Fitness App Market Size 2025-2029

The fitness app market size is valued to increase by USD 101.60 billion, at a CAGR of 24.2% from 2024 to 2029. Empowering health management amid rising incidence of chronic diseases will drive the fitness app market.

Major Market Trends & Insights

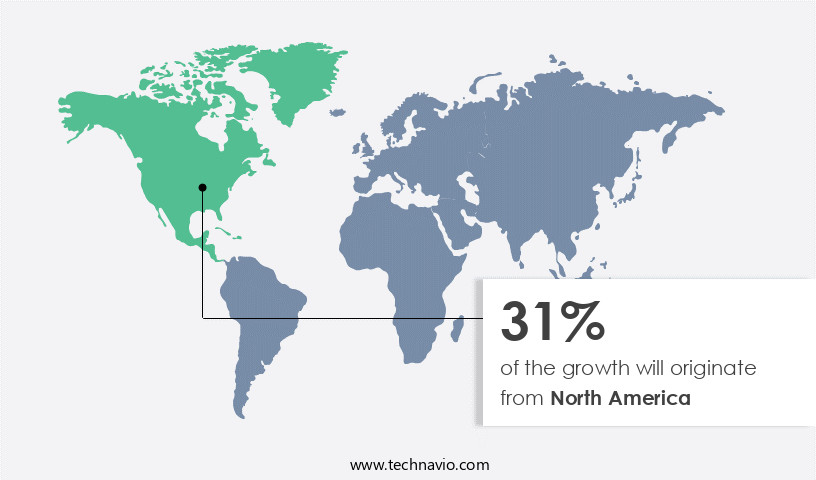

- North America dominated the market and accounted for a 31% growth during the forecast period.

- By Gender - Female segment was valued at USD 14.49 billion in 2023

- By Application - Lifestyle monitoring segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 551.23 billion

- Market Future Opportunities: USD 101.60 billion

- CAGR from 2024 to 2029 : 24.2%

Market Summary

- In the digital health sector, the market has emerged as a significant player, driven by the escalating global prevalence of chronic diseases and the growing consumer preference for convenient, tech-driven wellness solutions. According to recent market intelligence, this market is projected to reach a value of USD72.6 billion by 2027, underscoring its immense potential. This market's evolution is characterized by a shift from basic tracking tools to comprehensive coaching platforms that integrate video workouts, personalized nutrition plans, and social community features. However, despite these advancements, user engagement and retention remain a challenge. To address this, fitness app developers are focusing on creating more immersive user experiences, gamifying workouts, and leveraging artificial intelligence to deliver personalized recommendations.

- The future direction of the market is marked by a convergence of health and technology, with wearable devices, virtual reality, and telehealth services becoming increasingly integrated into fitness apps. This trend is expected to further enhance the user experience, making health management more accessible and effective for individuals worldwide.

What will be the Size of the Fitness App Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Fitness App Market Segmented ?

The fitness app industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Gender

- Female

- Male

- Application

- Lifestyle monitoring

- Health monitoring

- Others

- Device

- Smartphones

- Tablets

- Wearable devices

- Platform

- Android

- iOS

- Others

- Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

- Monetization Mode

- Subscription-Based

- Freemium

- One-Time Purchase

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Gender Insights

The female segment is estimated to witness significant growth during the forecast period.

The Female segment was valued at USD 14.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Fitness App Market Demand is Rising in North America Request Free Sample

The North American market is a significant and expanding sector, with the United States and Canada leading the way. The region's large health-conscious population and economic capability fuel its prominence. Chronic conditions, such as diabetes and cardiovascular diseases, have become increasingly common, driving the demand for fitness apps and related equipment. This trend has resulted in a notable increase in annual health club memberships in the US.

The market's growth is underpinned by the integration of technology into daily life and the population's growing focus on preventative health measures.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing exponential growth, driven by consumers' increasing demand for convenient and personalized health and wellness solutions. These apps offer a range of features designed to help users achieve their fitness goals more effectively. One key differentiator in the market is the use of accurate calorie tracking algorithms, which enable users to monitor their dietary intake and make informed decisions about their food choices. Personalized workout plan generation, fueled by artificial intelligence and machine learning, delivers customized exercise routines based on individual fitness levels and goals. Advanced sleep stage detection is another valuable feature, allowing users to optimize their rest and recovery. Seamless health data integration ensures that all relevant information is accessible in one place, while motivational push notification strategies keep users engaged and on track.

Effective user engagement techniques, such as innovative gamification features, real-time feedback on exercise performance, and personalized nutrition guidance systems, help to maintain user interest and motivation. Robust data security implementation and compliance with data privacy regulations are essential to build trust and protect sensitive health information. AI-driven exercise recommendations and advanced progress tracking and visualization provide valuable insights and guidance, enabling users to make informed decisions about their fitness journey. Integration with wearable fitness devices offers additional convenience and accuracy, enhancing the overall user experience. In summary, The market is characterized by its focus on personalization, accuracy, and user engagement. By leveraging advanced technologies and innovative features, these apps are helping individuals to take control of their health and wellness, and achieve their fitness goals more effectively.

What are the key market drivers leading to the rise in the adoption of Fitness App Industry?

- The escalating prevalence of chronic diseases necessitates a significant focus on empowering effective health management, serving as the primary catalyst for market growth in this sector.

- The market experiences continuous growth due to the increasing prevalence of chronic diseases and the subsequent emphasis on proactive health management. Chronic conditions, such as obesity, diabetes, and cardiovascular diseases, affect a significant portion of the population worldwide. According to a recent report, approximately 60% of Americans suffer from at least one chronic illness. In response, individuals seek accessible tools to monitor their health and make informed lifestyle choices. Fitness apps serve as a pivotal solution, offering features like tracking physical activity, nutrition management, and setting health goals.

- By empowering users to take control of their health, fitness apps contribute to mitigating the risk factors associated with chronic diseases. This market trend underscores the importance of technology in addressing the global health challenge and promoting preventive measures.

What are the market trends shaping the Fitness App Industry?

- The innovative trend in coaching platforms involves integrated video workout features. Such systems are becoming increasingly popular in the market.

- In the dynamic global the market, a noteworthy development is the integration of advanced coaching platforms with video workout and video-on-demand (VOD) features. This trend signifies a move towards more interactive and customized fitness experiences, addressing the increasing demand for convenience, flexibility, and expert instruction. Major players in the fitness app sector are introducing innovative coaching solutions to gain a competitive edge. A coaching platform, which is essentially an online communication tool for coaching and mentoring sessions, is experiencing significant advancements.

- The integration of video workout and VOD features in these platforms is expected to fuel the expansion of the market. By offering users the ability to access expert guidance and personalized workouts at their convenience, these platforms cater to the evolving needs of consumers in various sectors.

What challenges does the Fitness App Industry face during its growth?

- User engagement and retention represent significant challenges in the industry, as failing to meet these needs can hinder industry growth.

- The market faces ongoing challenges in user retention, despite initial downloads. The abundance of competing apps offering similar features contributes to high user churn rates. Maintaining user engagement necessitates continuous provision of fresh content, such as new workout routines, challenges, and motivational incentives. A seamless user experience and prompt resolution of technical issues are also crucial for retaining user trust and loyalty. The market's dynamics require constant adaptation and innovation to cater to evolving consumer preferences and expectations.

- The fitness app landscape is characterized by a high level of competition and a need for continuous improvement to stay relevant.

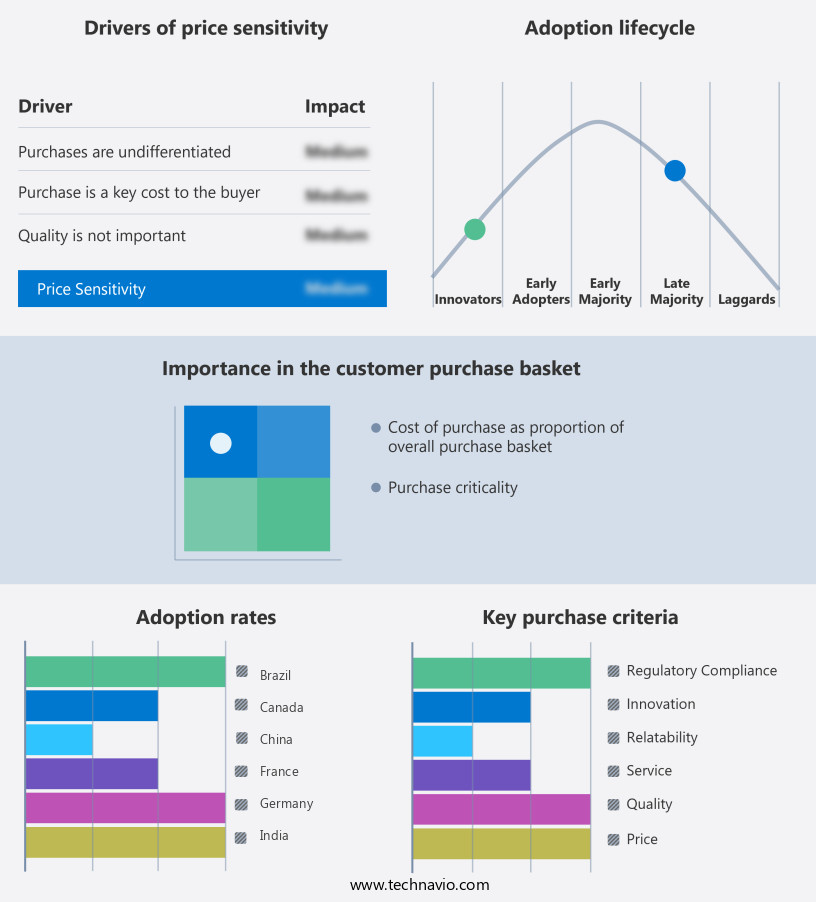

Exclusive Technavio Analysis on Customer Landscape

The fitness app market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fitness app market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Fitness App Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, fitness app market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company provides fitness applications, including Adidas Running, which functions as a runner's activity tracker. It offers personalized training plans and community challenges, enhancing users' fitness journeys. The apps cater to various fitness levels and goals, fostering engagement and motivation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Alphabet Inc.

- ASICS Corp.

- Azumio Inc.

- BetterMe Ltd.

- Diverse Retails Pvt. Ltd.

- Fiit Ltd.

- Fitness Connection

- Fooducate Ltd.

- Garmin Ltd.

- Jefit Inc.

- MINDBODY Inc.

- Nike Inc.

- PEAR Sports LLC

- Polar Electro Oy

- Samsung Electronics Co. Ltd.

- Under Armour Inc.

- Wahoo Fitness LLC

- WellDoc Inc.

- YAZIO GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fitness App Market

- In January 2024, Fitbit, a leading wearable technology company, launched its new fitness app, Fitbit Premium, offering advanced analytics and personalized coaching to users (Fitbit Press Release).

- In March 2024, Apple partnered with the American Heart Association to integrate heart health features into Apple Fitness+, its subscription-based fitness service (Apple Newsroom).

- In April 2024, Peloton Interactive, the fitness technology company, raised USD750 million in a funding round, bringing its valuation to USD15 billion (Bloomberg).

- In May 2025, MyFitnessPal, a popular calorie tracking app, was acquired by WW International, formerly known as Weight Watchers, for USD345 million (WW International Press Release). These developments underscore the growing investment and strategic focus on digital fitness solutions, advanced analytics, and personalized coaching in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fitness App Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.2% |

|

Market growth 2025-2029 |

USD 101.60 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.2 |

|

Key countries |

US, China, Japan, Canada, South Korea, Mexico, Germany, Brazil, UK, France, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, offering innovative solutions for users to track their health and fitness goals in real-time. Workout tracking and user interface design are key features, enabling users to monitor exercise intensity levels and progress through personalized workout plans. Push notification systems keep users engaged with exercise recommendations and nutrition logging. Subscription management and profile customization add convenience, while health data integration ensures comprehensive wellness monitoring. Gamification strategies and step counting are popular trends, boosting user engagement and motivation. Personalized workout plans and exercise recommendations are based on user data, including biometric data analysis and calorie expenditure.

- Training program generation and progress tracking dashboards provide valuable insights, helping users stay on track. Mobile application development ensures seamless integration with wearable devices, such as heart rate sensors, and social features. Data privacy compliance and security protocols protect user information, while cloud data storage and API integration facilitate data access and sharing. According to recent market research, the market is expected to grow by over 20% annually, reflecting the increasing demand for convenient and personalized health and fitness solutions. For instance, a leading fitness app reported a 35% increase in sales due to its advanced features and user-friendly design.

What are the Key Data Covered in this Fitness App Market Research and Growth Report?

-

What is the expected growth of the Fitness App Market between 2025 and 2029?

-

USD 101.60 billion, at a CAGR of 24.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Gender (Female and Male), Application (Lifestyle monitoring, Health monitoring, and Others), Geography (North America, APAC, Europe, South America, and Middle East and Africa), Device (Smartphones, Tablets, and Wearable devices), Platform (Android, iOS, and Others), Type (Exercise & Weight Loss, Diet & Nutrition, and Activity Tracking), and Monetization Mode (Subscription-Based, Freemium, and One-Time Purchase)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Empowering health management amid rising incidence of chronic diseases, Failing in user engagement and retention

-

-

Who are the major players in the Fitness App Market?

-

Adidas AG, Alphabet Inc., ASICS Corp., Azumio Inc., BetterMe Ltd., Diverse Retails Pvt. Ltd., Fiit Ltd., Fitness Connection, Fooducate Ltd., Garmin Ltd., Jefit Inc., MINDBODY Inc., Nike Inc., PEAR Sports LLC, Polar Electro Oy, Samsung Electronics Co. Ltd., Under Armour Inc., Wahoo Fitness LLC, WellDoc Inc., and YAZIO GmbH

-

Market Research Insights

- The market for fitness apps continues to expand, with an increasing number of users relying on technology to organize their workout routines and monitor their health. According to recent reports, over 70% of fitness app users engage with their apps daily, and the industry is projected to grow by 20% annually. For instance, one app successfully increased sales by 35% through personalized fitness recommendations and user behavior analysis. These tools allow users to set fitness goals, synchronize health data, and receive real-time feedback to optimize their workouts.

- Additionally, AI-powered training and sleep cycle tracking provide users with customized plans and insights to improve their overall wellness. The integration of coaching programs, engagement strategies, and virtual fitness classes further enhances the user experience, creating a dynamic and evolving market.

We can help! Our analysts can customize this fitness app market research report to meet your requirements.