Europe ERW Steel Tube Market Size 2024-2028

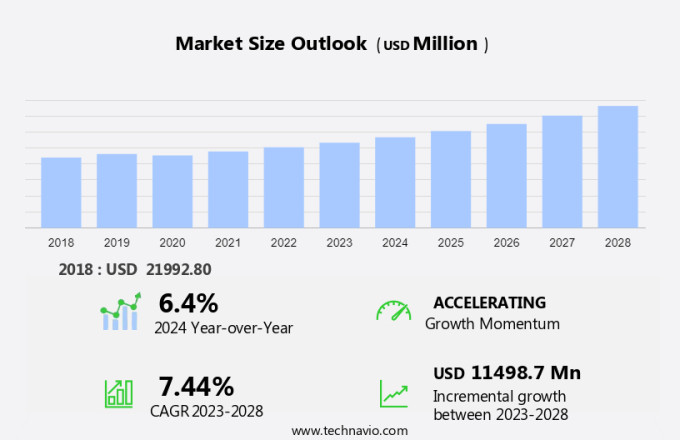

The Europe ERW steel tube market size is forecast to increase by USD 11.5 billion, at a CAGR of 7.44% between 2023 and 2028.

- The ERW Steel Tube Market is experiencing significant growth, driven by increased demand from end-user industries such as automotive, construction, and agriculture. The construction industry's expansion, in particular, is a major growth factor, as ERW steel tubes are essential for infrastructure projects and building structures. In the industrial sector, ERW steel tubes find extensive use in petrochemicals, wind turbines, batteries, medical devices, plastics, detergents, tyres, automotive applications, diesel spark plugs, engine block heating, and diesel particulate filters.

- Additionally, the safety concerns associated with traditional steel tubes have led to a shift towards ERW tubes, which offer improved strength, durability, and consistency. Market trends include the increasing adoption of advanced manufacturing technologies, such as laser welding and hydroforming, to produce high-quality ERW steel tubes. Challenges include price volatility due to raw material costs and increasing competition from alternative materials and manufacturing methods. Despite these challenges, the market is expected to continue growing due to its versatility and superior performance characteristics.

What will be the size of the Europe ERW Steel Tube Market during the forecast period?

- The market is witnessing significant growth due to the increasing demand from various end-use industries. The primary applications of ERW steel tubes are in infrastructural projects and the agriculture industry. In the agriculture sector, these tubes are used for irrigation systems and livestock farming. In the construction industry, they are used for structural purposes such as scaffolding and for pressure vessels in petrochemicals. ERW steel tubes come in different pressure ratings, outside diameters, and inside diameters, catering to various applications.

- Similarly, seamless tubes, a type of ERW steel tubes, are gaining popularity due to their anti-corrosion properties, making them ideal for rust-free applications. Iron is the primary raw material used in the production of ERW steel tubes. The tubes are available in various sizes and can be used as alternatives to plastic pipes made of UPVC, HDPE, Polypropylene, and Polyethylene. The adoption of ERW pipes is increasing due to their superior strength and durability compared to plastic pipes. The market is expected to grow further due to the increasing number of construction projects and the need for efficient and reliable infrastructure.

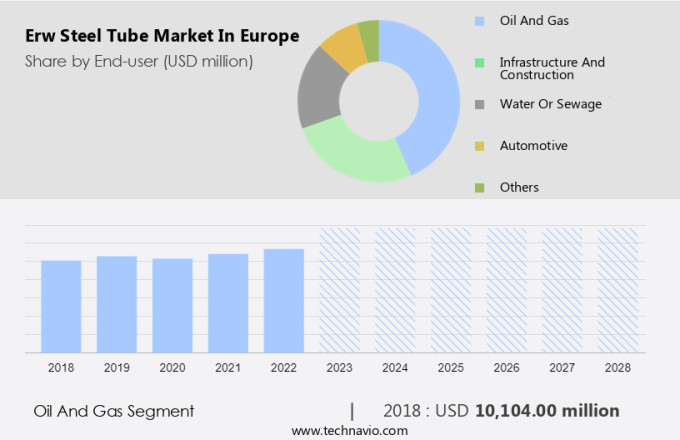

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas

- Infrastructure and construction

- Water or sewage

- Automotive

- Others

- Product Type

- Pressure tubing

- Standard pipes

- Geography

- Europe

- Germany

- France

- Italy

- Spain

- Europe

By End-user Insights

- The oil and gas segment is estimated to witness significant growth during the forecast period.

The market encompasses various applications in infrastructure and construction, oil and gas, agriculture industry, and numerous industrial sectors. Infrastructural projects, such as pipeline transportation for water or sewage, heavily rely on ERW steel tubes due to their pressure rating capabilities. High energy prices have boosted the demand for oil and gas exploration and production, leading to increased usage of ERW steel pipes in this sector. ERW steel tubes are also widely used in the agriculture industry for irrigation systems, as well as in the manufacturing of anti-corrosion, rust-free applications like propane cylinders and pressure vessels.

ERW steel tubes are available in various outside diameters and inside diameters, catering to the specific requirements of diverse applications. Seamless ERW alloy steel tubes offer superior strength and durability, making them suitable for structural purposes, scaffolding, and other heavy-duty applications. The increasing industrialization, population growth, and construction expenditures drive the demand for ERW steel tubes in building homes and other infrastructure projects.

Get a glance at the market share of various segments Request Free Sample

The oil and gas segment was valued at USD 10.10 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe ERW Steel Tube Market?

Increased demand from end-user industries is the key driver of the market.

- ERW steel tubes play a pivotal role in various industries, including infrastructure projects, agriculture, and the automotive sector. In the infrastructure and construction industry, they are utilized for structural purposes such as scaffolding and pressure piping in pipeline transportation for water or sewage systems. In the oil and gas sector, ERW steel tubes are employed for high-pressure applications, like oil and gas pipelines, and in the production of propane and other gases.

- Furthermore, these tubes are also used in the petrochemical industry for pressure vessels and heat exchangers, as well as in wind turbines, batteries, medical devices, plastics, and detergent manufacturing. The increasing industrialization, population growth, and construction expenditures necessitate the use of ERW steel tubes in various applications, such as diesel spark plugs, engine block heating, and diesel particulate filters. The seamless ERW steel tubes, made from alloy steel, offer anti-corrosion and rust-free properties, making them suitable for various applications where durability and strength are essential.

What are the market trends shaping the Europe ERW Steel Tube Market?

The growing construction industry requiring ERW steel tubes is the upcoming trend in the market.

- The European construction industry experienced significant growth in 2022, primarily driven by civil engineering and new home construction projects. According to the European Construction Industry Federation (FIEC), total investment in European construction increased by 5.2% in 2021 compared to the previous year. Countries such as the UK, France, and Italy are major contributors to this growth due to an increase in infrastructure development. ERW steel tubes play a crucial role in this sector, as they are extensively used for structural purposes, including pipeline transportation for oil and gas, water or sewage, and pressure tubing for industries like petrochemicals, wind turbines, batteries, medical devices, plastics, detergent production, and automotive applications. These tubes are available in various pressure ratings, outside diameters, and inside diameters, making them suitable for diverse industries.

- Moreover, their anti-corrosion and rust-free properties make them a preferred choice for infrastructure and construction projects, especially in regions with high energy prices. ERW steel tubes are also used for scaffolding, engine block heating, diesel spark plugs, and diesel particulate filters. The growing trend of industrialization, population growth, and increasing construction expenditures are expected to further boost the demand for ERW steel tubes in the coming years. Seamless ERW alloy steel tubes are the preferred choice due to their superior strength and durability, making them an essential component in various industries.

What challenges does Europe ERW Steel Tube Market face during the growth?

The safety issue is a key challenge affecting market growth.

- Steel tubes are extensively utilized in various industries, including infrastructure and construction, pipeline transportation for oil and gas, water or sewage, and agriculture. These tubes come in different pressure ratings, outside diameters, and inside diameters, catering to diverse applications. Steel pipes are widely used for pressure applications due to their strength and durability. However, they are susceptible to corrosion, which can lead to significant risks, particularly in infrastructural projects and industrialization. For instance, in the oil and gas sector, corrosion can result in pipeline leaks, as seen in the Nord Stream 1 and 2 pipelines in September 2022.

- Furthermore, fuel theft is another hazard associated with pipeline transportation, which can lead to explosions. Low-cost alternatives, such as anti-corrosion and rust-free steel tubes, are increasingly being adopted to mitigate these risks. Steel tubes find applications in various sectors, including propane, petrochemicals, wind turbines, batteries, medical devices, plastics, detergents, tyres, automotive applications, diesel spark plugs, engine block heating, diesel particulate filters, and scaffolding. The population growth and increasing construction expenditures necessitate the use of seamless ERW (Electric Resistance Welded) and alloy steel tubes for infrastructure development.

Exclusive Europe ERW Steel Tube Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal

- bsh Precision Steel Tube Trading GmbH

- CELSA GROUP

- Ceruti Spa

- Chinchurreta Group

- Danieli and C. Officine Meccaniche Spa

- H. Butting GmbH and Co. KG

- Mannesmann Line Pipe GmbH

- Ml Tubi

- Nippon Steel Corp.

- OMV Ventura

- Seeberger GmbH and Co. KG

- Seyame

- Siderinox SpA

- SMS group GmbH

- Soconord Group

- Steelimpex Ltd.

- Tata Steel

- Threeway Steel Co. Ltd.

- Tubificio del Friuli SpA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand from various industries such as infrastructure and construction, oil and gas, agriculture, and industrialization. Infrastructure projects like pipeline transportation for water or sewage and infrastructure development for homes require large quantities of steel tubes for structural purposes. The oil and gas industry uses ERW steel tubes for pressure rating applications in transporting high-pressure gases like propane. The agriculture industry uses ERW steel tubes as low-cost alternatives for irrigation systems. In the oil and gas sector, ERW steel tubes are used for pipeline transportation of oil and gas, while in the agriculture industry, they are used for irrigation systems. However, high energy prices have led to an increase in demand for ERW steel tubes in the oil and gas industry.

Also, ERW steel tubes are used in various industries, such as petrochemicals, wind turbines, batteries, medical devices, plastics, detergents, tyres, automotive applications, diesel spark plugs, engine block heating, and diesel particulate filters. ERW steel tubes are available in various sizes, with pressure rating, outside diameter, and inside diameter being the key specifications. Seamless ERW steel tubes are preferred for their anti-corrosion and rust-free properties, making them suitable for various applications. The growth of the market is driven by factors such as population growth, industrialization, and increasing construction expenditures. Iron is the primary raw material used in the production of ERW steel tubes, and the market is expected to grow at a steady pace in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market Growth 2024-2028 |

USD 11.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements