Europe Fourth Party Logistics (4PL) Market Size 2025-2029

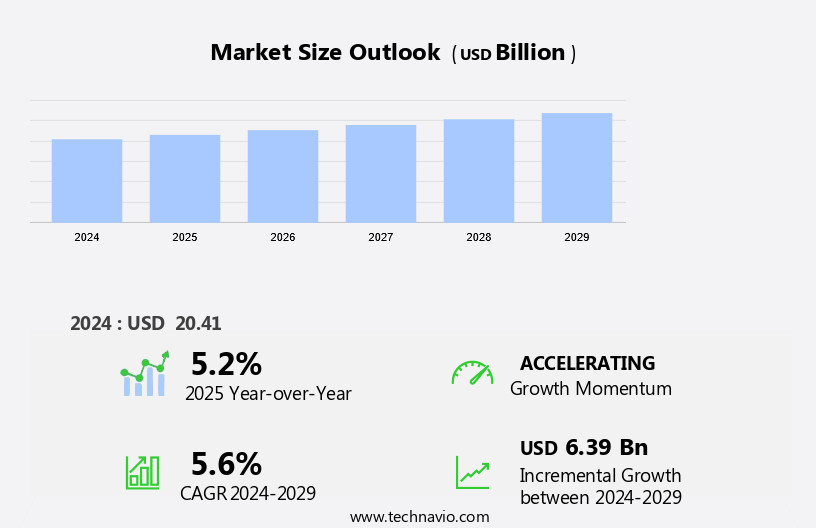

The europe fourth party logistics (4pl) market size is forecast to increase by USD 6.39 billion, at a CAGR of 5.6% between 2024 and 2029.

- The European Fourth Party Logistics (4PL) market is experiencing significant growth, driven by the increasing adoption of advanced technologies such as blockchain in logistics operations. This innovation enhances transparency, security, and efficiency, making it an attractive proposition for businesses seeking to streamline their supply chain processes. Moreover, the competitive pricing and operational cost advantages offered by 4PL providers continue to draw in new clients. However, the European 4PL market faces several challenges. One of the most pressing issues is the complexity of managing international regulations and compliance requirements. The intricacies of customs procedures, tax laws, and labor regulations vary significantly across European countries, necessitating a deep understanding of local markets and regulations.

- Additionally, the need for real-time visibility and collaboration between multiple stakeholders in the supply chain can be a significant challenge, requiring robust technology solutions and strong communication skills. Effectively addressing these challenges will be crucial for 4PL providers seeking to capitalize on the market's growth potential and maintain a competitive edge.

What will be the size of the Europe Fourth Party Logistics (4PL) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The European 4PL market is characterized by a dynamic business environment, shaped by various trends and regulations. Network design plays a crucial role in optimizing logistics operations, enabling agile supply chains and real-time tracking. Circular economy principles are increasingly influencing the industry, driving the adoption of cloud-based solutions and digital twins for inventory optimization and demand planning. Data security is a top priority, with companies implementing advanced technologies to ensure compliance with environmental and regulatory requirements. Lean manufacturing and sustainability reporting are essential components of the circular economy, with route optimization and transportation optimization playing key roles in reducing carbon emissions.

- Autonomous vehicles and drone delivery are transforming the transportation sector, offering capacity optimization and just-in-time (JIT) capabilities. Predictive analytics and automated warehousing are also gaining traction, enhancing supply chain visibility and risk mitigation. Dynamic pricing and inventory optimization strategies are essential for businesses to remain competitive, while adhering to regulatory frameworks and ensuring data security. Environmental and compliance regulations continue to shape the industry, with green logistics becoming a priority for businesses seeking to reduce their carbon footprint and improve sustainability. Overall, the European 4PL market is evolving rapidly, with a focus on digitalization, optimization, and sustainability.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Manufacturing

- Retail

- Consumer goods

- Healthcare

- Others

- Type

- Solution integrator mode

- Synergy plus operating mode

- Industry innovator mode

- Service

- Transportation management

- Supply chain consulting

- Warehouse and distribution management

- IT and data management

- Contract Type

- Short-Term

- Long-Term

- Deployment Type

- On-Premises

- Cloud-Based

- Geography

- Europe

- France

- Germany

- Italy

- UK

- Europe

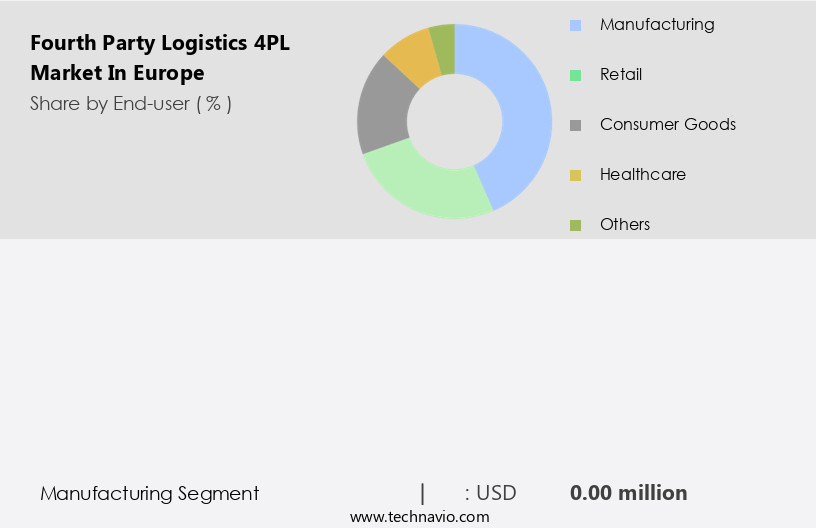

By End-user Insights

The manufacturing segment is estimated to witness significant growth during the forecast period.

The manufacturing industry in Europe, comprising factories, plants, and mills, accounts for 15% of the region's GDP, according to World Bank data from 2023. This sector's growth is fueled by technological innovations and government support. Logistics plays a crucial role in manufacturing, encompassing planning, coordination, and service functions. In the competitive European logistics landscape, companies are outsourcing advanced logistics solutions like Fourth Party Logistics (4PL) to enhance their capabilities. 4PL providers offer integrated services, including demand forecasting, route planning, customs brokerage, on-time delivery, last mile delivery, and carbon footprint reduction through fuel efficiency and technology integration. They ensure cost optimization through freight brokerage, order fulfillment, and value-added services.

Third-party logistics (3PL) partners provide risk management, network optimization, business continuity, and supply chain optimization, adhering to safety standards. Advanced technologies like artificial intelligence (AI), data analytics, and cloud computing streamline operations, reduce lead times, and enhance tracking and visibility. 4PLs also offer strategic partnerships, capacity planning, and disruption management to ensure supply chain resilience and digital transformation. Additionally, they manage company relationships, fleet management, inventory management, compliance audits, e-commerce integration, and reverse logistics. By outsourcing logistics functions to 4PLs, manufacturing companies can focus on their core competencies while benefiting from economies of scale and improved efficiency.

The Manufacturing segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Europe Fourth Party Logistics (4PL) Market drivers leading to the rise in adoption of the Industry?

- The advantages of a Fourth Party Logistics (4PL) provider significantly drive the market growth by optimizing supply chain management, enhancing operational efficiency, and ensuring seamless coordination among multiple logistics service providers.

- The European market for Fourth Party Logistics (4PL) is experiencing significant growth as businesses seek to outsource their logistics functions to specialized providers. With increasing complexities and competitive pressures, companies are focusing on their core competencies and leveraging the expertise of 3PL providers for order fulfillment, value-added services, and network optimization. 4PL offers integrated solutions that go beyond traditional 3PL services, providing risk management, business continuity, and supply chain optimization. These solutions enable businesses to maintain safety standards, ensure tracking and visibility, and enhance customer service. By outsourcing logistics, companies can reduce operational costs, improve efficiency, and mitigate risks.

- The shift towards 4PL is driven by the need for immersive and harmonious logistics solutions that can strike a balance between cost savings and service excellence. In recent research, it has been concluded that 4PL can provide a competitive edge by offering advanced technologies, innovative practices, and a focus on continuous improvement. In conclusion, the European 4PL market is a dynamic and evolving landscape that offers significant benefits to businesses seeking to optimize their logistics operations.

What are the Europe Fourth Party Logistics (4PL) Market trends shaping the Industry?

- The use of blockchain technology in logistics is gaining significant traction and is considered the next major trend in this industry. This innovative solution enhances supply chain transparency, security, and efficiency.

- The European Fourth Party Logistics (4PL) market is experiencing significant growth due to the integration of advanced technologies such as cloud computing and data analytics. These innovations enable efficient contract negotiation, capacity planning, and lead time reduction. Shipping rates are optimized through technology-driven solutions, ensuring cost savings and improved multimodal transportation. Cross-border shipping complexities are addressed through strategic partnerships and technology integration. Shipping documentation is streamlined, reducing errors and delays. Blockchain technology is increasingly utilized for enhanced transparency, security, and accountability in the logistics process.

- This includes faster transactions with lower fees and the elimination of fraud. Technology-driven solutions also prioritize real-time data access and analysis, providing valuable insights for capacity planning and supply chain optimization. The European 4PL market continues to evolve, focusing on strategic partnerships and technological advancements to meet the demands of the complex and dynamic logistics landscape.

How does Europe Fourth Party Logistics (4PL) Market faces challenges face during its growth?

- The convergence of operational costs and competitive pricing poses a significant challenge to the industry's growth trajectory.

- The European fourth party logistics (4PL) market is experiencing significant growth due to the increasing demand for specialized supply chain solutions. Companies are seeking value-added services beyond traditional logistics offerings, such as disruption management, company management, fleet management, inventory management, compliance audits, e-commerce integration, and reverse logistics. This shift has intensified competition among 4PL service providers, leading to price pressures. The market's capital-intensive nature requires a substantial investment in infrastructure, including a large fleet of vehicles and containers, technologically advanced warehouses, and a skilled workforce. Digital transformation is also a critical factor, as companies strive for greater supply chain resilience and immersive, harmonious customer experiences.

- In conclusion, the European 4PL market presents both opportunities and challenges for service providers. While the demand for value-added services creates new revenue streams, the competitive landscape and price pressures necessitate a strategic approach to differentiation and innovation. Companies that can effectively manage disruptions, integrate e-commerce platforms, and provide specialized services will be well-positioned to succeed in this dynamic market. Recent research indicates that the market's growth is expected to continue, making it an attractive proposition for businesses looking to optimize their supply chain operations.

Exclusive Europe Fourth Party Logistics (4PL) Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DHL Supply Chain

- Kuehne+Nagel

- DB Schenker

- CEVA Logistics

- GEODIS

- XPO Logistics

- UPS Supply Chain Solutions

- FedEx Logistics

- Agility Logistics

- CH Robinson

- Expeditors

- Nippon Express

- Bolloré Logistics

- Hellmann Worldwide Logistics

- DSV

- Panalpina

- Ryder System

- Logistics Plus

- Wincanton

- Yusen Logistics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fourth Party Logistics (4PL) Market In Europe

- In February 2023, DHL Supply Chain, a leading 4PL provider, announced the launch of its new Digital Control Tower solution in Europe. This advanced technology enables real-time monitoring and optimization of customers' supply chains, enhancing transparency and efficiency (DHL Press Release).

- In May 2024, DB Schenker, another major 4PL player, formed a strategic partnership with Google Cloud to implement digital logistics solutions. This collaboration aims to improve supply chain visibility, agility, and sustainability using Google Cloud's AI and machine learning technologies (DB Schenker Press Release).

- In August 2024, Kuehne + Nagel, a global logistics company, acquired a significant stake in a Dutch 4PL provider, adding to its European footprint and expanding its 4PL capabilities (Kuehne + Nagel Press Release).

- In December 2025, the European Union introduced new regulations on supply chain transparency, requiring companies to disclose information on their environmental, social, and governance practices. This initiative is expected to drive demand for 4PL services that can help businesses comply with these regulations (European Commission Press Release).

Research Analyst Overview

The European 4PL market continues to evolve, driven by the ever-changing dynamics of various sectors and industries. Technology integration plays a pivotal role in this continuous transformation, with entities leveraging cloud computing to streamline operations and enhance data analytics capabilities. Contract negotiation remains a critical aspect, with shipping rates and capacity planning being key areas of focus. Multimodal transportation and cross-border shipping are becoming increasingly complex, necessitating strategic partnerships and effective risk management. The integration of value-added services, such as customs brokerage and freight forwarding, further enhances the value proposition of 4PL providers. Lead time reduction and business continuity are essential for maintaining customer satisfaction, with on-time delivery and real-time tracking and visibility being crucial components.

Safety standards and compliance audits are also paramount, ensuring the seamless flow of goods and adherence to regulatory requirements. Disruption management and supply chain resilience are becoming increasingly important, with digital transformation and e-commerce integration playing key roles in enhancing supply chain flexibility and adaptability. The ongoing integration of artificial intelligence (AI) and machine learning algorithms is revolutionizing operations, from demand forecasting and route planning to order fulfillment and inventory management. In the face of evolving market demands and complexities, 4PL providers must continuously adapt and innovate to meet the needs of their clients. Capacity planning, cost optimization, and network optimization are essential components of this ongoing process, with a focus on delivering integrated solutions that cater to the unique requirements of each client.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fourth Party Logistics (4PL) Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 6.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch