Fixed Asset Management Software Market Size 2024-2028

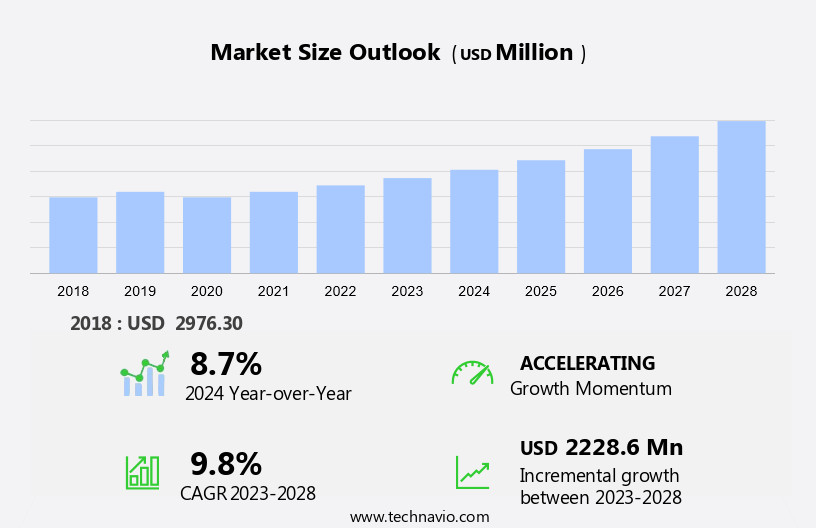

The fixed asset management software market size is forecast to increase by USD 2.23 billion at a CAGR of 9.8% between 2023 and 2028.

- Fixed asset management software plays a crucial role in monitoring and managing a company's inventory of physical assets, including equipment and machinery. The market for this software is experiencing significant growth due to several factors. First, there is a rising trend towards the adoption of cloud-based deployment solutions, which offer greater operational efficiency and cost savings. Second, advanced technologies, such as IoT sensors and predictive maintenance algorithms, are increasingly being used to reduce maintenance costs and minimize equipment failures, leading to decreased downtime and increased lifetime value. However, data privacy and security concerns remain a challenge, as these systems contain sensitive information that must be protected. Overall, the market is expected to continue growing In the manufacturing sector and beyond, as businesses seek to optimize their operations and improve their bottom line.

What will be the Size of the Fixed Asset Management Software Market During the Forecast Period?

- Fixed assets are essential components of any business, including vehicles, computers, furniture, machinery, and equipment. Effective management of these assets is crucial for controlling maintenance costs, enhancing operational efficiency, and maximizing their lifetime value. In today's business environment, organizations are increasingly turning to advanced tracking technologies, such as barcodes, QR codes, and RFID, to streamline their fixed asset management processes. Barcodes, a popular technology for inventory management, offer a cost-effective solution for tracking and managing fixed assets. By assigning unique barcode labels to each asset, businesses can easily track their location, status, and maintenance history. Barcodes can be scanned quickly and efficiently using handheld devices, allowing for real-time updates to asset databases. QR codes, a more advanced form of barcodes, offer additional capabilities, such as storing larger amounts of data and supporting multiple data types. QR codes can be used to store asset information, maintenance schedules, and repair histories, providing a more comprehensive view of each asset's lifecycle. RFID technology takes asset tracking a step further by enabling automatic identification and tracking of assets without the need for line-of-sight scanning.

- Moreover, RFID tags can be attached to assets and read by readers placed throughout a facility, allowing for real-time monitoring of asset location and status. An asset management system that incorporates these tracking technologies can significantly improve operational efficiency by reducing downtime due to equipment failures and enabling predictive maintenance. By monitoring asset performance and identifying potential issues before they become critical, businesses can minimize repairs and replacements, reducing maintenance costs and increasing productivity. Capital investment in fixed assets is a significant expense for many organizations, and accurate asset tracking is essential for maintaining an accurate record of net worth. Regulatory standards, such as the Sarbanes-Oxley Act, require businesses to maintain accurate records of their fixed assets and their associated costs.

- An effective asset management system can help businesses meet these regulatory requirements while also providing valuable insights into their asset inventory and utilization. Asset management services that leverage these tracking technologies can help businesses optimize their fixed asset management processes. By providing predictive processes for maintenance and repairs, these services can help businesses minimize downtime and extend the lifecycle of their assets. Additionally, they can help businesses make informed decisions about asset replacement and capital investment based on real-time data and insights. In summary, the use of barcodes, QR codes, and RFID technologies in fixed asset management offers significant benefits for businesses looking to enhance operational efficiency, reduce maintenance costs, and maintain regulatory compliance. By implementing an asset management system that incorporates these technologies, businesses can gain valuable insights into their fixed asset inventory and optimize their management processes for maximum productivity and profitability.

How is this Fixed Asset Management Software Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Deployment Insights

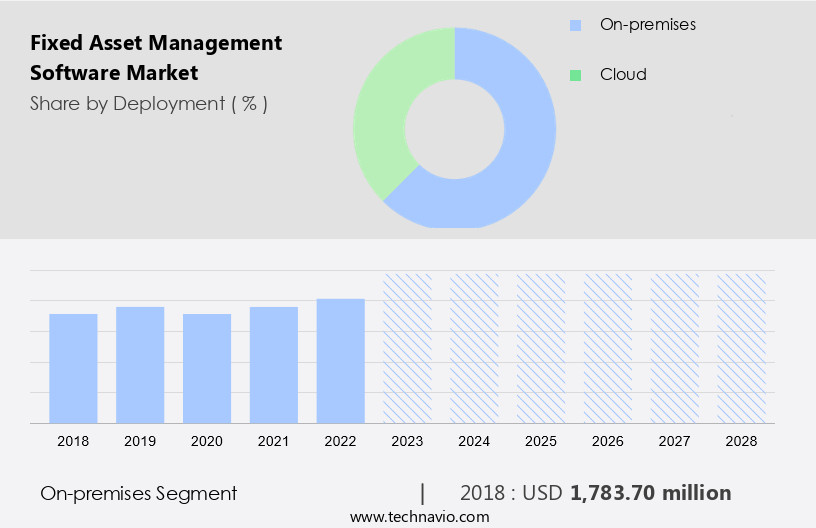

- The on-premises segment is estimated to witness significant growth during the forecast period.

Fixed asset management software is essential for monitoring and managing an organization's inventory of significant business assets, including equipment and machinery. This software helps businesses keep track of maintenance costs, operational efficiency, and equipment failures to minimize downtime and maximize the lifetime value of their assets. On-premises deployment is the most common approach, as it offers greater control and security over sensitive data. This method involves installing the software on a company's own servers, enabling customization and seamless integration with existing systems. Industries such as aerospace and defense, banking, financial services, and healthcare, which deal with critical information, prefer on-premises solutions due to their stringent compliance and security requirements. By implementing this, businesses can optimize their maintenance costs, improve operational efficiency, and minimize downtime, ultimately enhancing their overall profitability.

Get a glance at the Fixed Asset Management Software Industry report of share of various segments Request Free Sample

The on-premises segment was valued at USD 1.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

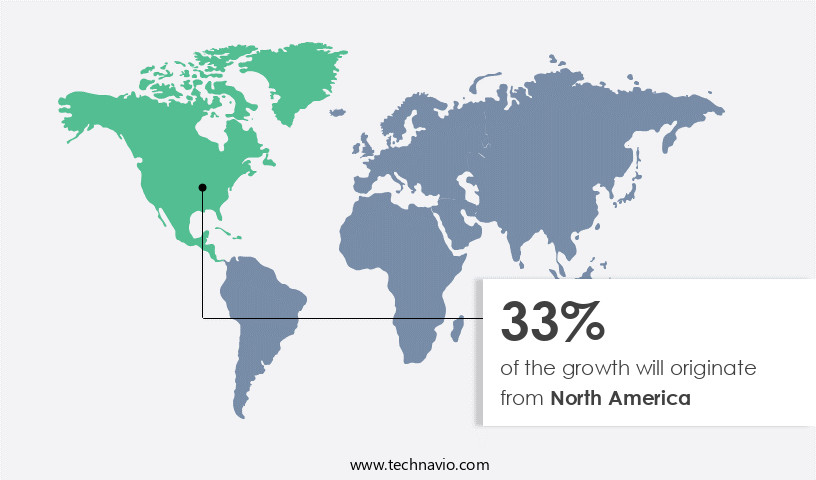

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the North American market, fixed asset management software holds significant value for businesses due to the region's technologically advanced industrial sector. The high adoption of enterprise asset management solutions, which integrate software, systems, and services for managing and controlling assets and equipment, is a primary factor driving the market's growth. These solutions enhance asset quality and utilization throughout their lifecycle, maximizing productive uptime and minimizing operational costs. Advanced technologies, such as AI, ML, virtualization, and cloud computing, are increasingly being adopted in North America, creating numerous opportunities for the market. AI and ML enable predictive maintenance, while virtualization and cloud computing offer flexibility and scalability.

Asset disposition, scheduling, reporting, and workflows are essential management processes that these solutions automate, ensuring accurate and efficient asset tracking. Periodic audits are simplified through these software systems, ensuring regulatory compliance and reducing the risk of errors. Overall, the North American market is poised for growth due to its advanced technological landscape and the industrial sector's high adoption of enterprise asset management solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fixed Asset Management Software Industry?

Growing adoption of cloud-based deployment solutions is the key driver of the market.

- In today's digitally advancing business landscape, the adoption of cloud-based services is on the rise. These solutions, which are applications or software accessible remotely and hosted on companies' servers, offer numerous benefits. They provide businesses with IT resources through the Internet, accessible via public, private, or hybrid clouds. The flexibility and scalability of cloud-based services enable organizations to bypass the intricacies of managing hardware, licenses, and software. Fixed asset management software, in particular, is increasingly being offered in a cloud-based format. This shift is in response to the growing demand for streamlined asset management.

- With cloud-based solutions, businesses can access critical asset details, monitor asset status, and manage aging and depreciation more efficiently. Additionally, rule-based alerts can be set up to notify users of important asset events, such as maintenance schedules or asset sales. A centralized repository for asset information ensures that physical records are easily accessible and up-to-date. This is crucial for accurate asset tracking and reporting. In the event of a sale or scrap, the software can facilitate the process, ensuring a seamless transition. By embracing cloud-based fixed asset management software, businesses can optimize their asset management processes and gain a competitive edge.

What are the market trends shaping the Fixed Asset Management Software Industry?

The rising adoption of advanced technologies is the upcoming market trend.

- Fixed asset management software has seen significant advancements with the integration of technologies such as barcodes, QR codes, RFID, and hybrid cloud. These technologies enable organizations to effectively manage and track assets, including vehicles, computers, furniture, machinery, and more. Hybrid cloud environments combine on-premises networks with cloud providers, offering organizations the benefits of both private and public cloud models. This approach allows for application efficiency, enhanced security, backup, privacy, and cost savings.

- Additionally, technologies like RFID, QR codes, and barcodes enhance asset tracking capabilities, providing real-time visibility and accurate data. Organizations can leverage these technologies to optimize their asset management systems, improve operational efficiency, and minimize risks associated with asset loss or mismanagement.

What challenges does the Fixed Asset Management Software Industry face during its growth?

Data privacy and security concerns are key challenges affecting the industry's growth.

- Fixed asset management software In the cloud is a popular choice for businesses due to its cost-efficiency and accessibility. Cloud-based solutions offer several advantages, including configurable checklists for streamlined processes, rule-driven checklists for automated tasks, and timely reminders for maintenance and renewals. These tools are essential for managing leases, warranties, and services, ensuring seamless integration with multiple applications.

- Government agencies, in particular, have embraced cloud solutions for their sensitive data. Cloud-based systems offer centralized data storage, high-speed networks, and improved information management, leading to increased productivity, enhanced data sharing, and collaboration. The benefits of cloud-based fixed asset management software extend to simplified software maintenance and upgrades, lower upfront costs, effective security, and high reliability. By connecting functional gaps in existing systems and processes, these solutions offer organizations significant value and agility.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AccuFund Inc.

- Acumatica Inc.

- Adaequare Info Pvt. Ltd.

- Aramex International LLC

- Asset Panda LLC

- AssetWorks LLC

- Bloomberg LP

- EAZY ERP

- EZ Web Enterprises Inc.

- Financial and Management Information Systems Ltd.

- Infor Inc.

- International Business Machines Corp.

- Multiview Corp.

- Mynd Integrated Solutions

- Oracle Corp.

- Ramco Systems Ltd.

- Sage Group Plc

- SAP SE

- Tech Mahindra Ltd.

- Xero Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fixed asset management is a crucial aspect of business operations, involving the tracking, monitoring, and maintenance of various assets such as vehicles, computers, furniture, machinery, and more. Traditional methods of managing these assets using physical records and manual processes are time-consuming and prone to errors. However, the advent of advanced technologies like barcodes, QR codes, and RFID has revolutionized the way businesses manage their fixed assets. An asset management system utilizing these technologies enables businesses to automate their asset management processes, reducing manual intervention and minimizing errors. By integrating these technologies, businesses can digitize their asset details, enabling real-time tracking and monitoring of asset status, aging, and depreciation.

Moreover, predictive processes and rule-based alerts help businesses identify maintenance needs before equipment failures lead to downtime, reducing maintenance costs and enhancing operational efficiency. Asset management services provide businesses with valuable insights into their inventory, enabling them to optimize capital investment, net worth, and productivity. Regulatory standards and customer satisfaction demand accurate and timely reporting, which is made possible through automation software's scheduling, workflows, and seamless integration with multiple applications. Asset movements, disposition, lease, warranty, service, renewals, and sales are all streamlined, ensuring value for money and a positive business reputation. A centralized repository for asset details and asset movements facilitates periodical audits and rule-driven checklists, ensuring timely reminders for renewals, lease expirations, and rule-based alerts for asset replacement or repairs. Configurable checklists and rule-driven workflows further enhance the efficiency of the asset management process.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.8% |

|

Market growth 2024-2028 |

USD 2.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.7 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.