Enterprise Labeling Software Market Size 2024-2028

The enterprise labeling software market size is forecast to increase by USD 133.9 mn at a CAGR of 6.59% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. The adoption of enterprise labeling solutions is increasing as businesses seek to streamline their labeling processes and improve efficiency. Dynamic labeling, which allows for real-time updates to labels, is gaining popularity as it enables companies to quickly respond to changing regulations or product information. The market is experiencing growth as companies leverage data integration and analytics to streamline labeling processes, ensuring greater accuracy, compliance, and operational efficiency. Moreover, stringent government regulations mandating accurate and compliant labeling are driving the need for enterprise labeling software. These factors are expected to fuel market growth In the coming years. The market landscape is constantly evolving, and staying abreast of these trends is essential for businesses looking to remain competitive.

What will be the Size of the Enterprise Labeling Software Market During the Forecast Period?

- The market encompasses solutions designed for creating, managing, and printing labels in various industries. Compliance with regulations and ensuring labeling accuracy are key drivers for this market. Real-time updates and customizable templates enable businesses to maintain consistency and adapt to changing requirements. Integration capabilities with enterprise systems, data management planning, and the printing process are essential for streamlining workflows and improving efficiency. Innovative technology, such as automation and machine learning, enhances labeling quality and speed, providing a competitive edge.

- A user-friendly interface and economic conditions influence market demand. Urbanization and the growing need for packaging solutions, branding, and on-premises-based software further expand the market's reach. Overall, the market continues to grow, offering significant benefits to businesses seeking to optimize their labeling processes.

How is this Enterprise Labeling Software Industry segmented and which is the largest segment?

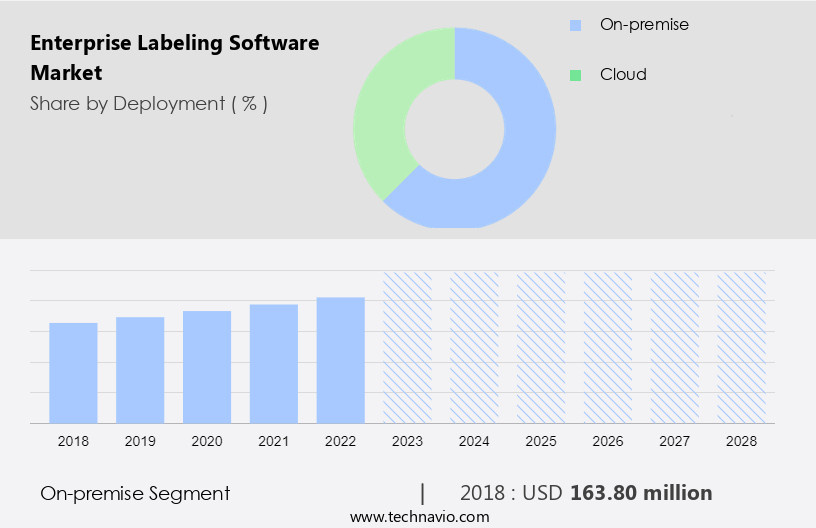

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premise

- Cloud

- End-user

- FMCG

- Retail and e-commerce

- Healthcare

- Warehousing and logistics

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Deployment Insights

- The on-premise segment is estimated to witness significant growth during the forecast period.

The market is driven by the need for compliance, creation, management, printing, and real-time updates of labels in various industries. Large enterprises require unique labeling solutions to meet diverse industry standards and traceability regulations, ensuring product quality and customer satisfaction. On-premise and cloud-based enterprise labeling software offer agility, scalability, and flexibility, optimizing operations and enhancing resilience and adaptability. Compliance management, seamless collaboration, contactless processes, safety measures, and predictive analytics are key features. Driving factors include digitalization, automation, and evolving challenges in logistics and e-commerce. However, varying industry standards, implementation costs, legacy systems, and integration challenges pose restraining factors. Enterprise labeling software solutions offer customizable templates, integration capabilities, and language support, catering to the economic condition, urbanization, and packaging solutions.

Brands prioritize a data-driven approach and regulatory requirements In their labeling strategy. The market is expected to grow, with key players catering to enterprise sizes and time to market.

Get a glance at the Enterprise Labeling Software Industry report of share of various segments Request Free Sample

The On-premise segment was valued at USD 163.80 mn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to experience significant growth due to the increasing number of end-users in sectors such as food and beverage, personal care products, and pharmaceuticals. This trend is driving companies to invest heavily in enterprise labeling software to meet unique labeling requirements and ensure regulatory compliance. The shift from analog to digital printing in APAC is another factor fueling market growth, as companies adopt digital label printing solutions. Enterprise labeling software offers benefits such as real-time updates, customizable templates, integration capabilities, and traceability, which are crucial for industries with stringent regulatory requirements and a focus on product quality and customer satisfaction.

The market is also influenced by the need to optimize operations, ensure resilience and adaptability, and support remote work and label design. Cloud-based and on-premise solutions, as well as augmented reality features, are key offerings In the market. Despite these drivers, challenges such as implementation costs, legacy systems, integration difficulties, and cybersecurity concerns persist. The market is expected to continue evolving, with a focus on digitalization, automation, and agile labeling solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Enterprise Labeling Software Industry?

The rise in the adoption of enterprise labeling is the key driver of the market.

- Enterprise labeling software plays a crucial role in connecting the labeling process with various business operations. This integration offers benefits such as real-time updates, customizable templates, and seamless collaboration, ensuring regulatory compliance, product quality, and customer satisfaction. The software caters to diverse industries with unique labeling requirements, providing traceability, agility, and resilience. Regulations like the GHS, DSCSA, UDI system, and GS1 General Specifications mandate enterprise labeling in several sectors. Compliance management is a significant aspect of enterprise labeling, which optimizes operations and enhances operational resilience and adaptability. With the shift towards remote work and label design, cloud-based solutions and mobile applications have become essential.

- Enterprise labeling software offers various features, including machine learning capabilities, predictive analytics, and augmented reality features, to meet evolving challenges in logistics, retail, healthcare, and warehousing and logistics. The market is driven by customer expectations, the rise in e-commerce, and the need for standardized labeling. However, varying industry standards, implementation costs, legacy systems, and integration challenges pose restraining factors. Enterprises of all sizes can benefit from a data-driven approach to labeling strategy, ensuring labeling quality, delivery time, and a competitive edge. Enterprise labeling software offers flexibility, scalability, and cybersecurity measures, enabling businesses to adapt to changing market conditions and customer demands.

What are the market trends shaping the Enterprise Labeling Software Industry?

Demand for dynamic labeling is the upcoming market trend.

- Enterprise labeling software plays a crucial role in managing and creating labels for various industries with unique labeling requirements. Compliance with regulatory standards, product traceability, and customer satisfaction are key driving factors. Dynamic labeling, a feature of enterprise labeling software, offers agility by configuring labels based on real-time data from a company's database. This eliminates manual changes and ensures data accuracy, consistency, and efficiency In the labeling process. Integration capabilities with diverse industries, such as retail, healthcare, warehousing and logistics, are essential. Cloud-based and on-premise solutions cater to different enterprise sizes and preferences. companies focus on providing user-friendly interfaces, customizable templates, and integration with other systems for seamless collaboration.

- Enterprise labeling software offers benefits like traceability, regulatory compliance, optimizing operations, resilience, adaptability, and remote label design. Real-time updates, predictive analytics, and machine learning capabilities enhance labeling quality and competitive edge. However, challenges include implementation costs, varying industry standards, integration, and cybersecurity concerns. Cloud-based applications, mobile applications, and augmented reality features are innovations in enterprise labeling software. Digitalization and automation are essential in today's evolving business landscape. Adopting a data-driven approach to labeling strategy ensures consistency, speed, and accuracy, meeting customer expectations and delivering high-quality products.

What challenges does the Enterprise Labeling Software Industry face during its growth?

Stringent government regulations for labeling procedures is a key challenge affecting the industry growth.

- Enterprise labeling software plays a crucial role in ensuring compliance with various regulations and unique labeling requirements across diverse industries. With the increasing need for traceability, regulatory compliance, product quality, and customer satisfaction, optimizing labeling processes has become essential for businesses. The flexibility and adaptability of enterprise labeling software enable the management of real-time updates and customizable templates, seamlessly integrating with various systems and processes. The challenges of implementing enterprise labeling software include varying industry standards, integration capabilities, and cybersecurity concerns. However, the benefits of digitalization, automation, and agile labeling solutions outweigh the costs. These solutions offer data management capabilities, enabling a data-driven approach to labeling strategy.

- Cloud-based applications and mobile applications provide remote label design and compliance management, enabling seamless collaboration and contactless processes. Augmented reality features enhance safety measures and product traceability, providing a competitive edge. However, operational costs, flexibility, scalability, and cyber-attacks are restraining factors. End-users need to consider the economic condition, urbanization, and packaging solutions when implementing enterprise labeling software. The enterprise segment requires on-premises based software for data management and planning, ensuring speed, accuracy, and efficiency In the printing process. The implementation costs, integration challenges, and database management are essential factors to consider when selecting enterprise labeling software.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, enterprise labeling software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AstroNova Inc.

- Aulux Corp. Ltd.

- Cristallight Software

- CYBRA Corp.

- Data Systems International

- DDi

- Esko Graphics BV

- Freyr Software Services

- Innovatum Inc.

- Kallik Ltd.

- Linn Systems Ltd.

- Loftware Inc.

- OPAL Associates Holding AG

- PSI Systems Inc.

- RF SMART

- Seagull Scientific Inc.

- TEC IT Datenverarbeitung

- Teklynx Newco SAS

- Tharo Systems Inc.

- Wasp Barcode Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Enterprise labeling software plays a crucial role in ensuring product compliance, creation, and management across various industries. The need for customizable templates and real-time updates is essential to meet unique labeling requirements and regulatory compliance. Product quality and customer satisfaction are optimized through the use of enterprise labeling solutions, which offer agility, resilience, and adaptability. The diverse industries that rely on enterprise labeling software include logistics, retail, healthcare, and warehousing and logistics. Each industry faces evolving challenges in labeling, requiring solutions that offer traceability, regulatory compliance, and digitalization. Compliance management is a significant driving factor In the adoption of enterprise labeling software.

Moreover, seamless collaboration and contactless processes enable organizations to maintain safety measures while ensuring labeling accuracy and consistency. Agile labeling solutions offer the flexibility and scalability needed to meet the demands of a digital transformation. Cloud-based and on-premise solutions are available to meet the varying needs of enterprises. Cloud-based applications offer the benefits of predictive analytics, machine learning capabilities, and mobile access, while on-premise solutions provide greater control and security. The enterprise labeling market is experiencing a rise in demand due to the increasing importance of standardized labeling and e-commerce. However, there are also restraining factors, such as varying industry standards, implementation costs, and integration challenges.

Furthermore, cybersecurity concerns are a critical consideration In the adoption of enterprise labeling software. Data accuracy and consistency are essential to maintaining a competitive edge and ensuring customer satisfaction. The planning and printing process must be efficient, with fast delivery times and high labeling quality. Enterprise labeling software offers a data-driven approach to labeling, enabling organizations to meet regulatory requirements and optimize their labeling strategy. Cloud labeling applications and innovative technology provide a user-friendly interface, making it easier for enterprises to adapt to changing economic conditions and urbanization. Packaging solutions and branding are also important considerations In the enterprise labeling market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.59% |

|

Market Growth 2024-2028 |

USD 133.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.17 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Enterprise Labeling Software Market Research and Growth Report?

- CAGR of the Enterprise Labeling Software industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the enterprise labeling software market growth of industry companies

We can help! Our analysts can customize this enterprise labeling software market research report to meet your requirements.