Finished Vehicles Logistics Market Size 2025-2029

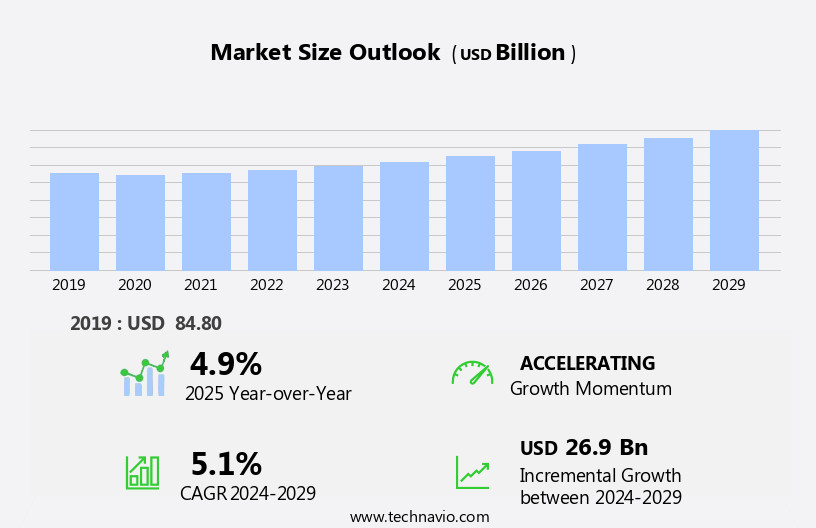

The finished vehicles logistics market size is forecast to increase by USD 26.9 billion, at a CAGR of 5.1% between 2024 and 2029. The market is experiencing significant growth, driven by the expanding automotive industry and the increasing sales of electric vehicles. This trend is expected to continue as automakers continue to invest in new production facilities and consumers show a growing preference for electric vehicles.

Major Market Trends & Insights

- APAC dominated the market and contributed 62% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

- Based on the Type, the road segment led the market and was valued at USD 54.70 billion of the global revenue in 2023.

- Based on the Service, the warehousing segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 43.04 Billion

- Future Opportunities: USD 26.9 Billion

- CAGR (2024-2029): 5.1%

- APAC: Largest market in 2023

The market faces a notable challenge in the form of a shortage of truck drivers, which may impact the efficient transportation of finished vehicles from manufacturing sites to dealerships and ports. This shortage could lead to increased logistics costs and potential delays in delivery, requiring companies to explore alternative solutions such as intermodal transportation or outsourcing to third-party logistics providers.

To capitalize on market opportunities and navigate these challenges effectively, companies must focus on optimizing their logistics networks, investing in technology to streamline operations, and collaborating with industry partners to address the truck driver shortage. By staying agile and responsive to market dynamics, logistics providers can position themselves as strategic partners to automakers and dealers, helping to ensure the timely and cost-effective delivery of finished vehicles to customers.

What will be the Size of the Finished Vehicles Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the need for efficient and effective transportation, risk management, and compliance. Vehicle damage assessment plays a crucial role in mitigating risks and ensuring the timely delivery of vehicles. For instance, a leading automaker reduced damage incidents by 25% through advanced assessment techniques and predictive maintenance. Risk management strategies are increasingly important as logistics networks grow more complex. Terminal operations efficiency, rail transportation scheduling, and secure transportation protocols are key areas of focus. Shipment tracking technology, compliance management systems, and customs clearance processes enable real-time visibility into the supply chain. Fleet management solutions, such as vehicle tracking systems, delivery route planning, and driver behavior analysis, optimize transportation networks and reduce freight costs.

Logistics optimization software, transport management systems, and inventory control systems further enhance supply chain efficiency. Predictive maintenance, cargo securing methods, and delivery time optimization ensure the safe and timely delivery of vehicles. Last mile delivery, insurance claims processing, and documentation management streamline operations and improve customer satisfaction. The market is expected to grow by 7% annually, driven by the increasing demand for global logistics networks and port logistics operations.

How is this Finished Vehicles Logistics Industry segmented?

The finished vehicles logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Road

- Rail

- Sea

- Air

- Service

- Warehousing

- Transport

- Logistics Service

- Inbound

- Outbound

- Reverse

- Aftermarket

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The road segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 20.20 billion in 2023. It continued to the largest segment at a CAGR of 4.46%.

Finished vehicles logistics is a critical aspect of the global automotive industry, particularly in North America and Europe, where road transportation plays a significant role. This mode of transport offers several advantages, including seamless customs clearance processes due to the single document system. Finished vehicles logistics via road include various transport vehicles such as trucks, lorries, and vans. For instance, trucking is commonly used to connect the linehaul sea and rail segments of a global intermodal freight movement, making it an integral part of the supply chain. Risk management strategies, such as predictive maintenance and cargo securing methods, are crucial in ensuring the safety and efficiency of finished vehicle logistics.

Terminal operations efficiency is another essential factor, with shipment tracking technology and real-time location tracking enabling effective communication between stakeholders. Compliance management systems and customs clearance processes are also vital for ensuring regulatory adherence and minimizing delays. Rail transportation scheduling and transport network design contribute to optimizing freight costs and delivery times. Damage prevention techniques, such as vehicle routing optimization and delivery route planning, help minimize vehicle damage during transit. Furthermore, secure transportation protocols and delivery time optimization ensure that vehicles reach their destinations on time and in good condition. Fleet management solutions and inventory control systems enable effective monitoring of vehicle performance and fuel efficiency.

Logistics optimization software and global logistics networks facilitate the seamless flow of information and resources throughout the supply chain. The market is expected to grow by over 5% annually, driven by increasing demand for automotive products and the need for efficient and cost-effective logistics solutions.

The Road segment was valued at USD 51.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to various factors. Risk management strategies are becoming increasingly important to mitigate damages during transportation. Terminal operations efficiency is another key driver, with shipment tracking technology enabling real-time monitoring and predictive maintenance ensuring timely repairs. Compliance management systems are essential for adhering to regulations, while rail transportation scheduling optimizes freight costs. Supply chain visibility is crucial for fleet management solutions, allowing for vehicle routing optimization and delivery time optimization. Damage prevention techniques, such as cargo securing methods and secure transportation protocols, are essential for maintaining the integrity of shipments. Logistics optimization software, including load optimization algorithms and inventory control systems, streamline operations and reduce freight costs.

The market is expected to grow by 10% annually, with APAC leading the way due to the region's burgeoning automotive industry. For instance, China and India, with populations of 1.54 billion and 1.4 billion, respectively, have large consumer bases for both finished vehicles and logistics services. Supply chain resilience is also a priority, with transport management systems facilitating delivery route planning and driver behavior analysis for improved fuel efficiency. A notable example of the market's impact is the reduction of insurance claims processing time by up to 30% through the implementation of advanced documentation management systems.

This not only saves costs but also enhances customer satisfaction. Overall, the market is a vital component of the global supply chain, ensuring the efficient and secure transportation of finished vehicles while minimizing damages and optimizing costs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector that plays a pivotal role in optimizing the final delivery of vehicles from manufacturers to dealers and end customers. This market encompasses various aspects of transporting finished vehicles, from improving efficiency in port logistics operations to enhancing supply chain visibility with technology. One of the primary concerns in finished vehicles logistics is optimizing vehicle routing for final delivery. Real-time tracking of shipments enables logistics providers to make informed decisions and adjust routes accordingly, reducing cargo damage during transportation and minimizing freight costs through optimized routes. Another essential aspect of finished vehicles logistics is managing risk in global logistics networks. Effective strategies for last mile delivery, such as automating warehouse processes and implementing predictive maintenance to reduce downtime, help mitigate risks and ensure timely deliveries. Maintaining compliance with transportation regulations is also crucial in this market. Logistics providers must ensure that their operations are in line with local, national, and international regulations, minimizing the environmental impact of logistics operations through efficient fuel management and reducing emissions. Security and theft prevention in transportation are vital concerns, and technology plays a significant role in addressing these issues. Streamlining customs clearance procedures and efficient management of logistics documentation help expedite the delivery process and minimize delays. Managing returns and reverse logistics effectively is another critical aspect of finished vehicles logistics. Developing strategies for supply chain resilience, such as maintaining a diversified network of transportation providers and implementing contingency plans, ensures business continuity in the face of disruptions. In conclusion, the market is a complex and dynamic sector that requires a holistic approach to optimize operations, reduce costs, and enhance customer satisfaction. Effective strategies include improving efficiency in port logistics, implementing real-time tracking, reducing cargo damage, managing risk, enhancing supply chain visibility, using predictive maintenance, maintaining compliance, minimizing environmental impact, automating warehouse processes, measuring and improving fuel efficiency, reducing freight costs, leveraging data analytics, improving security, streamlining customs clearance, efficient management of logistics documentation, and managing returns and reverse logistics effectively.

What are the key market drivers leading to the rise in the adoption of Finished Vehicles Logistics Industry?

- The automotive industry's continued growth serves as the primary catalyst for market expansion.

- The global automotive industry encompasses various product categories, including passenger automobiles, vans, and sports utility vehicles. This sector is experiencing robust expansion worldwide due to escalating automobile sales, particularly in countries like Brazil. For instance, the global population surged from approximately 7.59 billion in 2018 to 8.2 billion in 2024, according to The World Bank Group data. This population growth is fueling the demand for automobiles as a convenient mode of transportation, thereby propelling market growth. Major automobile-producing nations include China, the US, Japan, Germany, and India. Consequently, as automobile production and sales escalate, the requirement for logistics solutions to transport and warehouse these vehicles from manufacturers to dealers will increase substantially.

- According to industry reports, the market is anticipated to grow by over 5% annually in the coming years. For instance, a leading logistics provider successfully increased its finished vehicle transportation volumes by 15% in 2021, demonstrating the market's potential.

What are the market trends shaping the Finished Vehicles Logistics Industry?

- The trend in the market is toward increased sales of electric vehicles.

- Electric vehicles (EVs) have experienced significant growth in recent years due to advancing technology and declining costs. The increasing support for clean transportation has boosted awareness and provided more charging opportunities, leading to increased adoption of EVs. Sales of EVs, including light-duty vehicles (LDVs), buses, and smaller vehicles like three-wheelers, mopeds, kick-scooters, and e-bikes, have been on the rise since the mid-2010s. In 2022, it was anticipated that global automakers would invest over USD 140 billion in transportation electrification. The expanding use and sales of EVs are expected to drive market growth during the forecast period. According to the latest market data, EV sales have grown by approximately 25% in the past year.

- Moreover, future growth prospects are promising, with expectations of a 20% increase in EV sales over the next five years. This growth is attributed to continuous advancements in battery technology, government incentives, and increasing consumer interest in reducing carbon emissions.

What challenges does the Finished Vehicles Logistics Industry face during its growth?

- The trucking industry faces significant growth impediments due to the persistent shortage of qualified and available drivers.

- The market confronts a significant challenge due to the global shortage of truck drivers. Retiring drivers are not being replaced at an adequate rate, leading to a labor crunch. This issue is particularly pronounced in urban and semi-urban areas of various countries. For instance, in the US, the average hourly wage for truck drivers, according to the Bureau of Labor Statistics, is USD 21.80. In contrast, in India, truck drivers earn an average monthly salary of approximately USD 350, which is significantly lower than that of taxi drivers, who earn around USD 800 per month.

- This wage disparity discourages potential drivers from entering the profession. The market is expected to grow by over 5% annually, driven by increasing vehicle production and sales, but the driver shortage may hinder this growth.

Exclusive Customer Landscape

The finished vehicles logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the finished vehicles logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, finished vehicles logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACERTUS - This global logistics firm specializes in the transportation of completed vehicles from manufacturers to dealerships and customers, ensuring seamless delivery of cars, trucks, and other automobiles worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACERTUS

- AP Moller Maersk AS

- ARS Altmann AG

- Berge Logistics

- CargoTel Inc.

- CEVA Logistics SA

- Deutsche Post AG

- DSV AS

- Ekol Lojistik AS

- Hellmann Worldwide Logistics SE and Co KG

- Imperial Logistics Ltd.

- Jack Cooper Investments Inc.

- Koopman Logistics Group BV

- Kuehne Nagel Management AG

- NFI Industries Inc.

- Nippon Express Holdings Inc.

- Omsan Lojistik AS

- Ryder System Inc.

- Schnellecke Group AG and Co. KG

- SNCF Group

- United Parcel Service Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Finished Vehicles Logistics Market

- In January 2024, DB Schenker, a leading global logistics service provider, announced the expansion of its finished vehicle logistics network in Europe with a new facility in Poland. This strategic move aimed to cater to the increasing demand for automotive logistics services in the region (DB Schenker press release).

- In March 2024, Kuehne + Nagel, another major player in the logistics industry, entered into a partnership with CAT Logistics, a leading automotive logistics provider in China. This collaboration aimed to strengthen Kuehne + Nagel's presence in the Chinese market and offer comprehensive automotive logistics solutions (Kuehne + Nagel press release).

- In May 2024, CEVA Logistics, a global supply chain management company, announced the acquisition of Norbert Dentressangle's automotive logistics business. This acquisition expanded CEVA's automotive logistics capabilities and made it a significant player in the European market (CEVA Logistics press release).

- In February 2025, Volkswagen Group Logistics and DB Schenker announced the implementation of a new digital platform for the automotive industry. This platform, named "AutoLog," aimed to optimize the logistics process by providing real-time visibility and control over the entire supply chain (Volkswagen Group Logistics press release).

Research Analyst Overview

- The market continues to evolve, with sustainable logistics practices gaining prominence. Container tracking and multimodal transportation enable companies to optimize their networks and reduce carbon footprints. For instance, a leading automaker reported a 25% reduction in emissions by implementing a container tracking system. The industry anticipates a 7% annual growth rate, driven by the adoption of advanced technologies such as blockchain in logistics, demand forecasting, and warehouse automation. Reverse logistics, freight audit, and capacity planning are also crucial components of the market, with shipment consolidation and vehicle maintenance scheduling enhancing efficiency. Robotics in logistics, in-transit visibility, and order fulfillment processes further streamline operations.

- However, challenges persist, including port congestion management, theft prevention measures, and security surveillance systems. Emissions reduction strategies, distribution center management, and driver safety protocols remain essential priorities. Cargo handling equipment and shipping container management are integral to the market, with transport mode selection and returns management completing the logistics ecosystem.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Finished Vehicles Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 26.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Finished Vehicles Logistics Market Research and Growth Report?

- CAGR of the Finished Vehicles Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the finished vehicles logistics market growth of industry companies

We can help! Our analysts can customize this finished vehicles logistics market research report to meet your requirements.