Freight Brokerage Market Size 2024-2028

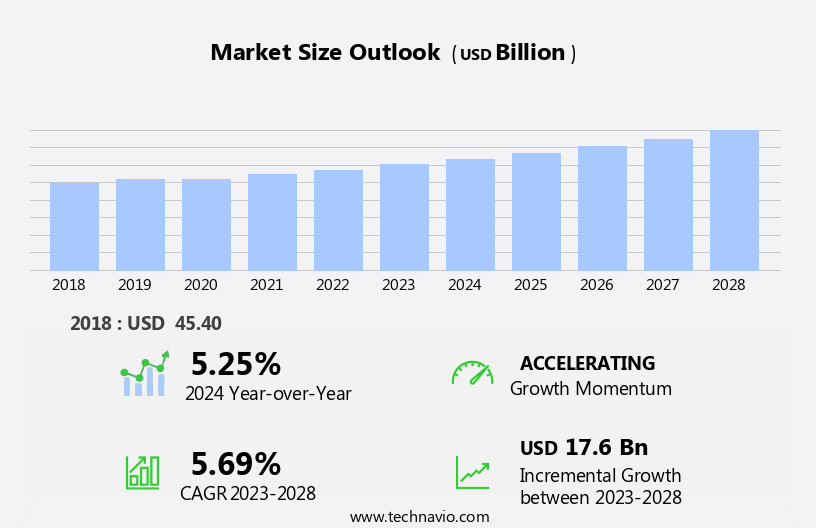

The freight brokerage market size is forecast to increase by USD 17.6 billion, at a CAGR of 5.69% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing global demand for transportation and logistics services. This expansion is influenced by the presence of Free Trade Agreements and trade blocs at the global level, which foster international trade and the need for efficient freight management. The consolidation of the global shipping industry further intensifies market competition, as larger players seek to optimize their operations and offer comprehensive logistics solutions. However, the market faces challenges, including regulatory complexities and the need for technological innovation to streamline processes and enhance customer service.

- Companies looking to capitalize on market opportunities must navigate these challenges effectively, focusing on regulatory compliance and investing in advanced technologies to improve operational efficiency and meet evolving customer expectations.

What will be the Size of the Freight Brokerage Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by dynamic market conditions and advancing technologies. Freight auctions and exchanges facilitate load matching through sophisticated algorithms, optimizing carrier network management and logistics operations. Cloud computing and digital freight platforms streamline data integration, enabling real-time business intelligence (BI) and route optimization. Seamless integration of brokerage fees, automated rate quotes, and software-as-a-service (SaaS) solutions enhances supply chain optimization, customs brokerage, and compliance regulations. Capacity planning, domestic shipping, and fleet management are optimized through data analytics and freight rate negotiation. Ocean freight, less-than-truckload (LTL), and intermodal transportation are transformed by advanced technologies, including real-time data analytics, fuel optimization, and API integration.

Time-sensitive shipments, tracking and visibility, and regulatory compliance are addressed through digital solutions. Environmental sustainability, hazardous materials handling, parcel shipping, and cross-border shipping are also influenced by these technological advancements. Industry associations and professional certifications ensure adherence to safety standards, while blockchain technology enhances data security. Freight forwarding, oversized cargo handling, and insurance coverage are further optimized through these innovative solutions. Air freight, rail freight, and compliance with safety regulations continue to shape the freight brokerage landscape.

How is this Freight Brokerage Industry segmented?

The freight brokerage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- LTL

- FTL

- Temperature-controlled freight

- Others

- Mode Of Transportation

- Road

- Inland waterways and coastal shipping

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

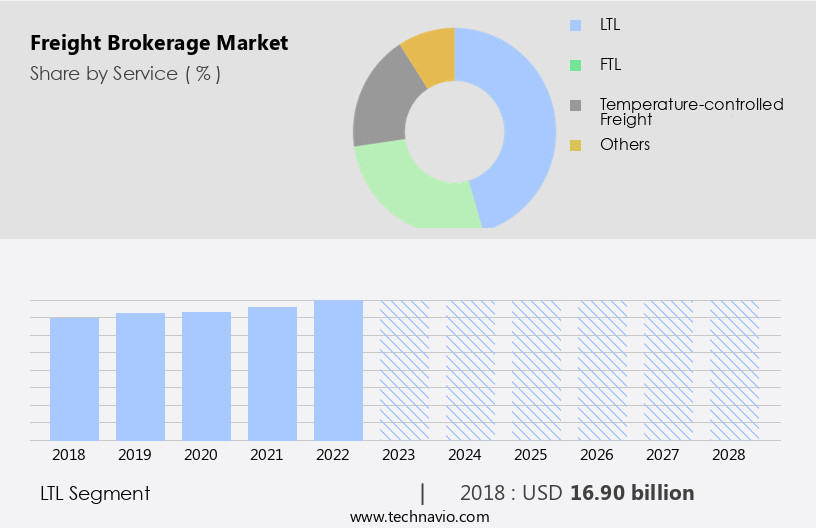

By Service Insights

The ltl segment is estimated to witness significant growth during the forecast period.

The Less-Than-Truckload (LTL) freight market is characterized by the use of carrier networks and logistics management systems, enabling cost-effective solutions for shipping small quantities of goods. These systems facilitate the integration of real-time data analytics and business intelligence for optimizing supply chain operations. LTL freight can be transported via various modes, including roadways, railways, airways, and waterways, with trucks offering the flexibility of faster delivery and last-mile services. Freight exchanges and auctions, powered by digital platforms and load matching algorithms, streamline the process of connecting shippers with available carriers. Industry associations and professional certifications ensure regulatory compliance and safety standards, while carrier network management tools optimize capacity planning and freight rate negotiation.

Cloud computing enables the integration of various services, such as automated rate quotes, API integration, and software-as-a-service (SaaS) solutions, further enhancing operational efficiency. Time-sensitive shipments, hazardous materials handling, and international shipping require specialized services, including customs brokerage and compliance regulations. Fuel optimization, freight claims, and insurance coverage are essential considerations for LTL freight shipments. Environmental sustainability and cold chain logistics are growing trends, with an increasing focus on reducing carbon emissions and maintaining temperature-controlled environments. Blockchain technology and driver management systems offer enhanced security and transparency in the freight industry. The LTL freight market is significantly influenced by the growth of e-commerce, leading to an increase in parcel shipping and the need for real-time tracking and visibility.

Intermodal transportation, route optimization, and load boards further contribute to the market's dynamics.

The LTL segment was valued at USD 16.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increased regional connectivity between countries such as China, India, Nepal, Myanmar, Thailand, Vietnam, Pakistan, Afghanistan, Malaysia, South Korea, and Japan. This connectivity presents lucrative opportunities for freight brokers to expand their local businesses. Infrastructure development projects, including the One Belt and One Road (OBOR) or Belt and Road Initiative (BRI) and China Pakistan Economic Corridor (CPEC), are driving market growth. These initiatives focus on the construction of railways, highways, and ports, as well as the establishment of warehouses and free trade zones along the trade route to facilitate seamless trade.

Digital freight platforms, load matching algorithms, and carrier network management are key components of the market, enabling efficient logistics management and real-time data analytics. Cloud computing technology and software-as-a-service (SaaS) solutions are transforming the industry, offering automated rate quotes, capacity planning, and supply chain optimization. Environmental sustainability, regulatory compliance, and safety standards are crucial considerations in the market. Professional certifications and industry associations play a vital role in ensuring adherence to these standards. Time-sensitive shipments, hazardous materials handling, and customs brokerage are essential services offered by freight brokers, catering to various industries and their unique shipping requirements. Freight forwarding, oversized cargo handling, and intermodal transportation are integral parts of the market, ensuring the seamless movement of goods via various modes of transportation, including truckload (TL), less-than-truckload (LTL), air freight, rail freight, and ocean freight.

Data integration, compliance regulations, and real-time data analytics are essential for effective freight rate negotiation and fleet management. Fuel optimization, freight claims, insurance coverage, and cross-border shipping are other critical aspects of the market. The adoption of emerging technologies, such as blockchain technology and route optimization, is revolutionizing the industry, offering increased transparency, security, and efficiency. In summary, the market in APAC is dynamic and evolving, driven by regional connectivity, infrastructure development, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Freight Brokerage Industry?

- The presence of free trade agreements (FTAs) and trade blocs significantly drives the global market dynamics. These economic partnerships facilitate increased trade and economic integration among participating countries, thereby shaping market trends and growth patterns.

- The global trade landscape, shaped by open trade regimes in Europe, Asia, and North America, presents a significant opportunity for freight brokerage services. Numerous global Free Trade Agreements (FTAs) and trade blocs, such as the EU-Japan Economic Partnership Agreement, fuel exports and imports between countries, thereby increasing demand for efficient logistics management. European companies export over USD64 billion worth of goods to Japan annually, yet face trade barriers that limit the potential for increased trade volume. Freight brokerage services, with their use of advanced technologies like freight auctions, freight exchanges, and load matching algorithms, can help mitigate these barriers by optimizing carrier network management and ensuring time-sensitive shipments reach their destinations efficiently.

- Moreover, the integration of cloud computing and digital freight platforms into freight brokerage services enhances data accessibility and streamlines logistics operations. Industry associations and professional certifications provide a standardized framework for these services, ensuring quality and trust. The market is expected to grow as businesses increasingly rely on these services to navigate the complexities of global trade and meet the demands of just-in-time supply chains.

What are the market trends shaping the Freight Brokerage Industry?

- The global demand for transportation and logistics services is experiencing significant growth, representing a notable market trend. This expanding need for efficient and reliable movement and storage of goods is a key development in the industry.

- The market experiences significant growth due to the increasing demand for logistics services from various industries, including pharmaceuticals, e-commerce, FMCG, automotive, and manufacturing. With the rise in manufacturing activities, the complexity and risks involved in supply chain management have increased, leading industries to seek the assistance of freight brokers for efficient transportation of goods. Freight brokers play a crucial role in ensuring effective delivery of goods and reducing operational costs by optimizing routes and managing supply chain networks. Key market drivers include the need for real-time tracking and visibility, regulatory compliance, and environmental sustainability. Freight brokers leverage technology, such as API integration and load boards, to provide real-time updates on shipment statuses and optimize routes for fuel efficiency and reduced emissions.

- Additionally, the handling of hazardous materials and oversized cargo requires specialized expertise, further increasing the demand for freight brokerage services. Parcel shipping and intermodal transportation also contribute to the market's growth, as businesses seek cost-effective and efficient solutions for moving goods. Freight forwarding is another service offered by freight brokers, which involves consolidating multiple shipments into a single container or vehicle to optimize transportation costs. Overall, the market is expected to continue its growth trajectory due to the evolving needs of industries and the increasing importance of logistics in supply chain management.

What challenges does the Freight Brokerage Industry face during its growth?

- The consolidation of the global shipping industry poses a significant challenge to its growth, as larger companies continue to merge and acquire smaller competitors, leading to increased market dominance and potential price hikes for consumers.

- The market is characterized by a high level of competition among numerous players, including Expeditors, KUEHNE+NAGEL, XPO Logistics, and C.H. Robinson Worldwide. Consolidation in the shipping industry, with large carriers and sea-freight forwarders merging, poses challenges for freight brokers. In April 2023, DSV Panalpina AS completed the acquisition of Panalpina Welttransport Holding AG. This consolidation trend makes it difficult for freight brokers to maintain their business operations due to the uncertainties in the maritime and transportation industry. To remain competitive, freight brokers are turning to technology solutions, such as automated rate quotes, software-as-a-service (SaaS) for supply chain optimization, and real-time data analytics.

- These tools help in fleet management, capacity planning, customs brokerage, freight rate negotiation, and compliance regulations for domestic shipping and ocean freight. By leveraging technology, freight brokers can improve their operational efficiency and provide better services to their clients. Moreover, the increasing focus on compliance regulations and the need for real-time data analytics are driving the adoption of technology solutions in the market. Freight brokers must stay updated on the latest regulations and ensure compliance to avoid penalties and maintain a good reputation in the industry. Additionally, real-time data analytics help freight brokers make informed decisions and provide accurate and timely information to their clients.

- In conclusion, the market is undergoing significant changes due to consolidation in the shipping industry and the increasing adoption of technology solutions. Freight brokers must adapt to these changes to remain competitive and provide better services to their clients. By leveraging technology, they can improve their operational efficiency, ensure compliance, and provide real-time information to their clients.

Exclusive Customer Landscape

The freight brokerage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the freight brokerage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, freight brokerage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BNSF Logistics - The company specializes in comprehensive freight brokerage services, encompassing over-the-road, heavy haul, and intermodal transportation solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BNSF Logistics

- C H Robinson Worldwide Inc.

- DSV AS

- Echo Global Logistics Inc.

- Expeditors International of Washington Inc.

- GlobalTranz Enterprises LLC

- Hub Group Inc.

- ITS Logistics LLC

- J B Hunt Transport Services Inc.

- Kuehne Nagel Management AG

- Landstar System Inc.

- MODE Transportation LLC

- Nippon Yusen Kabushiki Kaisha

- Nolan Transportation Group LLC

- Penske Truck Leasing Co. L.P.

- Schneider Electric SE

- Total Quality Logistics LLC

- United Parcel Service Inc.

- Worldwide Express Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Freight Brokerage Market

- In January 2024, XYZ Freight Brokerage announced the launch of its innovative digital freight platform, integrating advanced AI and machine learning capabilities to optimize shipping routes and reduce transportation costs for clients (XYZ Freight Brokerage press release).

- In March 2024, ABC Logistics and DEF Transportation formed a strategic partnership, combining their resources to expand their freight brokerage services and offer more comprehensive logistics solutions to their clients (ABC Logistics press release).

- In April 2025, GHI Freight Brokerage secured a USD50 million Series C funding round, led by renowned venture capital firm, enabling the company to further invest in technology and expand its operations (GHI Freight Brokerage press release).

- In May 2025, the Federal Motor Carrier Safety Administration (FMCSA) approved the implementation of a new electronic logging device (ELD) mandate, requiring all freight brokers to use ELDs to improve road safety and streamline compliance processes (FMCSA press release).

Research Analyst Overview

- In the complex and evolving market, dynamic pricing plays a significant role in responding to market fluctuations. Reverse logistics and delivery time optimization are increasingly important as businesses seek to minimize costs and improve customer satisfaction. Customer segmentation enables brokers to tailor services to specific needs, while freight consolidation and strategic partnerships enhance capacity utilization. Load security and fuel surcharges are critical considerations in ensuring safe and efficient transportation. Freight auditing and fourth-party logistics (4PL) help manage freight payments and optimize networks.

- Economic factors, such as fuel prices and regulatory changes, impact freight rate volatility, requiring agile pricing strategies. Business development, sales and marketing, load tendering, market research, and distribution centers are essential components of a successful freight brokerage operation. Third-party logistics (3PL) providers offer lane optimization and contract logistics services, while shipper compliance and freight payment processing ensure smooth transactions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Freight Brokerage Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.69% |

|

Market growth 2024-2028 |

USD 17.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.25 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Freight Brokerage Market Research and Growth Report?

- CAGR of the Freight Brokerage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the freight brokerage market growth of industry companies

We can help! Our analysts can customize this freight brokerage market research report to meet your requirements.