Enzyme-Linked Immunosorbent Assay Market Size 2024-2028

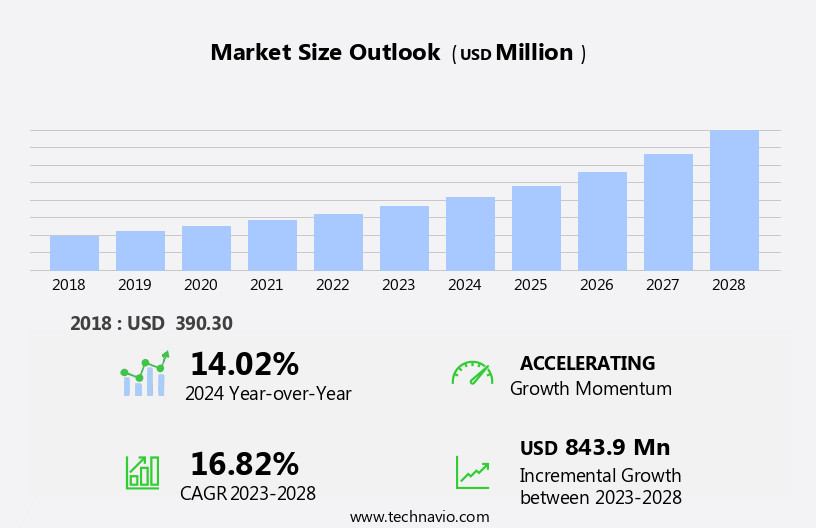

The enzyme-linked immunosorbent assay (ELISA) market size is forecast to increase by USD 843.9 million at a CAGR of 16.82% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for ELISA in various applications, including medical diagnostics, food safety testing, vaccines, toxicology testing, and biomarker discovery. The aging population's growing need for frequent diagnostic testing is a major market driver. Additionally, the importance of ELISA in immunology research and immunoassay technology's automation and multiplexing capabilities are boosting market growth. Monoclonal antibodies and software solutions are essential components of ELISA, further fueling market expansion. However, challenges such as the lack of accessibility and affordability of diagnostic tests in developing countries remain. Protein-based assays, such as ELISA, play a crucial role in medical diagnostics and food safety testing, making them indispensable in the healthcare and food industries. ELISA's versatility and ease of use make it a preferred choice for detecting various biomarkers and toxins, ensuring food safety and accurate medical diagnoses.

What will be the Size of the Enzyme-Linked Immunosorbent Assay Market During the Forecast Period?

- The market encompasses diagnostic tools utilized for the detection of various biomolecules, including proteins, antibodies, and hormones, in diverse industries such as medical diagnostics, pharmaceuticals, environmental monitoring, and food testing. ELISA's significance lies in its ability to effectively and efficiently identify infectious diseases, with applications ranging from HIV or AIDS, hepatitis, Lyme disease, and Dengue fever, among others. The global health threat posed by these conditions necessitates continuous advancements in diagnostic technologies, driving market growth. ELISA assays come in various formats, including direct and indirect, and can be multiplexed for simultaneous detection of multiple biomolecules. Regulatory frameworks ensure stringent quality standards, ensuring the reliability and accuracy of ELISA tests.

- Instruments and software solutions streamline ELISA processes, reducing turnaround times. The aging population further fuels the demand for ELISA in clinical diagnostics, as early and accurate detection of diseases becomes increasingly crucial. Overall, the market exhibits strong growth, driven by its versatility and essential role in addressing critical diagnostic needs.

How is this Enzyme-Linked Immunosorbent Assay Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Vaccine development

- Immunology

- Diagnostics

- Drug monitoring and pharmaceutical industry

- Others

- End-user

- Hospitals and diagnostic centers

- Research laboratories

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

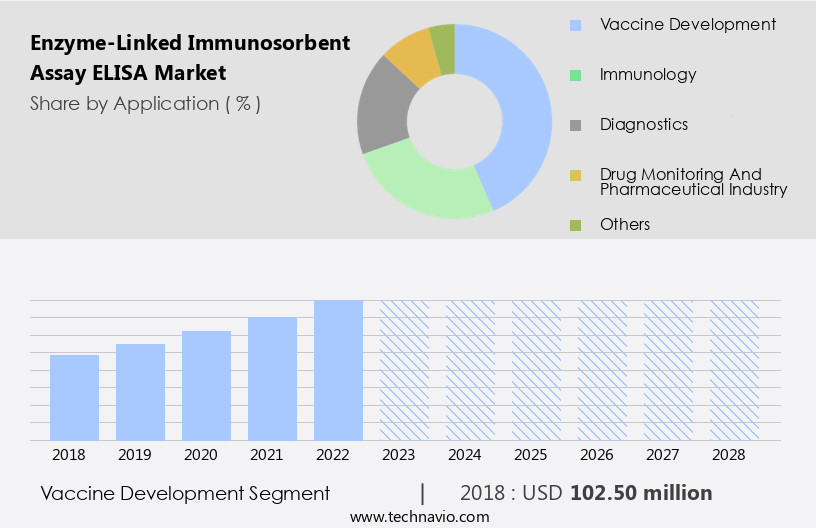

- The vaccine development segment is estimated to witness significant growth during the forecast period.

Elisa, or Enzyme-Linked Immunosorbent Assay, is a crucial diagnostic tool in various industries, including immunology, toxicology, drug monitoring, transplantation, cancer research, and protein quantitation. This technique is widely used for the measurement of antibodies in biological fluids or culture media. In the context of infectious diseases, ELISA tests play a significant role in diagnosing HIV or AIDS, hepatitis, Lyme disease, and dengue fever, among others. WHO data indicates that ELISA is the preferred method for serosurveillance in public health emergencies. ELISA formats include Direct, Indirect, Sandwich, and Competitive, with the latter three offering enhanced sensitivity and specificity. ELISA is also used in vaccine development, drug discovery, food safety testing, and environmental monitoring.

In hospitals and research laboratories, ELISA is employed to diagnose chronic diseases, autoimmune disorders, diabetes, prediabetes, and various cancers. Multiplex assays and personalized medicine further expand ELISA's applications. Assay performance parameters such as sensitivity, specificity, and cross-reactivity are crucial for ELISA's success. Technological advancements have led to the development of chemiluminescent, colorimetric, and fluorescent ELISA formats, enhancing assay performance and turnaround times. ELISA instruments and software solutions are essential for achieving optimal results. ELISA plays a vital role in clinical diagnostics, particularly in the context of infectious diseases, chronic conditions, and cancer. As the aging population grows, screening programs and next-generation sequencing are increasingly relying on ELISA for accurate and efficient diagnosis.

Get a glance at the Enzyme-Linked Immunosorbent Assay (ELISA) Industry report of share of various segments Request Free Sample

The Vaccine development segment was valued at USD 102.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

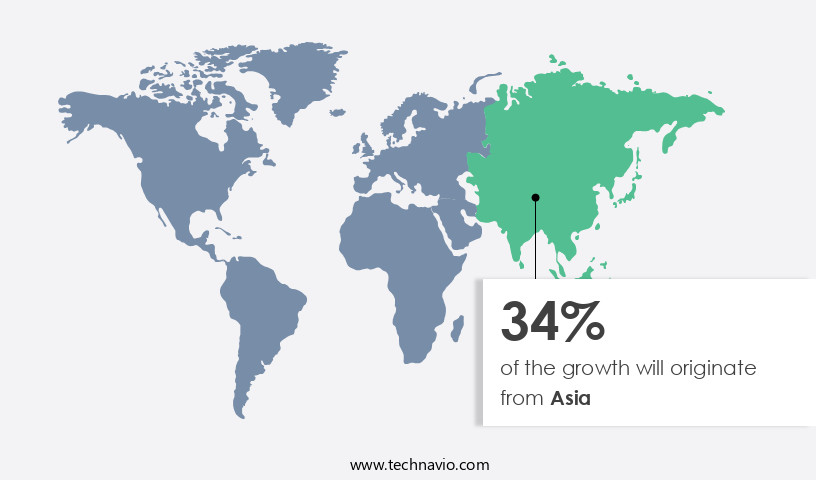

- Asia is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Another region offering significant growth opportunities to companies is North America. The market is significant, particularly in North America, with the US and Canada leading in revenue generation. The region's market growth is attributed to the increasing demand for swift and precise diagnosis of infectious diseases, such as HIV or AIDS, hepatitis, Lyme disease, and dengue fever, as well as chronic conditions like diabetes and prediabetes. Pharmaceutical industries in North America, including those in the US and Canada, are focusing on drug development, investing heavily in research and development (R&D). This investment leads to the production of pharmaceutical products, including drugs, vaccines, and antibodies, which increases the demand for Elisa tests to monitor their production.

Elisa tests are essential diagnostic tools for various applications, including immunology, toxicology, drug monitoring, transplantation, cancer, protein quantitation, and autoimmune disorders. Elisa tests are used in hospitals, research laboratories, clinical diagnostics, food testing, environmental monitoring, and personalized medicine. The market is expected to grow further due to the increasing prevalence of chronic diseases, aging population, and screening programs. Elisa tests offer advantages like shorter turnaround times, high sensitivity, specificity, and low cross-reactivity compared to alternative diagnostic methods, such as Polymerase Chain Reaction (PCR) and Next-generation sequencing.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Enzyme-Linked Immunosorbent Assay (ELISA) Industry?

The growing need for frequent diagnostic testing among aging population is the key driver of the market.

- The market is witnessing significant growth due to the increasing prevalence of both infectious and chronic diseases among the aging population. According to the World Health Organization (WHO), non-communicable diseases such as cardiovascular disease, cancer, and chronic respiratory diseases are the leading causes of death worldwide, accounting for approximately 70%. In low and middle-income countries, these diseases account for 85% of premature deaths. ELISA tests play a crucial role in diagnosing various diseases, including HIV or AIDS, hepatitis, Lyme disease, and dengue fever. These tests are also used in vaccine development, immunology, toxicology, drug monitoring, transplantation, and cancer research.

- ELISA testing is also used in medical diagnostics, pharmaceutical industries, and research laboratories for the measurement of proteins, antibodies, hormones, and peptides. Multiplex assays, personalized medicine, and next-generation sequencing are emerging trends in the market. ELISA instruments and software solutions offer faster turnaround times and improved assay performance, making them increasingly popular in clinical diagnostics, environmental monitoring, food testing, and pregnancy tests. The market for ELISA tests is expected to grow due to the increasing demand for rapid and accurate diagnostic tools for infectious and chronic diseases, autoimmune disorders such as diabetes and prediabetes, and cytokines and soluble proteins.

What are the market trends shaping the Enzyme-Linked Immunosorbent Assay Industry?

The growing importance of promotional activities is the upcoming market trend.

- ELISA tests play a crucial role in diagnosing various infectious diseases, including HIV or AIDS, hepatitis, Lyme disease, and dengue fever. These diagnostic tools are essential for identifying target substances such as proteins, antibodies, hormones, and antigens in different matrices. The market for Elisa tests caters to diverse industries, including hospitals, research laboratories, pharmaceutical industries, and clinical diagnostics. These formats cater to different applications, such as vaccine development, immunology, toxicology, drug monitoring, transplantation, cancer, protein quantitation, and pregnancy tests. Despite the niche market, the demand for ELISA tests is driven by the increasing prevalence of chronic diseases, autoimmune disorders, diabetes, prediabetes, and public health emergencies.

- The market also benefits from advancements in technology, such as chemiluminescent, colorimetric, and fluorescent ELISA, which enhance assay performance and reduce turnaround times. Moreover, the Elisa test market caters to various industries, including environmental monitoring, food testing, clinical diagnostics, and drug discovery. The market's growth is further fueled by the aging population, screening programs, and next-generation sequencing. companies in this market focus on increasing the availability of products to end-users by expanding their distribution networks and promoting the use of Elisa testing through their websites.

What challenges does the Enzyme-Linked Immunosorbent Assay Industry face during its growth?

The lack of accessibility and affordability of diagnostic tests in developing countries is a key challenge affecting the industry growth.

- The market plays a pivotal role in diagnosing various infectious diseases, including HIV or AIDS, hepatitis, Lyme disease, and dengue fever. ELISA tests are essential diagnostic tools used for the detection of specific antibodies or antigens in biological samples. WHO data indicates that chronic diseases, autoimmune disorders, diabetes, and prediabetes affect a significant population worldwide. ELISA formats, such as Direct ELISA, Indirect ELISA, Sandwich ELISA, and Competitive ELISA, are used for vaccine development, immunology, toxicology, drug monitoring, transplantation, cancer, protein quantitation, and pregnancy tests. ELISA formats also find applications in chemiluminescent, colorimetric, and fluorescent assays for medical diagnostics, pharmaceutical industries, and biotechnology.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Abcam plc

- Agilent Technologies Inc.

- Amgen Inc.

- Avantor Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- bioMerieux SA

- Cardinal Health Inc.

- Crux Biolabs Pty Ltd.

- Danaher Corp.

- Eppendorf SE

- Illumina Inc.

- Lonza Group Ltd.

- Merck KGaA

- Novo Nordisk AS

- Perkin Elmer Inc.

- QIAGEN NV

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of diagnostic applications, spanning various sectors including infectious diseases, immunology, toxicology, drug monitoring, transplantation, cancer, protein quantitation, and clinical diagnostics. This versatile technology is utilized extensively in research laboratories, hospitals, and pharmaceutical industries to detect and measure target substances, such as proteins, antibodies, hormones, peptides, and antigen-antibody combinations. ELISA assays are instrumental in the diagnosis and monitoring of chronic diseases, autoimmune disorders, and prediabetes. In the realm of infectious diseases, ELISA plays a crucial role in the detection and serosurveillance of various pathogens, including HIV or AIDS, hepatitis, Lyme disease, and dengue fever.

Moreover, this technology is also employed in hepatitis B vaccination programs to assess vaccine efficacy and immunity levels. ELISA formats exhibit diverse applications, encompassing direct, indirect, sandwich, competitive, chemiluminescent, colorimetric, and fluorescent variations. These formats cater to the unique requirements of various applications, such as drug discovery, food safety testing, and environmental monitoring. The advent of next-generation sequencing and Polymerase Chain Reaction (PCR) technologies has led to the development of multiplex assays, enabling the simultaneous detection and quantitation of multiple target substances. This innovation significantly enhances the efficiency and throughput of diagnostic processes. ELISA instruments and software solutions are integral components of this market, ensuring optimal assay performance, turnaround times, and data analysis.

Moreover, the technology's adaptability extends to various industries, including medical diagnostics, biotechnology, and pharmaceutical industries. The aging population and the increasing prevalence of chronic diseases necessitate the development of more sensitive, specific, and cross-reactivity-minimized ELISA assays. This requirement is further accentuated by the implementation of screening programs and public health emergencies. ELISA's applications extend beyond diagnostic applications to include drug monitoring, transplantation, and cancer. In drug monitoring, ELISA is employed to detect and quantify drugs, metabolites, and biomarkers in various matrices, such as serum, plasma, and urine. In transplantation, ELISA is used to monitor immunosuppressive drug levels and detect donor-specific antibodies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.82% |

|

Market Growth 2024-2028 |

USD 843.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.02 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Enzyme-Linked Immunosorbent Assay Market Research and Growth Report?

- CAGR of the Enzyme-Linked Immunosorbent Assay (ELISA) industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the enzyme-linked immunosorbent assay market growth of industry companies

We can help! Our analysts can customize this enzyme-linked immunosorbent assay market research report to meet your requirements.