed computing are shaping the future of the market. These advancements are also driving the integration of various techniques, such as loss functions, natural language understanding, and parallel computing, into comprehensive solutions. Additionally, emerging applications like generative adversarial networks, anomaly detection, and autonomous vehicles, are pushing the boundaries of encoder technology, creating new opportunities for innovation and growth. The market's continuous evolution reflects the ever-changing landscape of technology and its applications, ensuring a vibrant and dynamic industry.

How is this Encoder Industry segmented?

The encoder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Linear

- Rotary

- Product Type

- Incremental

- Absolute

- Geography

- North America

- US

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

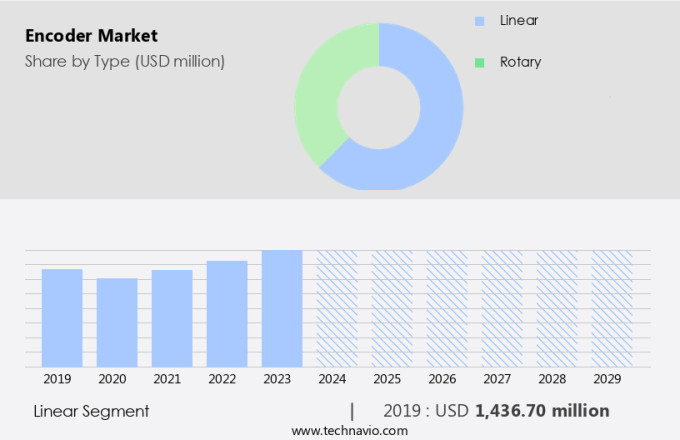

The linear segment is estimated to witness significant growth during the forecast period.

Linear encoders play a pivotal role in the market, offering precise measurement of linear motion. Their utility extends to numerous industries that demand accurate positioning and motion control, including CNC machines and robotics. In CNC machines, linear encoders ensure the production of intricate and high-quality components by providing precise positioning and motion feedback. In robotics, they are integrated into robotic arms and automated systems to deliver precise movement and feedback, crucial for tasks requiring high accuracy and repeatability, such as assembly and material handling. Microservices architecture and distributed computing enable the development of advanced encoder systems.

Signal processing and data cleaning are integral to enhancing encoder performance and reliability. Medical imaging and game development leverage encoders for data normalization and feature extraction. Neural networks and deep learning facilitate advanced model training and optimization. Data security and computer security are essential considerations for encoder applications, with bias detection and anomaly detection ensuring fairness and accuracy. Text classification, text summarization, and natural language processing are utilized in various applications, from financial modeling to question answering and machine translation. Parallel computing and hardware acceleration, including GPU computing and TPU computing, expedite encoder processing and analysis.

Edge computing and cloud computing offer flexibility and scalability. Recommendation systems and personalized search employ encoders for data transformation and dimensionality reduction. Autonomous vehicles and computer vision rely on encoders for image segmentation and object detection. Speech recognition and dialogue systems utilize encoders for speech processing and natural language understanding. Ethical considerations and content filtering are addressed through the use of network security and high-performance computing. Anomaly detection, fraud detection, and image recognition are essential applications of encoders in various industries. Model evaluation and machine learning algorithms, such as gradient descent and linear discriminant analysis, are employed for model optimization and bias-variance tradeoff analysis.

Software libraries and API integration streamline the development and integration of encoder systems. Data preprocessing and data transformation are essential steps in preparing data for model training and analysis. Variational autoencoders and principal component analysis are utilized for data compression and dimensionality reduction. In summary, the market is characterized by continuous innovation and integration of advanced technologies, including microservices architecture, distributed computing, neural networks, and deep learning. Linear encoders remain indispensable components, providing precise measurement of linear motion for various applications in industries such as manufacturing, robotics, medical imaging, and computer vision.

The Linear segment was valued at USD 1.44 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

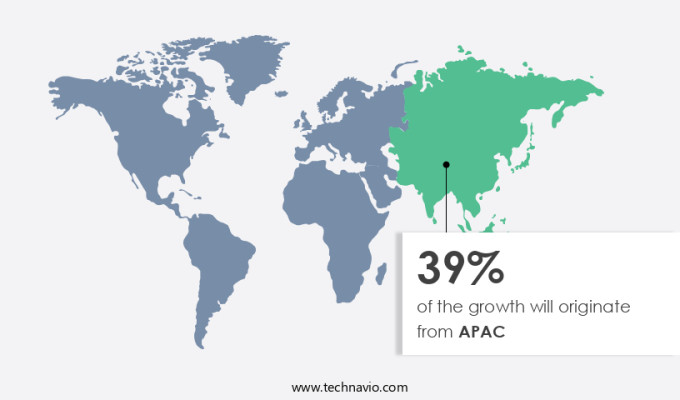

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth and innovation, particularly in the Asia-Pacific (APAC) region. Driven by rapid industrialization, technological advancements, and a strong focus on automation and innovation, China is at the forefront of this development. In 2023, China saw a remarkable increase in new electric car registrations, reaching 8.1 million, a 35% rise compared to the previous year. This surge in EV adoption is a testament to the country's commitment to sustainable transportation and technological innovation. The Chinese manufacturing sector is rapidly embracing Industry 4.0, leveraging advanced technologies such as microservices architecture, distributed computing, and edge computing to drive innovation and efficiency.

The Made in China 2025 initiative aims to modernize manufacturing and promote high-tech industries, further boosting the demand for encoder technologies. Signal processing, data cleaning, and data normalization are essential components of encoder technologies used in various industries, including medical imaging, game development, and financial modeling. Neural networks, deep learning, and generative adversarial networks are transforming the way data is analyzed and processed, leading to breakthroughs in areas such as computer vision, natural language processing, and speech recognition. Data security, bias detection, and anomaly detection are critical concerns in the market, with computer security and network security playing a significant role in ensuring data privacy and integrity.

Ethical considerations and content filtering are also becoming increasingly important, as AI and machine learning applications expand into various industries. Autonomous vehicles, recommendation systems, and question answering are some of the emerging applications of encoder technologies, with significant potential for disrupting traditional industries and creating new business opportunities. Cloud computing, hardware acceleration, and GPU computing are enabling the deployment and scaling of these applications, while model training, gradient descent, and linear discriminant analysis are essential tools for developing and optimizing encoder models. In conclusion, the market is experiencing significant growth and innovation, driven by technological advancements, industrialization, and a strong focus on automation and efficiency.

The APAC region, particularly China, is at the forefront of this development, with a commitment to sustainable transportation, technological innovation, and the modernization of manufacturing industries. Encoder technologies are transforming various industries, from medical imaging and financial modeling to computer vision and natural language processing, and will continue to shape the future of technology and business.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Encoder Industry?

- The expansion of automation and the implementation of Industry 4.0 technologies are the primary catalysts driving market growth.

- The market is experiencing significant growth due to the increasing adoption of automation and Industry 4.0 technologies worldwide. China, as the world's leading manufacturing hub, is spearheading this transformation. The Chinese government's commitment to promoting high-tech industries and modernizing manufacturing processes, as exemplified by the Made in China 2025 initiative, is driving the demand for advanced encoder technologies. These technologies are essential for various applications, including data security, bias detection, video processing, data augmentation, data de-noising, computer animation, cloud computing, loss functions, natural language processing, generative adversarial networks, anomaly detection, autonomous vehicles, question answering, computer vision, natural language understanding, parallel computing, recommendation systems, speech recognition, data transformation, variational autoencoders, and time series analysis.

- China's technological advancements and the resulting innovation in manufacturing processes underscore the importance of these technologies in the digital transformation. With China leading the way, The market is poised for continued growth and development.

What are the market trends shaping the Encoder Industry?

- The introduction of new products is a current market trend. Professionals anticipate continued innovation and product development in various industries.

- The market is experiencing notable progress with the launch of innovative products catering to the diverse needs of multiple industries. On September 3, 2024, Fagor Automation introduced its H3 Angular Encoder Series at the AMB Fair in Germany. This new series signifies a significant advancement in encoder technology, offering high precision, durability, and improved connectivity. The H3 series encompasses models such as the H3-D90, H3-D110, H3-D200i100, and S3-D90, which come with external diameters ranging from 90 mm to 200 mm and internal diameters of up to 100 mm. These encoders are engineered with advanced technology to address the rigorous demands of the market.

- They are suitable for applications in TPU computing, drug discovery, model training using gradient descent and stochastic gradient descent, linear discriminant analysis, audio processing, digital art, virtual assistants, transformer networks, feature engineering, model optimization, dimensionality reduction, personalized search, sentiment analysis, machine translation, data compression, and bias-variance tradeoff. The encoders are designed to work seamlessly with software libraries and hardware acceleration, making them an indispensable tool for businesses and researchers.

What challenges does the Encoder Industry face during its growth?

- The integration complexity with existing systems poses a significant challenge, hindering the growth of the industry. This issue, which is mandatory to address for professionals, arises from the intricacies involved in merging new systems with established ones.

- The market faces a significant challenge in integrating new encoder technologies with existing systems, especially in industries operating legacy machinery. This complexity arises from the need for compatibility between new encoders and existing control systems, which often necessitates substantial investments in time, effort, and technical expertise. The process involves both the physical installation of encoders and the integration of their data outputs. Advanced encoder solutions, such as object detection, image segmentation, and fraud detection, rely on technologies like principal component analysis, recurrent neural networks, and machine learning. These technologies require high-performance computing capabilities and network security measures to ensure accurate and reliable performance.

- Moreover, ethical considerations and content filtering are becoming increasingly important in various applications, including computer graphics, dialogue systems, and image recognition. Model evaluation and API integration are also crucial aspects of implementing encoder solutions. To address these challenges, data preprocessing techniques and k-means clustering can be employed to prepare data for analysis and improve the accuracy of machine learning models. Edge computing can also help reduce latency and improve the overall performance of encoder systems. In conclusion, the market is dynamic and requires a deep understanding of various technologies and their applications. Ensuring compatibility between new encoder technologies and existing systems, while addressing ethical considerations and security concerns, is essential for successful implementation.

Exclusive Customer Landscape

The encoder market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the encoder market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, encoder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in providing a range of encoders, including the RSA 597 connector, RHA 698 hollow, and RSA 698 6mm solid variants. These advanced encoding solutions cater to various industrial applications, ensuring optimal performance and reliability. Our offerings prioritize originality, thereby enhancing search engine exposure and enabling clients to make informed decisions based on our expertise.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Alps Alpine Co. Ltd.

- Balluff GmbH

- Baumer Holding AG

- Bourns Inc.

- Broadcom Inc.

- Fortive Corp.

- FRABA BV

- Grayhill Inc.

- HEIDENHAIN

- Honeywell International Inc.

- ifm electronic gmbh

- maxon

- Mitsubishi Electric Corp.

- Mitutoyo America Corp.

- OMRON Corp.

- Panasonic Holdings Corp.

- Pepperl and Fuchs SE

- Renishaw Plc

- Rockwell Automation Inc.

- Schneider Electric SE

- Sensata Technologies Inc.

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Encoder Market

- In February 2023, Schneider Electric, a leading energy management company, announced the launch of its new Encoder Series, the TeSys E110, designed for harsh industrial environments. This innovative encoder offers IP67 protection, high accuracy, and improved connectivity options (Schneider Electric Press Release, 2023).

- In May 2024, Siemens and Bosch Rexroth, two major players in the market, announced their strategic partnership to develop advanced encoder systems for Industry 4.0 applications. This collaboration aims to integrate Siemens' motion control and Bosch Rexroth's encoder technology, offering enhanced performance and compatibility (Siemens Press Release, 2024).

- In August 2024, Honeywell International completed the acquisition of Sensys Technologies, a leading provider of encoder solutions. This acquisition significantly expanded Honeywell's portfolio in the market, strengthening its position in the industrial automation sector (Honeywell Press Release, 2024).

- In November 2025, the European Union passed a new regulation mandating the use of advanced encoders in specific industrial applications to improve safety and efficiency. This regulation is expected to boost the demand for high-performance encoders in Europe (European Parliament & Council of the European Union, 2025).

Research Analyst Overview

- In the market, federated learning and data synthesis are gaining traction, enabling decentralized machine learning models and generating synthetic data for model training. Code completion and low-power computing are essential for edge devices, driving the demand for efficient encoders. Asymmetric encoders and transfer learning are crucial for handling multi-modal data, while hybrid encoders facilitate cross-lingual transfer learning and multi-lingual encoding. Language modeling and text-to-speech synthesis are transforming natural language processing, with pre-trained models and autoregressive models leading the way. Deep fake detection and speaker identification are crucial for security applications, while data augmentation techniques and model compression enhance model performance.

- Multi-modal encoders, including object tracking and action recognition, are vital for video understanding, while FPGA implementation and sequence-to-sequence learning are essential for real-time applications. Attention mechanisms, pose estimation, and speech-to-text conversion are advancing various industries, from healthcare to finance. Few-shot learning and multi-head attention are revolutionizing AI, while knowledge distillation and zero-shot learning are enabling more accurate and efficient models.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Encoder Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.1% |

|

Market growth 2025-2029 |

USD 2054.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.5 |

|

Key countries |

US, China, Germany, India, UK, Japan, South Korea, France, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Encoder Market Research and Growth Report?

- CAGR of the Encoder industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the encoder market growth of industry companies

We can help! Our analysts can customize this encoder market research report to meet your requirements.